- The Fintech landscape in MENA is developing rapidly including many start-ups and heavy investment in recent years. Payments, in particular merchant payment acceptance, is one of the largest verticals for investment activities.

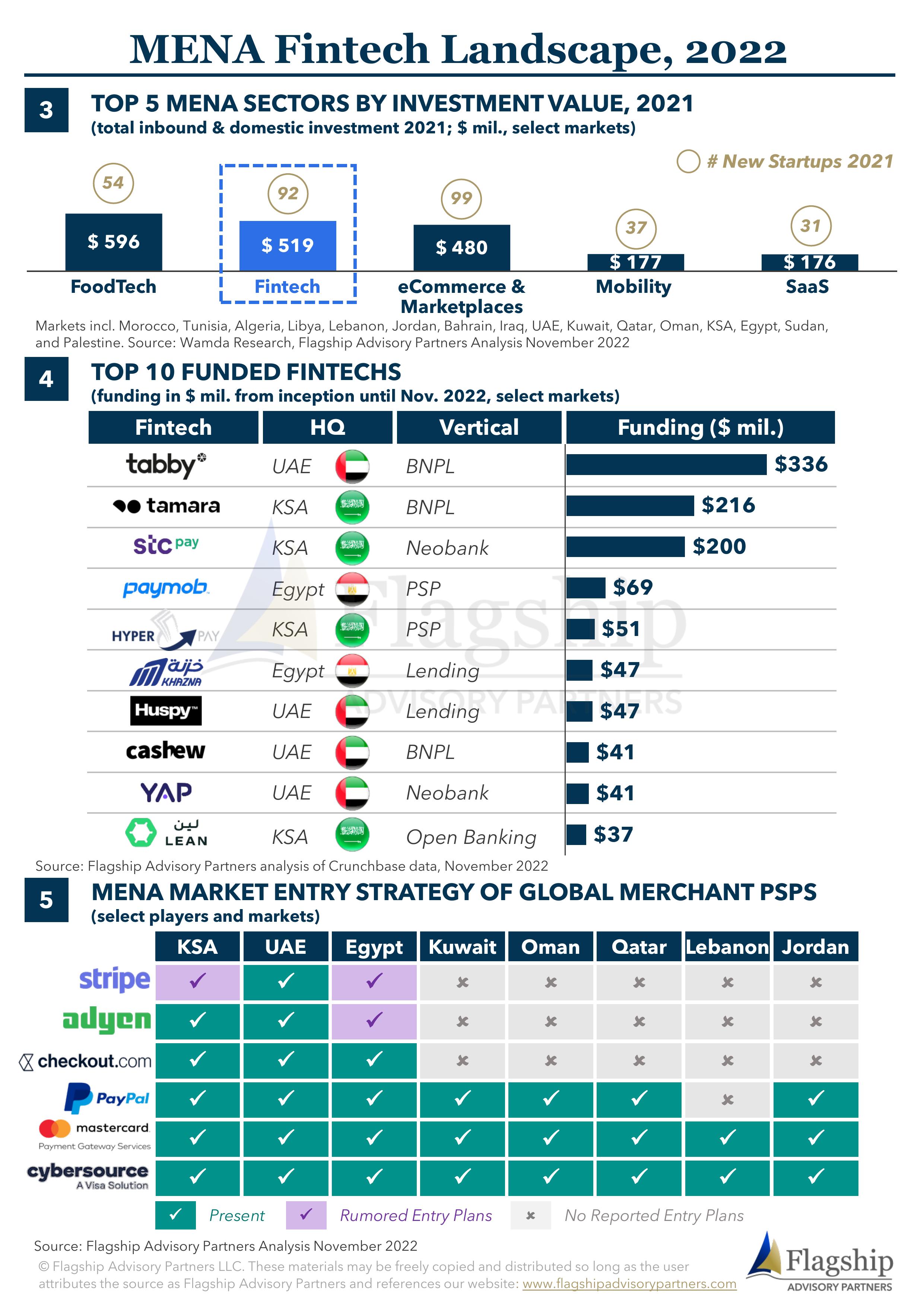

- The MENA fintech sector attracted $519 mil. of fundraising and 92 newly launched fintech start-ups in 2021.

- Both external investors and banks are investing in fintech franchises. Some of the major banks in MENA started and spun-off card processing/merchant fintechs, for example Geidea in the Kingdom of Saudi Arabia (KSA) and Magnati in the United Arab Emirates (UAE).

- UAE, KSA, and Egypt are the largest markets by activity level.

- Several MENA countries are launching real-time payment and/or open banking initiatives (e.g., SARIE network in KSA and IPP network in UAE).

- The region remains mostly localized although some global fintechs such as Checkout, Stripe, and Adyen are investing and rapidly expanding their presence in the region.

- The UAE is often the first entry point for international fintech entering the MENA region. Adyen and Stripe both launched in UAE in 2021.

Please do not hesitate to contact Simone Remba at Simone@FlagshipAP.com or Charlotte Al Usta at Charlotte@FlagshipAP.com with comments or questions.