Central Bank Digital Currencies (CBDCs) have emerged as a pivotal topic at the intersection of finance, technology, and policy. As traditional forms of currency give way to digital alternatives, central banks worldwide are exploring the potential of CBDCs to revolutionize how we conduct financial transactions, manage monetary policy, and safeguard economic stability. The article attempts to demystify CBDCs via a status update on various central bank initiatives, as well as insights into CBDC characteristics, use cases, and potential impact on stakeholders in the payment ecosystem.

Central Bank Digital Currency (CBDC)

A Central Bank Digital Currency (CBDC) is a digital form of a nation's currency created and overseen by the central bank. It is distinct from current “digital” funds (those that holders see in their bank balance online) as CBDC is issued directly to holders by the central bank, held on the central bank’s ledger (not on the ledger of banks, as is the case today). In some design constructs, the central bank operates or manages wallets and payments attached to the CBDC.

Central banks have diverse motivations for issuing CBDCs. For example, Nigeria and Brazil aim to increase financial inclusion and serve the underbanked, while Russia and China seek to reduce reliance on Western currencies and reduce exposure to sanctions. The European Union, currently researching a digital Euro CBDC, views it as a potent monetary policy tool to mitigate wide variances in economic conditions across the eurozone.

CBDCs come in two types:

CBDCs come in two types:

- CBDC Retail: for public use - individuals and businesses access digital currency from the central bank, replacing cash, and improving payments.

- CBDC Wholesale: for financial institutions and governments - used for interbank and cross-border transactions, settlements, and reserves management.

Due to its programmability and technological flexibility, a CBDC can cover multiple payment applications, which depends on the chosen issuance model and intermediaries' role in the value chain. Central banks around the globe are particularly intrigued by the potential applications of such technology.

CBDC development is in its early stages, but two models are emerging: one where the central bank handles the entire value chain, including CBDC holder interfaces (wallets and portals), and another where the central bank leverages existing bank or payment service provider (PSP) infrastructure with specific incentives.

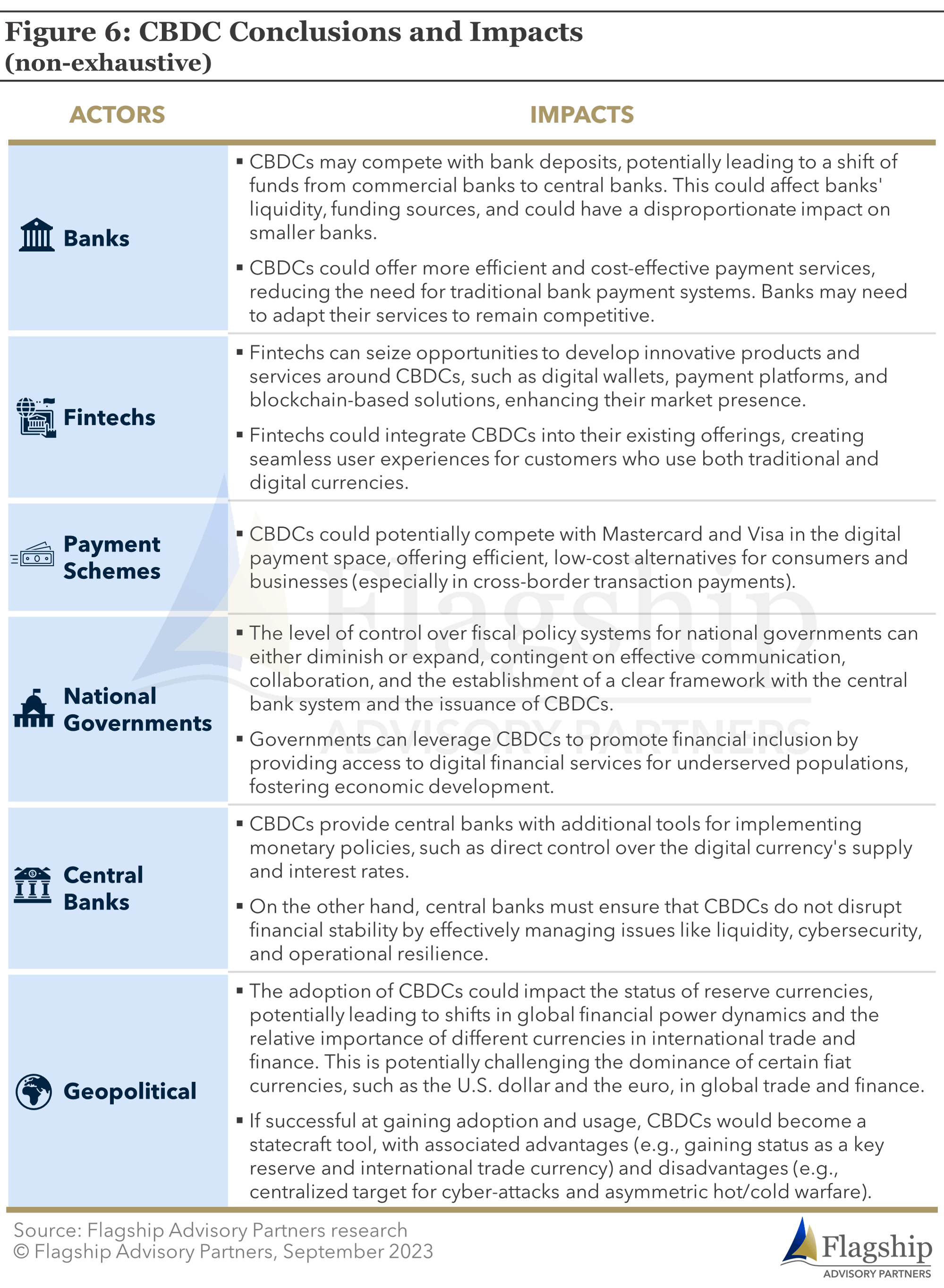

Although CBDC offers potential advantages (cost reduction, increased financial inclusion, financial innovation, etc.), some stakeholders and commentators have raised concerns about financial stability, privacy and cybersecurity risks, operational risks, and user adoption challenges. The specific model and design features chosen for an individual country’s CBDC will determine how real these advantages and disadvantages will ultimately be, and different stakeholders will have varied impacts.

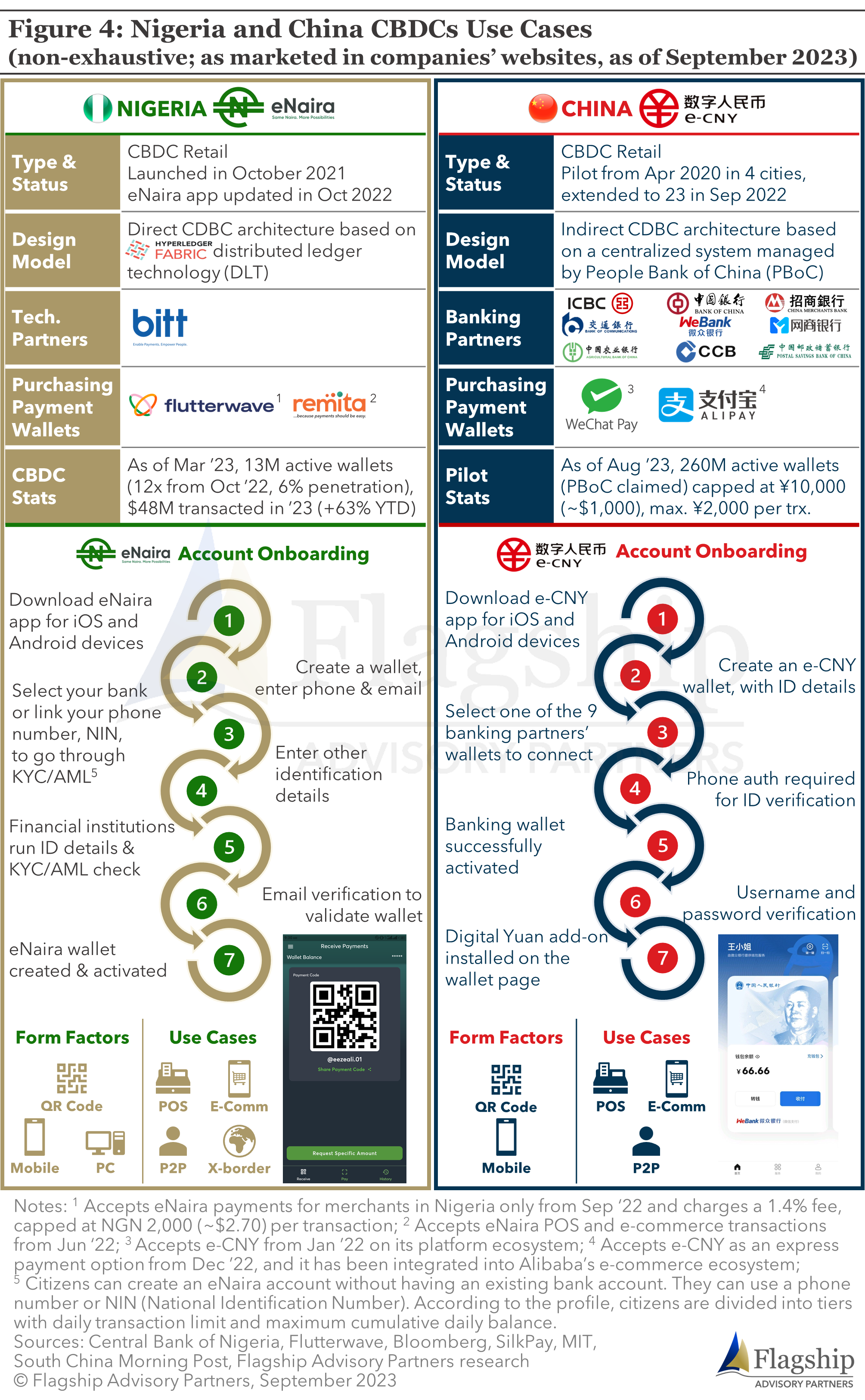

One of the most advanced and successful CBDCs projects are the Nigerian e-Naira and the Chinese Digital Yuan.

One of the most advanced and successful CBDCs projects are the Nigerian e-Naira and the Chinese Digital Yuan.

In October 2021, the Central Bank of Nigeria introduced its CBDC with the target to achieve a 95% financial inclusion rate by 2024. After some initial challenges with app functionalities in the first year, the Central Bank of Nigeria updated the eNaira wallet a year later in October 2022. Since then, 12x times more wallets have been activated, and penetration reached 6% (as of March 2023). The eNaira app allows individuals to sign up without having a bank account; in this case, a phone number and/or NIN (National Identification Number) is required. According to the profile and the sign-up process, individuals are split into tiers with daily transaction limits and maximum cumulative daily balance.

Launched in April 2020, China's digital yuan pilot (e-CNY) has evolved rapidly. The People's Bank of China expanded its nationwide reach, testing the initiative with existing payment channels. The user base has grown to over 260 million wallets since its debut, operating in only 23 cities (based on numbers cited by the PBoC). Unlike the set-up in Nigeria, the e-CNY employs an indirect CBDC architecture. In this setup, nine Chinese banks, seven commercial and two online banks, serve as intermediaries responsible for offering the application and front-end infrastructure.

CBDC projects in Western economies are still in the early stages, and most efforts to date have focused on prototypes and technology research, and initial issuance is not expected before 2025. Conversely, CBDC issuance in some major emerging economies is expected sooner. For instance, India, Brazil, and Russia expect to issue their CBDC in the next 18 months.

Conclusions and Impacts

Since CBDCs are still in their very early stages, it is premature for most stakeholders to draw definitive conclusions as much will depend on the ultimate design choices made by the central bank issuing the CBDC. For most stakeholders, the path forward is vigilant monitoring and assessing impacts as design specifications and business models become apparent. We summarize the potential implications for key stakeholder categories as they stand today in the table below.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com, Stanislav Dubský at Stanislav@FlagshipAP.com, or Alessandro Mighetto at Alessandro@FlagshipAP.com with comments or questions.