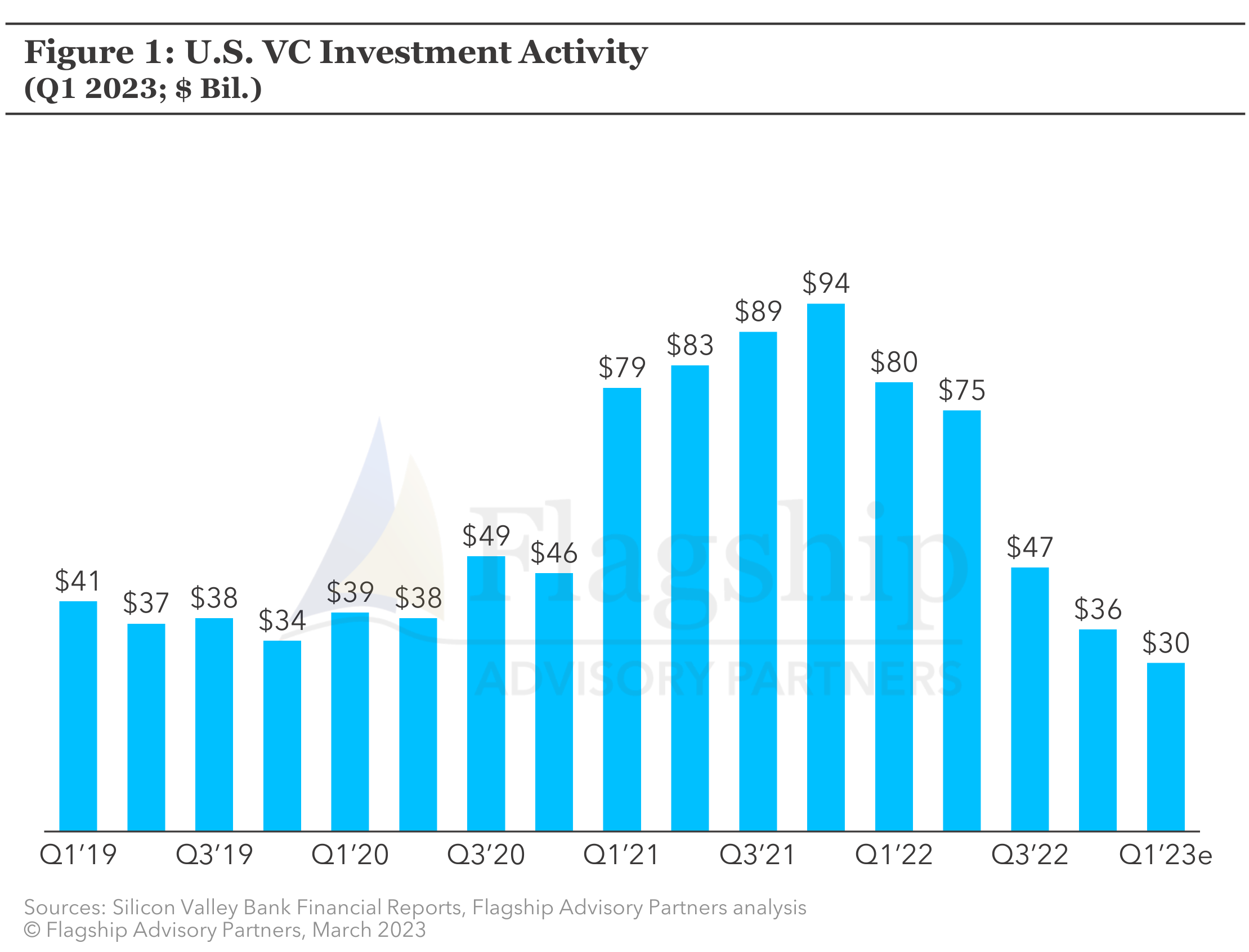

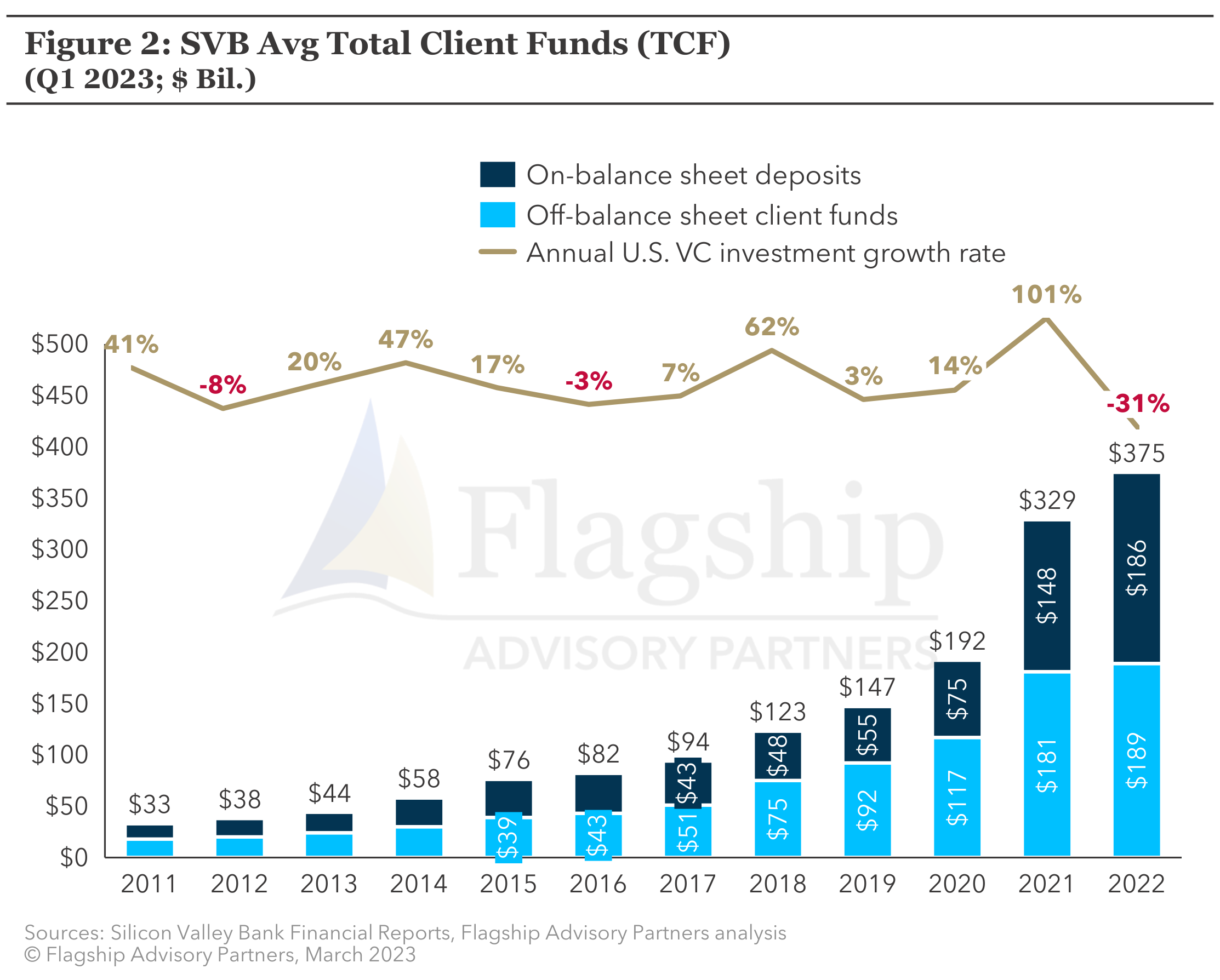

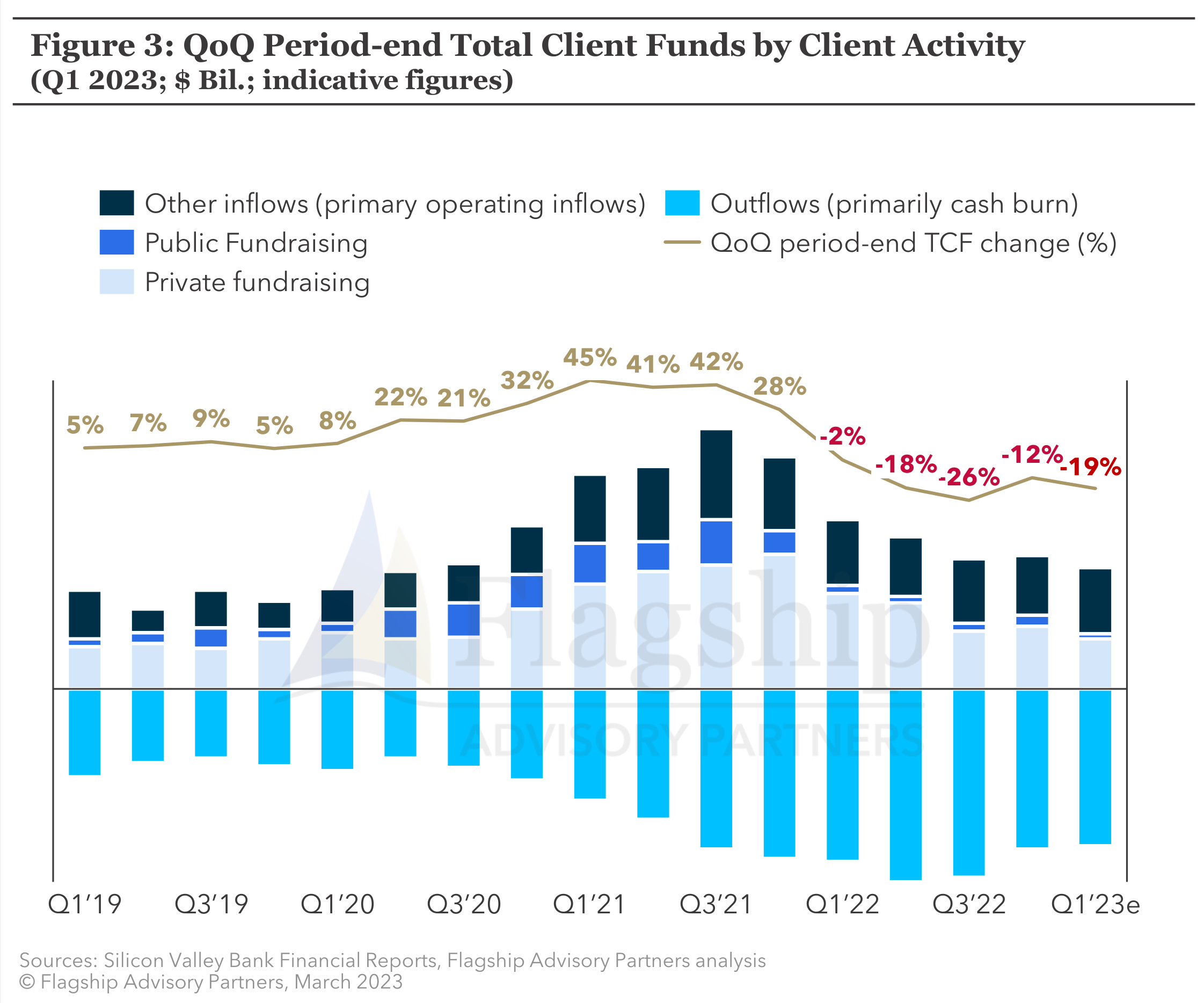

The collapse of Silicon Valley Bank (“SVB”) is the latest blow for fintech in what is shaping up to be a very tough year. We won’t recap the entire SVB story, but a brief look at SVB’s investor relations materials is instructive for the industry as a whole: a significant spike in funding from investors (Figure 1 below), leading to a buildup in Fintech deposits (Figure 2), coupled with increasingly high burn rates (Figure 3) by portfolio companies as expenses got increasingly stretched, and misalignment of liabilities and assets. SVB, a bank, has significant differences from operating fintechs, but we see three key implications for the broader fintech industry:

- Focus on identifying and mitigating operating model risks

- More scrutiny of sponsors and settlement mechanics

- Additional funding challenges

Implication #1: Focus on identifying and mitigating operating model risks

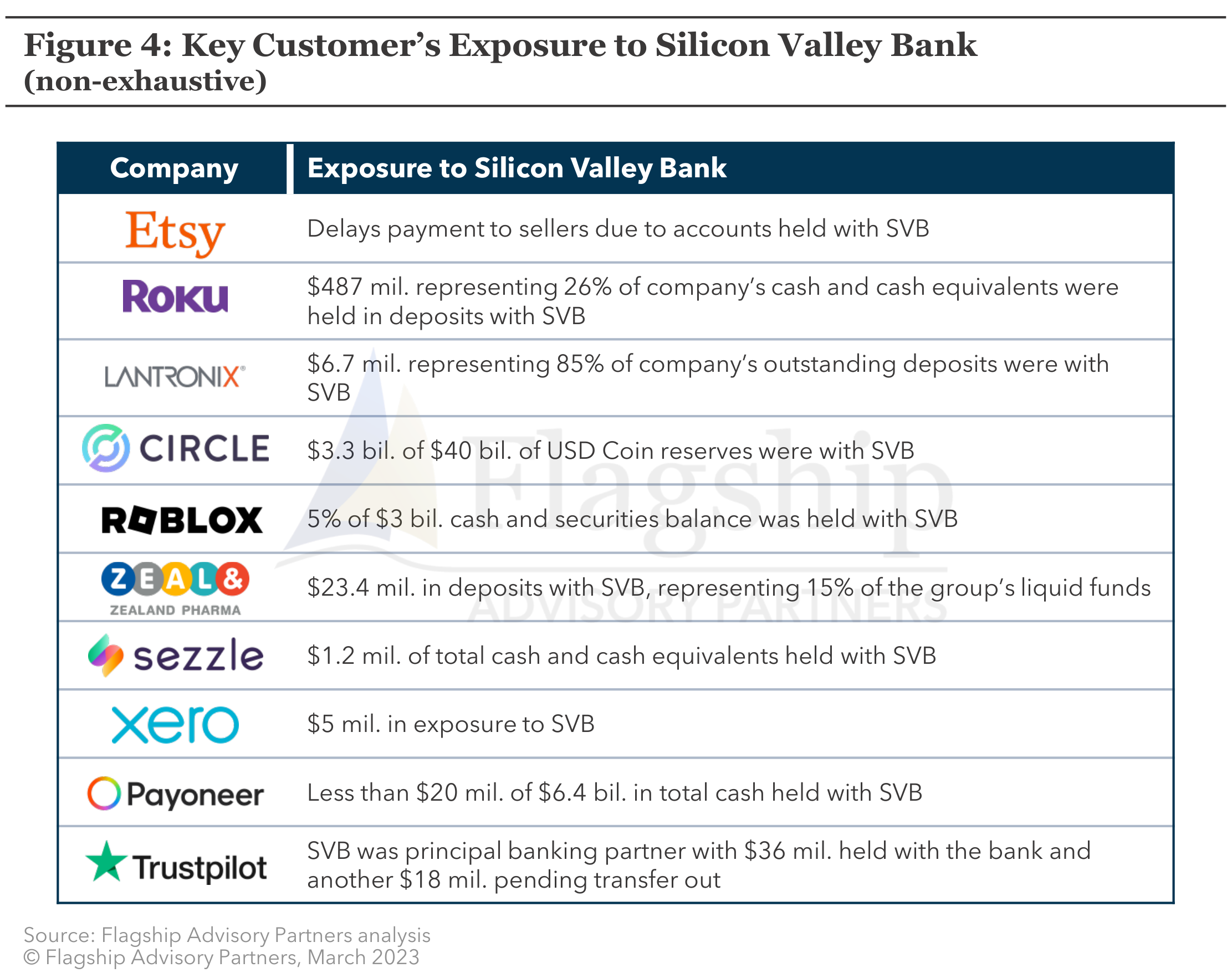

A bank run is a strong reminder of the risk posed by concentrated supplier relationships. There were many examples of fintechs disclosing their deposit exposure to SVB over the weekend (Figure 4 below), and several who had concentrated their deposits at SVB would have been challenged to make payroll. After fintechs make the obvious first move of diversifying their deposits, many will take deeper looks at the enterprise-level risks inherent in their operating models. Similar to the lessons learned by retailers, manufacturers, and others during the pandemic on the need to mitigate risks in supply chains, fintechs need to think through the risks in their operating models, and begin mitigation. Common threads in fintech operating models include:

- Relying on only one party to provide regulatory and payment scheme sponsorship;

- Relying on only one provider for core tech or for an even broader range services (e.g., BaaS);

- The difficulty in moving complex payments tech and processes to new providers in the event of a crisis;

- Heavy concentration of revenues among a few blockbuster clients and/or verticals;

- Heavy use of distribution partners;

- Significant reliance on partners to enable the broader value chain, and a natural tendency to concentrate activities at a few vendors in order to achieve scale efficiencies;

- Among others

We have seen some of this before (e.g., the collapse of Wirecard), but SVB is significantly bigger and touched a broader swath of the industry. While mitigating the types of risks listed above can be complex (e.g., mitigating reliance on a core technical processor is oftentimes impractical), SVB’s collapse serves as a strong reminder that fintechs typically have highly concentrated operating models clustered around a few key partners, and that this presents both systemic and idiosyncratic risks that need to be identified and at least partially mitigated.

We have seen some of this before (e.g., the collapse of Wirecard), but SVB is significantly bigger and touched a broader swath of the industry. While mitigating the types of risks listed above can be complex (e.g., mitigating reliance on a core technical processor is oftentimes impractical), SVB’s collapse serves as a strong reminder that fintechs typically have highly concentrated operating models clustered around a few key partners, and that this presents both systemic and idiosyncratic risks that need to be identified and at least partially mitigated.

Implication #2: More scrutiny of sponsors and settlement mechanics

SVB was a sponsor or settlement bank for several well-known PSPs and payment facilitators and maintained settlement accounts for several well-known marketplaces and PSPs. The prospect of a sponsor and settlement bank failing rightly caused a panicked scramble for payments providers to immediately source new sponsors and settlement banks. Etsy, a major marketplace, notified merchants on Friday of delays in settlement due to SVB, and by Monday had new settlement arrangements in place. 1

Anecdotal evidence from Europe, where e-money institutions and payment institutions have proliferated, indicates that regulators are placing greater demands on the activities of license and BIN sponsors. The fallout from SVB is likely to increase regulatory scrutiny of these relationships in Europe even further. We expect a similar impact in the US, where the sponsorship market is relatively large, and served primarily by small banks. The direct impact for fintechs could be fewer availability of sponsors (already relatively low in Europe), higher prices for sponsorship services, and increased regulatory burden as sponsors pass compliance requirements on to clients.

More immediate will likely be more stringent examination of the risks posed by settlement banks, since in the strictest interpretation of deposit insurance mechanics, a bank failure could result in settlement account balances being uninsured, and therefore Visa and MasterCard could potentially be liable to settle with merchants due to their role as the ultimate backstops in the cards system. Such a risk could prompt card schemes to reexamine the risks associated with settlement accounts, which could result in more stringent requirements for ringfencing and record-keeping of payfac sub-accounts, increased reserve/collateral requirements, and increased requirements on acquirers, all of which could to increased costs and less flexibility for PSPs and payfacs.

PSPs and payfacs will also be intrinsically motivated to diversify their settlement accounts in order to mitigate counterparty risk for settlement. This too will increase overall operational costs and complexity for these providers, some of which will likely be passed on to end customers.

Implication #3: Additional funding challenges

SVB’s failure further dents investors’ perception of fintech, has already hit regional bank stocks hard, and removed a major lender to fintechs from the market. Bloomberg reported that 190 firms are now on the hunt for a new lender. 2 This will likely reduce overall debt funding to the fintech sector, putting a further damper on growth.

Although aggressive moves by regulators to make SVB’s depositors whole appear to have stemmed any risk of a broader contagion, all evidence points to 2023 being a shakeout. Fintechs enjoyed a bounty of funding in the immediate post-pandemic period, but many lost their way on expense management, resulting in growth in expenses far outpacing growth in revenues. While fintechs are currently trying to right-size their expense bases, some will not do so before they run into liquidity challenges, and we expect more failures ahead (e.g., Railsr). Therefore, we encourage fintechs to review their operating models with an eye towards mitigating potential risks generated by partners. SVB’s failure underscores the potential operating vulnerabilities to house and sponsor banks, and we expect that failures of fintechs (i.e., operating tech partners) will create a parallel set of risks to operating models.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com with comments or questions.

[1] Source: “Etsy begins processing seller payments via alternative partners after delays caused by SVB implosion”, Tech Crunch, 13 March 2023, Etsy begins processing seller payments via alternative partners after delays caused by SVB implosion | TechCrunch

[2] Source: “190 Firms with SVB Loans May Hunt for New Lender”, Bloomberg, 14 march 2023, Silicon Valley Bank Collapse: 190 Firms With SVB Loans May Hunt for New Lender - Bloomberg