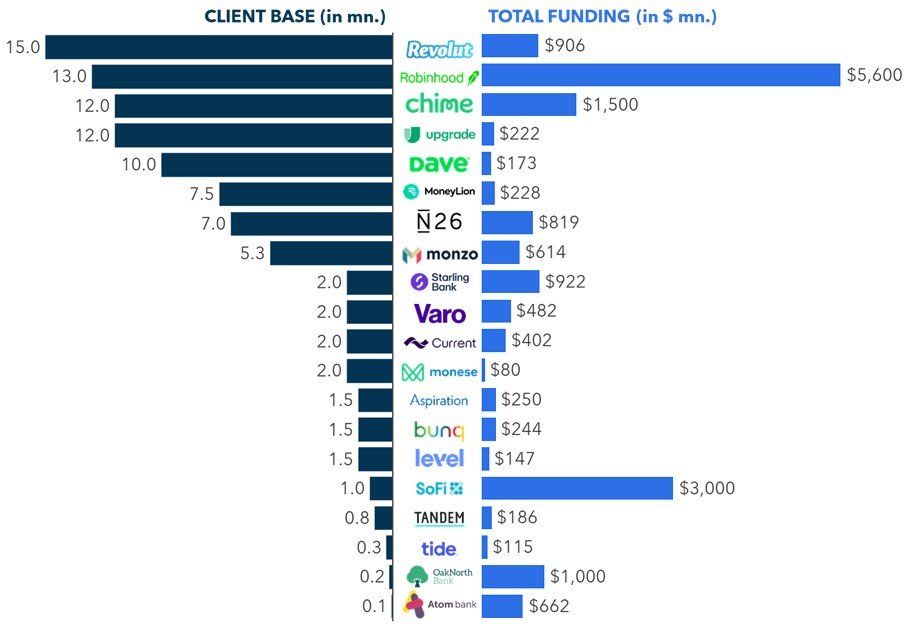

Neobanks have been highly influential in prodding traditional banks to digitize and improve the customer experience, but many still face a long road towards scale and profitability. The strength of the product catalog is a key growth driver; therefore, we examined the offerings of the top 20 neobanks in Europe and North America as measured by client base and funding. As shown in Figure 1 below, the top 20 neobanks share several characteristics: most are based in the US or UK, and several of the largest did not originate as “pure” neobanks.

FIGURE 1: Top 20 Neobanks in Europe and North America by Client Base (in millions) and Total Funding (in $ millions)

Note: We define neobanks as fintechs that offer deposit products or quasi-bank accounts. For example, Robinhood, an investment platform, offers a cash management account with a debit card that sweeps deposits to insured banks.

Source: Flagship Advisory Partners research compiled from company websites, The Financial Brand, and Crunchbase.

The growth in the number of neobanks has been driven by funding availability, the market opportunity to improve upon the customer experience offered by traditional banks, and the advantages of starting fresh with modern architecture, thereby enabling more innovation and faster responsiveness to market and customer needs than traditional banks.

Of course, not all neobanks are success stories – many are subscale, and some have failed (e.g., Simple, Azlo, Xinja). Many of these smaller neobanks are challenged to scale due to the inherent difficulties in getting customers to switch primary banks, narrow product ranges, and because many traditional banks have already closed the gap in the digital customer experience.

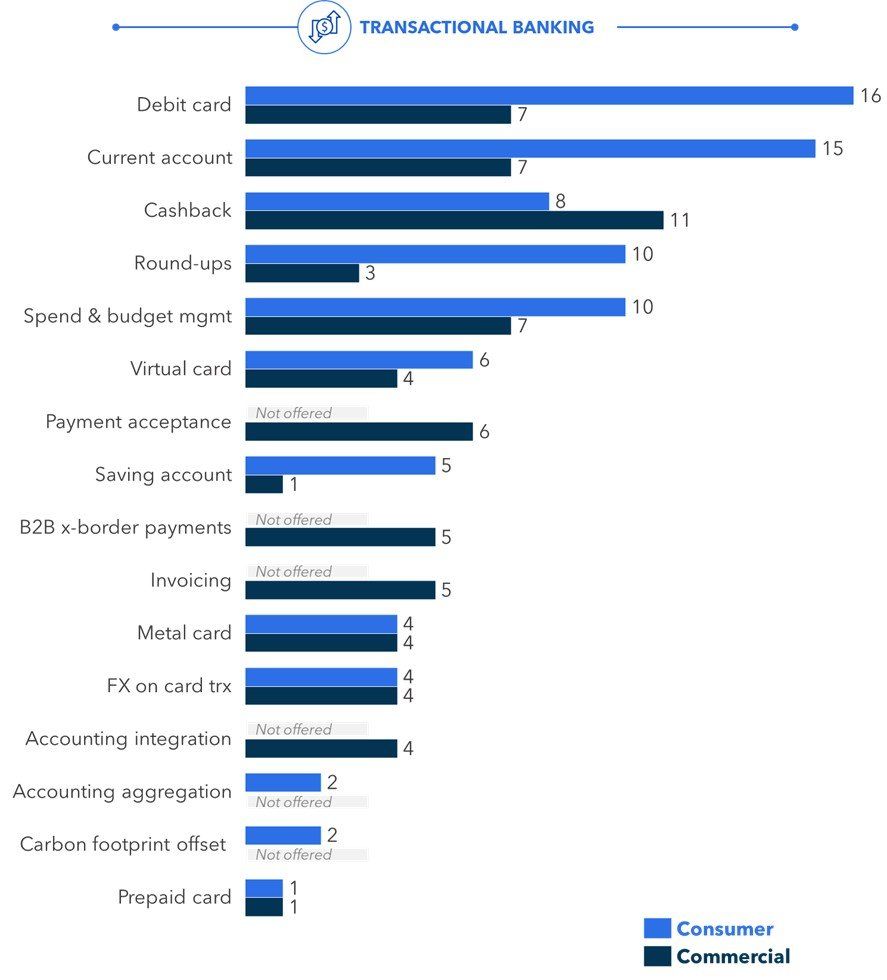

Even the largest neobanks still need greater scale and profitability (e.g., the largest, Revolut, still runs at a loss), and expanding the product catalog is a logical next step. We reviewed the products offered by the top 20 neobanks (Figure 2 below), and found several common themes:

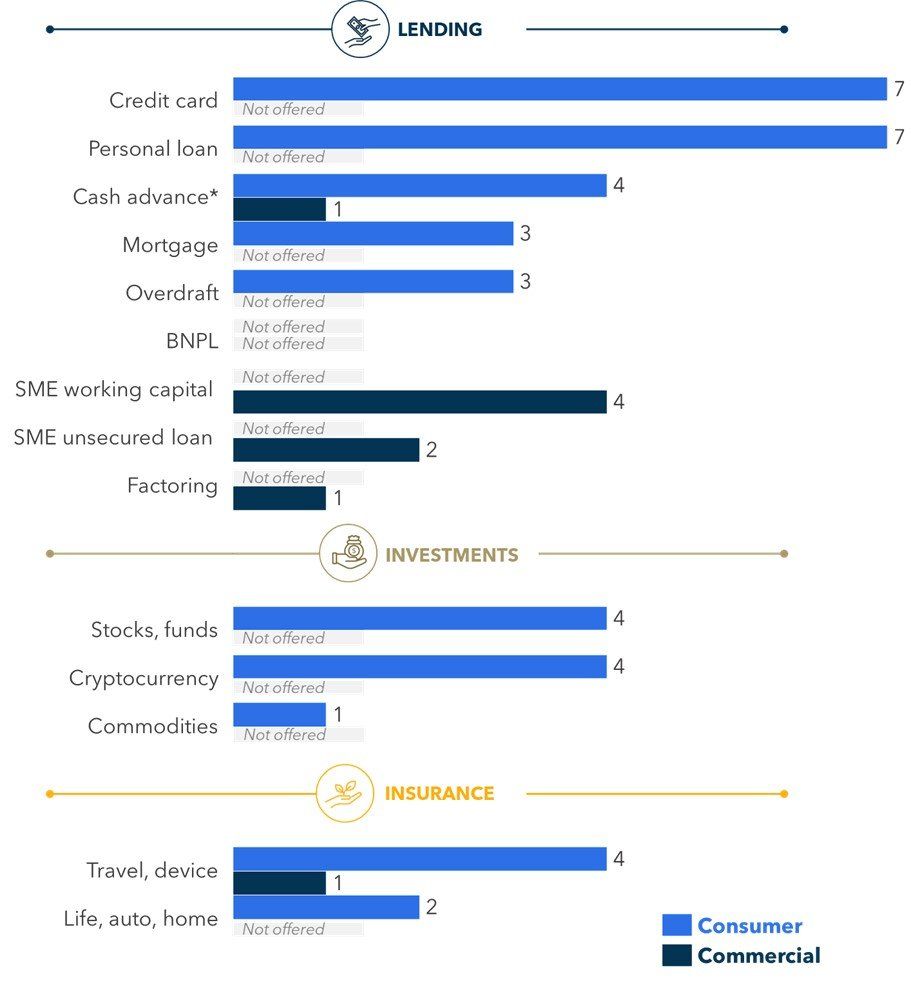

- Many neobanks still have significant room to expand their suite of lending products;

- Relatively few offer SME products (surprising given that the customer experience for SMEs at traditional banks is often markedly worse than for consumers);

- Neobanks’ transactional banking offerings towards consumers tend to offer optically appealing products and features such as round-ups and metal cards;

- Several have begun to offer direct investments into cryptocurrencies (crypto comprised 15% of Revolut’s 2020 revenue);

- However, overall offerings of insurance and investments are relatively light compared to traditional banks.

FIGURE 2: Product Offering of Top 20 Neobanks in Europe and North America (by number of Neobanks offering the product)

Source: Flagship Advisory Partners analysis of company websites.

* Cash advance is a small value loan typically structured as an unsecured advance on salary.

Given that top neobanks’ product sets are typically weighted towards transactional banking, many will need to continue to push into lending to drive profitability. Focus on SMEs is likely to increase, given the wave of small business digitization driven by COVID-19, general under-penetration in the market, and that the customer experience at traditional banks for SMEs generally remains below that of consumers. Further expansion of fee-generating products delivered by partners, such as insurance and investments, is also a natural next step.

To date, many neobanks have followed a logical path to expanding their product catalog: focus on core transactional banking and payments, and then add fee-generating products enabled via partners. While this is a logical launch strategy, it is also arguably not the disruption that the industry feared when neobanks emerged. Rather, it is the tried-and-true universal bank product strategy re-cast for digital delivery.

Neobanks’ next steps will likely be towards innovation where it is (arguably) needed most: lending and SMEs. Digital delivery presents a variety of opportunities to increase convenience for consumers via lending products (e.g., umbrella lines of credit, swipe to move your current account transaction to installments, etc.), and for SMEs generally (e.g., easy integration with accounting systems, working capital at the click of a button, digital factoring and receivables financing, etc.).

In the meantime, traditional banks, which learned many lessons from neobanks’ approach to digital delivery, should also consider neobanks’ approach to product catalogs. These include being easier to partner and integrate with, a willingness to test “small” products delivered via partners to round out the overall offering, and to increase the appeal of the overall banking relationship via optically appealing add-ons such as metal cards, round-up, carbon offset, and other “soft” benefits. Neobanks remain an influential force in banking. After successfully forcing traditional banks to clean up deficiencies in digital, neobanks’ next steps in product development will be watched closely by their older (but now more digitized) competitors.

Please do not hesitate to contact Erik Howell Erik@FlagshipAP.com or Aigerim Assembayeva Aigerim@FlagshipAP.com with comments or questions.