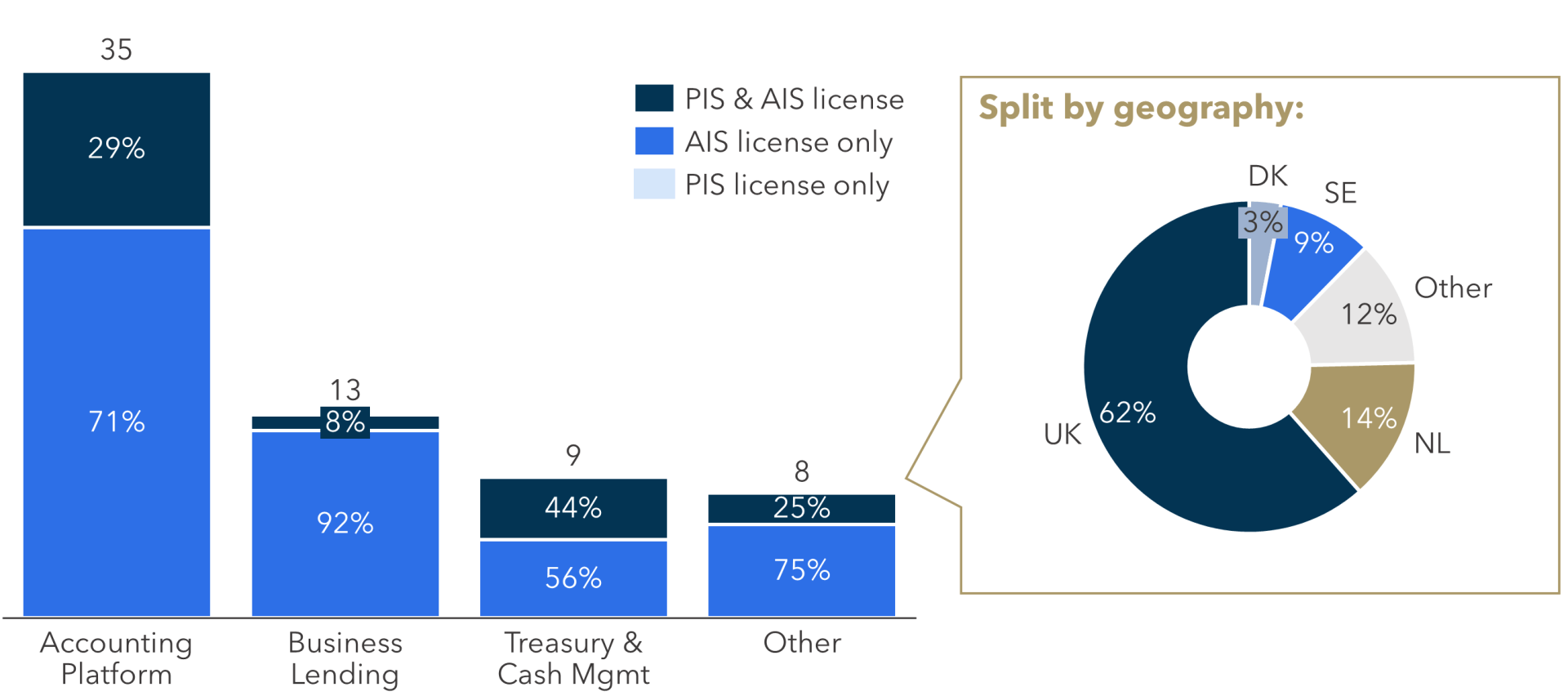

As we explored previously in this article, the integration of software and payment services in European B2B/corporate payments is relatively immature compared to the US. There is, however, great potential for this trend given Europe’s robust bank payments infrastructure and shift towards open banking. Most of the early adoption of open banking has focused on information aggregation and digital identity services rather than payments. Figure 1 illustrates that c.75% of all B2B ISVs (software providers) are AIS licensed (Account Information Services) only, not licensed for payments. ISVs that have a PIS license (Payment Initiation Services) are limited in number and often offer somewhat-immature integrated payment services.

FIGURE 1: European TPPs: B2B ISVs Licensing by Business (total European B2B ISVs=65)

Note: 59 of the TPPs (Third Payment Providers [of PSD2 services]) are in the business segment only, 6 TPPs are in the consumer and business segment. Other business lines include debt management and hosting ISV. Other geographies include Estonia, Italy, Norway, Finland, France, Ireland, Poland and Czech Republic with one B2B ISV in each market.

Source: Flagship market research

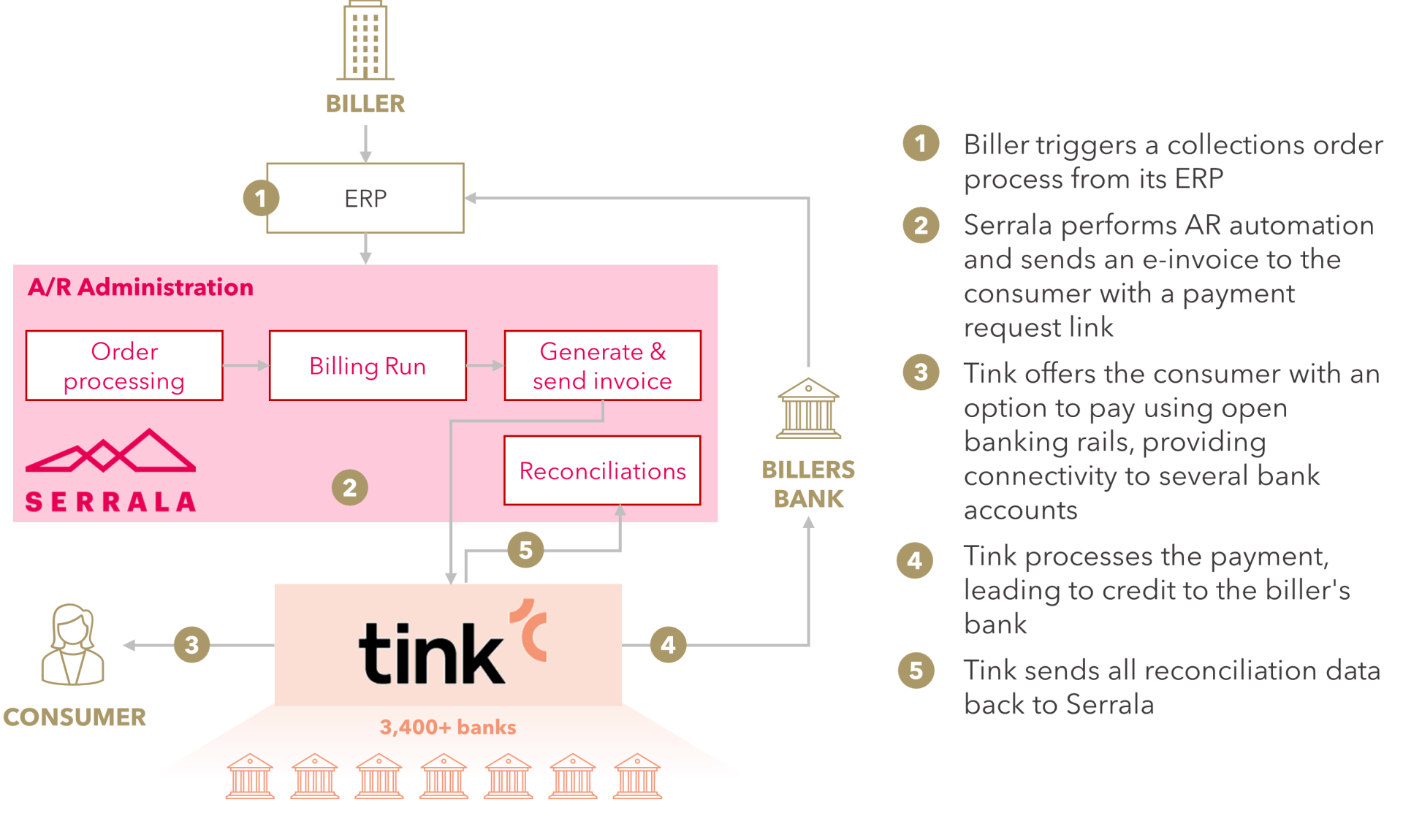

Serrala, a leading SaaS based AP (accounts payables) and AR (accounts receivables) automation platform recently announced a partnership with Tink that illustrates the tremendous market potential for integration of corporate AR/AP automation and corporate payments, enabled by cloud-based open banking technology. Tink is an open banking fintech unicorn that provides open banking connectivity services to more than 3 400 banks. The Tink and Serrala partnership will allow businesses to collect invoice/bill payments through open banking rails. Billers today often struggle with separate business processes and flows for the administration of their AR and related payments, often still relying on banks. Bills are also often still collected via traditional direct debits, which comes with limitations. Serrala’s integration of their core AR SaaS software with Tink’s open banking rails will enable billers to administer the automation of their AR and receipt of bill payments through a single integration and benefit from real-time push payments and related value-added services (as illustrated in Figure 2). Consumers could also benefit from added control, making their bill payments directly from their bank accounts through an integrated payment request link.

FIGURE 2: Illustration of Serrala-Tink Partnership for Integrated Bill Payments

Source: Flagship Advisory Partners research

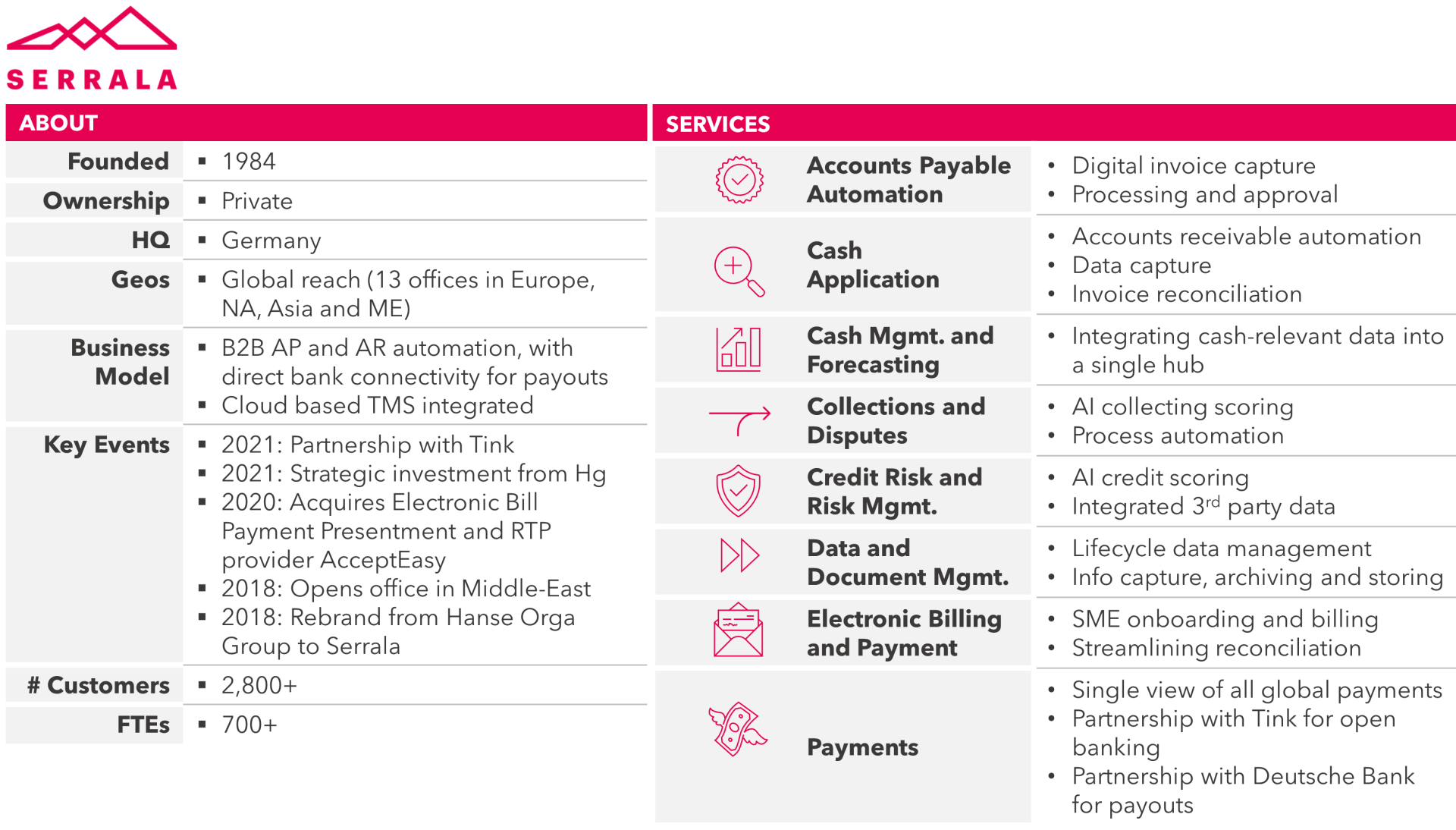

Serrala, who recently announced a strategic investment from Hg, is a pioneer in innovating corporate payments with integrated AR/AP workflows. As we describe in Figure 3, Serrala supports its corporate clients globally including 13 offices in Europe, North America, Middle Easy, and Asia Pacific.

FIGURE 3: About Serrala and Services

Source: Serrala website, crunchbase, linkedin

Hg’s investment in Serrala and parallel partnership with Tink illustrates two prominent themes in market development. One, there is tremendous opportunity for value creation on the forefront of software-integrated payments servicing global multinational corporates. And two, open banking is a catalyst for this trend (particularly in Europe) as open banking enables more robust and technically agile use cases. We anticipate many more investments and partnerships within this part of the market

Please do not hesitate to contact Anupam Majumdar Anupam@FlagshipAP.com with comments or questions.