Image credits: Freepik

Thoma Bravo continues to demonstrate an eagerness to invest in B2B SaaS and payments. On December 12, 2022, Thoma Bravo announced the acquisition of Coupa Software for $8 billion with the intention of taking the company private. Earlier last year, Thoma Bravo completed the acquisition of Bottomline Technologies for $2.6 billion.

Both Coupa and Bottomline provide spend management software facilitating Accounts Receivable (“AR”) and Accounts Payable (“AP”) automation, cash management, and other business management capabilities with embedded payments. We expect Thoma Bravo to exploit product and portfolio synergies across the two enterprises and further leverage payments monetization to drive future growth. In this article, we highlight Coupa’s financial performance, examine the growth levers for the business, and highlight the relevance of these levers for the broader B2B SaaS community.

Coupa’s Financial Performance

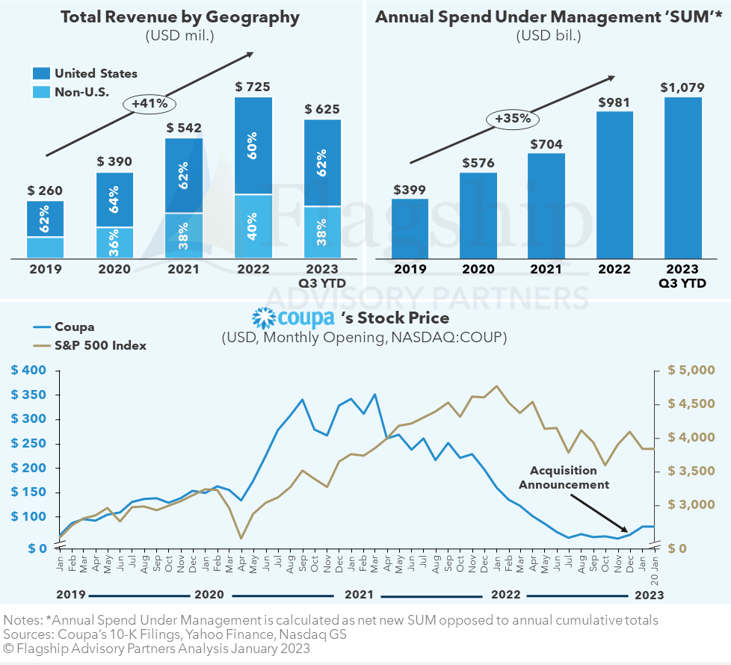

Coupa is a global spend management software for mid-market merchants and enterprises specializing in procurement, supply chain, and treasury management. As illustrated in Figure 1, Coupa experienced strong growth in revenue and spend under management from 2019 to 2022 (we explain “spend under management” more in the following section”). Despite robust growth, like most other publicly-traded SaaS companies, Coupa’s stock performed poorly in 2022, with management citing lower-than-street expected revenues and slowing new business growth across North America and EMEA.

FIGURE 1: Coupa’s Financial Performance Indicators (fiscal years 2019 – 2022 & FY2023 Q3 YTD: financial year ends Jan 31, growth rate 2019-2022)

Upon announcement of the acquisition, Holden Spaht, Managing Partner at Thoma Bravo, stated that they “Look forward to partnering with (…) the (Coupa) management team to keep investing in the company's product strategy while driving growth both organically and through M&A.” We believe Thoma Bravo will look to pull several levers to stimulate growth including payments monetization, which many B2B SaaS companies in the U.S. leverage today.

Payments Monetization and Coupa Pay as a Growth Lever

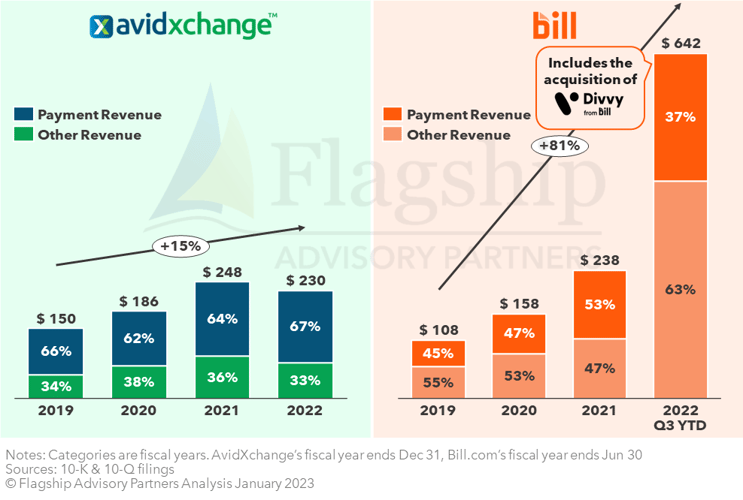

Payments monetization for software companies means embedding payments functionality (including payment acceptance, card payments, account-to-account payments, and alternative payment methods) into other business management functions like accounting, working capital, and supplier management. We observe AP automation and spend management SaaS companies like Avidxchange and Bill.com effectively monetizing payments, with 67% and 37% of 2022 YTD revenue coming from payments, respectively (Figure 2).

FIGURE 2: Payments Revenue of Select AP Automation & Spend Management SaaS Providers (2023; payments revenue as a share of total revenue, USD mil.)

Coupa Pay, Coupa’s embedded payments service, allows buyers (Coupa’s customers) to efficiently pay suppliers using any payment method, including virtual cards. Virtual cards are especially attractive for SaaS companies and their customers in the U.S., as most of the supplier’s acceptance costs for virtual cards (upwards of 3%) are earned as revenue by the SaaS company and shared with the SaaS company’s customers via rebates. Other embedded payment methods like account-to-account (“A2A”) payments are less lucrative but still offer monetization opportunities for SaaS companies.

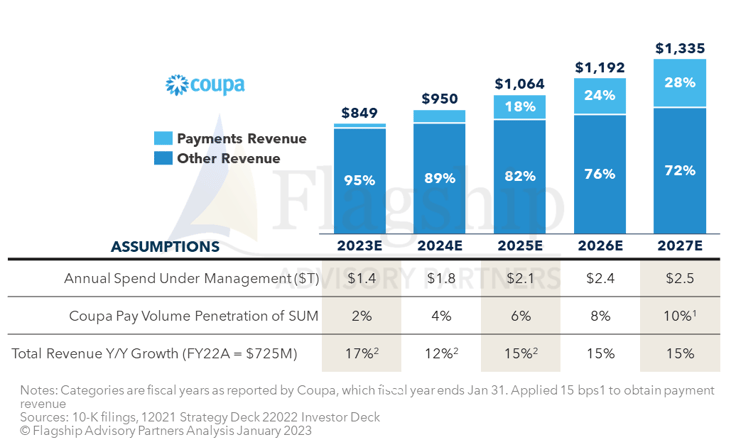

Coupa does not report its payments-related revenue. However, in Coupa’s 2021 strategy presentation, management projected that Coupa Pay would achieve 10% penetration of total spend under management (“SUM”) by 2027. SUM (highlighted earlier in Figure 1) is the total payments that Coupa’s solution oversees/manages from buyers to suppliers. The more SaaS companies can penetrate their SUM with embedded payments products, the greater the payments monetization opportunity. For context and comparison purposes, Avidxchange’s SUM in 2021 was $180 billion, of which $52 billion (29%) was monetized as “payments spend.”

By applying some key assumptions and management projections, we illustrate Coupa’s theoretical payments revenue in Figure 3.

FIGURE 3: Theoretical Coupa Payments Revenue as a Share of Total Revenue (2023; theoretical estimation, USD mil.)

Our theoretical payments revenue scenario above highlights Coupa’s runaway for growth via payments monetization. Several factors will impact Coupa’s actual payments revenue growth including:

- Geographic mix: integrated payments competition and business adoption vary globally, with more mature regions (e.g., North America and Europe) demonstrating higher digital payment volumes, but also relatively higher competitive intensity (although commercial interchange generally isn't regulated in Europe or the UK).

- Payment method mix: cards, A2A, checks, and other forms of B2B payments carry different commercial models and varying levels of monetization. Geography also plays a role, as B2B payments in regions like Europe are almost exclusively A2A while payments in the U.S. are more diverse across A2A, card, and checks.

- Merchant size mix: enterprise buyers and suppliers have greater influence over what payment methods are used and accepted than SMBs. Enterprise buyers will push suppliers to accept commercial/virtual cards while enterprise suppliers will often demand payment via lower-cost payment methods like A2A.

- Industry/Vertical mix: industries with smaller, more frequent payment transactions like travel will have different commercial implications from industries with higher value and less frequent transactions like freighting/logistics.

- Breadth and depth of value-added services: businesses utilize embedded payments when they offer a clear value proposition. Value-added services such as invoicing, data insights, supplier management, and other linked business management software modules increase the rationale for businesses to use embedded payments versus other payment enablers like business bank partners.

Breadth and depth of value-added services (#5 above) is arguably the biggest contributing factor to unlocking payments (and software) revenue growth. To that end, we expect Thoma Bravo to exploit synergies across Coupa and Bottomline Technologies (acquired by Thoma Bravo on May 13, 2022) to improve the performance of both companies.

Coupa & Bottomline Technologies Synergies

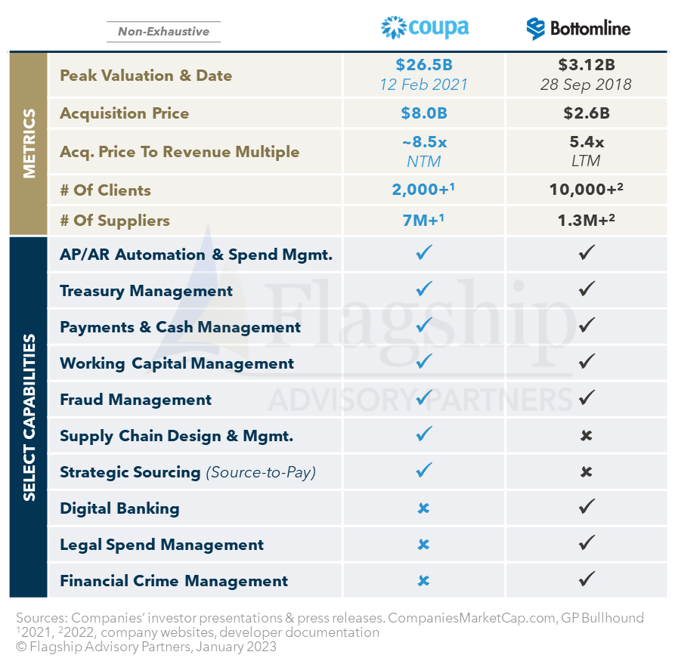

Like Coupa, Bottomline is a global AP automation and cash management software provider. Figure 4 compares key metrics and select capabilities across the two enterprises.

FIGURE 4: Coupa & Bottomline Technologies Select Key Metrics Comparison, 2023

Coupa and Bottomline offer similar, yet complimentary services. Coupa can create a more compelling solution for Treasurers in conjunction with Bottomline, offering a wider, more impactful business process automation solution. We observe potential synergies across four vectors:

- Enhanced front-end capabilities: back-offices utilize B2B SaaS front-end capabilities daily to manage payables, receivables, and the company’s overall cash position. These capabilities form the core of the B2B SaaS value proposition. Coupa can bring several front-end capabilities including supply chain management and strategic sourcing to Bottomline’s 10,000+ clients, creating a more comprehensive product and “one-stop-shop” for users.

- Superior fraud management: despite shifting to digital payment methods with inherently tighter spend controls and approval workflows, businesses are still battling B2B payment fraud. Bottomline’s fraud management specializations like “Record and Replay,” which allows businesses to record internal and external users in business applications, can bolster Coupa’s current offering.

- Expanded partner footprint: B2B SaaS partner networks create greater distribution reach and a more flexible product offering. For example, a robust bank partner/issuer network makes it (potentially) easier for clients with an existing commercial/virtual card relationship to adopt a B2B SaaS solution. Coupa and Bottomline partner with an extensive list of banks (e.g., Bank of America, JPMorgan Chase, Citizens, Citi, etc.) and complementary payment technology providers (e.g., Billtrust, Boost Payments, Transfermate, Stripe, etc.) that together can form a larger partner network to maximize top-of-the-funnel sales opportunities for both entities.

- Scaled buyer/supplier network: established buyer/supplier networks create instant value for new B2B SaaS customers by eliminating the need to self-onboard most (if not all) existing supplier relationships. Coupa’s and Bottomline’s combined customers (buyers) and supplier networks can create a larger network effect, allowing both companies to achieve critical mass across over 12,000 clients and 8 million suppliers globally.

Conclusions

Only time will tell if Thoma Bravo’s $10+ billion of M&A activity in B2B SaaS last year can deliver the growth and future exit multiples that such deals strive for. That said, we remain bullish on the power of B2B SaaS and embedded payments, particularly in the U.S., where profit margins on products like virtual cards remain high. Demand for B2B SaaS and embedded payments among customers continues, where early movers with global reach like Coupa are well positioned to profit. Looking forward, we expect continued deal flow in the B2B SaaS market as strategic and financial investors look to capitalize on modest valuations and strong industry tailwinds including the continued adoption of digital payment methods globally.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ryan Vincent at Ryan@FlagshipAp.com with comments or questions.