Less than a year after an abandoned de-SPAC deal that valued the company at $480 million, Plastiq, a U.S. B2B payments automation platform, filed for Chapter 11 bankruptcy and entered into an agreement to be acquired by Priority Technology Holdings, a publicly traded U.S. merchant acquirer/payment service provider. In this article, we summarize the rise of U.S. payment service provider investment in B2B payments and how the rise and fall of Plastiq illustrates such investment.

B2B Investment by U.S. Payment Service Providers

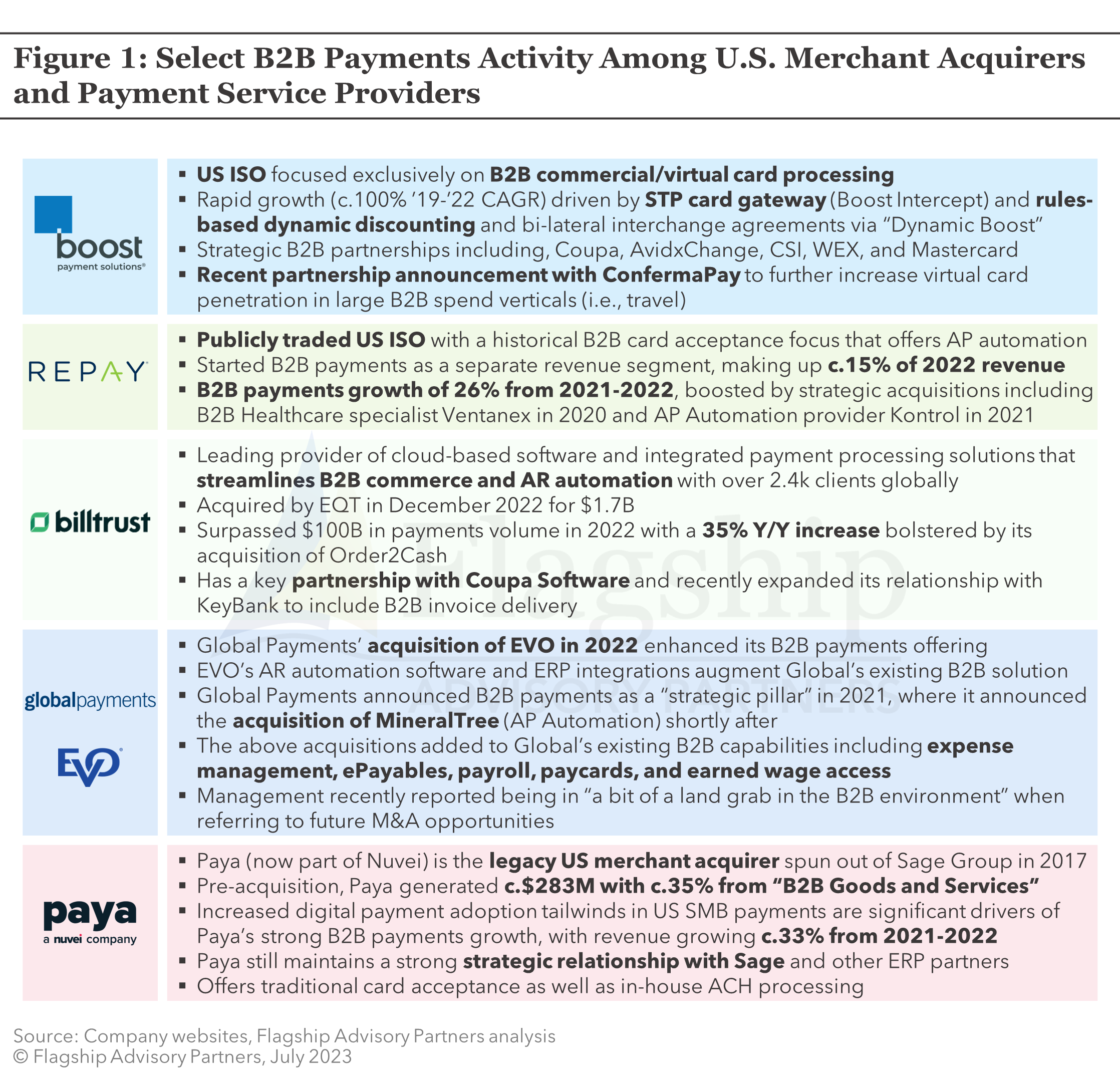

Over the last several years, we have observed U.S. merchant acquirers and payment service providers (‘PSPs’) increasing their strategic focus on B2B payments. Figure 1 highlights select B2B payments-related activity from these merchant acquirers and PSPs. Overarching themes of such investments include:

- Robust ERP and B2B vertical SaaS/platform integrations to embed payments within business management and other critical SaaS solutions.

- Acquisitions and/or partnerships with AP/AR automation providers to become a “one-stop-shop” for B2B payments.

- Expansion and monetization of non-card payment acceptance products like ACH, ACH+ (ACH transactions with enhanced remittance data and/or payment terms), and real-time payments.

- Expansion into other embedded finance and value-added services such as spend management and B2B lending.

As an AP/AR automation and short-term financing solution, Plastiq’s merchant value proposition marries well with several of the aforementioned investment themes. Its untimely demise proved to be an opportunity for Priority Technology Holdings (‘Priority’) to further invest in its own B2B payments strategy. We describe this investment story in more detail in the following sections.

Plastiq Background

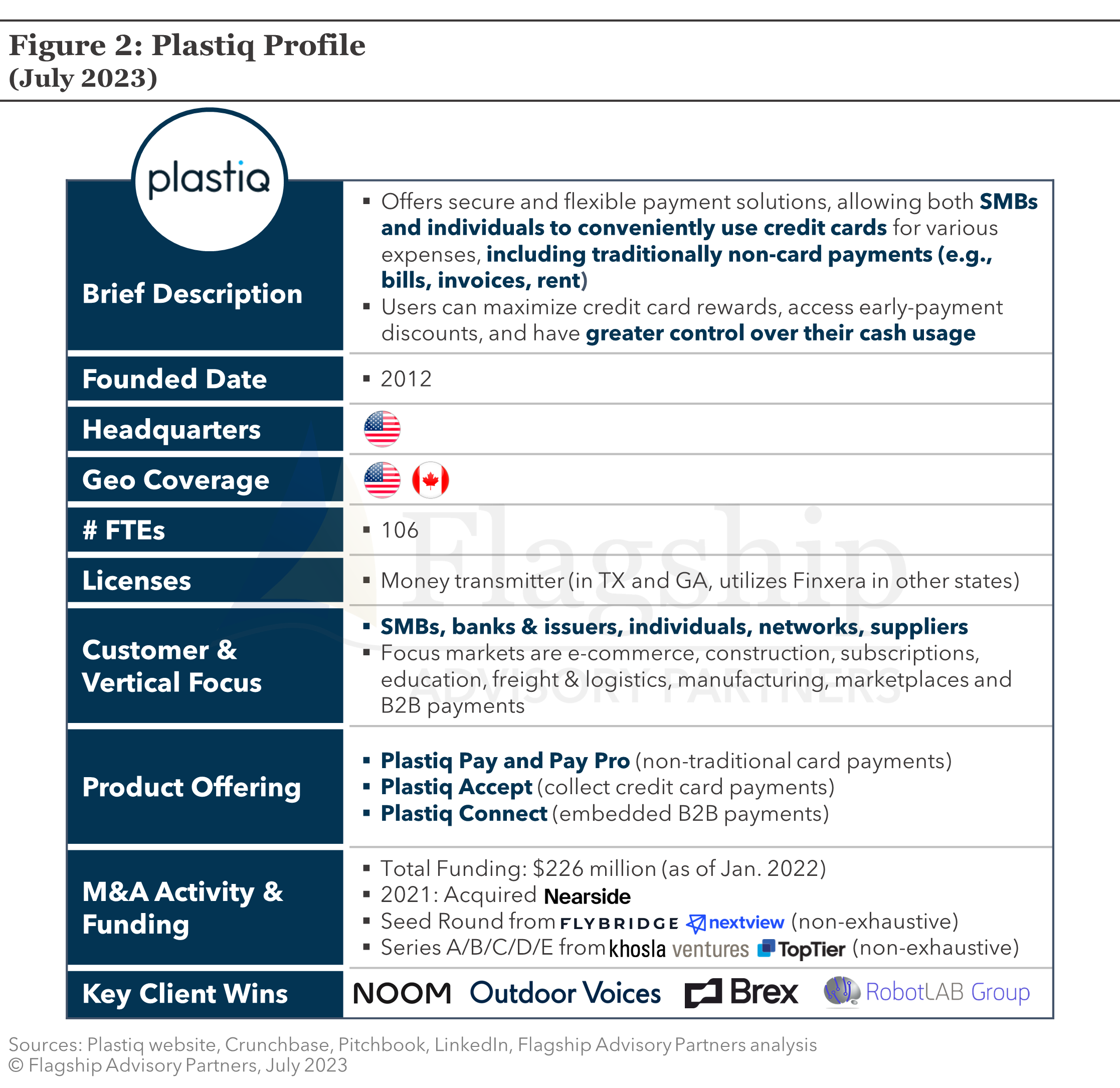

Founded in 2012, Plastiq is a buyer-driven AP/AR automation platform for SMBs that offers card, account-to-account (including check, ACH, and wire) payments, and short-term financing. In Figure 2, we profile Plastiq including its geographic coverage, product offerings, customer segmentation, and funding rounds.

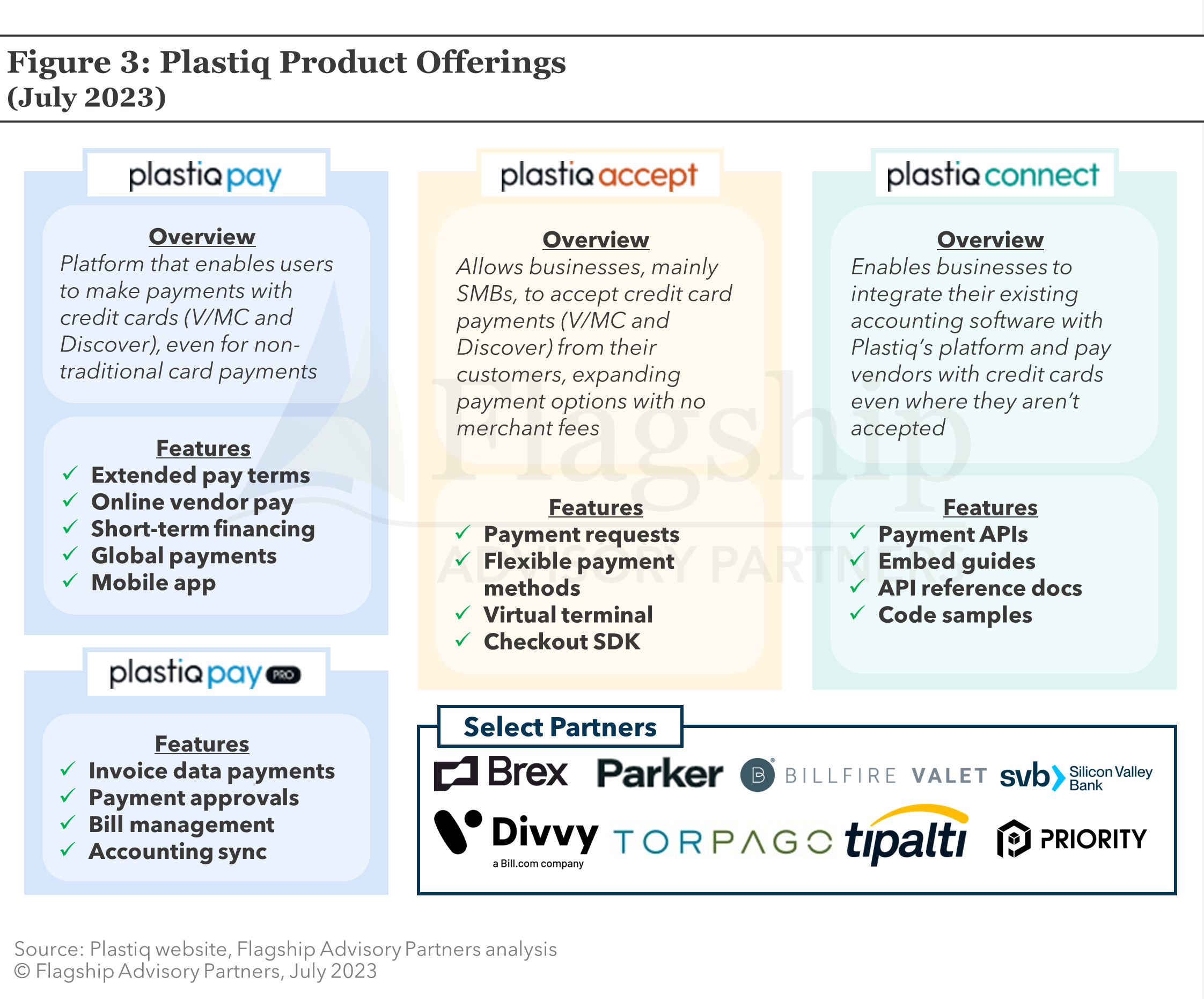

Plastiq’s flagship product, Plastiq Pay, allows businesses to pay suppliers with virtual/commercial cards, even if the supplier does not accept credit cards themselves. This process, also referred to as “buyer-initiated payments” (‘BIP’), deposits payments directly into a supplier’s bank account while charging the buyer a fee of up to 2.9% for using the card. In exchange, buyers extend the amount of time they have to pay (also known as days payable outstanding or ‘DPO’), get access to short-term financing, and utilize the payment controls embedded within many of today’s commercial/virtual card programs.

Plastiq Pay is not a substitute for buyers looking to use card payments at card-accepting suppliers (where the buyer does not need to pay the 2.9% fee), but rather at non-card-accepting suppliers where the flexible payment terms and controls of commercial cards offset the cost of capital and potentially offer better short-term financing options than traditional SMB loans.Other product groups include Plastiq Accept (an SMB supplier payment acceptance solution) and Plastiq Connect (an embedded AP/AR solution for B2B SaaS/platforms). In Figure 3, we further illustrate Plastiq’s product offerings and corporate card issuing and processing partner network.

Plastiq Financial Performance & Bankruptcy

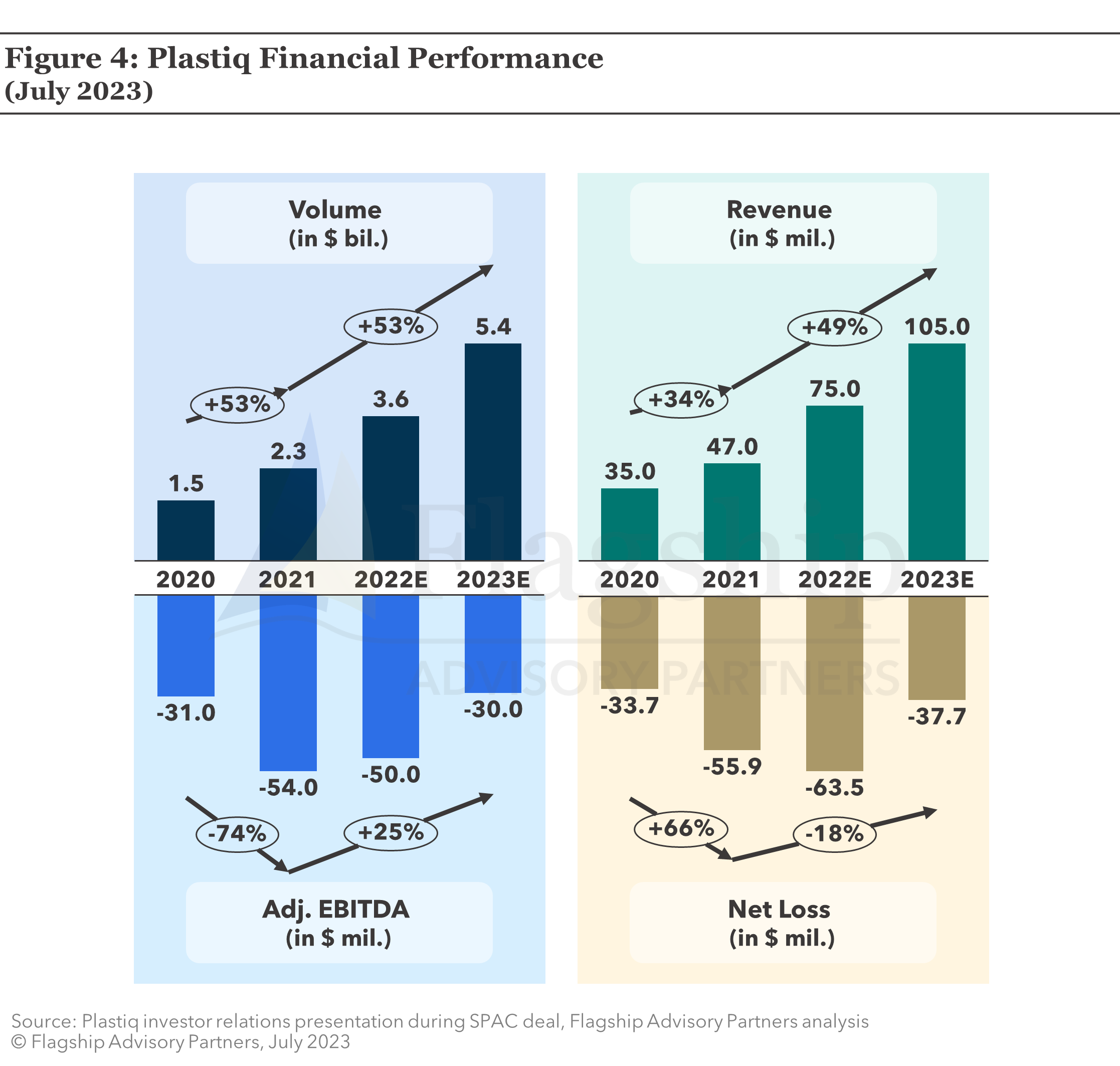

According to Pitchbook, Plastiq raised over $220 million from investors since 2012 and was last valued at $480 million in August 2022, well below its peak valuation of $940 million in January 2022, due in large part to overall fintech valuation compression. While Plastiq presented impressive revenue growth and expectations in its August 2022 Investor Relations report, it also presented increasing net losses (see Figure 4 below).

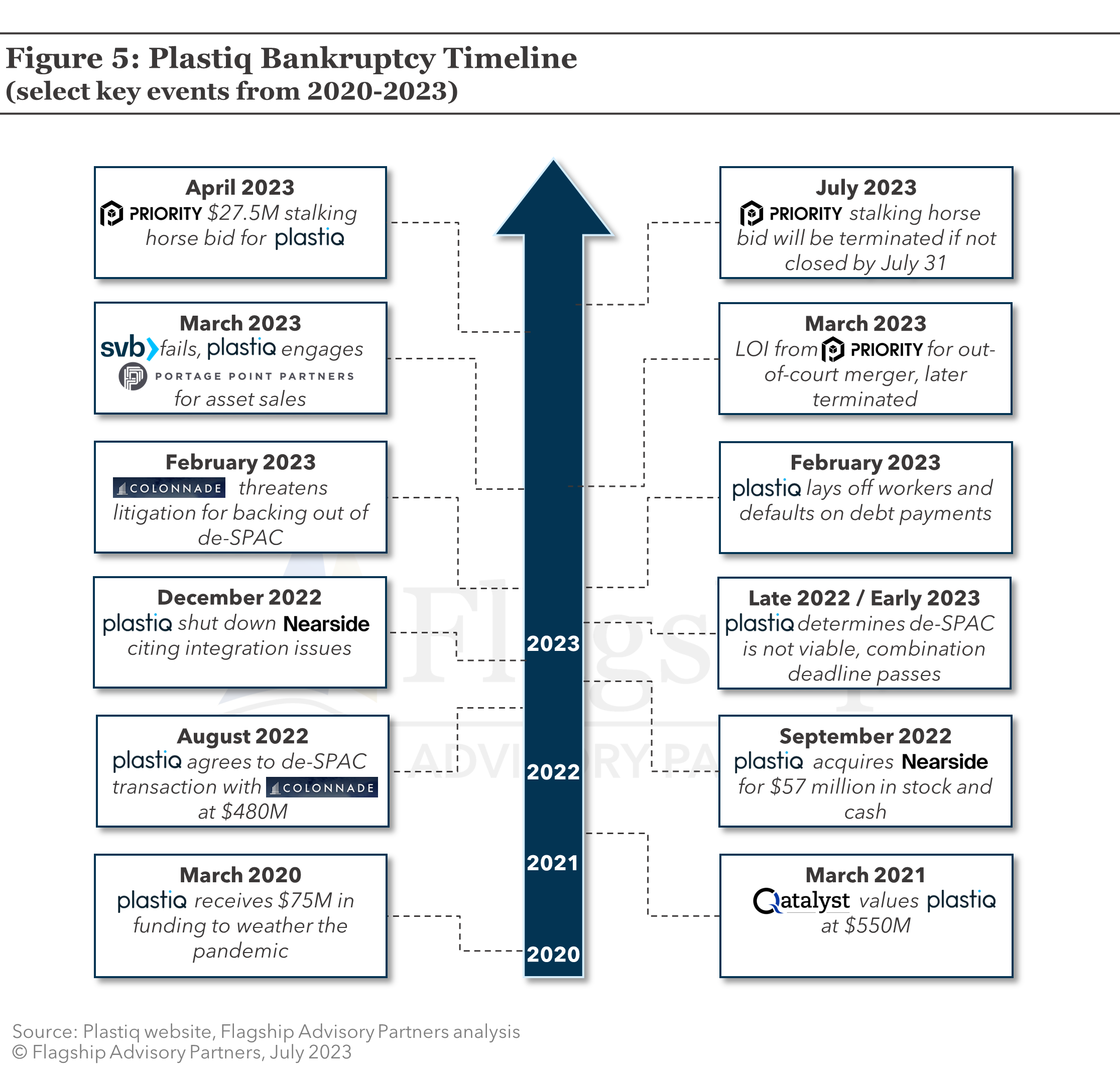

Plastiq’s 2023 ambitions for margin and EBITDA expansion were cut short after its Chapter 11 bankruptcy filing on May 24, 2023. While Plastiq’s fundamental business value proposition is strong, three liquidity-related factors stand out when explaining what led to the business’s demise:

- Plastiq’s failed de-SPAC with Colonnade Acquisition Corp. II: Colonnade attempted to merge with Plastiq to take the firm public in August 2022 at a $480 million valuation. At the time of the agreement, Plastiq expected to add more than $300 million to its balance sheet. While the reasons for the deal falling through were not publicly disclosed, we can speculate that overall economic headwinds related to fintech investment created deal pressure. The lack of additional liquidity and post-failure litigation between Colonnade and Plastiq strained the company’s financial health.

- Plastiq’s $57 million stock and cash acquisition of Nearside failed: Nearside, an SMB banking and lending fintech, was acquired by Plastiq in September 2022 and, according to Plastiq’s management, was shut down 3 months later after failing to cross-sell its technology and products into Plastiq’s customer base. Expenses related to the acquisition, integration, and unwinding of Nearside’s business put even more pressure on Plastiq’s capital position.

- Plastiq was one of the many Silicon Valley Bank (‘SVB’) fintech casualties: SVB served as Plastiq’s primary BIN sponsor, payment processor, and treasury disbursement partner. Upon collapse, Plastiq was forced to halt operations and scramble to find a new banking and payments partner, creating liquidity strains from lost customers and revenues linked to the collapse.

Priority Potential Acquisition & B2B Payments Strategy

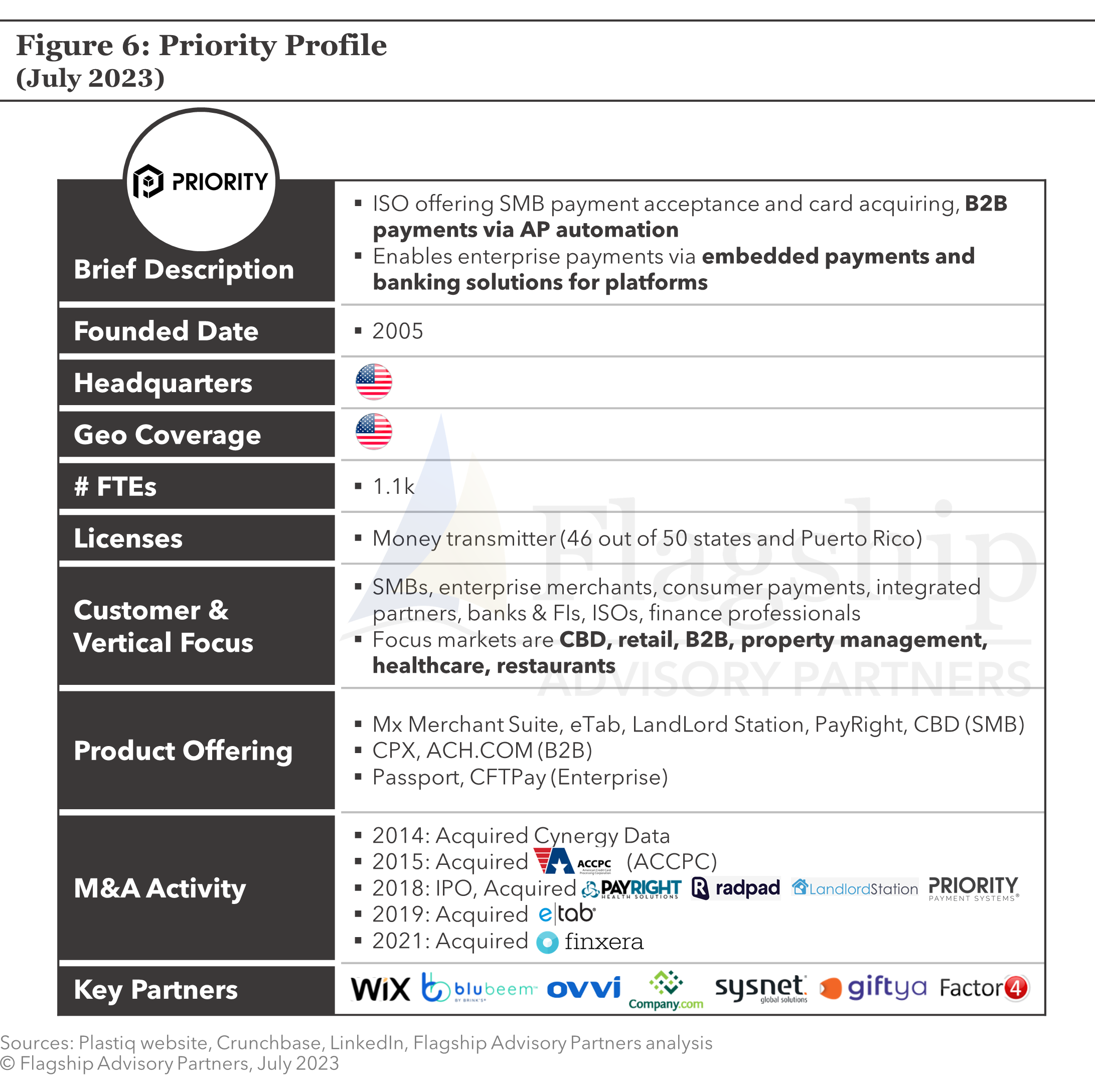

Priority is a publicly traded U.S. payments technology company operating three business segments: (i) SMB payment acceptance and card acquiring, (ii) B2B payments via AP automation, and (iii) Enterprise payments via embedded payments and banking solutions for platforms. In Figure 6, we profile Priority including its geographic coverage, product offerings, customer segmentation, and recent M&A activity.

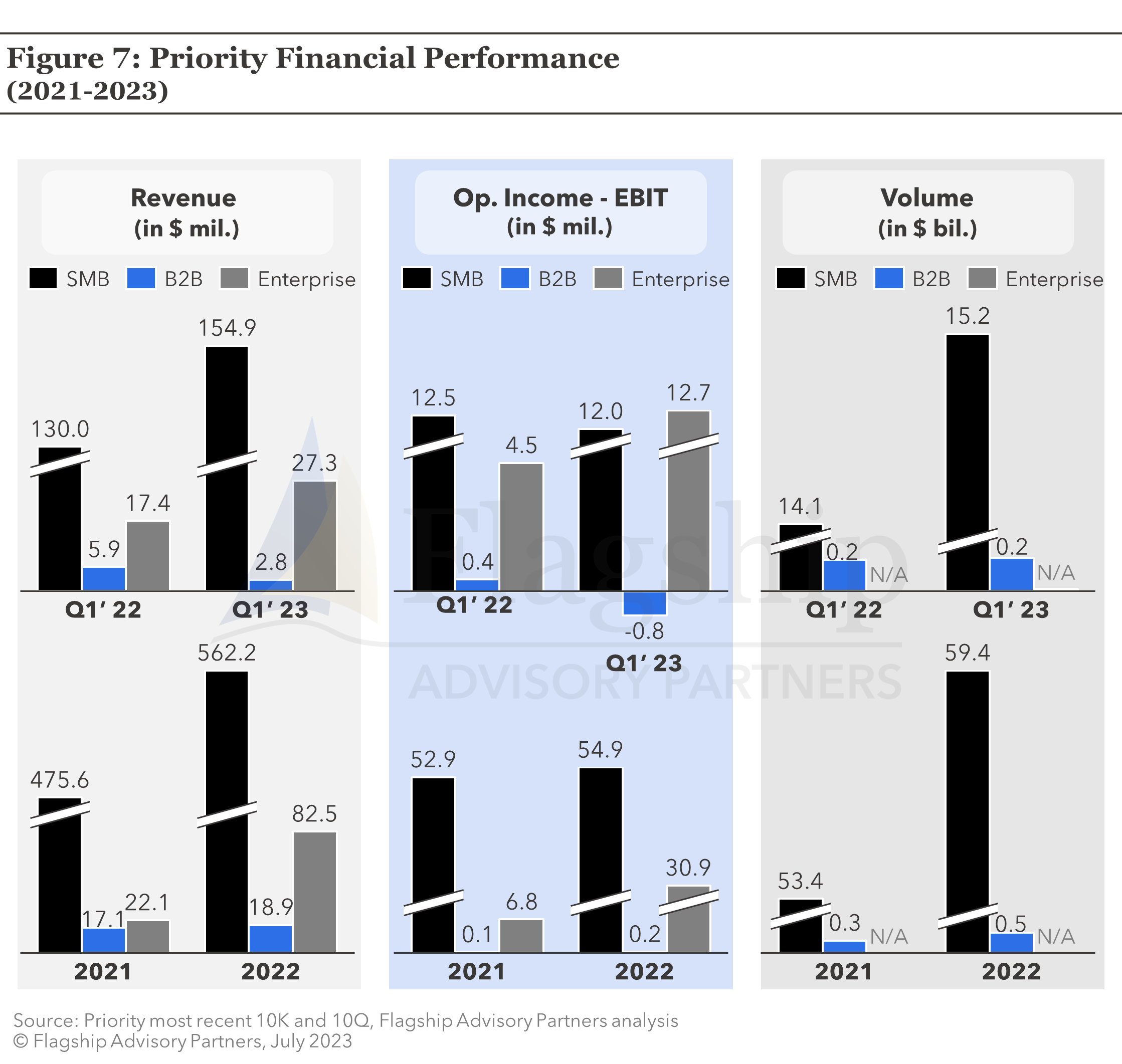

Priority’s roots (founded in 2005) are in payment acceptance and merchant acquiring, where the business has scaled into the fifth largest non-bank merchant acquirer in the U.S. by volume. In Figure 7, we highlight Priority’s most recent 10-K and 10-Q financial performance by business segment. Priority’s B2B segment (c.2% of Priority’s Q1’23 Revenue) provides AP automation services to merchants and financial institutions through its CPX platform, offering a bridge for buyer-to-supplier payments by integrating directly to a buyer's payment instruction/procurement solutions and moving money to suppliers via virtual card, purchase card, ACH/ACH+, dynamic discounting, or check.

According to Priority’s public filings and management commentary, the B2B segment is core to diversifying the company’s sources of revenue. However, Priority has not yet scaled its B2B payments segment (at least on the buyer/AP automation side of payments) relative to its SMB payment acceptance and merchant acquiring business. Plastiq’s buyer-driven AP/AR automation platform adds scale and product features such as buyer-initiated payments capabilities to Priority’s AP automation platform (CPX) and the overall B2B segment.

Referring back to our observed investment themes introduced at the beginning of the article, Priority’s potential acquisition of Plastiq further positions itself as a “one-stop-shop” for B2B payments (offering AR and AP automation) while expanding its products into other embedded finance and value-added services such as short-term financing/B2B lending via Plastiq’s platform.

Future Outlook

The Plastiq story illustrates several themes for investors targeting payments and fintech:

- B2B investment is defining the next wave of activity among U.S. merchant acquirers, PSPs, and financial investors. We further describe the value of B2B payments in a recent article here.

- For B2B payments, the flow of payments data and control of capital is just as important as the underlying payments form factor (card, ACH, check, etc.). Solutions like Plastiq demonstrate that the cost of payment acceptance (typically borne by the supplier) can be shared or completely paid by buyers if value is created (e.g., buyer extends payment terms, buyer accesses incremental line of credit, both parties access additional remittance data, supplier receives early payment and settlement, etc.).

- Future winners in B2B payments will offer a comprehensive, software-enabled AP/AR solution set alongside payment acceptance and other value-added B2B services (e.g., card issuing, spend management, supply chain financing, payroll, treasury management, etc.).

- Controlling costs and having a prudent mindset for organic and inorganic investment is critically important. High capital burn rates can destroy even the most fundamentally sound business plans and value propositions.

- M&A, especially for growth-stage fintechs, is a double-edged sword. Mis-evaluating acquisition targets can create an operational and financial pitfall that distracts from the company’s core value proposition. It is important for fintechs to get their core product right before expanding into other product adjacencies.

Meanwhile, Plastiq’s failure is just one of the latest examples of fintech companies struggling out of the most recent economic downturn. Fintech financial struggles reinforce an attractive environment for strategic buyers, including merchant acquirers and PSPs seeking to acquire strong products and services at reasonable valuations.

Separately, for financial investors, the market for bolt-on assets for core portfolio companies is as attractive as ever, as well as opportunities to make inroads into new B2B-payments-related domains to execute go-to-market improvement.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com with comments or questions.