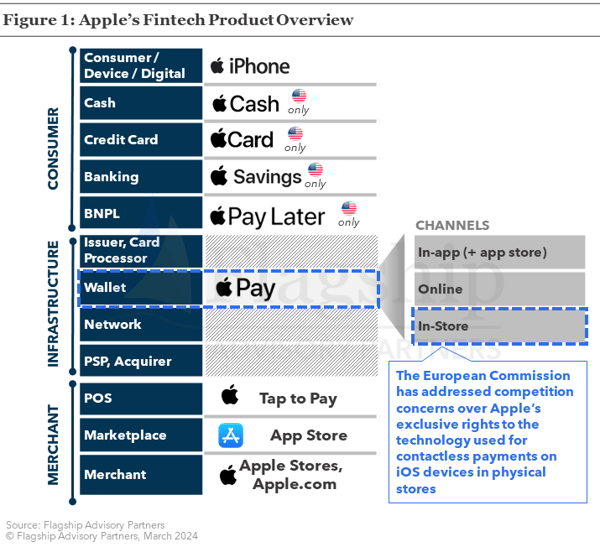

Gaining access to the physical POS (‘Point-of-Sale’) has been a pain point for local wallets and APMs (‘Alternative Payment Methods’) in several European markets. Apple Pay, Google Pay, and contactless cards have excellent customer experiences and broad acceptance, and APMs have struggled to match these card-centric form factors in terms of ease of use. European regulators have focused on Apple for blocking third-party access to the NFC (‘Near Field Communication’) element in iOS devices, as this would be required (in regulators’ view) to increase competition and access to payments for European users in stores. In response to regulatory pressure, Apple committed, effective 19 January 2024 to allow third-party wallet and payment providers to access iOS devices' NFC functionality via APIs, free of charge.

Opening access to iOS device NFCs is a big deal for wallet providers that run on card rails (e.g. PayPal, Google Wallet, MobilePay, Vipps), but likely not (at least for the moment) for APMs that run on account-to-account (‘A2A’) rails (e.g. Swish, Blik, iDeal), as the underlying technology applies to card, not A2A rails. In this article, we explain the commitments made by Apple to European regulators to open up iOS NFCs, discuss potential implications for ecosystem participants, and whether this will change the game for in-store mobile payments.

Background

NFC is the technology enabling the communication of contactless payments between a form factor (e.g., a smartphone or a plastic card) and a POS terminal. Since the launch of Apple Pay nearly 10 years ago, Apple has held exclusive rights to access the NFC technology in its proprietary iOS devices, essentially forcing all iOS device holders to use Apple’s proprietary Wallet (also referred to as Apple Pay) to make NFC payments in-store. This exclusivity has caused headaches for banks (which must either pay Apple fees on volume run through Apple Pay, or simply not be able to provide mobile payments to the significant portion of bank customer bases that use iOS devices) and other rival wallets, which have struggled to create a similarly seamless user experience for in-store payments (e.g. QR codes and BLE beacons being significantly clumsier at the physical POS than NFC). As a result, Apple has been blamed by the European Commission for hindering innovation, freedom to choose, and fair competition. A formal investigation of Apple by the European Commission was initiated in 2020 and concluded that Apple violates EU competition rules and abuses its dominant market position by limiting access to the NFC hardware required to make payments at physical POS devices. Per European Union rules, breaches could result in significant fines up to 10% of Apple's global revenue. Apple proposed in January 2024 to make several commitments as a response to competition concerns by opening access to their NFC technology to third parties. The European Commission has invited feedback on these commitments and could decide to push for further changes.

Commitments

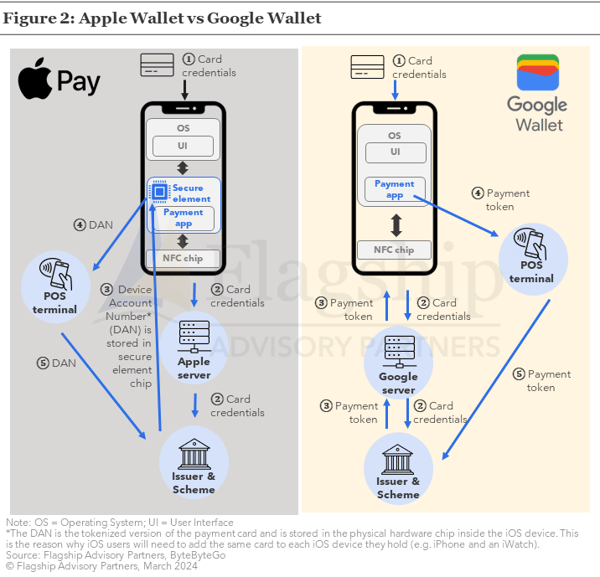

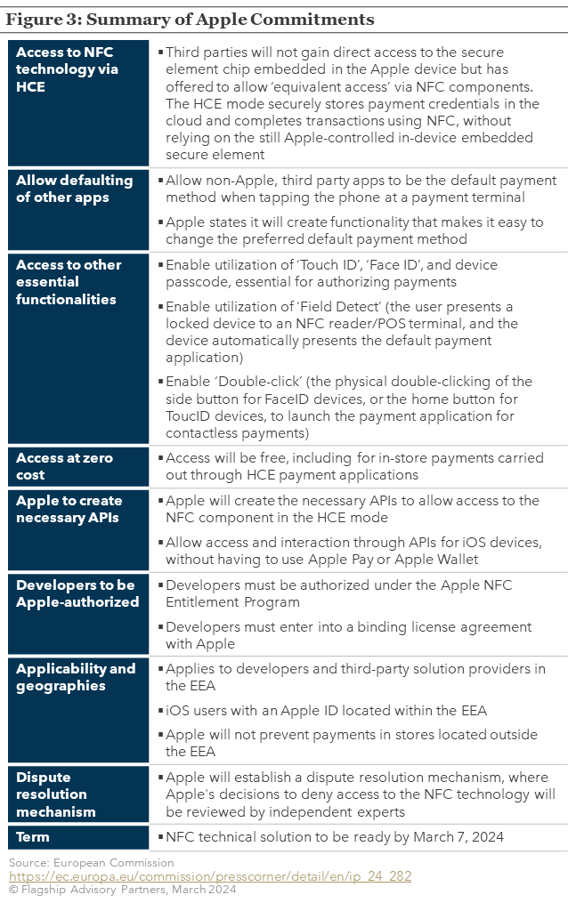

The most critical commitment made by Apple is enabling access to iOS device’s NFC technology via HCE (‘Hosted Card Emulation’). Apple has not committed to grant direct access to the ‘secure element’ chip within the iOS device itself but has offered to allow ‘equivalent access’ via HCE, similarly to how Google Wallet enables NFC payments today (see Figure 2 on how the two wallets compare). In simple terms, in the ‘HCE mode’ there is no direct reliance on a secure element to complete a transaction as payment credentials are stored and transactions are completed in the cloud, rather than on the device itself.

Other important commitments by Apple include allowing the iOS device to default to third-party payment apps (effectively allowing a third-party wallet, not Apple Wallet, to display a card when tapping the iOS device at a contactless POS terminal), and enabling the utilization of Face ID, Touch ID, and other authentication features at a physical checkout. To gain access to Apple’s NFC technology, developers must be authorized under the ‘Apple NFC Entitlement Program’, and will need to enter into a binding license agreement with Apple. Apple has also developed a dispute resolution mechanism where Apple's decision to deny access to third parties will be reviewed by independent experts. Apple has stated that the solution will be ready in Q1 2024, and the European Commission has gathered feedback from market participants. This implies that there is room for changes to be made, and likely a delayed implementation timeline. Third parties seeking access to iOS solutions will require time to prepare and build, so we are unlikely to see a live solution anytime soon. See Figure 3 for a summary of Apple’s commitments.

Implications and Opportunities

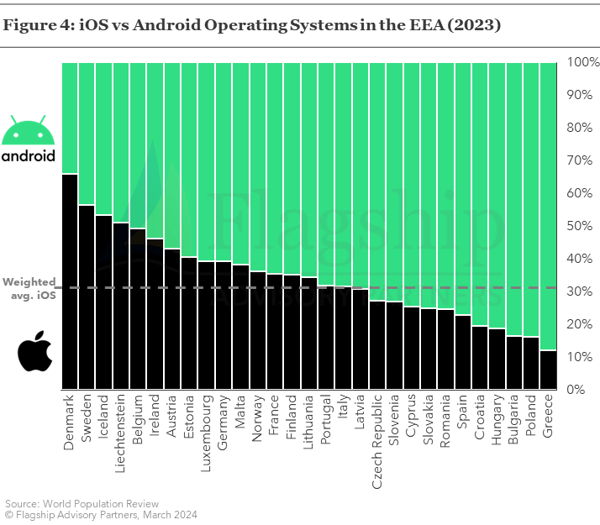

As we have discussed in prior insights (The Rise of Alternative Payment Methods in Europe), the physical POS has proven to be a pain point for most payment apps. Note that with ‘payment apps’ we mean everything from A2A-based APMs to card-based wallets, which can come in a range of constructs, as explained in the article ‘Digital Wallets Thriving, Proliferating in All Directions’. Many payment apps have tried and failed in the physical channel primarily due to a worse user experience than contactless cards and wallets like Apple Pay, when (arguably) apps need a superior user experience and/or value proposition to gain user adoption. Some providers of these alternative payment apps have cited the closed ecosystem of Apple as a contributing factor to their failure; iOS devices are after all a significant proportion of devices in Europe (see Figure 4), and finding an equally seamless solution to NFC (which has been exclusive to Apple Wallet and Apple Pay) at the physical POS is hard.

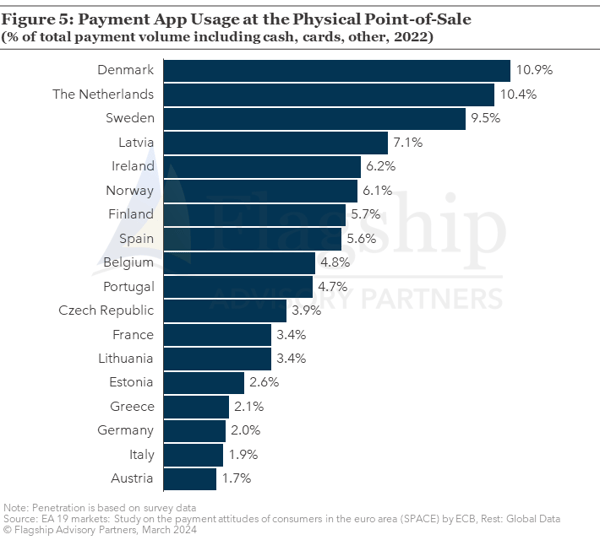

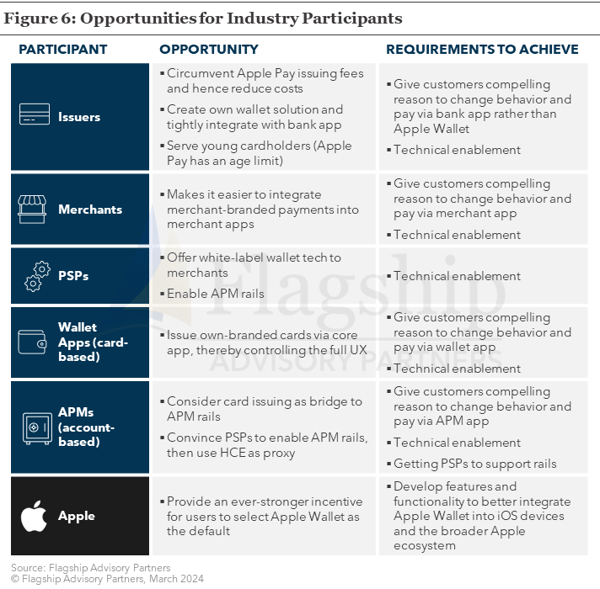

Wallets as a means for payment in-store to date represent a relatively small proportion of payment volumes in several European markets (see Figure 5), which leaves white space to grow. Market participants like issuers and competing wallets (that run on card rails), might therefore have popped the champagne when reading the news on Apple's commitments to open up their NFC technology, as new opportunities now arise. For example, issuers can take back more ownership over their customers if they tightly integrate a wallet with their banking app, and for rival wallets, it can make sense to issue own-branded cards and control the full user experience. While this is the moment some have waited for, realizing advantages (e.g., reducing fees paid to Apple for Apple Pay, changing consumer behaviors) are likely to be challenging to achieve. Opportunities will be less prominent for other participants like accounts-based payment methods, merchants, and PSPs. We summarize opportunities and requirements to achieve these in Figure 6 below.

Will it Change the Game for In-Store Payments?

While Apple opening up access to NFC for in-store payments certainly creates new opportunities for stakeholders, it is unlikely to be a game changer for two core reasons;

- User experience: Third-party wallets’ user experience will at best be on par with Apple Pay, but likely still clunkier overall, which leaves little incentive for consumers to change their payment behavior. Additionally, Apple can still build in features in the remainder of its ecosystem to further differentiate Apple Wallet.

- Card-rails: As the solution still will run on card-rails this does not solve the (arguably) sub-optimal in-store user experience for account-to-account-based payment apps (e.g. Twint, Blik, Bizum), other than leaving the option to issue cards in a digital wallet environment (which then defeats the fundamental purpose of account-based rails as an alternative to cards).

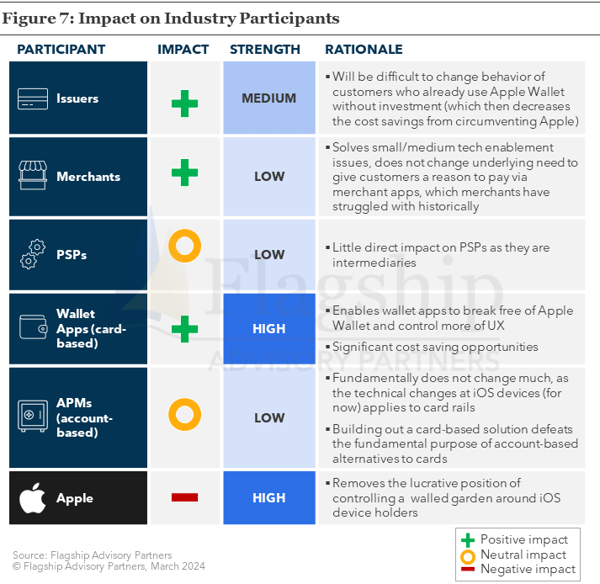

For competing card-based wallet providers, however, these are interesting developments as they will be able to distribute their solution to a broader audience, some of which have already started issuing cards (e.g. PayPal), while others will be incentivized to do so (e.g. MobilePay, Vipps). Issuers are also winners, given that they can convince their customer base to avoid using the Apple Wallet and instead use a competing wallet (in fact, some issuers like DNB, the largest bank in Norway, still have not purposely enabled Apple Pay on their card portfolio) although for the vast majority of issuers, as they have already enabled Apple Pay, convincing customers to change behavior will be very difficult. In Figure 7 we summarize the impact and impact strength for select industry participants.

Conclusion

Apple opening up NFC will not result in instant changes overnight and will not prevent Apple from developing features and functionality to better integrate Apple Wallet into iOS devices and the broader Apple ecosystem, providing ever-stronger incentives for users to use Apple Wallet. Competing card-based wallets are undoubtedly the winners of Apple opening up, but cannot simply piggyback on iOS devices to win market share. Growth and success will depend on the ability to build a seamless customer experience at the physical point-of sale (UX being the holy grail of mobile payments), in addition to changing consumer habits - a tough nut to crack.

Please do not hesitate to contact Elisabeth at Elisabeth@FlagshipAP.com or Erik at Erik@FlagshipAP.com with comments or questions.