Global Payments (“Global”), a historically acquisitive company, has recently foregone M&A in favor of using available capital for share repurchases (~$1.25B in equity repurchased to date in 2022). On Monday, August 1, Global marked a return to form with three announcements:

-

Entered into a definitive agreement to acquire EVO Payments for $4 billion ($34 per share)

-

Entered into a definitive agreement to sell Netspend’s consumer assets to Searchlight Capital and Rêv Worldwide for $1 billion

-

Private equity investor Silver Lake committed a $1.5 billion investment in Global Payments in the form of convertible senior notes(1)

The EVO announcement marks Global Payments’ first acquisition since its acquisition of MineralTree in October 2021.

(1) Convertible note will have a cash coupon of 1%, 7-year term, and conversion price of $140.66; Global Payments intends to execute a call spread overlay to raise the effective conversion premium significantly

Strategic Fundamentals of EVO Acquisition

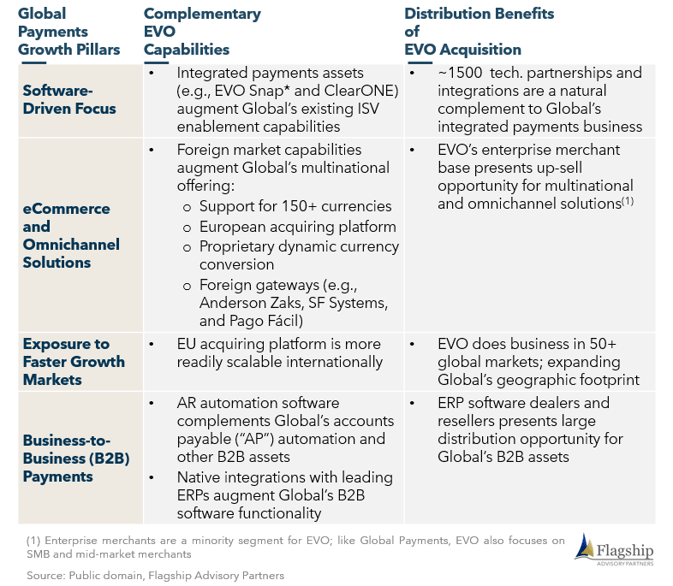

The strategic fundamentals of the EVO acquisition are strong. Namely, EVO brings scale to Global’s merchant payments acceptance business with a largely complementary geographic, customer, and distribution footprint, as well as accounts receivable (“AR”) automation software and ERP integrations that augment Global’s existing B2B solution set. As shown in Figure 1 below, EVO complements all four of the growth pillars that Global has communicated to the investment community.

FIGURE 1: Complements of EVO Acquisition Across Global Payments’ Stated Growth Pillars

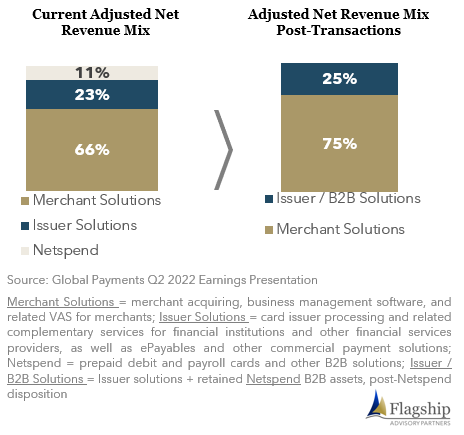

Moreover, as shown in Figure 2, the future business (post-EVO acquisition and Netspend disposition) will be more strategically aligned with Global’s target customer sets (businesses, FIs, and intermediaries, not consumers).

FIGURE 2: Global Payments Pro-Forma Revenue Mix (2022E Adjusted Net Revenue)

Strategic Benefits to Growth Pillar #1: Software-Driven Focus

The EVO acquisition brings ~1,500 technology partnerships and integrations that complement Global’s 6,000 ISV relationships and integrated payments assets (e.g., EVO Snap* and ClearONE) that will bolster Global’s already strong ISV enablement capabilities. Given EVO's partner-based ISV distribution model, Global should also expect little to no channel conflict with its owned assets.

Strategic Benefits to Growth Pillar #2: eCommerce and Omnichannel Solutions

EVO’s capabilities in foreign markets (e.g., support for 150+ currencies, European acquiring platform, dynamic currency conversion capabilities, and foreign market gateways) will improve Global’s multinational offerings. Additionally, Global Payments’ management has stated that EVO’s enterprise merchant base presents an up-sell opportunity for its Unified Commerce Platform (Global’s multinational eCommerce and omnichannel solution).

Strategic Benefits to Growth Pillar #3: Exposure to Faster Growth Markets

EVO has been successfully pursuing geographic expansion since c. 2012. It currently does business in 50+ geographic markets, and its international operations contribute ~60% of revenue (2021). For comparison, Global generated more than 80% of its revenue from the Americas in 2021.

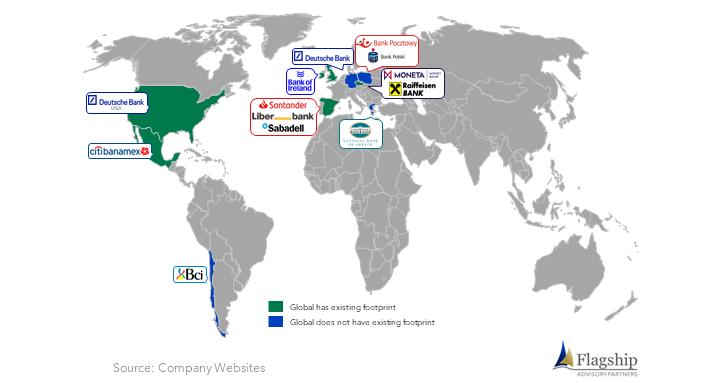

EVO’s footprint will significantly expand Global’s presence in international markets. Specifically, EVO will establish Global’s presence in Chile, Poland, Germany, and Greece and add to its footprint in markets such as Mexico, Spain, the UK, and the Czech Republic. As shown in Figure 3, EVO’s bank partnerships (a key tenet of its distribution strategy abroad) will support distribution in foreign markets.

FIGURE 3: Headquarters of EVO’s Bank Partners

Strategic Benefits to Growth Pillar #4: Business-to-Business (B2B) Payments

Last year, Global announced B2B payments as a fourth growth pillar; shortly thereafter, it acquired MineralTree in October 2021, adding AP automation software to its existing B2B assets (virtual card and commercial card processing, as well as B2B software and other solutions including expense management, ePayables, payroll, paycard, and earned wage access). EVO’s AR automation solution is a natural complement, combining solutions on both sides of the buyer-supplier network. EVO’s integrations with several leading ERPs (including Microsoft Dynamics, SAP, Oracle, Acumatica, and Sage) will bolster several of Global’s B2B offerings and expose a large distribution opportunity in ERP software dealers and resellers.

Market Impacts

The announced transactions will have varying degrees of impact across markets and stakeholders:

US Merchant Services

While it is arguably the largest strategic acquisition in US merchant services since the string of mega-deals in 2019, as shown in Figure 4, the combination of Global Payments and EVO’s relatively small US portfolio does not materially shift the leaderboard. The larger consideration is Global Payments improved position for multinational merchants.

FIGURE 4: Competitive Rankings of US Merchant Acquiring Leaders

European and Global Merchant Services

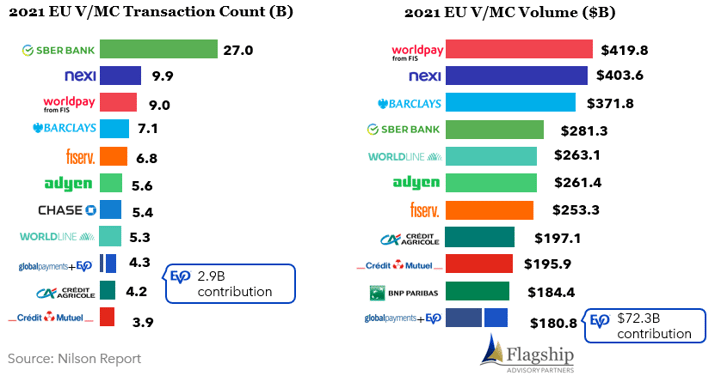

The impacts of the EVO acquisition are more pronounced in European merchant services. As shown in figure 5, the combined entity will become the 9th largest European merchant acquirer, based on 2021 European Visa and MasterCard transactions. Separately, EVO and Global Payments ranked 13th and 21st based on the same criteria.

From a global perspective, the EVO portfolio adds approximately 3.5 billion total purchase transactions. Global Payments is expected to remain the 5th largest global acquirer based on purchase transactions.

FIGURE 5: Competitive Rankings of EU Merchant Acquiring Leaders

Issuer Processing

The impacts on the issuer processing competitive landscape are minimal. Global Payments management has stated that EVO’s European bank partners present opportunities to cross-sell issuing solutions, but we view this strategy as opportunistic at best.

B2B Payments

We have seen a general maturation of B2B payments providers evolving their product portfolios away from point solutions toward full suite solutions. The addition of EVO’s AR capabilities fits well into Global’s growing suite of B2B solutions. That said, digital B2B payments are still a large a greenfield opportunity.

EVO’s Bank Partners

EVO’s bank partners (particularly those operating in regions where Global Payments already has a footprint) should consider if the pending merger presents potential channel conflicts or competitive concerns, although in our experience, in reality, there is no negative impact to a bank if its acquiring partner has well established “Chinese Walls” to separate management of its different bank alliance partners. There is also an argument that having greater scale and presence in a market via multiple bank partners adds to the acquirer’s overall capabilities and commitment to a market, which benefits its bank partners.

Global Payments Shareholders

The public equity market has reacted positively to Global’s announcements; Global’s stock price jumped 7% on the day of the announcement and remained positive throughout the subsequent week. Over the near term, shareholders should of course, pay keen attention to regulatory and EVO shareholder approval of the acquisition, as well as to Global’s ability to meet 2022 earnings projections amid the Netspend disposition (and exit from Russia). Longer-term, shareholders should be mindful of Global’s ability to:

- Manage increased leverage (net leverage is expected to be approximately 3.9 times EBITDA after the close of both transactions)

- Realize synergies (Global is forecasting to generate $125M in run-rate EBITDA synergies within two years of the EVO transaction)

- Continue to realize scale benefits given additional platform and gateway complexity, post-EVO acquisition

That said, the Global Payments management team has a successful track record of managing integrations of this size (and bigger).

EVO Deal Commentary and Outlook

Only time will tell if Global Payments can deliver the $125M in run-rate EBITDA synergies that it is forecasting. Still, overall, we are bullish on the strategic fundamentals of the EVO deal. Additionally, Global Payments appears to have achieved a favorable price (the 10x Enterprise Value / 2023 Calendar EBITDA multiple is modest compared to past comparable scale acquisitions) presenting a moderate hurdle rate to positive ROI.

Looking forward, the investment from Silver Lake also provides ample dry powder. We expect Global to be an active participant in future M&A.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Erik Howell at Erik@FlagshipAP.com with comments or questions.