Unless you are Stripe, successful ISV/SaaS channel strategies require focus. ISVs are vertically or functionally specialized, resulting in a broad array of market segments. Flagship developed a simple framework to focus an ISV channel strategy, which we describe below.

ISV Partner Targeting – Flagship’s Framework

Flagship’s ISV partner targeting framework is founded on two principles:

-

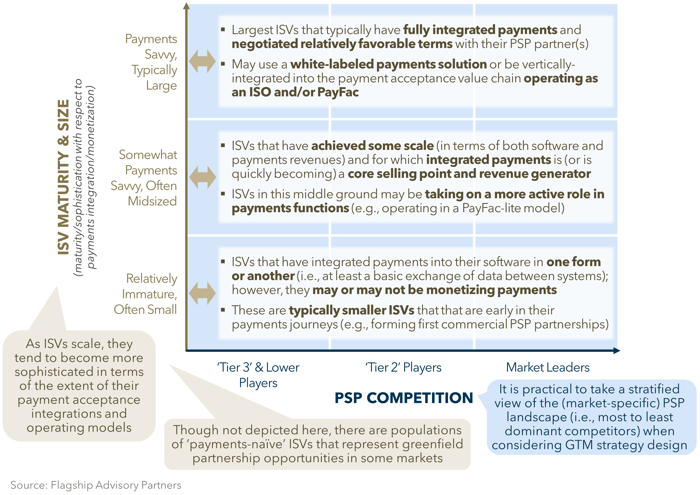

ISVs can be categorized by payments maturity/size (3 categories: y-axis on the below figures)

-

PSPs can be categorized by competitive positioning (3 categories: x-axis on the below figures)

The first step in developing an ISV partnership strategy is selecting a vertical and/or horizontal target market. This is an important strategic decision that needs to consider multiple factors, such as merchant market characteristics, card usage trends, PSP competition, ISV competition, merchants’ needs, ISVs’ needs, and a PSP’s own capabilities, among others. Selecting a target market broadly defines the “who” of a PSP’s ISV partnership strategy. “Who” could include potential partners, end-user merchants, and relevant payments competitors. The next step is refining the “who”: which ISVs to target, specifically, and determining “how”: key positioning statements and execution actions. PSPs should closely examine ISV and PSP competitive landscapes when forming ISV partnership strategies.

FIGURE 1: ISV Partner Targeting – Flagship’s Strategic Framework, ISV Maturity & Size Explanation

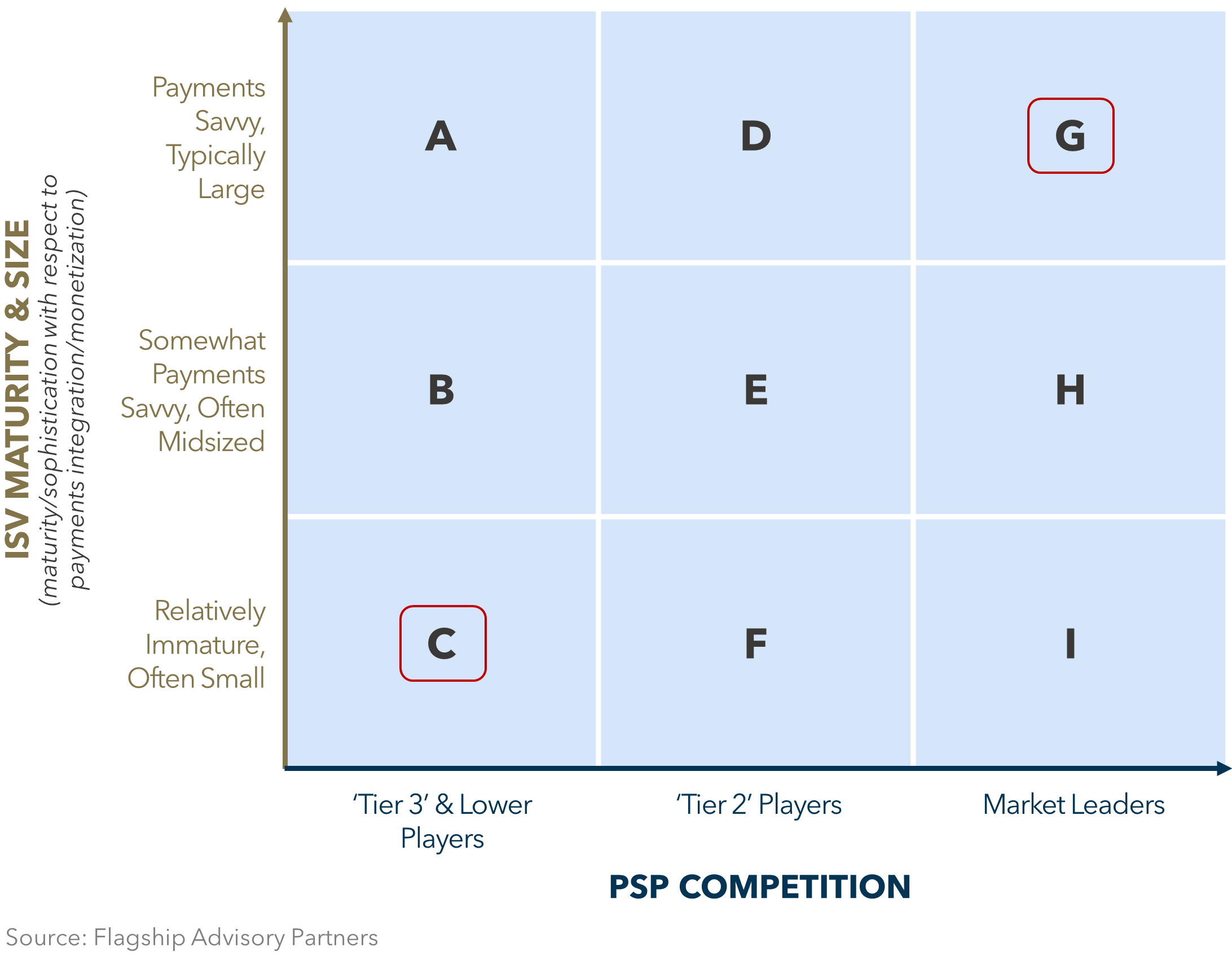

9-Cell Matrix: Refine the “Who” & Define the “How”

We visualize our simple framework as a 9-cell matrix, as shown in Figure 2. Each cell represents a combination of ISV typology and behavior and the nature of the PSP competition.

Flagship uses the framework to segment the market into distinct groups of ISVs requiring different sales approaches and to estimate where the largest market opportunities exist.

Forming a deep understanding of the ISVs and competitors in each cell enables PSPs to understand their customer needs and how to position to win ISV deals. For instance, the sales approach a PSP would use to target an ISV in cell “C” of Figure 2 below (i.e., a relatively immature ISV partnered with a Tier 3 PSP) should differ from the approach used for an ISV in cell “G” (i.e., a payments-savvy ISV partnered with a market-leading PSP).

FIGURE 2: IISV Partner Targeting – Flagship’s Strategic Framework, Competitive Mapping

Refining the “who” and determining the “how” requires the investigation of these questions:

ISV Partner Availability

1. Who are the ISVs at various stages of payments maturity?

2. How large are the ISV populations at the various stages of maturity?

3. Are there ISVs with meaningful market shares or is the market fragmented?

4. What type(s) of ISVs can you serve now?

5. What type(s) of ISVs do you aspire to serve? What do you need to achieve this goal?

6. How quickly will less-payments-mature ISVs become more mature?

PSP Competition

1. Which competitor types (e.g., Tier 2) are targeting different types of ISVs?

2. Are there competitors with a large share of a specific type of ISV?

3. How did Market Leaders attain success? Can the winning model(s) be replicated and/or improved?

4. Which competitors may not be adequately serving the needs of existing ISV partners (e.g., are Market Leaders neglecting small ISVs?)?

5. Where can you logically displace existing PSP partners and why?

Greenfield ISV Opportunities

1. How large is the greenfield ISV opportunity?

2. How many new ISVs are entering the market annually?

3. Are PSPs actively targeting the greenfield opportunities? If so, how? If not, why?

4. How can you best approach the greenfield opportunity?

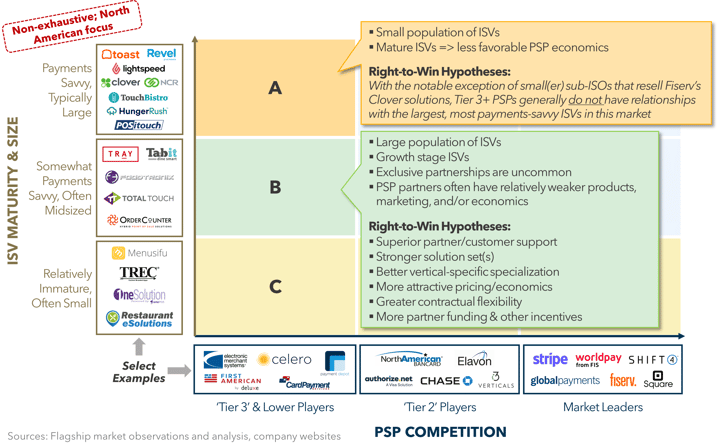

We illustrate how our framework can be leveraged in the Restaurant vertical here:

FIGURE 3: ISV Partner Targeting – Flagship’s Strategic Framework, Restaurant Example

In the Restaurant market, Tier 3 PSPs (with few exceptions) generally seek out less-payments-savvy ISVs (i.e., those in cells “B” and/or “C” rather than the orange-shaded cell “A” in Figure 3 above). Larger ISVs tend to partner with larger PSPs that provide broader capabilities and scale efficiencies. Additionally, a strategy targeted to the long-tail of small ISVs (like the yellow-shaded cell “C”) is challenging given the low lifetime value of these partner relationships. Competition focuses on larger deals, although switching rates are low with scaled ISVs (adding incrementally new payment partners is far more common).

There is an interesting middle-market for ISVs (“somewhat payments-savvy”; green-shaded cell “B” in Figure 3) that tends to be overlooked by the leading PSPs but is capable of driving good profitability. This segment of the market can be won via verticalized one-to-one sales focused on driving higher payments revenue generation for partners.

In Summary

PSPs that invest time into targeting and deeply understanding their core ISV market segments are better armed to win deals in the ISV channel.

Flagship has extensive experience supporting PSPs with developing vertical and horizontal market strategies as well as ISV partner targeting strategies. We would welcome the opportunity to discuss your unique market positioning and opportunity.

Please do not hesitate to contact Scott DeHaven Scott@FlagshipAP.com or Stephen Ford Stephen@FlagshipAP.com with comments or questions.