In collaboration with Flagship Advisory Partners, Transaction Network Services (TNS) has released a new report, "A Guide to Payment Orchestration: Navigating In-Person and Online Payment Complexity", shedding light on the growing demand for payment orchestration solutions, particularly in unattended and fuel and convenience retail sectors. Link through to this page: Payment Orchestration Platform | TNS

SELECT REPORT EXTRACTS

The surge in digital transactions, increased consumer demand for convenience and speed, and growing concerns over cyber security all place immense pressure on the underlying payment infrastructure. Addressing these challenges head-on is essential for merchants to deliver seamless experiences and stay ahead of the competition. Below we highlight select key takeaways from the report.

The Payments Landscape is Growing Increasingly Complicated

With consumers demanding new payment methods and expecting smooth, secure transactions across various channels, merchants are faced with the challenge of navigating the growing complexities of commerce. Enterprise-level merchants need a comprehensive solution that not only standardizes the customer experience but also simplifies internal payment procedures – all while catering to the specific requirements of different industries.

Payment orchestration for omnichannel merchants can be particularly complex, as the payment processing flow must facilitate transactions from payment terminals across a diverse hardware footprint. Merchants operating with in-person channels will prioritize robust, secure hardware and integrated POS systems that are capable of handling high transaction volumes while ensuring data integrity.

Figure 1- Complexities of Channels, Payment Hardware, and Use Cases for Fuel and Convenience Retailers

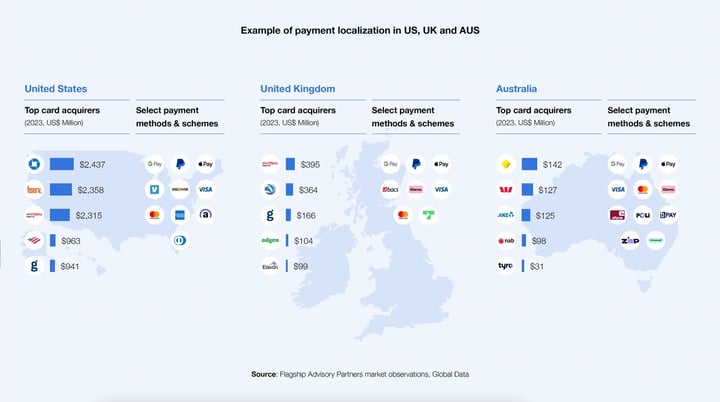

Powering payments both domestically and internationally is a challenge for enterprise (and larger) merchants who are navigating expanding products, services, commerce channels, and use cases. Globally, every market has localization requirements that require a level of optimization to align with the local acquirers (to process card payments), customer payment preferences (alternative payment methods), regulations, and more.

Figure 2- Example of payment localization in US, UK, and AUS

Source: Report "Navigating in-person and online payment complexity" (Transaction Network Services, Flagship Advisory Partners, and Global Payments)

Source: Report "Navigating in-person and online payment complexity" (Transaction Network Services, Flagship Advisory Partners, and Global Payments)Payment Orchestration: A True Flexible-Vendor Solution

To tackle the complex challenges of today’s payments environment, the industry is shifting toward the latest evolution in digital commerce: payment orchestration. Payments orchestration is a unification of payments, technology, hardware, and connectivity – elevating the merchant’s pressure from a disjointed payment network and streamlining the entire payment infrastructure via a single point of reference. Core benefits of payment orchestration include improved merchant experience and operational flexibility, easy facilitation of a resilient acquirer-agnostic environment, and more.

Figure 3- The Impact of the Payment Orchestration Unified Stack

Source: Report "Navigating in-person and online payment complexity" (Transaction Network Services and Flagship Advisory Partners)

Source: Report "Navigating in-person and online payment complexity" (Transaction Network Services and Flagship Advisory Partners)

The Perfect Fit for Orchestration

The larger the scale of operations, the greater the need for orchestration. Merchants who recognize the value proposition either opt to build an orchestration solution in-house or look to third-party orchestrators for their online and/or in-person needs. Merchants in digital-native verticals were the earliest adopters of payment orchestration due to their online orientation and global nature. Innovation within in-person channels, use cases, and terminal hardware (e.g., SoftPOS, unattended/ self-checkout terminals) drove demand for payment orchestration within more traditional in-person verticals such as fuel and convenience, retail, groceries, and other select unattended verticals like parking. Despite clear demand from merchants for in-person-led verticals, few payment gateways/orchestrators focus on enabling POS-terminal use cases today.

Figure 4- Payment Orchestration Adoption by Industry and Channel

Source: Report "Navigating in-person and online payment complexity" (Transaction Network Services and Flagship Advisory Partners)

Source: Report "Navigating in-person and online payment complexity" (Transaction Network Services and Flagship Advisory Partners)

Final Thoughts

A payment orchestration platform enables enterprises to pick the best-in-class services to meet their needs, but still access the range of services through a simplified API layer. This significantly reduces the time, cost, and complexity of expanding online and in-person commerce use cases and integrating new providers across markets. In summary, Payment orchestration simplifies payments.

Click here to download the full report of insights on how merchants can navigate the complexity of payments through payment orchestration, and more.

For any questions related to Payments Orchestration, please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com.

.png)