Fintech is full of acronyms and catch phrases, none more used and yet more confusing than ‘embedded finance’. Everyone seems to have a different definition and understanding of embedded finance. To some, it is something specific, to others, it effectively encompasses all fintech. We can all agree, however, that fintechs that master embedded finance as a product and go-to-market model are winning. Given our exposure to what we think are the many domains of embedded finance, we attempt to define and to explain exactly what embedded finance is within this article by pealing back the onion and illustrating its many layers with real-life examples.

Embedded Finance At Its Core

Before we get into defining embedded finance, let’s first agree that ‘fintech’ and ‘financial services’ are effectively synonymous for this discussion. The days of financial services without technology are over, at least if you want to be relevant as a provider within embedded finance, where embedding is technology driven. Throughout this article, we will refer to ‘fintech’ or ‘fintech services’ therefore, rather than ‘financial services’. We also acknowledge that leaders in embedded finance tend to be companies with technology DNA, rather than traditional financial institutions.

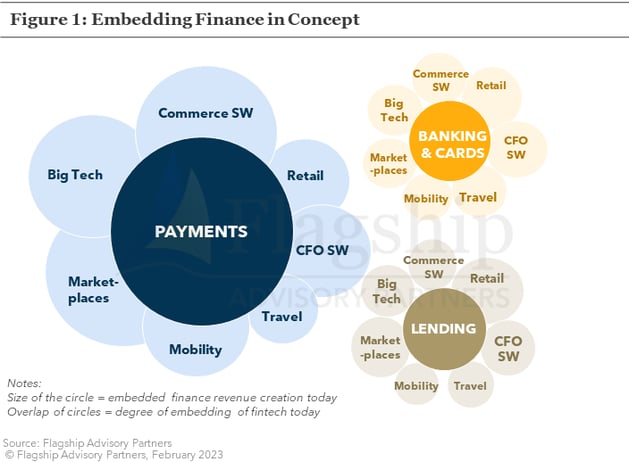

“Embedded” is the operative word when defining embedded finance. Embedded finance, at its core, involves embedding fintech services into non-financial use cases, which in turn makes these use cases better and more lucrative. The deeper and more seamless the embedding, the more powerful the outcome. As shown in Figure 1, embedded finance revolves around three primary product categories of finance: payments, banking and cards, and lending. There are also use cases for embedded investments and insurance, but for this article, we focus on the former fintech domains. Figure 1 also attempts to illustrate the most relevant ‘platforms’ into which fintech services are embedded, and the relative size and depth of embedding in the market today.

Embedded Finance Use Cases

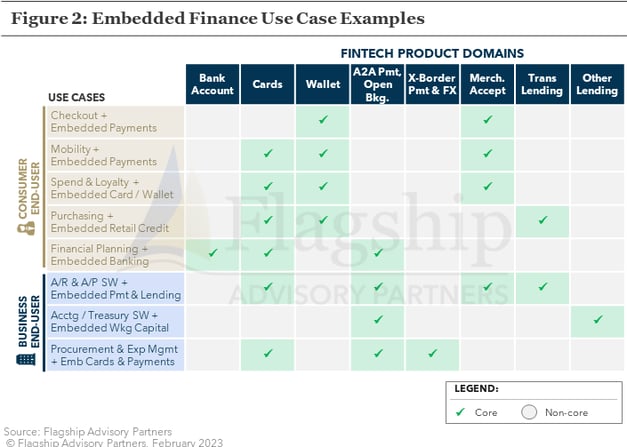

Now let’s begin peeling back the embedded finance onion, starting with real-life use cases that we observe in our daily lives. The most common embedded finance use cases focus on commerce enablement, for example, frictionless shopping or frictionless mobility (e.g. ,Uber). Beyond commerce, many use cases also focus on financial planning and business management. In figure 2, we provide a handful of examples of embedded finance use cases, separated those prevalent with consumers as the user and those prevalent with businesses as the user.

Examining these use cases, the influence of technology becomes clearer. Embedded finance is far from new; seamless e-comm checkout has been around for nearly two decades, and retail cards and credit accounts have been around (in electronic form) since the 1980s. What is different today is the prevalence of software, which in many forms, is perfect for embedded finance. Embedded finance is hot stuff today principally because consumers and businesses use software (or apps) across all aspects of our lives and businesses. Software, in its many forms, is the key fundamental enabler for most embedded use cases, because software technology allows a fintech service to be frictionlessly embedded within a broader use case. In other words, a retailer selling me a loan at a separate desk in the back of the store is not seamless, nor embedded, but walking out of the store with no checkout at all via BNPL is a powerful embedding of shopping and finance.

Embedded Finance ‘Clients’

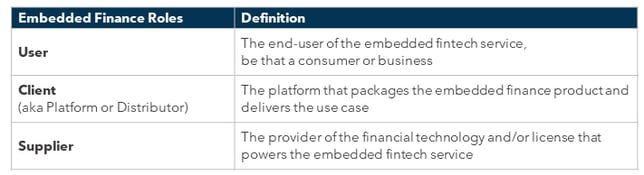

Peeling back the next layer of the onion, we distinguish between users, clients, and suppliers of embedded finance. Users are all of us, who engage with embedded finance when using Uber or buying from Amazon. ‘Clients’ is the term we assign to the platform owners who design and distribute the embedded finance use cases (for example, Amazon who owns many embedded finance products such as branded cards, checkout service/wallet, and embedded lending to its sellers and suppliers … among others). Suppliers are the fintechs that provide the technical infrastructure and licensing that powers embedded finance. In the case of Amazon, embedded finance suppliers include companies such as JPM Chase, Synchrony, C2FO, and others.

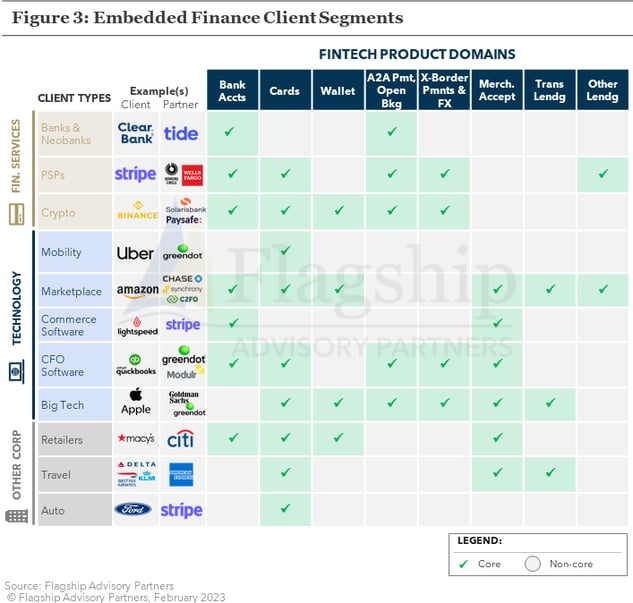

In Figure 3, we define a range of embedded finance client segments, which also tie back to the illustration shown earlier in Figure 1:

Financial Services: A primary segment for many embedded finance suppliers is other financial services companies. In fact, some suppliers focus only on “wholesaling” their infrastructure services to other fintechs, for example, Mastercard, Banking Circle, and Clear Bank. We will circle back to this concept of operating models shortly.

Technology Companies: The next client segment defined in Figure 3 is technology companies, whose DNA is founded on technology, including: mobility platforms, marketplaces, commerce software, business and financial management software, and ‘big tech’ platforms. Technology companies are in many ways the most powerful clients (aka platforms) driving the evolution of embedded finance. Technology platforms power the mobile commerce universe and help to automate many aspects of business. The most successful suppliers of embedded finance services are generally those that position well as partners to the technology client segment.

Other Corporates: The final client segment within our embedded finance taxonomy, are corporations, where we include retailers, travel providers, automotive and petrol companies, among others. Within the corporate segment, there are some clear and powerful use cases (e.g., retail cards, smart vehicles), but also questions as to potential reach and scale of embedded finance. This is a question that we are frequently asked: “how far will embedded finance reach … will is extend to all forms of corporates and their respective use cases?” A complex question lacking a simple answer, but in general, we do not believe that embedded finance has limitless potential. There are practical limitations to the demand for embedded finance. Personalizing the question, I quite like my banks and I simply don’t need banking services from most of the corporates with whom I interact.

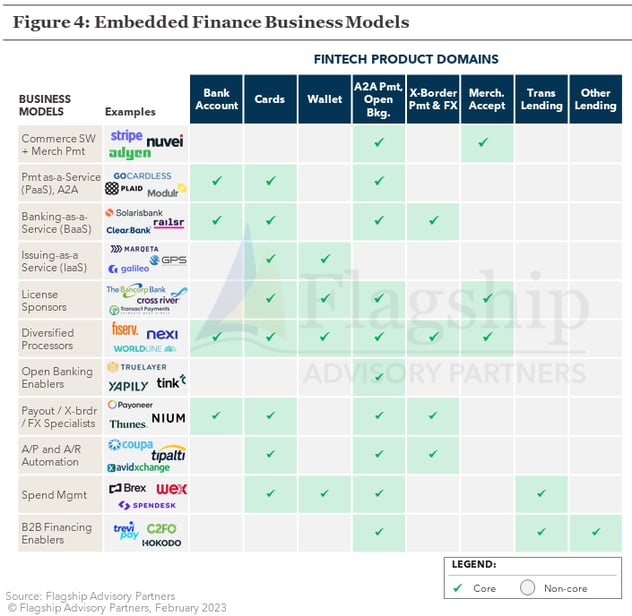

Embedded Finance Business Models

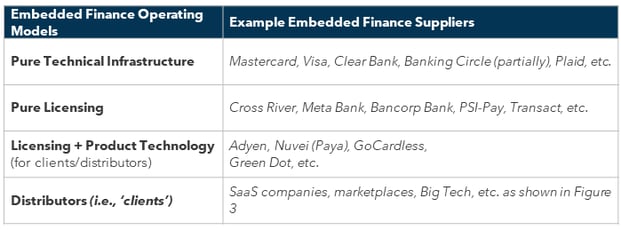

In the final layer of our embedded finance onion, we dive into the weeds to examine the myriad of business models visible in the market. These business models differ by product, client focus, and operating model. Before we parse through these business models (with no shortage of jargon), we first distinguish between the general operating models that we see, as shown in the table below.

When presented this landscape of business models (shown in Figure 4), our investor clients often ask: “which business models are superior.” Again, not such a simple answer as we find great companies within each of these business model definitions. But we can identify certain underlying fundamentals. For example, market leaders in embedded merchant payments have clearly created massive value (e.g., Stripe as a supplier and Shopify as a client). Similarly, in the U.S. B2B fintech market, procure-to-pay, invoice-to-cash, and expense management use-cases created massive shareholder value for fintechs and software providers (e.g., bill.com, Coupa, Brex, etc.). However, some of these business models are less proven or still nascent, for example open banking and A2A payment specialists or B2B lending fintechs in Europe.

The broad and complex universe of embedded finance is defining the future of fintech, and the many use cases into which fintech services are embedded. Embedded finance is multi-layered, touching all corners of fintech. While embedded finance is not easily defined, as the saying goes, “you know it when you see it.” We also know that if you want to be a winner in fintech, you need to master embedded finance.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.