SoftPOS, otherwise known as 'tap to pay' or 'pin on glass' was first conceptualized a decade ago. Since then, SoftPOS progressed slowly but steadily towards mass market readiness, and that time is now, or at least visible on the 2023 horizon. Several key events in 2022 catalyzed the momentum of SoftPOS, which is now clearly visible in the market. We expect rapid growth in usage and volumes starting next year as SoftPOS products find their footing across a number of use cases and segments. Within this article, we discuss these recent key events, the journey toward readiness, and expectations for future growth.

Introduction to SoftPOS

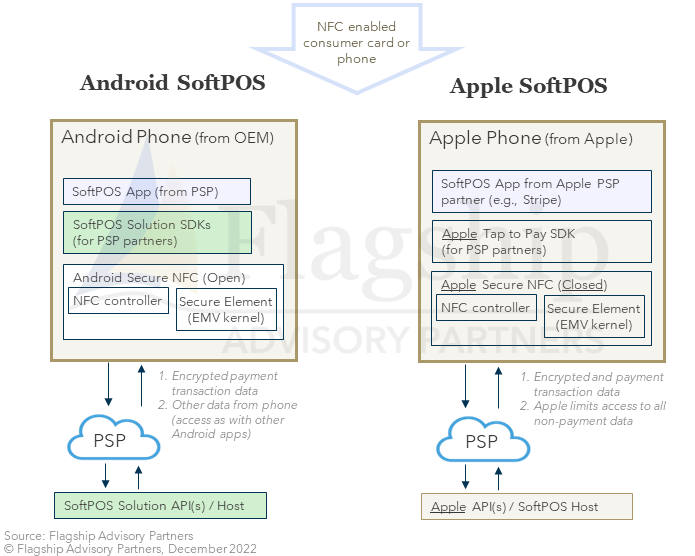

SoftPOS is a mobile application (and related solution set) that enables an approved smartphone to capture card data, encrypt that data, and then route that encrypted data in the form of a transaction request via the internet to a payment processor and services provider. SoftPOS is built for NFC-based contactless payments, not for physical card reading.

FIGURE 1: The Basic Mechanics of SoftPOS

A Decade to Readiness – The Evolution of SoftPOS

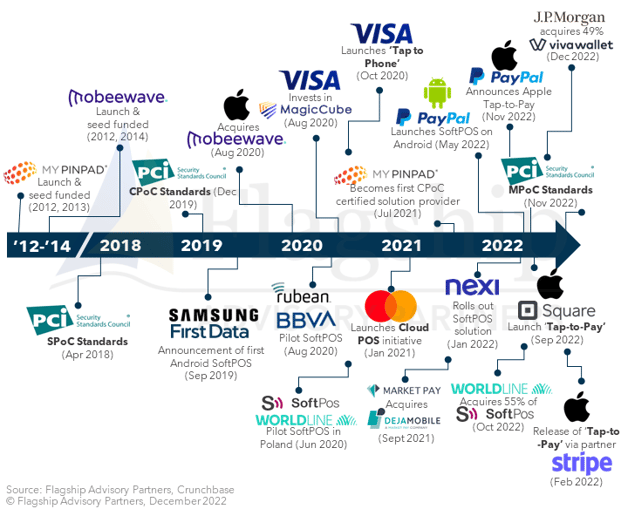

As shown in Figure 2, SoftPOS started as a concept in c. 2012 with the founders of the first start-ups in the space including MyPinPad and Mobeewave. It took another half-decade for the market to establish technical standards for the safety and soundness of transacting via SoftPOS. The PCI Security Standards Council released its initial technical standards for SPoC (defining standards for PIN entry on mobile phones) and CPoC (standards for contactless payments on mobile phones) in 2018 and 2019. The establishment of these standards defined the technical legitimacy and certification requirements for trusted solutions.

Major commercial launches then followed, for example First Data and Samsung (along with Visa), announced their first forays into SoftPOS in September 2019. Apple made its first big move into SoftPOS when it acquired Mobeewave in August 2020. Visa and Mastercard (V/MC) then announced advancements of their SoftPOS programs near the end of 2020. The year 2022 clearly established momentum with the launch of Apple's Tap to Pay program and the launch of numerous SoftPOS products from fintech leaders such as Stripe, Square, and PayPal.

Most recently, the PCI Security Standards Council released its MPoC standards, which many see as the first truly mass-market-ready and scalable foundation for the technology. Under MPoC previous limitations around usability (e.g., PIN ready, phone ready, no transaction limitations, etc.) will fall away.

FIGURE 2: Select Events & Key Milestones in SoftPOS Evolution

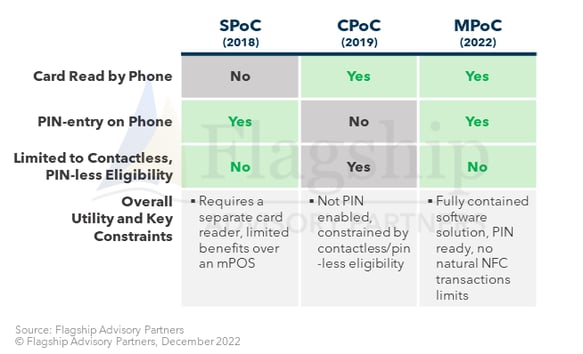

SoftPOS standards (established by PCI) evolved as shown in Figure 3. The CPoC standard is limited by the lack of PIN enablement. CPoC certified SoftPOS solutions are therefore limited to NFC transactions that do not require a PIN (plastic initiated below transaction limits or NFC-based wallets). SPoC certification is effectively a stop-gap that allows PIN on glass but only with a separate card reader, and therefore no real value-add versus an mPOS solution. The MPoC standard announced last month merges the two prior standards and will allow market participants to be PCI compliant, and enable secure PIN entry directly on approved phones (aka a COTS devices). We see MPoC as effectively the first standard that is truly mass-market ready. Given the recent release of the new standards, certifications will come only later in 2023.

FIGURE 3: Comparing the Basics of SoftPOS Certification Standards

An Expanding Landscape of SoftPOS Solution Suppliers

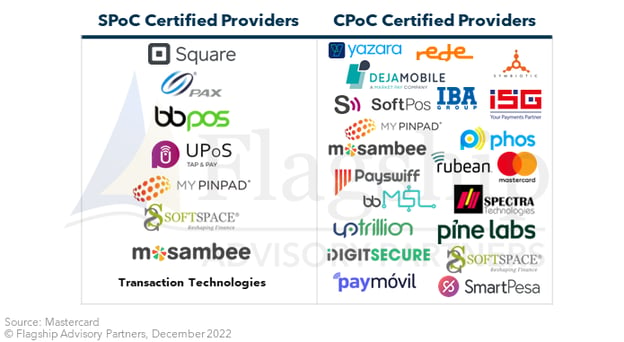

Today, there are c. 30 SoftPOS solution providers certified under SPoC or CPoC, and several dozen more approved by V/MC for pilots under certification exemptions. Many of these solution providers are specialists, but there are also a variety of established fintechs such as Square, Pine Labs, and several incumbent terminal OEMs. Figure 4 lists the Mastercard SPoC and CPoC certified solution providers.

We observe many PSPs and acquirers currently working with SoftPOS solution partners on pilots, or at least engaging to select their solution partners as we head into 2023. There are few PSPs and acquirers actively pushing SoftPOS as a mass-market solution today, although Worldline appears to be pushing this proposition hard following its divestment of Ingenico.

FIGURE 4: Mastercard Certified SoftPOS Solution Vendors

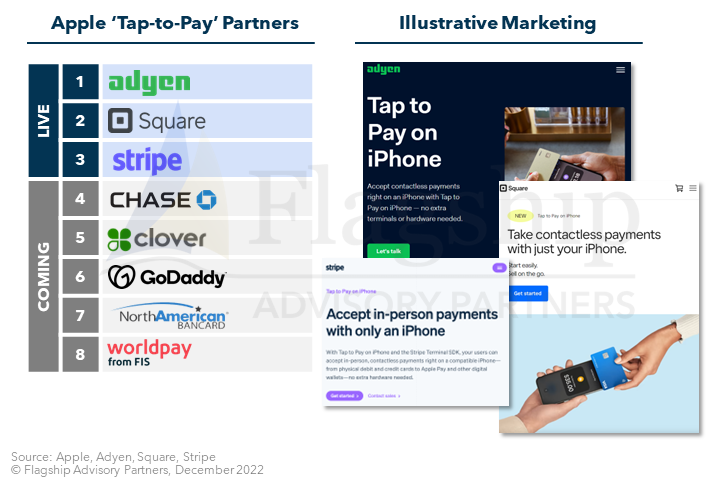

Apple, long a roadblock to SoftPOS readiness, catalyzed the SoftPOS market earlier this year by announcing its Tap-to-Pay product with Stripe as its launch partner. Apple Tap-to-Pay is a closed system controlled by Apple with merchant propositions provided by Apple approved PSPs. Currently, there are several live partners (Stripe, Square, Adyen) with many more in the queue (as shown in Figure 5). SoftPOS solution vendors play no role in the Apple Tap to Pay ecosystem as Apple fills this role directly.

FIGURE 5: ‘Tap to Pay’ on iPhone Apple-Approved Partners

No Full Cannibalization of the Traditional Terminal

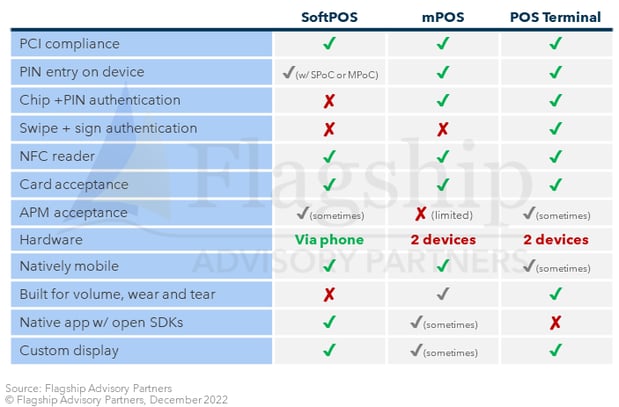

SoftPOS (even with the new MPoC standard) is not a solution that will address all needs and we do not expect wholesale cannibalization of payment terminals given their robust utility and value. There are practical limitations to when SoftPOS is superior to payment terminals and when it is not (see Figure 6 for a high-level comparison). SoftPOS is ideal as a no/low cost, real-time deployed solution for enabling small numbers of transactors. SoftPOS is also ideal for mobility use cases where commerce is already driven by phones or tablets (for example, checking out on a tablet within a shop or at an unattended device). Payment terminals are still the best solution for higher volume needs given that payment terminals can support tens of thousands of transactions across a c. 5-year lifetime at a reasonably low cost (generally less expensive than a phone).

FIGURE 6: Comparison of SoftPOS, mPOS & Traditional POS

Scale Via Four Key Growth Vectors

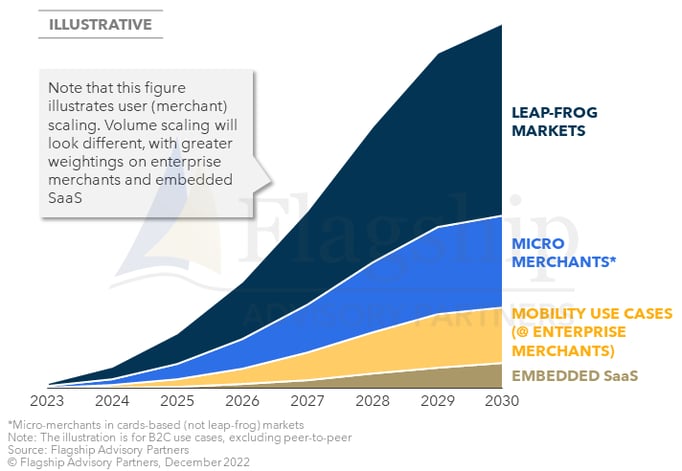

SoftPOS solutions that are card-ready and V/MC approved (i.e., excluding other forms of phone-to-phone payments) are tiny in scale today. It is hard to find a reliable data point, but we suspect that there are a few hundred thousand active users today. From 2023, we expect rapid acceleration of SoftPOS scale. We see four key growth vectors driving the scaling of SoftPOS usage:

- Leap-frog markets: Markets such as India, where QR-based payments are more prevalent than cards, and where phone-to-phone consumer-to-business payments are already common, are ripe for accelerated growth in card-enabled SoftPOS. SoftPOS allows a single app (e.g., Pine Lab's AllTap) to support both card acceptance and acceptance of alternative payment methods such as QR-based or BNPL.

- Micro merchants and infrequent transactors: Micro-merchants who trade infrequently want a payment proposition with no fixed cost. SoftPOS is perfect for this profile as reliance on a smartphone is not problematic (low volumes, no employees, etc.). SoftPOS can also be initiated near-instantaneously, an advantage over shipping hardware.

- Mobility use cases @ corporate merchants: There are many use cases for larger merchants to deploy SoftPOS outside of the traditional central POS, for example, consultative selling, kiosks and self-checkout, self-scanning, etc.

- Embedded SaaS: SaaS platforms such as Toast or Lightspeed benefit from SoftPOS as it dematerializes the hardware requirements of the proposition and makes it easier, and less costly to deploy and operate their software solutions. For example, if a café is already using a tablet for checkout, payments can simply be embedded into the tablet rather than requiring a separate device.

Figure 7 provides a rough visualization of our scaling expectations as active B2C users grow from less than 1 million to tens of millions in the coming years.

FIGURE 7: Illustrative SoftPOS User Scaling

Conclusions

It is hard to believe that the SoftPOS concept has been around for a decade. SoftPOS needed that decade to establish technical readiness. The MPoC certification, which will land in practice in 2023, now establishes this foundation. The historical constraints of SoftPOS (no PIN, transaction limits, only latest phone models, etc.) will fall away in 2023, giving rise to rapid scaling in the years to come. Starting next year, we expect rapid scaling of SoftPOS usage driven by a variety of use cases (e.g., mobility), across geos (particularly mobile-centric leapfrog geos) and merchant segments (micro and enterprise).

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com or Elisabeth Magnor Elisabeth@FlagshipAP.com with comments or questions.