Vipps MobilePay

Innovations

Innovations

Image Credit: Vipps MobilePay

Yuriy Kostenko and Levi van Dalen • 1 May, 2025

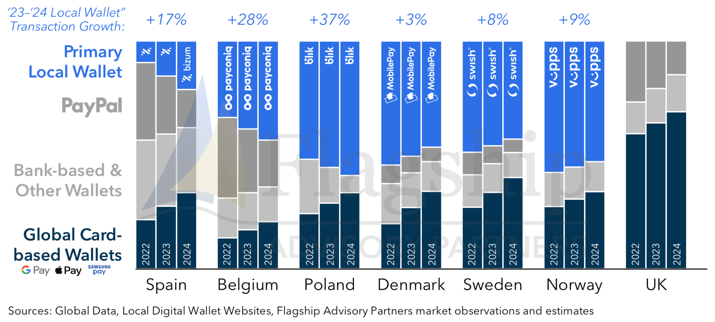

Local digital wallets across Europe are experiencing varied levels of success as they face increasing competition from global wallet solutions such as Apple Pay and Google Pay.

While some local solutions — often backed by strong domestic banking networks — continue to build loyal user bases and demonstrate solid growth, others are seeing stagnation.

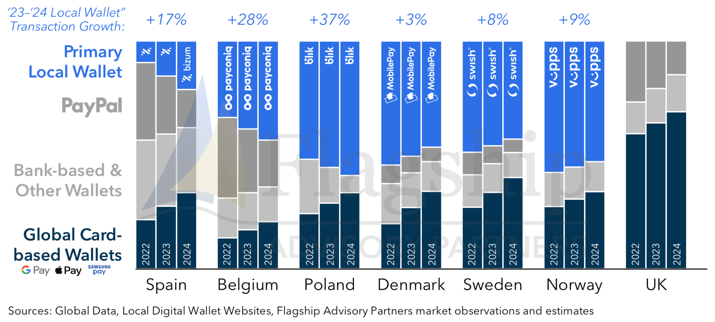

1. Which Mobile Wallet App Do You Use Most Frequently for Payments?

(survey based; % total wallet payment volume; Oct. 2024)

- Several European markets have developed local digital wallet leaders (e.g., Bizum in Spain), though their success in resisting the rise of global wallet solutions (e.g., Apple Pay) has seen mixed results.

- Wallets such as BLIK in Poland and Payconiq in Belgium continue to show strong growth, driven in large part by increasing usage in e-commerce.

- Established local wallets like MobilePay in Denmark and Swish in Sweden, however, are witnessing a slowdown in usage, as global wallets like Apple Pay continue to attract new users in their home markets.

- In markets where local alternatives have not taken root — such as the UK — global solutions like Apple Pay and Google Pay have rapidly become the default digital wallet choices for consumers.

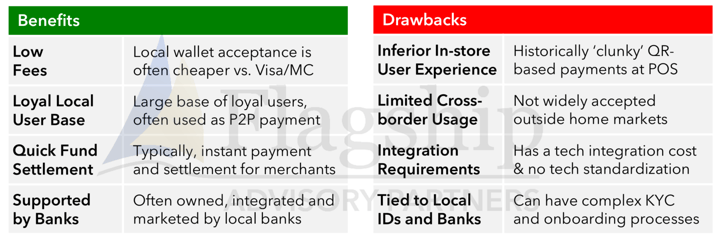

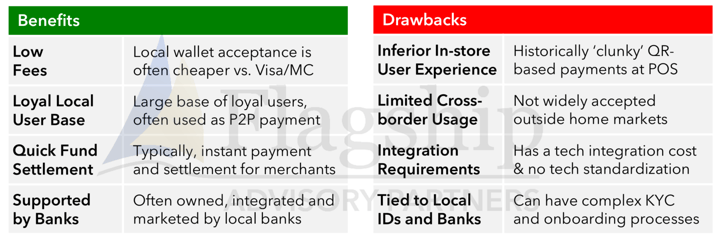

2. Key Benefits and Drawbacks of Local Digital Wallets

- Local digital wallets offer several compelling benefits. These include lower merchant acceptance fees, instant or near-instant settlement with minimal chargeback risk, and strong brand recognition and user loyalty within their home markets. Additionally, these wallets often benefit from promotional backing by local banks, which helps drive user adoption.

- Despite their strengths, local wallets face notable limitations. These include restricted cross-border usability, and fragmented technical standards that complicate and increase the cost of integration for payment providers. Their dependence on national identity infrastructure can limit scalability and accessibility. Furthermore, many local wallets have historically offered a subpar user experience in physical retail environments — a shortcoming that several local wallet providers are now actively working to address.

Key Implications of Local Wallets for the Ecosystem

For Banks

- Enables access to a wider base of local users via infrastructure independent of Visa/MC.

- Creates opportunities to gain transaction-level insights and cross-sell financial products.

- However, some local wallets have mixed UX vs. international wallets, and some generate lower interchange revenue.

For PSPs (Payment Service Providers)

- Prominent PSPs increasingly support local wallets to enhance their localized offerings. This improves conversion rates and strengthens local competitive position.

- Integration with local wallets, however, introduces technical complexity and regulatory overhead. These challenges are also often accompanied by lower margins.

Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com and Levi van Dalen at Levi@FlagshipAP.com with comments and questions.

Image Credit: Vipps MobilePay

Local digital wallets across Europe are experiencing varied levels of success as they face increasing competition from global wallet solutions such as Apple Pay and Google Pay.

While some local solutions — often backed by strong domestic banking networks — continue to build loyal user bases and demonstrate solid growth, others are seeing stagnation.

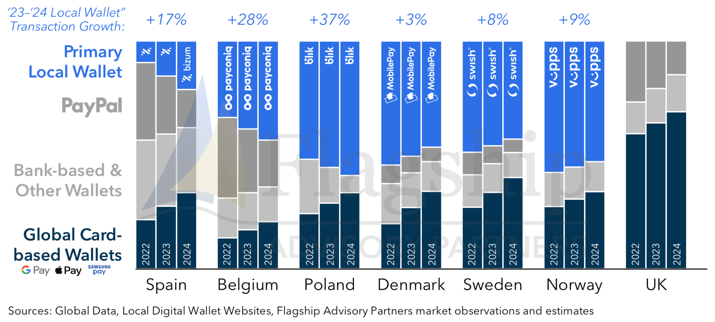

1. Which Mobile Wallet App Do You Use Most Frequently for Payments?

(survey based; % total wallet payment volume; Oct. 2024)

- Several European markets have developed local digital wallet leaders (e.g., Bizum in Spain), though their success in resisting the rise of global wallet solutions (e.g., Apple Pay) has seen mixed results.

- Wallets such as BLIK in Poland and Payconiq in Belgium continue to show strong growth, driven in large part by increasing usage in e-commerce.

- Established local wallets like MobilePay in Denmark and Swish in Sweden, however, are witnessing a slowdown in usage, as global wallets like Apple Pay continue to attract new users in their home markets.

- In markets where local alternatives have not taken root — such as the UK — global solutions like Apple Pay and Google Pay have rapidly become the default digital wallet choices for consumers.

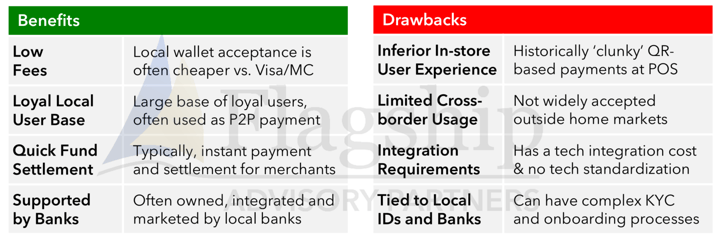

2. Key Benefits and Drawbacks of Local Digital Wallets

- Local digital wallets offer several compelling benefits. These include lower merchant acceptance fees, instant or near-instant settlement with minimal chargeback risk, and strong brand recognition and user loyalty within their home markets. Additionally, these wallets often benefit from promotional backing by local banks, which helps drive user adoption.

- Despite their strengths, local wallets face notable limitations. These include restricted cross-border usability, and fragmented technical standards that complicate and increase the cost of integration for payment providers. Their dependence on national identity infrastructure can limit scalability and accessibility. Furthermore, many local wallets have historically offered a subpar user experience in physical retail environments — a shortcoming that several local wallet providers are now actively working to address.

Key Implications of Local Wallets for the Ecosystem

For Banks

- Enables access to a wider base of local users via infrastructure independent of Visa/MC.

- Creates opportunities to gain transaction-level insights and cross-sell financial products.

- However, some local wallets have mixed UX vs. international wallets, and some generate lower interchange revenue.

For PSPs (Payment Service Providers)

- Prominent PSPs increasingly support local wallets to enhance their localized offerings. This improves conversion rates and strengthens local competitive position.

- Integration with local wallets, however, introduces technical complexity and regulatory overhead. These challenges are also often accompanied by lower margins.

Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com and Levi van Dalen at Levi@FlagshipAP.com with comments and questions.