Navigating fintech innovation

Flagship Advisory Partners is a boutique strategy and M&A advisory firm focused on payments and fintech. We serve clients globally and have a team of 40+ professionals who have a unique depth of knowledge in payments and fintech.

Latest Insights

Filter by

Topics & Themes

Topics & Themes

Apply

Clients

Clients

Apply

Type

Type

Apply

Topics & Themes

Clients

Type

Selected:

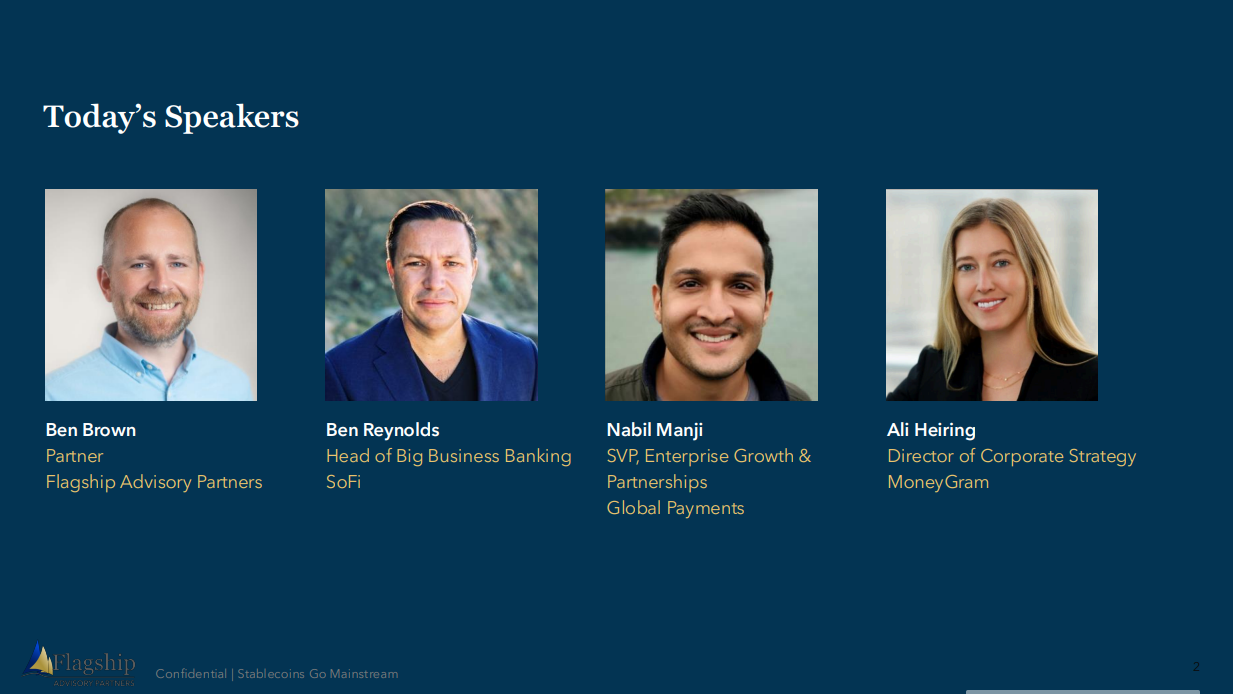

A panel discussion on the stablecoin landscape with Ben Brown (Partner, Flagship Advisory Partners), Nabil Manji (SVP, Head of Fintech Growth &...

Webinar

3 March 2026

Most Read Insights

Flagship Leadership

Recent Posts

Press Release: Ben Brown Joins Flagship Advisory Partners to Strengthen Growth & Innovation Capabilities

Press Release

14 Jan 2024

Annapolis, MD – Flagship Advisory Partners, the leading global boutique strategy consulting and M&A advisory firm focused on payments and fintech, is pleased to announce the addition of Ben Brown as a Partner, based in our Annapolis, MD office. "We are excited to welcome Ben to Flagship," said Joel Van Arsdale, Managing Partner of Flagship Advisory Partners. "His years of experience working with fintech innovators around the world and his unique market insights will advance Flagship’s mission of helping innovators and investors to position for the future of financial services." Image Credits: Ben Brown “I’m thrilled to join Flagship and build upon the firm’s early success as a highly specialized advisor to market leaders in the payments and fintech world. Flagship is a special firm dedicated to the boutique model: focus, passion, subject matter expertise, agility, and personal relationships with our clients and our people. I look forward to helping the fintech ecosystem benefit from our ability to rapidly unlock value and accelerate innovation,” said Ben Brown. Ben has over 15 years of experience working with payments and fintech companies, technology giants, major merchants, banks, and private equity investors. Most recently, Ben co-founded Accenture’s Fintech Practice and led their Cross-Industry Payments Practice in North America. Prior to that, he worked for First Annapolis Consulting where he was an integral contributor to development of that business in Europe and established their West Coast office in San Francisco. Over his career, Ben has worked with more than 100 fintech, technology, and banking clients on growth, business transformation, and product innovation topics. Ben also supported fintech innovators through angel investments, various fintech accelerator programs, and mentoring early-stage companies. Ben's addition to the Flagship team aligns with the company's strategy of bringing in top-tier talent to advise payments and fintech leaders on the rapidly evolving financial services ecosystem. Ben will focus on helping fintech companies diversify their revenue, helping banks leverage the fintech ecosystem through partnerships and M&A, and helping merchants unlock value in their integrated payments and embedded finance initiatives. About Flagship Advisory Partners Flagship Advisory Partners is a boutique strategy consultancy and mergers and acquisitions advisory firm specializing in payments and fintech. Flagship delivers c. 75 engagements per year across the areas of M&A advisory, growth/innovation strategy, operational transformation, and client and market insights. Flagship is comprised of 30+ professionals with a unique blend of deep industry knowledge, practical operating experience, and proven consulting and analytical skills. Flagship serves clients globally from three offices across North America and Europe. We look forward to delving into more diverse topics that generate debate and challenge perspectives in the coming year. Should you have any questions, please do not hesitate to contact us at Info@FlagshipAP.com

perspectiveonkeyevents

pressrelease

What We Learned During Fintech: Spring Conference Season, 2023

Infographic

16 Jun 2023

Article Synopsis and Visuals Guide: We summarize some of the key themes discussed during the conferences attended by Flagship Advisory Partners’ leadership team from January to June 2023 in the UK/Europe and the U.S. General themes and topics covered: SAAS & Payments/Fintech (C2B & B2B) Payment Orchestration Marketplaces B2B Payments A2A, Open Banking Fraud & Risk Management Regulation Crypto & CBDC Please do not hesitate to contact Joel Van Arsedale Joel@FlagshipAP.com, Erik Howell Erik@FlagshipAP.com, or Yuriy Kostenko Yuriy@FlagshipAP.com with comments or questions.

perspectiveonkeyevents

processorssolutionproviders

infographic

Our Most Read Insights of 2022: Debate About the Impact of BaaS, Open Banking Payments, and SoftPOS

Article

6 Jan 2023

Flagship published insights across a diverse set of topics in 2022, including integrated payments, crypto, open banking, payfacs, M&A, neobanks, SoftPOS, Banking-as-a-Service (BaaS), the impact of inflation, B2B payments, spend management, and many others. Below we review and summarize our most popular articles of the past year. The rise of Banking-as-a-Service (BaaS), in parallel with our commentary on the muted adoption of open banking payments generated significant reaction and healthy debate. Other topics which captured our audience’s attention entailed our reporting on Stripe’s remarkable 2021 performance, the historical evolution of SoftPOS and its potential for growth in 2023, and our proprietary analysis on the shifting market dynamics in U.S. merchant payments. Links to our top-read articles here: 1. Banking-as-a-Service (BaaS) Fintechs Coming to Age to Fuel Integrated Finance Needs 2. European A2A Schemes Thriving, Not Yet Open Banking Payments 3. SoftPOS is Ready for Prime Time in 2023 4. Infographic: Stripe Setting the Performance Bar in Fintech 5. M&A No Longer the Key Driver of Consolidation in U.S. Merchant Payments 1. Banking-as-a-Service (BaaS) Fintechs Coming to Age to Fuel Integrated Finance Needs As the focus of our most-read article in 2022, Banking-as-a-Service (BaaS) enables any company to embed integrated financial services. The category came of age in 2022 with an influx of funding, the rapid proliferation of fintechs (including scaled players), and maturity in product setting the scene for widespread disruption of financial services distribution in 2023 and beyond. FIGURE 1: European Landscape of BaaS Providers (2022; select players, based on office locations and license approvals) 2. European A2A Schemes Thriving, Not Yet Open Banking Payments In parallel, our views on the unmet expectations European open banking payments generated healthy online debate. Open banking payment adoption remains muted and faces adoption challenges given the traction of A2A APM schemes in certain markets, and we went as far as calling open banking payments a solution in search of a problem. We do however remain optimistic that structural impediments will be removed, driving an ongoing expansion of PIS volumes, and that additional verticals and use cases will gain traction increasing its overall relevance. FIGURE 2: Landscape of Select European A2A APM Schemes (2022; select players) 3. SoftPOS is Ready for Prime Time in 2023 SoftPOS progressed slowly over the last decade, but is finally ready for the mass market with the launch of the most recent set of standards (MPoC). Our year-end article highlighted the importance of these new standards, which will address many historical constraints associated with SoftPOS giving rise to rapid scaling in the years to come. We believe that 2023 is the year SoftPOS takes off in earnest. FIGURE 3: Select Events & Key Milestones in SoftPOS Evolution (2022) 4. Stripe Setting the Performance Bar in Fintech Stripe remains a darling of the fintech ecosystem, and our infographic highlighted its remarkable performance in 2021. Stripe outperformed peers in volume growth (an impressive 100% since 2016), and according to press releases, claims to partner with 60% of technology companies that went public in 2021. In conjunction with an aggressive global expansion strategy, Stripe has expanded its product set along the value chain with the most recent add-ons including card issuing, identification, tax, and revenue recognition. FIGURE 4: Payments Volumes (2022; in $ bil. equivalent) 5. M&A No Longer the Key Driver of Consolidation in U.S. Merchant Payments Finally, our analysis of the dynamics of market consolidation and growth in the U.S. merchant payments market disproved the conventional wisdom stating that M&A is the key driver of consolidation in merchant payments. This is no longer true in the U.S. market. Disparate organic performance led by high-growth disrupters is now the driving force behind U.S. consolidation. FIGURE 5: Payments Volumes (2022; in $ bil. equivalent) We look forward to delving into more diverse topics that generate debate and challenge perspectives in the coming year. Should you have any questions, please do not hesitate to contact us at Info@FlagshipAP.com

a2apayments,embeddedfinancebaas,innovations

financialinvestors

article

Key Themes and Insights from Merchant Payments Ecosystem (‘MPE’) Berlin, 5 - 7 July 2022

Infographic

11 Jul 2022

We summarize below some of the key themes discussed during the MPE conference in Berlin. Core Payments Broader Fintech Crypto and the Metaverse Please do not hesitate to contact: Erik Howell (Erik@FlagshipAP.com), Yuriy Kostenko (Yuriy@FlagshipAP.com), Anupam Majumdar (Anupam@FlagshipAP.com), Charlotte Al Usta (Charlotte@FlagshipAP.com), or Dan Carr (Dan@FlagshipAP.com) with comments or questions.

perspectiveonkeyevents

processorssolutionproviders

infographic

Key Themes and Insights from Money20/20 Europe, 7 - 9 June 2022

Infographic

10 Jun 2022

We summarize below some of the key themes discussed during the Money20/20 Europe conference. Key Themes & Insights Please do not hesitate to contact: Joel Van Arsdale (Joel@FlagshipAP.com), Erik Howell (Erik@FlagshipAP.com), Yuriy Kostenko (Yuriy@FlagshipAP.com), Anupam Majumdar (Anupam@FlagshipAP.com), or Charlotte Al Usta (Charlotte@FlagshipAP.com) with comments or questions.

perspectiveonkeyevents

processorssolutionproviders

infographic

No results found

Topics & Themes

A2A Payments

AI Artificial Intelligence

B2B Payments

Best Practices & Toolkits

Card Issuing

Compliance & Security

Credit

Embedded Finance & BaaS

Fintech & SaaS

Innovations

M&A

Open Banking

Payments Acceptance

Payments Orchestration

Perspective on Key Events

Processing & Technology

SaaS

X-Border Payments