Banking as a Service (BaaS), an innovative fintech model of powering fintechs and corporates with ”integrated financial services” (white label provision of a full stack of financial services products and supporting infrastructure and back office capabilities), has rapidly evolved as a disruptive theme in Europe. As we observed previously, SaaS (Software as a Service) and ISVs (Independent Software Vendors) saw massive upsides in integrating financial services starting with payments, a theme that investors loved. Integrated payment services matured due to Adyen, Stripe, and other PSPs offering the tech and enabling infrastructure for SaaS to embed payment services across use cases. Heavy interest from investors also supported high valuations for PSPs such as Stripe and Checkout, amongst others. Now, with the rapid proliferation of BaaS fintechs (see figure 1), we are seeing the expansion of integrated financial services beyond payments to fuel the broader needs of fintechs, corporates, and SaaS.

FIGURE 1: European Landscape of BaaS Providers (2022; select players, based on office locations and license approvals)

Defining BaaS

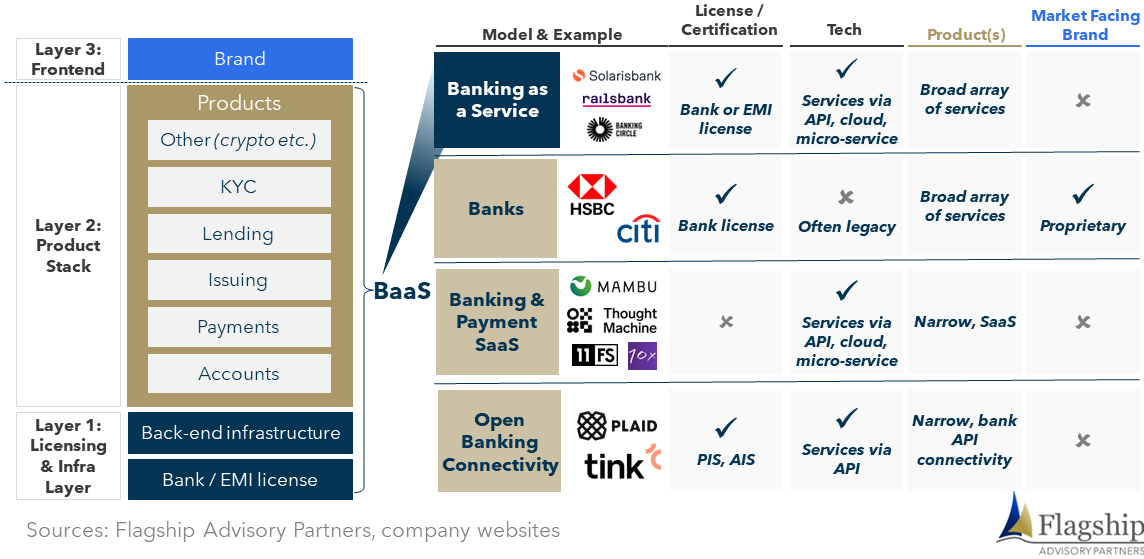

BaaS has reshaped how financial products and services are accessed and distributed. BaaS fintechs offer white-labeled plug-and-play licensed financial products that enable fintechs (e.g., neobanks, lending, wallets, PSPs, etc.) and corporates (e.g., fuel, insurance, retailers, etc.) to embed these products into their own customer journeys. As we illustrate in figure 2, BaaS fintechs are equipped with modern tech and platform capabilities that enable them to layer financial products on top of the underlying licensing and back-office infrastructure. In contrast to traditional banks (which are monolithic and control the brand), core banking software (which only provide technical enablement for some products), or open banking fintechs (which mainly provide infrastructure), the multi-layered architecture used by BaaS providers allows them to offer decoupled or integrated financial products to brands on a relatively flexible basis.

FIGURE 2: BaaS Platform Stack and Value Chain Comparison by Business Model

Baas Gained Relevancy Serving Untapped Fintech Needs

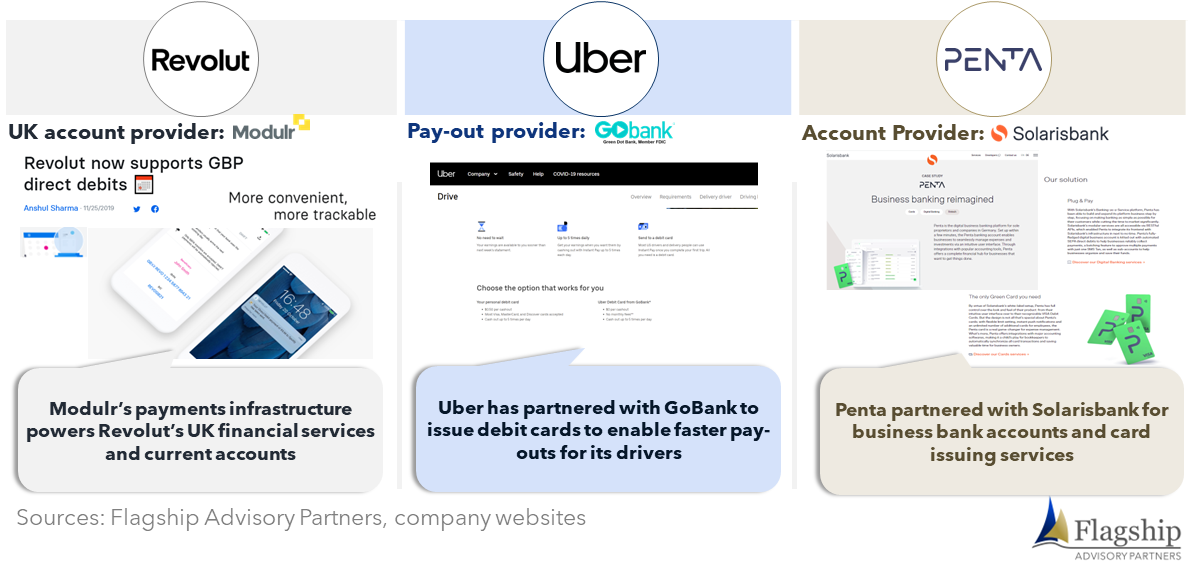

BaaS providers gained early traction by addressing the needs of fintechs and select Big Techs. BaaS offers fintechs a rapid path to market with significant technical and business case advantages over building everything in-house or assembling legacy components and partnerships. Neobanks in particular benefitted by leveraging BaaS partners and focusing on customer-facing products and customer acquisition, rather than building plumbing. As we illustrate in figure 3, several fintechs and Big Techs have entered into partnerships with BaaS providers to offer branded financial services products to their end customers. For example, Uber partnered with Green Dot Bank to issue Uber debit cards to its drivers, enabling faster disbursements, cashback rewards, and discounts for gas and car maintenance services. In another example, Revolut works with Modulr Finance in the UK to power its consumers and businesses with current accounts and payment services.

FIGURE 3: Example Integrated Finance Use Cases Powered by BaaS

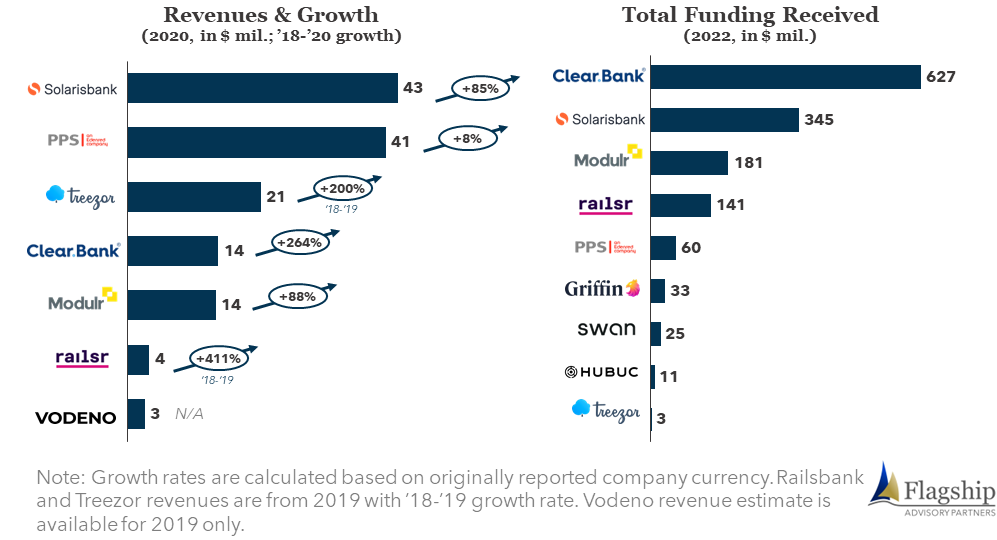

The increasing demand for integrated financial products is also evident in the recent financial performance of BaaS fintechs, as we illustrate in figure 4, which are growing at double to triple-digit topline growth. At the same time, these fintechs are also receiving a massive injection of capital from investors to drive international expansion, product expansion, and address the needs of new corporate/SaaS verticals.

FIGURE 4: BaaS Financials (Select players)

Expanding from serving fintechs to corporates and SaaS

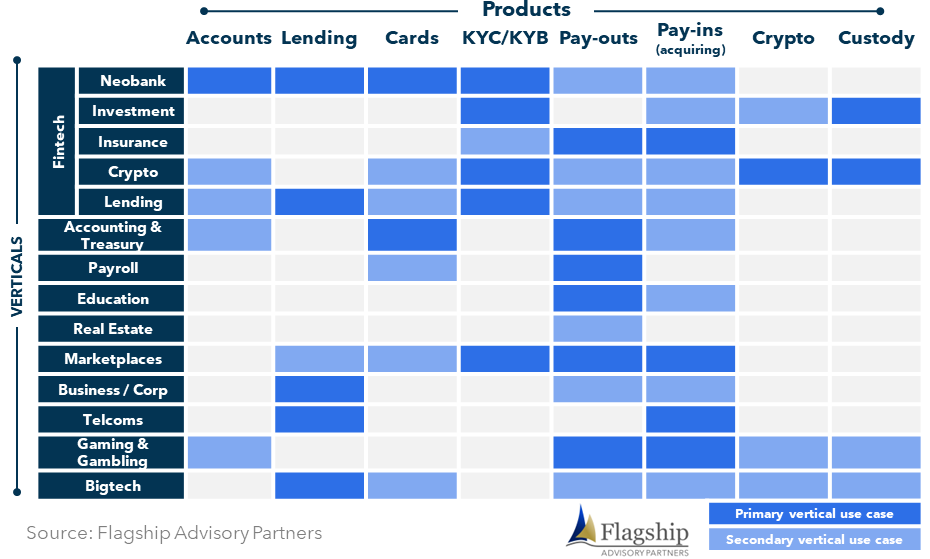

Fintechs were clearly the early drivers of demand for BaaS, but large corporates (Amazon, Samsung, Ikea) are now using BaaS services. These corporates aspire to integrate fintech products into their customer user journeys to increase customer stickiness, drive brand loyalty, and benefit from new fintech revenue streams. Today, leading BaaS providers offer a broad product suite that caters to a variety of fintech and corporate needs, as we illustrate in figure 5. Corporates and SaaS providers see value in using a single provider for all their financial infrastructure needs, instead of using separate providers for payments, banking, lending, investments, and others. Not all BaaS have the same product portfolio, however. The underlying BaaS license is a key determinant of the products that can be offered. For example, having a banking license offers the possibility of offering deposit accounts, and a range of credit products. In contrast, an electronic money institution (EMI) or payments institution (PI) license enables several payment products, but not deposit accounts or lending. BaaS providers also differentiate via breadth and depth of product coverage. Solarisbank and Railsr are examples of BaaS providers with broad product coverage. Banking Circle and Modulr Finance are more focused on bank payments and virtual IBANs (though Banking Circle also enables merchant and B2B lending).

FIGURE 5: BaaS Products by Verticals (non-exhaustive)

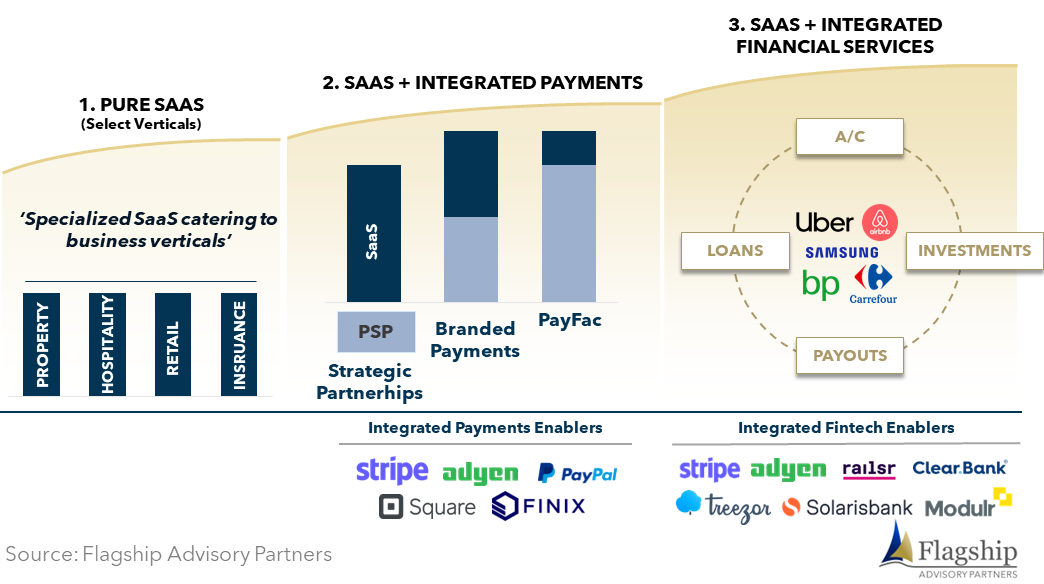

BaaS fintechs are likely to power next-generation SaaS models in the near future. As illustrated in figure 6, SaaS saw massive upsides in evolving from being purely software native to specialized integrated payment players in the last few years. Stripe, Adyen, Square, and others enabled the payment infrastructure to integrate payment services. Leading SaaS players also adapted their operating models to take more ownership of payments (e.g., through a payfac license). With Stripe and Adyen expanding into broader BaaS products, and the proliferation of newer BaaS fintechs, we anticipate an evolution towards next-generation SaaS models that will drive broader integration of fintech services into their core software. We already see examples of such next-generation SaaS, for example, Shopify working with Stripe to power their merchants with money management accounts, spending cards, rewards, and payments.

FIGURE 6: BaaS to Power Next Generation SaaS

Please do not hesitate to contact Anupam Majumdar Anupam@FlagshipAP.com, Elisabeth Magnor Elisabeth@FlagshipAP.com or Anton Zoldak Anton@FlagshipAP.com with comments or questions.