Issuer card processing and financial institution account to account processing have evolved dramatically in the past ten years. What used to be an (arguably) commoditized landscape of providers with a clear delineation between card issuing and account to account payments has undergone significant shifts in technology, business models, and new entrants. Below we examine the overall landscape as it stands in 2021, and in subsequent articles, we will examine issuer card processing and account to account (bank payments) processing separately.

Shifts in supply and demand have shaped the landscape as of 2021. On the supply-side:

- Traditional incumbents consolidating via M&A

- Next-gen processors achieving rapid growth and high valuations (e.g., Marqeta’s $10 billion IPO) from what used to be viewed as “niche” segments such as prepaid and B2B

- Initial steps towards convergence as traditional incumbents focus more on non-banks, and next-gen processors start to focus on banks

On the demand side, buyers are seeking:

- Easy and robust integrations

- Fewer silos (especially cards)

- Speed to market

- Turnkey business models

- Digital VAS (onboarding, risk, fraud, etc.)

- Back-off automation tools

- Bundled pricing, including coverage of future regulatory requirements

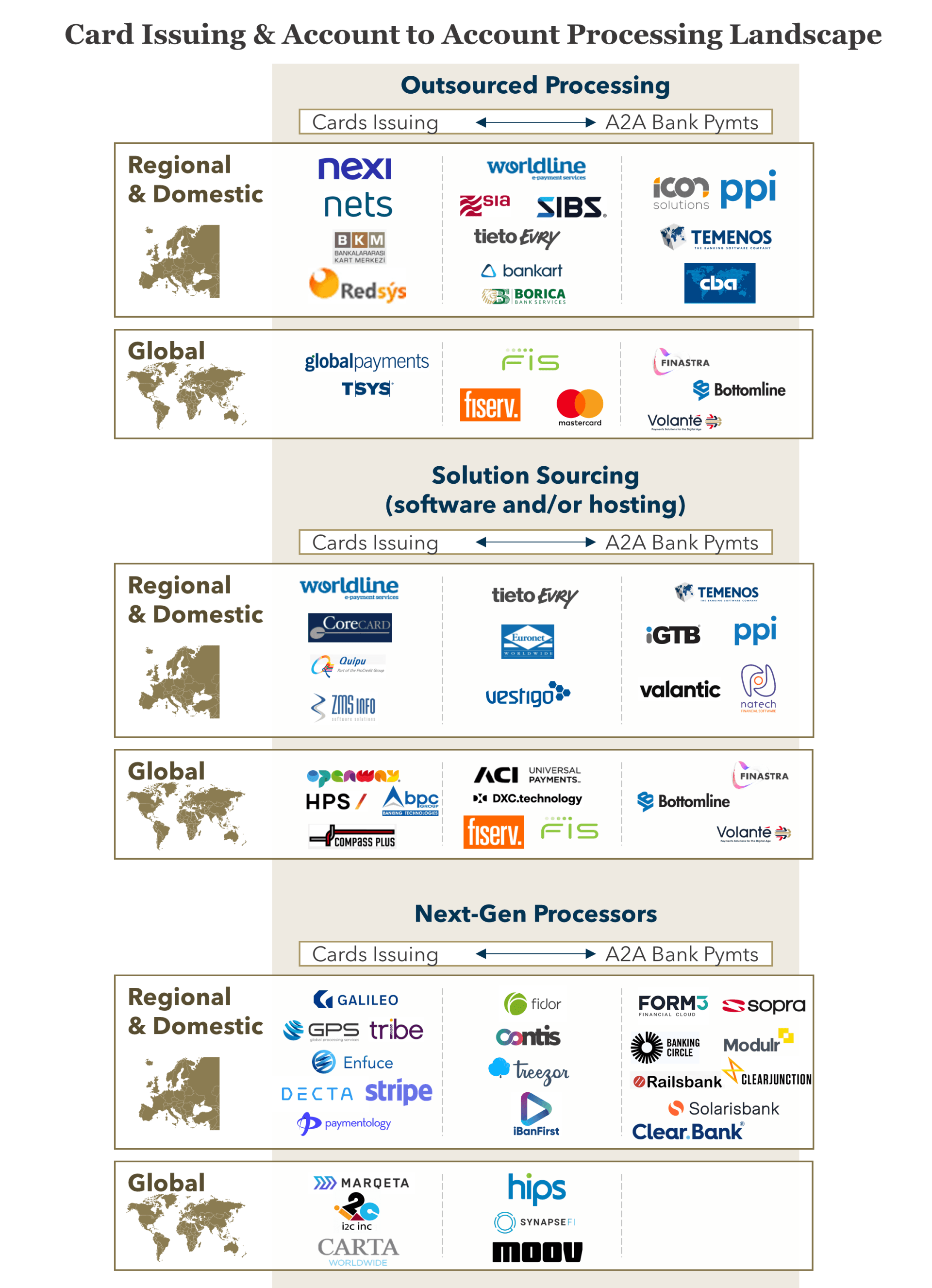

As illustrated in Figure 1 below, these shifts have created a landscape of providers that give buyers significantly more options than 5-10 years ago. What used to be 2-3 provider options per category, often with geographic limitations, has expanded to multiple providers with expanded geographic coverage, support for a range of operating models, and (to varying degrees) support for both card issuing and account to account processing.

FIGURE 1: Card Issuing & Account to Account Bank Payments Processing Landscape

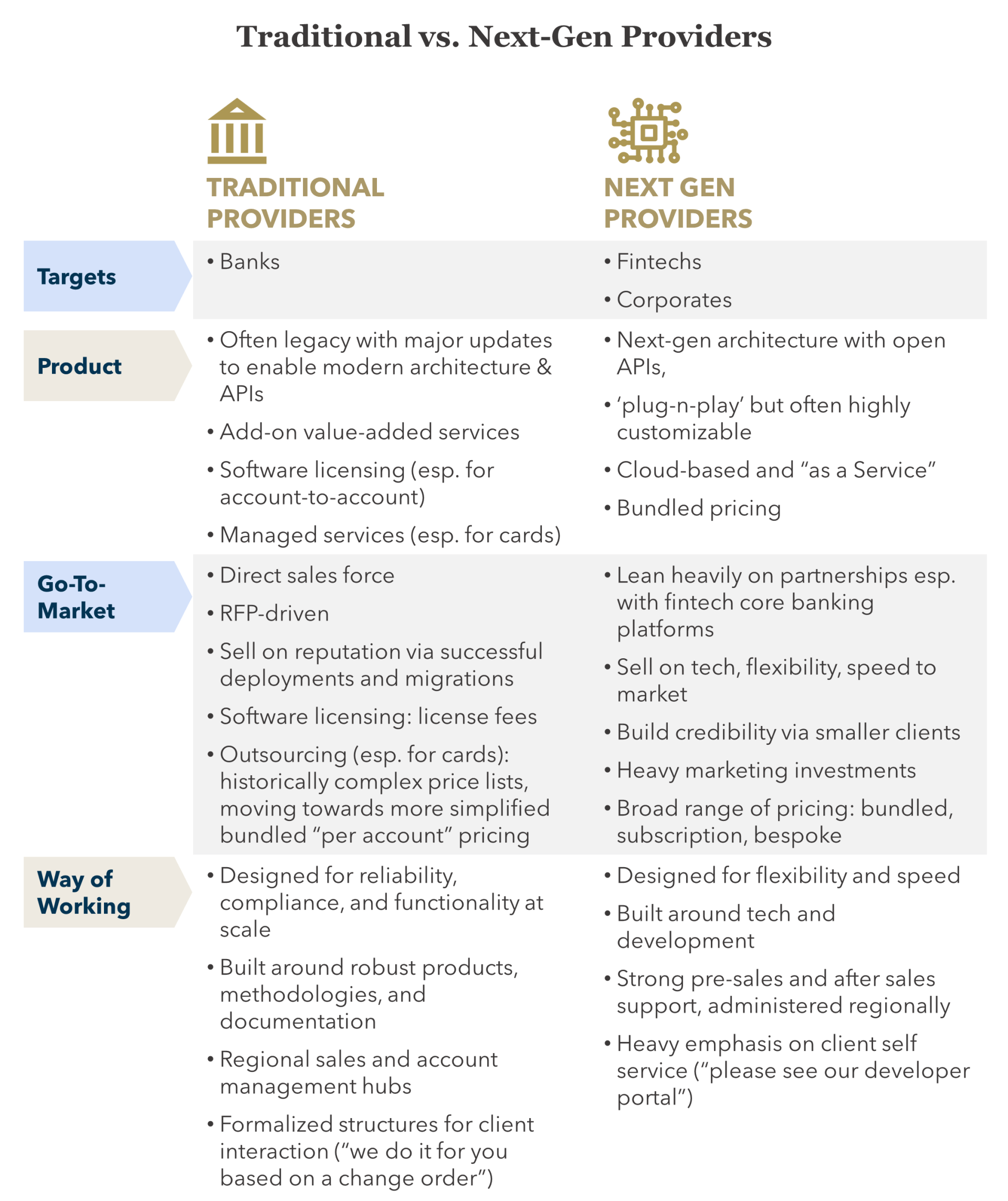

As shown in Figure 2 below, the provider landscape is broadly categorized into “Traditional” and “Next-Gen” providers. Traditional providers primarily target financial institutions, while Next-Gen providers have achieved high growth and valuations by focusing on previously underserved categories such as prepaid cards, virtual cards, B2B payments, and open banking. Next-Gen providers target fintech and corporate customers, often using “as a Service” operating models, but are likely to target financial institutions as they seek scale.

FIGURE 2: Traditional vs. Next-Gen Providers

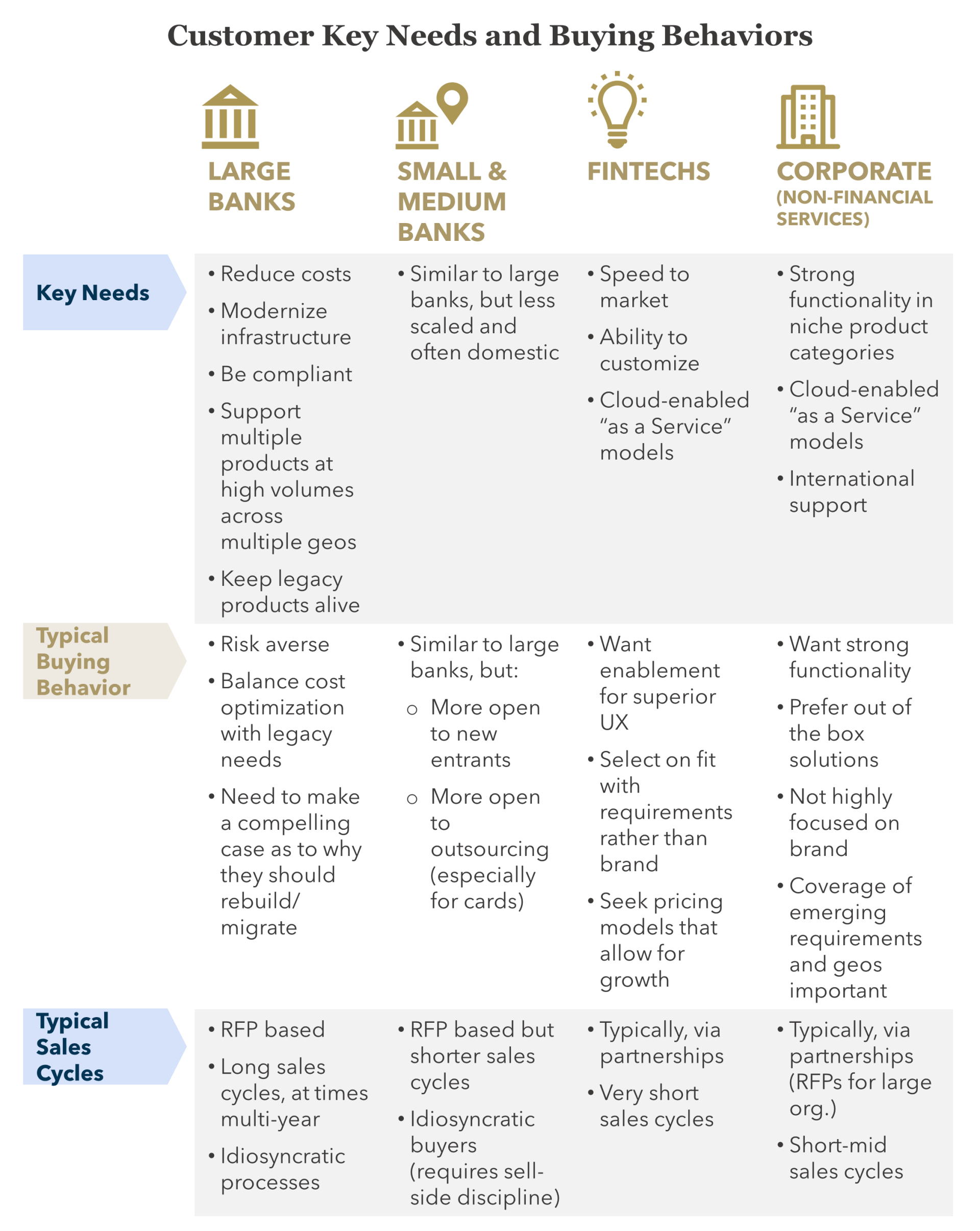

Customer needs and buying behaviors, as illustrated in Figure 3 below, vary widely by segment. While banks often seek well-established brands and have long and idiosyncratic buyer behaviors, fintechs and corporates place high value on speed and ease of integration. As many financial institutions digitize and seek to reduce technical and business silos while increasing agility, traditional providers have adapted, and Next-Gen providers see entry opportunities. To date, these “worlds” have remained largely separate, but we expect further crossover over time. This convergence will require both traditional and next-gen providers to adjust their go-to-market approaches, as targeting a bank migration a far different sales and delivery process than a fintech implementation, and vice versa.

FIGURE 3: Customer Key Needs and Buying Behaviors

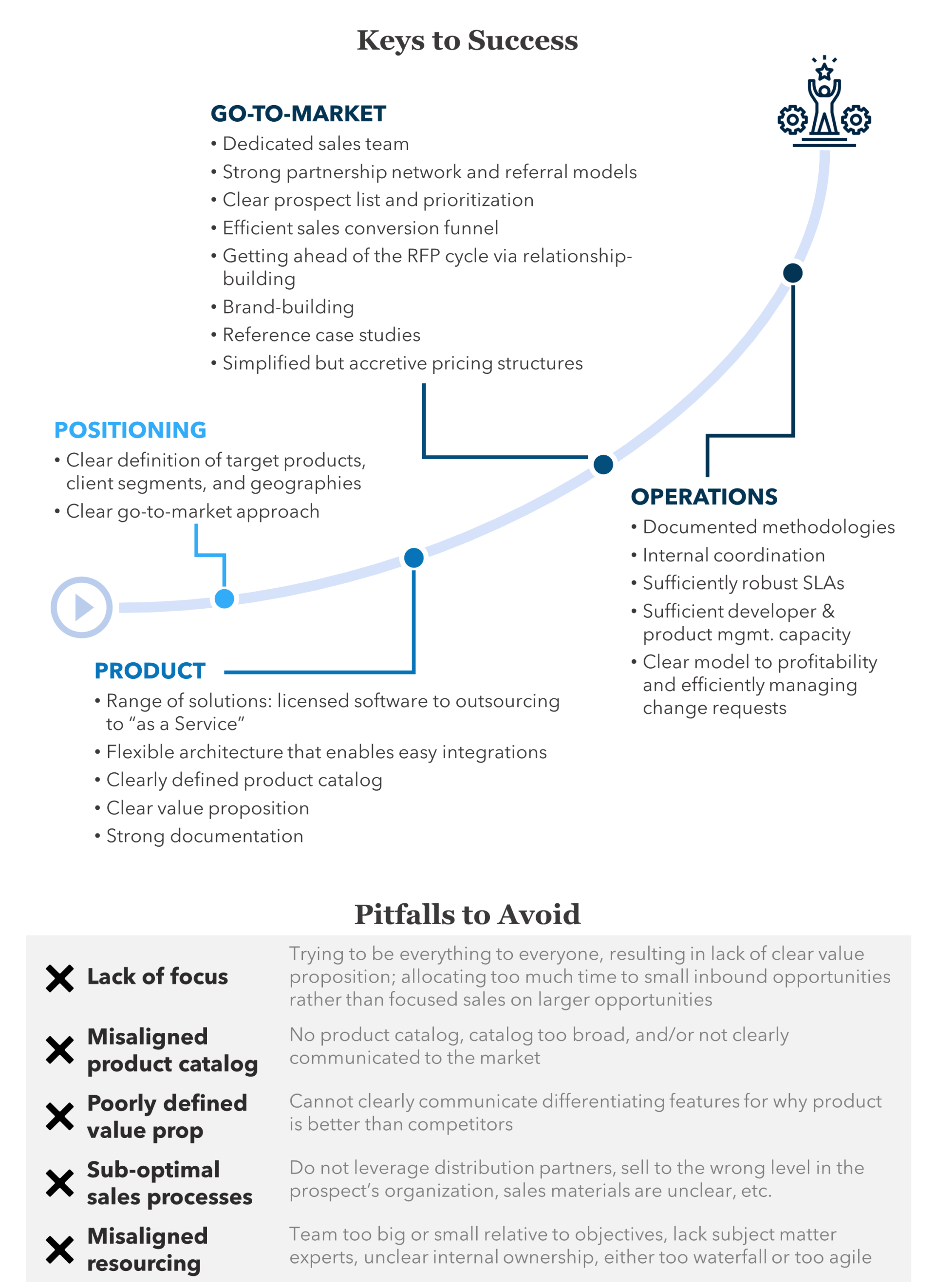

As shown in Figure 4 below, successful providers will navigate the changing processing landscape using classic B2B vendor tactics: clear positioning, clearly defined and string products, a focused go-to-market approach, and strong operational execution while avoiding pitfalls such as lack of focus, poorly defined value propositions, and misaligned resourcing.

FIGURE 4: Keys to Success and Pitfalls to Avoid

Please do not hesitate to contact Erik Howell Erik@FlagshipAP.com, Anupam Majumdar Anupam@FlagshipAP.com, or Zuzana Krulišová Zuzana@FlagshipAP.com with questions.