Navigating fintech innovation

Flagship Advisory Partners is a boutique strategy and M&A advisory firm focused on payments and fintech. We serve clients globally and have a team of 40+ professionals who have a unique depth of knowledge in payments and fintech.

Latest Insights

Filter by

Topics & Themes

Topics & Themes

Apply

Clients

Clients

Apply

Type

Type

Apply

Topics & Themes

Clients

Type

Selected:

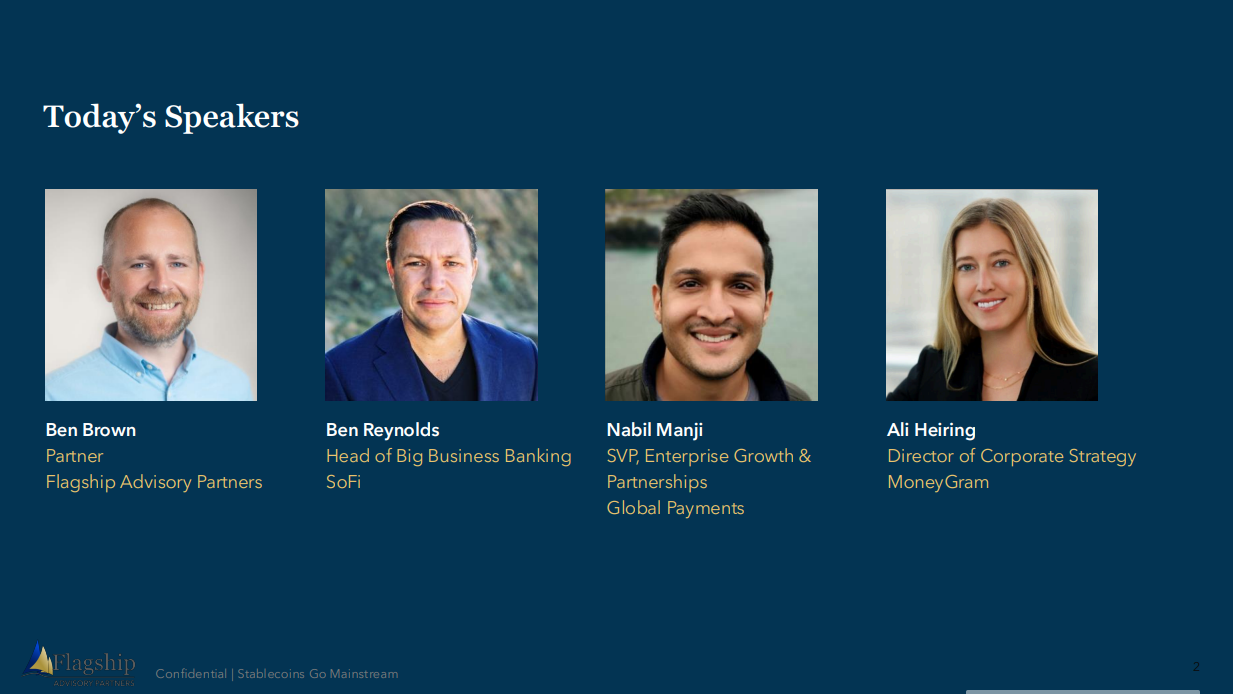

A panel discussion on the stablecoin landscape with Ben Brown (Partner, Flagship Advisory Partners), Nabil Manji (SVP, Head of Fintech Growth &...

Webinar

3 March 2026

Most Read Insights

Anupam Majumdar & Simone Remba

Recent Posts

Executive Interview Series: Ram Sundaram, co-Founder & COO, TerraPay

Executive Interview

22 Nov 2023

Flagship Advisory Partners’ Executive Interview Series provides readers with exclusive insights from thought leaders in the payments and fintech industry. This edition puts the spotlight on TerraPay, a leading fintech that serves businesses and fintechs in the B2B cross-border payments space. Flagship Advisory Partners met with Ram Sundaram, Co-Founder and COO of TerraPay to learn about TerraPay’s perspectives on fintech disruption and success in the B2B cross-border payments market. Image: Ram Sundaram, TerraPay 1. TerraPay has been at the forefront of fintech disruption in B2B cross-border payments. Can you walk us through what TerraPay does and how it has evolved from its early days? Ever since our inception in 2015, we have stayed true to our mission of simplifying global money movement by making it instant, digital, and fully compliant. The idea of interoperability played a key role in shaping our vision and what we do. Despite the global movement towards digitization, we saw the real-life challenges plaguing the world of small-value cross-border payments. We identified the gaps that legacy FIs could not address for such payments and took the initiative to obtain our own licenses and establish an ecosystem capable of assessing risk and accommodating varying Know Your Customer (KYC) and compliance standards across different markets. That’s what helped us build our trusted network of partners, with compliance and technology at the core. The first successfully piloted interoperable transaction on TerraPay occurred between a money transfer operator in the UAE and Airtel Money in Rwanda back in 2015. At that time, the only option for such transfers was through one of the largest MTOs in the world (who is now a client!), which had a total cost of a steep 25%. Today, we partner with leading banks, MTOs, wallet operators and global businesses to provide an instant, inclusive, and accessible payments ecosystem. When we say that we power instant cross-border payments, we are saying that more than 97% of the payments that are processed on the TerraPay platform are done in less than 60 seconds. 2. The B2B cross-border payments market is massive, with an estimated $30 trillion in turnover. Banks still own the lion's share of this market, but we see fintechs slowly winning share. What are some of the opportunities for fintechs in the B2B cross-border payments space? Before diving into the opportunities, it is crucial that we understand what led to the widespread emergence of fintechs. Armed with a vast network, robust regulatory and technical infrastructure, and sufficient liquidity, banks have supported multinational cross-border payments for decades, front-ending them through the SWIFT network. However, over the past decade, there has been a notable shift. The rapid rise of e-commerce, gig workers and a growing number of international sellers selling goods through local e-commerce platforms has accelerated SMB cross-border payments. According to the World Bank, SMBs represent approximately 90% of businesses and more than 50% of employment worldwide. They are responsible for over $17 trillion of cross-border payments annually. However, the experience of a bank’s SMB customer sending or receiving payments is radically different from a large business. SMBs face several unique challenges, and this becomes even more pronounced for lower-value B2B payments where parameters like forex trading volatility, liquidity, compliance, a lack of transparency, processing, and settlement times bear a significant impact on business. This is where fintechs come in. They are able to navigate these complexities quickly and come up with different solutions that address the market. They also target specific segments, avoiding massive multinationals with long sales processes, focusing on their strengths in addressing SMBs. At this point, fintechs hold 2% of global financial services revenue pool, which we estimate to be valued at $1.5 trillion in revenue by 2030. Competition isn’t the way forward. In this interconnected economy, I think the real opportunity lies in building strong fintech-bank partnerships that will strengthen the future of cross-border payments. 3. What kind of cross-border payment B2B use cases do you see where fintechs have found a sweet spot and banks have underserved? B2B payments, in essence, present a mosaic of scenarios, from individual entrepreneurs to global enterprises, demanding systems with the robustness to manage this intricate diversity. You’ll find a variety of use cases where fintechs are thriving. Let’s consider the travel industry, where there are businesses like travel aggregators, global distribution systems, etc. on one side, and on the other, you have suppliers, like hotels, tour guides, transit systems, etc. This landscape is fraught with an overwhelming number of challenges and unmet needs. Sometimes, the supplier is a single person who may require highly-specialized solutions, such as immediate payments and transparent fee structures. Fintech has been able to successfully address these needs to a large extent. 4. Are there any specific verticals that are underserved where Fintechs have more room to grow versus banks? At TerraPay we have realized that an industry or a vertical-led approach can drive customized value for organizations. Take travel for instance. Now, you might think that this trillion-dollar industry is well-served but in reality, there is still tremendous potential. Fintech has the opportunity to boost the efficiency of payment processes within this multi-player sector, improving payment experiences and overcoming challenges related to flexibility and personalization; meeting the evolving needs of the end consumer. The booming social media industry is another area of focus for us. Many social media firms are also venturing into e-commerce, enabling influencers to sell products and users to make purchases. This dynamic introduces an intriguing use case, as a significant portion of these transactions involves cross-border micropayments, which are currently associated with high costs. TerraPay collaborates with innovative startups aiming to develop solutions in this domain, allowing customers to make cost-effective payments of mere cents within a sustainable business model. E-commerce is another vertical packed with potential. However, we focus on targeting emerging and underserved markets in this sector. In the African continent, for instance, many use mobile wallets as their primary financial instrument. But they face limitations in using these wallets to make purchases from platforms like Amazon U.S. The current solution for consumers involves engaging a local retailer with a verifiable address and bank account, who then places orders on their behalf and charges an additional fee. TerraPay has been actively addressing this issue, most recently through collaborations with mobile money network operators (MNOs) like Airtel Money. This partnership seeks to enhance the accessibility and efficiency of e-commerce transactions for consumers in these markets. Lastly, with SMB payments, there is always a layer of intricacy owing to the nature of the industry or market they operate in. A simple example of this is a cross-border account receivables e-invoice sent by a supplier to their buyer which needs to be accompanied by documentation such as tax and customs papers depending on the place of origin and destination. Moreover, such requirements tend to be corridor-specific. Fintech can easily build capabilities to facilitate B2B transactions within well-established corridors, particularly in Western and U.S. regions where streamlined document exchange systems are already in place. However, the approach and challenges change when we talk about developing countries. , TerraPay actively collaborates with SMBs in Africa, a region characterized by robust import activity, notably from China. Needless to say, this geographical span linking Africa and China presents a new world of complexities in terms of regulatory requirements to enable the seamless movement of funds. The “white space” here is the opportunity to connect traditional supplier markets with emerging buyers spanning various markets. 5. Who are TerraPay’s key clients? Our key clients have always been financial institutions (FIs) for account payout networks. This includes money transfer operators (MTOs) who rely on other networks to deliver cross-border transactions. Next, are banks that are seeking to offer real-time solutions to their customers. The final segment is MNOs who need the ability to interoperate across other wallets. The B2B payment space is vast and each industry has specific needs and complex use cases. Across the three verticals I mentioned earlier, we work closely with our partners to identify their unique needs. Recently, we worked with a global e-commerce platform to transform their cross-border pay-out capabilities. We built customized pay-out experiences using diverse functionalities to offer the payees their preferred pay-out methods in their local currencies. We delivered multiple secure pay-outs such as fund disbursement to employees, sub-merchants, suppliers or customers and pay-outs to bank accounts, wallets, and cards – across the globe with a built-in compliance management system. We were able to deliver a success rate of 99%, with 90% of the transactions delivered under 15 minutes across 115k unique receivers with coverage of all leading banks within the region. All within a matter of months. 6. When it comes to Fintechs in the space, do you see any winners or losers? Many fintech startups are tackling cross-border challenges and truly changing the global payment environment, yet we anticipate eventual consolidation in this space. You see, most fintechs don't develop their technology in-house and outsourcing their core platform takes away their autonomy. This is what sets TerraPay apart, we have built our core platform, card acquiring, and recently tested issuance solutions from the ground up. This gives us complete control over our product. Ultimately, to establish a robust business, ownership of the core elements is crucial, and in fintech, what sets you apart is an equal blend of technological expertise and financial domain chops. Piecing together services from various sources limits capability and I think that renders the current fintech ecosystem somewhat delicate, akin to operating a Lego structure with borrowed blocks. 7. What are your growth areas or planned focused growth opportunities for the future? For geographical growth today, we are in 128 countries with an internal mission to reach 150 countries by 2025. The bigger that number gets each year, the harder those countries are to reach as now you are at the long tail of markets where there is no local infrastructure. Over the last few years, TerraPay has established itself as a leader in International Money Transfers. At the same time, we are constantly developing and adding new payment products and solutions to best use our existing network for Business pay-outs, Wallet enablement, Issuance, and Acquiring, Card-to-Account, through necessary regulatory licenses and approvals, adding more settlement banks for regions with an aim to remove the dependency on cash overall. We recently closed our Series B equity financing round, raising over $100 million in equity and debt financing, accelerating our global expansion plans, especially across the LATAM and MENA regions while also growing our existing pay-out network to 150 countries by 2024. 8. Given that Visa now has a strategic investment in TerraPay, what does the future hold from that perspective? With Visa joining us, the idea is to build holistic solutions and enhance connectivity. Our quality of service is something that stands out for Visa. They have been leveraging our technology for account transfers and Visa Direct is leveraging our network reach for payouts, expanding wallet reach and access to all our corridors. This grows the ecosystem substantially because for us to individually integrate with every bank in the world would be impossible. There are some interesting things that we are exploring with Visa where we can build, and they can scale to their customers because of the existing connectivity networks. Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com with comments or questions.

b2bpayments,xborderpayments

psps

executiveinterview

P27: Lessons Learned from the Latest Failure in Pan-European Payment Collaborations

Article

25 Apr 2023

Introduction The Nordic P27 initiative is the latest pan-European payments collaboration to fail. Coupled with last year’s struggles of the European Payment initiative (EPI), Europe has seen a slew of failures in pan-European collaborations that have desired to launch new payment schemes and harmonize the European payments landscape. At the time of writing this article, the EPI has just announced to acquire Currence iDEAL (Dutch A2A payment method) and Payconiq International (Belgian and Dutch A2A payment method) and pivot towards creating a pan-European digital wallet and instant payments infrastructure, abandoning its initial plans to create a Visa/Mastercard rival card network. As illustrated below in figure 1, failures in pan-European payment collaborations are not new as there have been several such initiatives in the past. Most of these initiatives failed due to multiple reasons: lack of political alignment and poor commitment across too many stakeholders (e.g., EPI, the Monnet Project); lack of a killer value proposition that fits market needs (e.g., the Euro Alliance of Payment Schemes); or misaligned priorities in context of local market structure (e.g., in the case of PayFair) The P27 Initiative As we wrote previously here, the P27 initiative was launched in 2017 by a consortium of Nordic banks with an aim to introduce a modernized A2A payments infrastructure for 27 million inhabitants in the Nordics, replacing 9 fragmented A2A clearing houses in the Nordics. The end goal was to create a harmonized cross-border payments infrastructure that could achieve cost synergies in back-end payment processing, create opportunities to offer innovation on top of the combined rails, and create new front-end value-added services (e.g., overlay services such as alternative payment methods, bill payments, cross-border payouts, cash management amongst others) (see figure 2). On paper, P27 had strong underlying rationale, met key market needs: rationalization of the Nordic A2A processing infrastructure, reduction in x-border processing costs, and creation of a platform for fintechs and non-bank participants to build front-end innovations for consumers and businesses. Also being a Nordic initiative, there were no cultural integration challenges. Reasons Behind Failure 6 years after the launch, as we illustrate in figure 3, a series of events led to the collapse of the initiative. To start with, P27 did not initially see participation from most Norwegian banks. However, in 2020, some Norwegian banks were rumored to join the initiative, but we are unclear as to how many. In 2020, P27 completed the acquisition of Bankgirot, the Swedish A2A clearing house and also the owner of SWISH, the main A2A mobile payment scheme in Sweden used by c.85% Swedish consumers. This was a logical steppingstone as P27 was likely to process all A2A payments in Sweden, including SWISH volumes, in the future. In 2021 Vipps (the leading Norwegian A2A and cards mobile payment method) merged with MobilePay (the leading Danish A2A and cards mobile payment method) to develop a new entity Vipps MobilePay A/S. Pivo, Finland’s leading mobile payment scheme was initially in the mix, but was later blocked by the European Commission. The merger was a critical milestone as Danske Bank (who used to own a 65% stake in MobilePay, announced to hold c.28% stake in the new entity) as well as other Danish banks which owned MobilePay, along with the consortium of Norwegian banks which owned Vipps, decided to create a competing pan-Nordic infrastructure for A2A payments. The objective was to harmonize cross border A2A mobile payments across 11 million consumers in Norway, Denmark, and Finland. Unsurprisingly, in April 2023, it was announced that the Danish banking sector had decided to relinquish the P27 initiative. At the same time, it was also announced that P27 would not be able to process SWISH A2A volumes (reasons remain unclear). Lack of political alignment across too many stakeholders, conflicting interests, and a lack of critical mass to start up with (as none of the scalable Nordic mobile payment schemes, e.g., MobilePay and Vipps were to be supported) ultimately led to the failure of P27, with further uncertainly on what this means for the consortium. Summary of Lessons Learned As noted above, this is not the first time that pan-European coalitions have failed. The P27 failure reinforces a number of lessons learned for participating banks and fintechs: Collaborations at a pan-European level are hard. It requires sharing a common vision, dedicated and sincere focus, as well as very strong stakeholder synergies to launch successful payment schemes. Thus far, we have failed to come across a perfect example that meets all of the above. Participating shareholders having conflicting priorities. Danske Bank, a key participant of P27 also had ownership of MobilePay. With the MobilePay and Vipps merger, Flagship's assessment is that Danske Bank (a key influencer in the Danish banking sector) was able to influence the Danish banking sector's approach to P27. Danske Bank disagrees with Flagship's assessment, and stated to Flagship that, "Danske Bank having ownership of MobilePay has nothing to do with the fact that the Danish banking sector unanimously decided to move forward without P27, and Danske Bank has not been swaying the Danish banking sector to abandon P27". Lack of meeting unmet needs and poor business case. Most of the pan-European initiatives have been politically motivated projects without a clearly thought-out revenue model or backed by adequate market research to meet a clear market need. Therefore, in most cases stakeholder willingness to fund (often large) required investments has been limited. Bank coalitions to create a national payment scheme can be successful; however, extending the vision at a pan-European level is hard. Coalitions at a national level can be successful provided banks are willing to back it up with the required investments and play an active role in developing a successful merchant acceptance ecosystem. This has been observed in several e-commerce payment methods in bank centric markets such as the Netherlands (e.g., iDEAL), Poland (e.g., BLIK), Sweden (e.g., SWISH). However, scaling this vision at a pan-European level requires achieving a commonality across problem areas, finding overlap in solutions and respecting local market conditions and structure. Not many pan-European solutions exist today that share this vision. Very often coalitions fail if the vision is too ambitious. For example, the EPI which wanted to establish a pan-European C2B scheme (across cards and A2A) was too ambitious, and from the sidelines appeared requiring a lot of heavy lifting – building the infrastructure, heavy consumer marketing, building the acceptance infrastructure, all of this required heavy leg work and lot of investments. P27, on the other hand, was not overly ambitious. However, as argued previously, it failed due to poor stakeholder alliance and political misalignment across the participants. Payments infrastructure rationalization has clear upsides, however it requires strong execution. A case in point is Geldmaat, the recently created entity for managing ATM infrastructure in the Netherlands, that required strong execution from the three largest Dutch banks (ING, ABN AMRO, Rabobank) to rationalize their ATM networks within 3 years. Conclusion The failure of P27 adds to the long list of failures in pan-European payment scheme coalitions. As history has told us, coalitions often fail unless there is a proper consensus across stakeholders, zero conflicting priorities, a strong market-product fit backed by strong execution from participants. While P27 is not a case in point, stakeholders embarking on future pan-European payment coalitions may want to resolve conflicting interests and priorities upfront, remain committed to a common vision, and have enough vested interest to remain invested for the long run. Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Simone Remba at Simone@FlagshipAP.com with comments or questions. Sources: Finextra, Mobile Pay, Financieel Dagblad

a2apayments,innovations,perspectiveonkeyevents,xborderpayments

processorssolutionproviders

article

No results found

Topics & Themes

A2A Payments

AI Artificial Intelligence

B2B Payments

Best Practices & Toolkits

Card Issuing

Compliance & Security

Credit

Embedded Finance & BaaS

Fintech & SaaS

Innovations

M&A

Open Banking

Payments Acceptance

Payments Orchestration

Perspective on Key Events

Processing & Technology

SaaS

X-Border Payments