Almost 20 years ago, eBay acquired PayPal for $1.5 billion. PayPal was subsequently spun-off from eBay while growing into the leading global e-commerce payment service provider (“PSP”), worth more than $300 billion. On Wednesday, October 20th, PayPal signaled a potential acquisition of Pinterest, a $40 billion digital marketplace and visual discovery engine. Where eBay and PayPal saw brighter futures as separate companies (and subsequently split in 2015), PayPal’s strategy six years later appears to have come full circle.

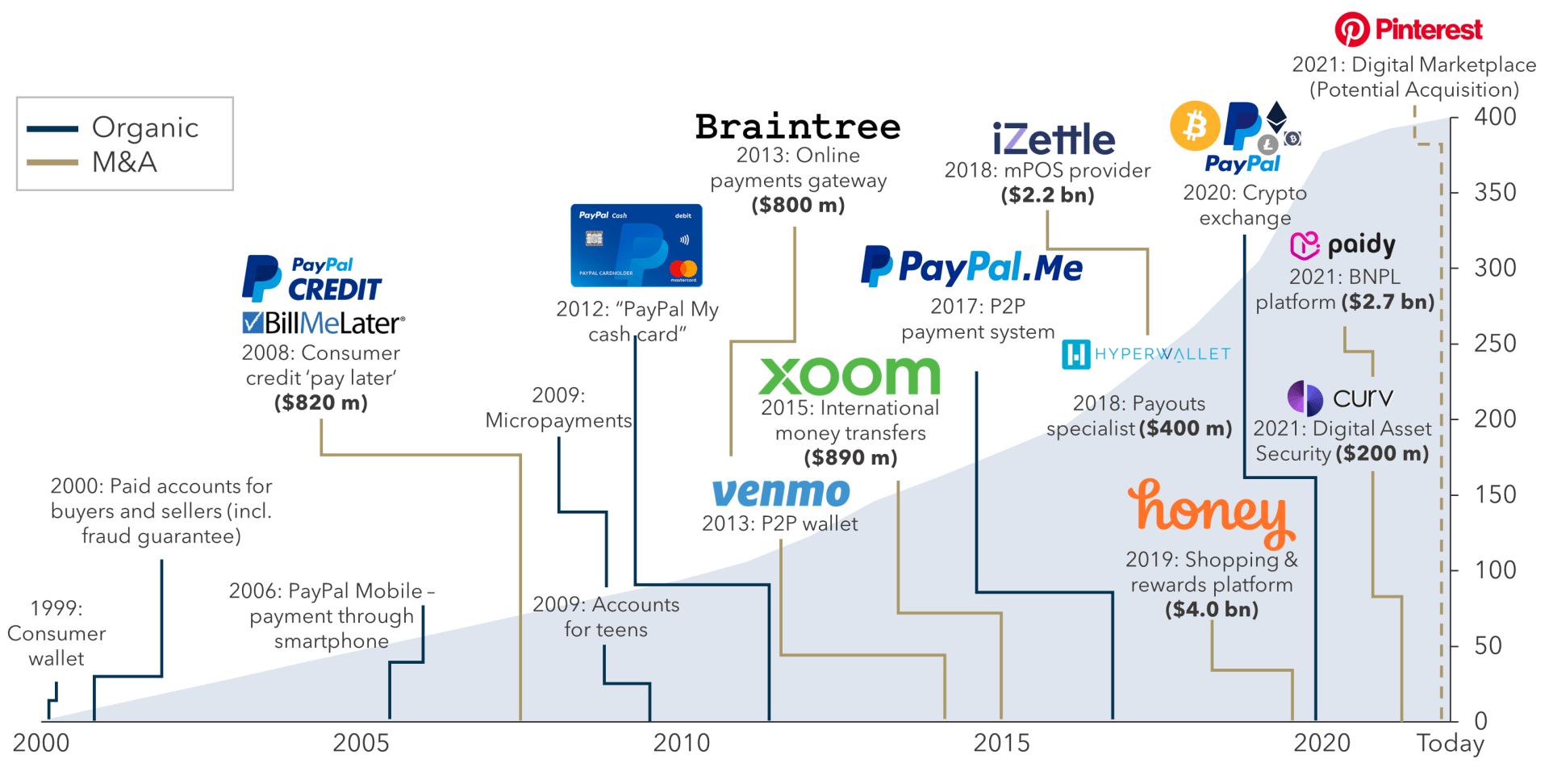

FIGURE 1: PayPal Product Expansion (selected examples; graphic = active user accounts in millions)

Sources:PayPal filings, GlobalData, Flagship market observations

In recent years, PayPal demonstrated increasingly willingness to expand into commerce services including its $4 billion acquisition of Honey in 2019 (as illustrated in Figure 1). Shareholders are less enthusiastic; PayPal’s stock price dropped more than 10% on the news of the potential acquisition of Pinterest. It appears that the market is drawing parallels between PayPal’s past with eBay and views the potential acquisition of Pinterest as a reversal of that decision. We see PayPal’s potential acquisition of Pinterest as a high-profile example of the broader trend toward convergence of commerce and payment services. In Figure 2 we illustrate this convergence by depicting the vertical integration of select platform providers into payments and payments providers into platform services.

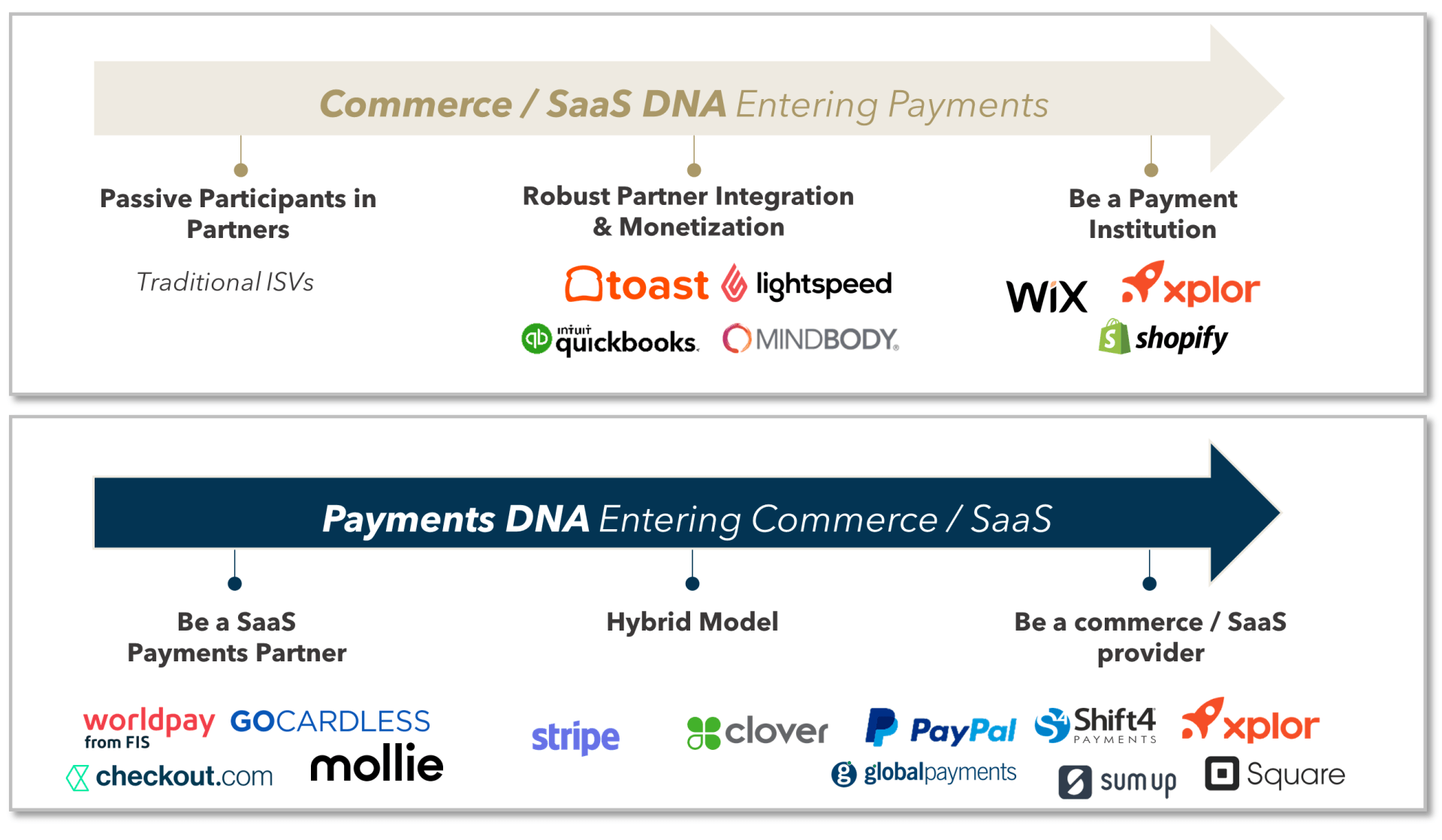

FIGURE 2: Vertical Integration of Payments and Commerce Specialists

Source: Flagship market observations

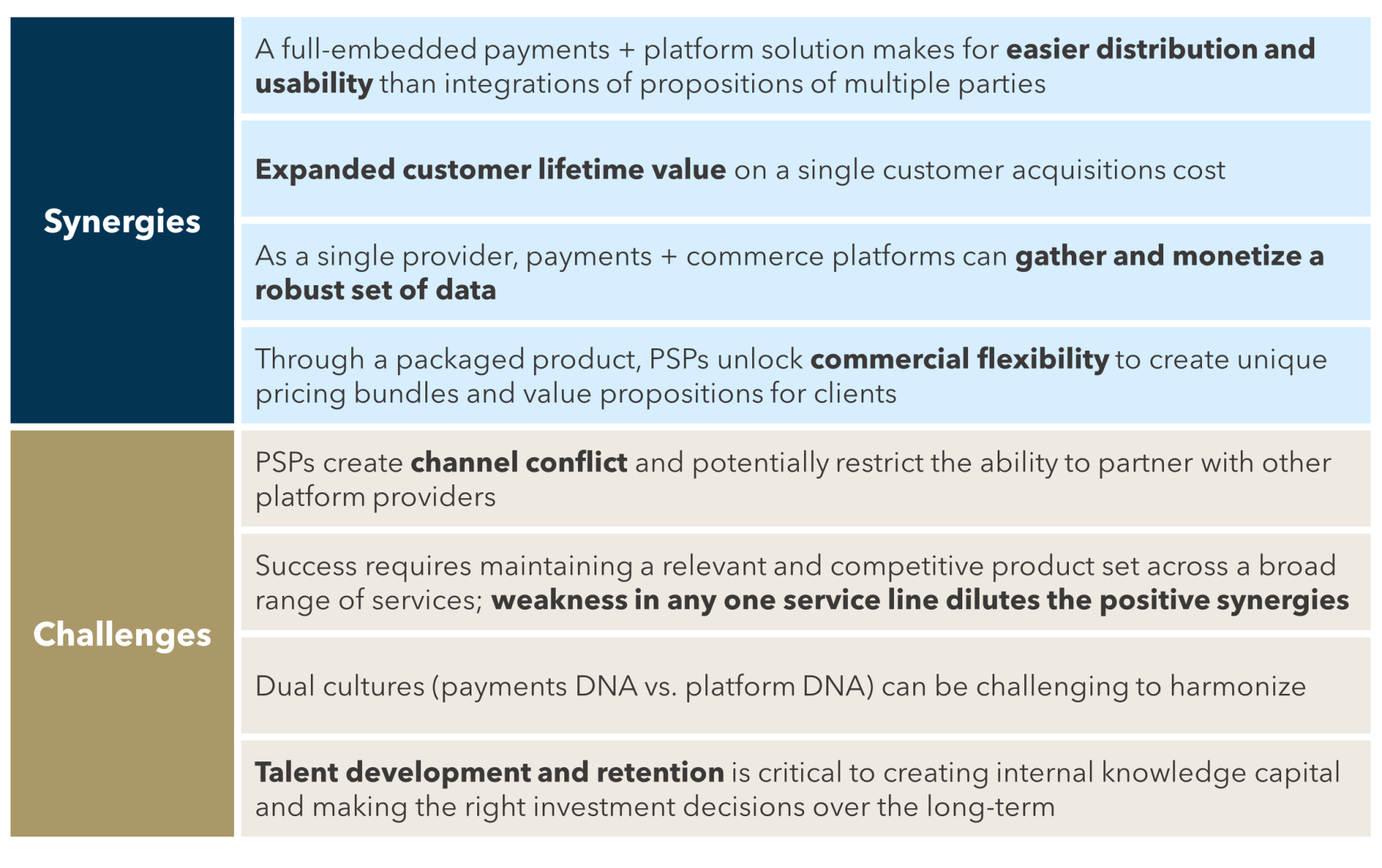

As PayPal – eBay case study illustrates, integrating payments services and commerce platform services can be challenging. Payments companies are fundamentally financial services operators while commerce platforms are built on software and digital marketing foundations. Combining these different DNAs and cultures is not easy, although PSPs themselves (e.g., Square, SumUp, Stripe) are also increasingly tech-centric and marketing-centric, which acts as a common thread. Merging commerce services into a payments franchise can also create channel conflict as PSPs increasingly rely on software/platform partners for distribution. PSPs must carefully prioritize their partnership strategies vs. the option to expand into commerce. In Figure 3 we list some of these challenges along with examples of synergies when merging payment services providers and commerce marketplaces and platforms.

FIGURE 3: Synergies and Challenges of Owning In-House e-Commerce Marketplace or ISV Capabilities

Source: Flagship market observations

PayPal’s potential acquisition of Pinterest is another high-profile example of the convergence of payment services and commerce platforms (and SaaS). There is no doubt that payments services and commerce services are converging at product level globally. But this does not mean that all PSPs should own commerce platforms, as partnership (and conflict avoidance) can be the higher priority. Both strategies (partnership-based and in-house owned commerce services) are successful strategies as long PSPs dedicate the right level of resources to maintain partner relationships and learn to successfully market a broad services bundle.

Flagship Advisory Partners has extensive experience working with global PSPs in developing their software/commerce channel and M&A strategies. Please do not hesitate to contact Rom Mascetti Rom@FlagshipAP.com or Scott DeHaven Scott@FlagshipAP.com with comments or questions.