Accounting software platforms that power SME financial and business administration offer massive potential for integrating fintech services. The power lies in the many touchpoints that accounting software offers for integrating a broad array of fintech services from various payment services to lending, card issuing, FX, and core banking services. Payouts to suppliers is the most closely adjacent among this broad array of integrable fintech services. We recently analyzed 100+ European accounting platforms to assess the maturity of embedded payouts. We share some of our key observations below.

SME Accounting Platforms, Positioning for Fintech

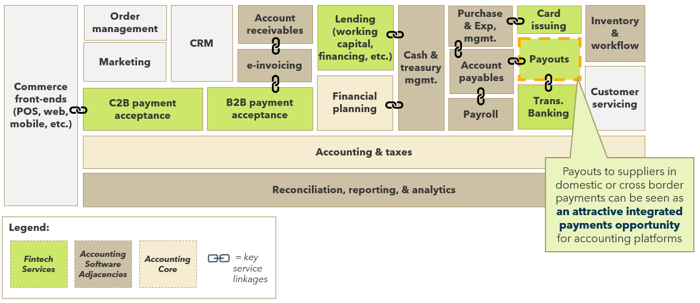

As we illustrate in figure 1, accounting software is increasingly positioned as business management platforms with a variety of software-enabled business services: financial accounting, payables management, receivables management, purchasing and expense, working capital and treasury management, payroll, and others. The ability to touch so many customer journeys allow these platforms to also embed and monetize an array of financial services: payment acceptance, lending and financing, cards issuing, transaction banking, and payouts (to name a few). Payouts to suppliers (the focus of our analysis) through domestic or x-border payments is the fintech services we consider to be most easily integrated into accounting software.

FIGURE 1: Value Chain of Key Software and Fintech Services Embedded in Accounting Platforms

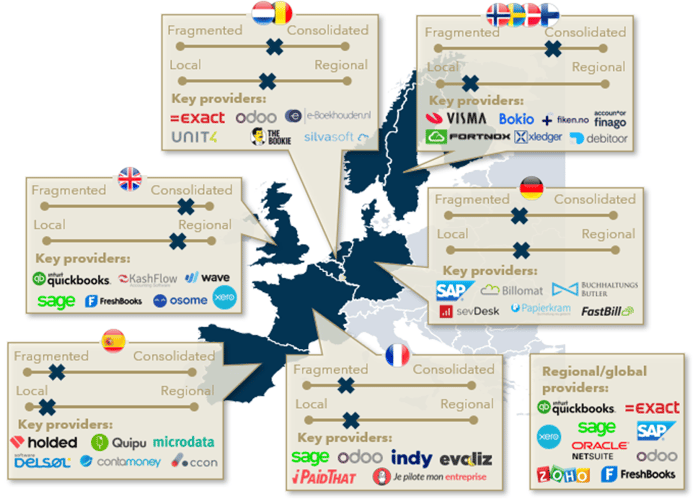

Accounting Platform Landscape in Europe

FIGURE 2: Overview of Accounting Platform Landscape in Europe

Source: Flagship Advisory Partners Research, Based on analysis of 100+ providers; March ‘22; as marketed on website; SME focus

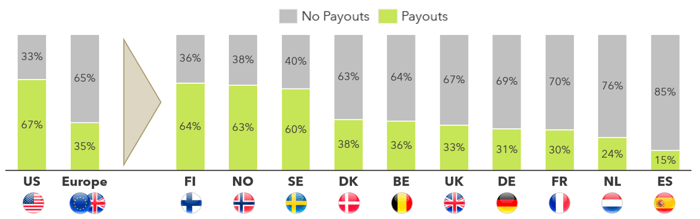

Maturity of Integrated Payouts

Accounting software integrated payouts are not deeply penetrated today in Europe. As we illustrate in figure 3, integrated payouts with European accounting platforms, on average, are significantly less mature when compared to the U.S., where accounting software with integrated payments is a common market practice. Accounting software integrated payouts are comparatively more mature in the Nordics, due to better integrations with real time A2A payment networks (e.g., P27 will offer real time payment APIs) and closer partnerships with banks. France, Spain and Benelux tend to be more domestic provider led and integrated payouts are significantly less mature today.

FIGURE 3: Maturity of Integrated Payouts with Accounting Platforms by Market

Methodology: Analyzed 100+ accounting platforms across 10 European markets; Maturity of integrated payouts per market is determined by the % of platforms that integrate payouts (as a product) compared to the total platforms analyzed

Methodology: Analyzed 100+ accounting platforms across 10 European markets; Maturity of integrated payouts per market is determined by the % of platforms that integrate payouts (as a product) compared to the total platforms analyzed

Source: Flagship Advisory Partners Research

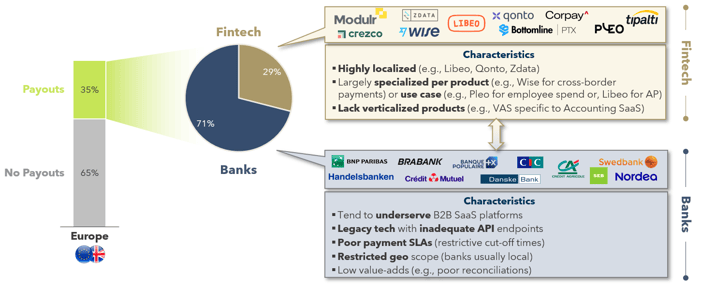

As illustrated in figure 4, the accounting platforms that offer integrated payouts predominantly rely on banks to power these payouts. Banks often underserve SaaS platform needs as they too often lack the technical sophistication for easy integration, customer onboarding, and ongoing feature enhancement. We see a clear shift towards specialized payout fintechs as integrated payment partners for accounting software. Winning fintechs offer more feature rich use case enablement: Wise that offers cross border payments, Modulr powers domestic A2A payouts, and Tipalti, Pleo provide virtual card-based payouts. These fintechs also provide increasingly rich value-added services to wrap around the core payout function such as workflow automation and automated reconciliation.

FIGURE 4: Payouts Partners: Accounting Platforms Offering Integrated Payouts

Source: Flagship Advisory Partners Research; % of platforms that offer integrated payouts; analysis of 100+ providers; March ‘22; as marketed on website

As SMEs start realizing the convenience and value of integrated payments, we are likely to see an increasing roll-out of embedded payments propositions with European accounting software solutions in the years to come, providing a huge addressable opportunity for payout fintechs.

Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Niko Beranek at Niko@FlagshipAP.com with comments or questions.