Brazil has evolved from a cash-centric society to one of the most dynamic digital payments markets in the world and a clear bellwether for fintech in the Latin American region. Digitization of Brazilian commerce, payments, and banking accelerated during the pandemic coupled with the government’s efforts to drive financial inclusion. The magnitude of the Brazilian economy and population, paired with the rapid evolution of its payments industry, makes Brazil one of the most attractive payments marketplaces in the world for payment service providers. However, success in the intensely competitive Brazilian payments market requires cutting-edge innovation and deep localization to compete with capable local vendors.

High Growth in Electronic Payments

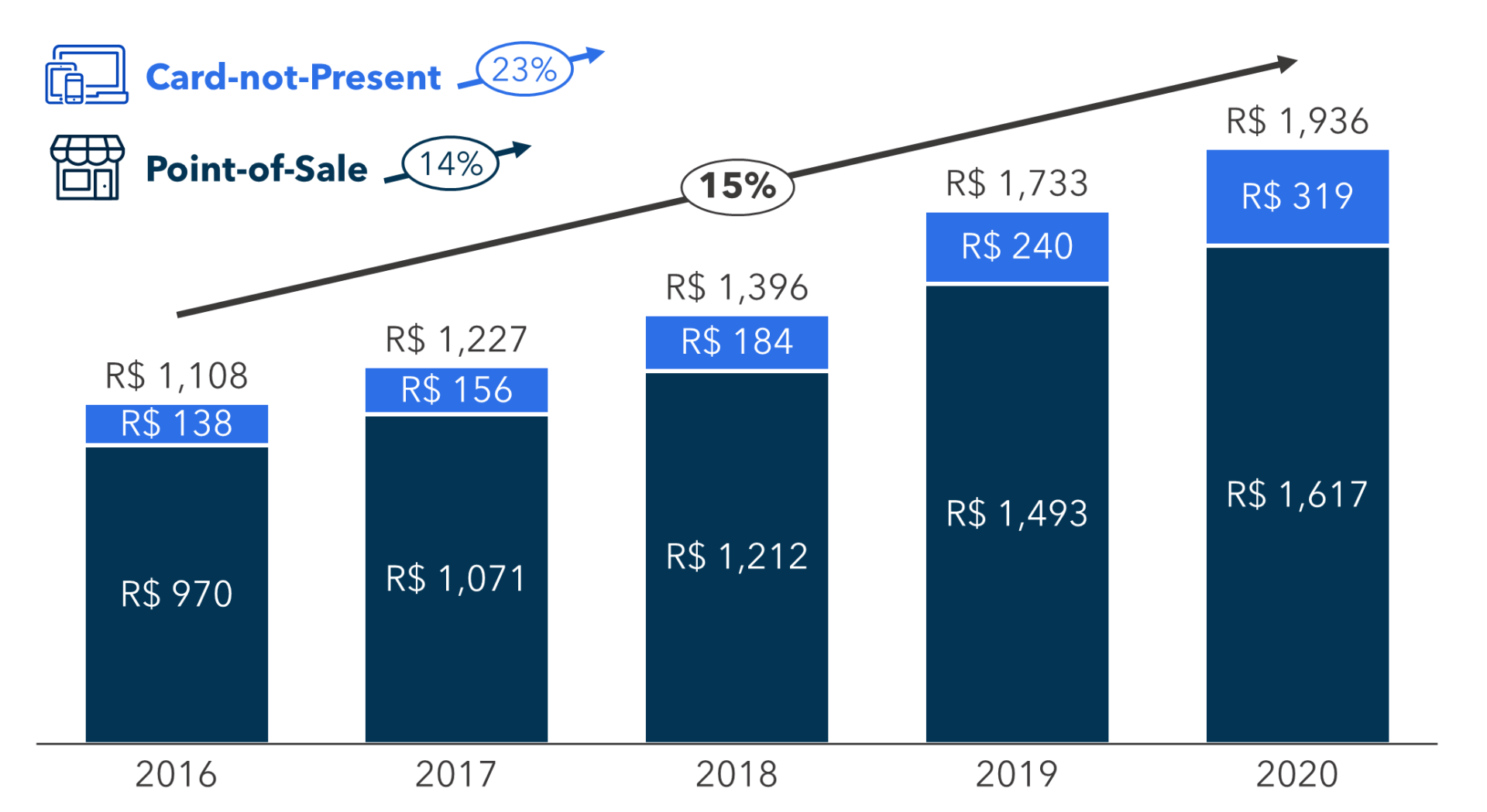

Brazil is a high growth payments market. From 2016 to 2020, card payments at POS grew at 14% while card-not-present volumes grew at 23% (see Figure 1). The value of payments via cards has already surpassed cash and is on pace to reach ~2x cash payments by 2025.

FIGURE 1: Card Payments in Brazil ($R trillions)

Sources: Central Bank of Brazil, ABECS (Brazilian Association of Credit Card Companies and Services)

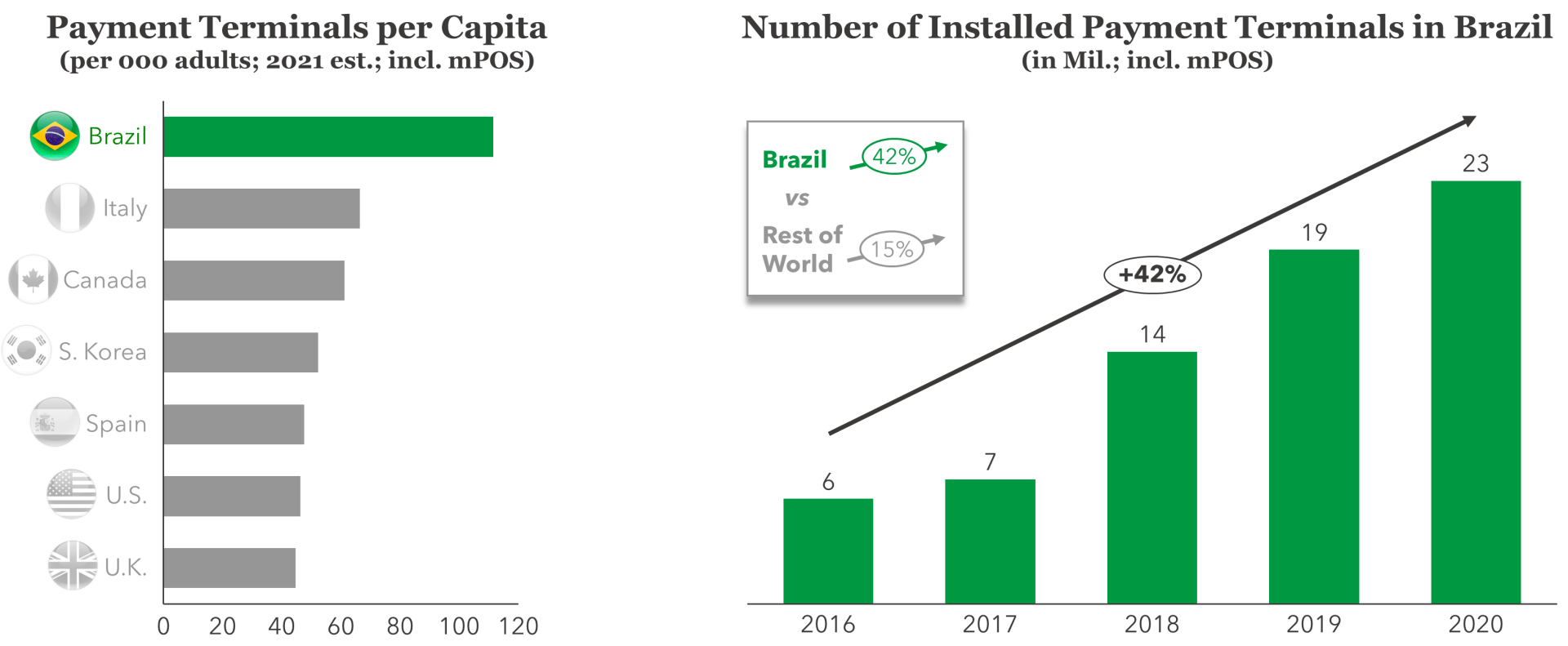

Brazil is the most terminalized market in the world, as measured by per-capita penetration. As shown in Figure 2, Brazil has more than 1 terminal for every 10 people, which is more than double the terminalization rate seen in mature cards markets such as the U.S. and U.K. One reason for this leading global terminalization rate is the incredible success of mPOS in Brazil. Almost half of the terminal installed base in Brazil are mPOS devices, which are low cost and well-suited for micro-merchants and rural environments. The card terminal installed base in Brazil grew an impressive 42% from 2016 to 2020, compared to global growth of 15%.

FIGURE 2: POS Terminal Statistics

Source: Central Bank of Brazil, Flagship estimates

Both consumers and the long tail of merchants are rapidly migrating to digital payments. Consumers have long favored credit cards in Brazil due to their enablement of installments. Merchants in turn must also support installments. This, along with the deep penetration of mPOS, results in broad acceptance of cards, even among micro-merchants. The pandemic has driven digital payments further into the under-banked population (who do not have credit cards). According to the survey carried out by the National Bank of Brazil, over 36% of Brazilians stated that they opened some form of a digital bank account during the pandemic. To access ‘coronavoucher’ aid program in Brazil, low-income members of the society had to open a digital bank account with an attached virtual debit card. The acceleration of financial inclusion post the pandemic in Brazil is expected spur a new wave of digital payments adoption among traditional cash users.

Shifting Payment Behaviors and Payment Schemes

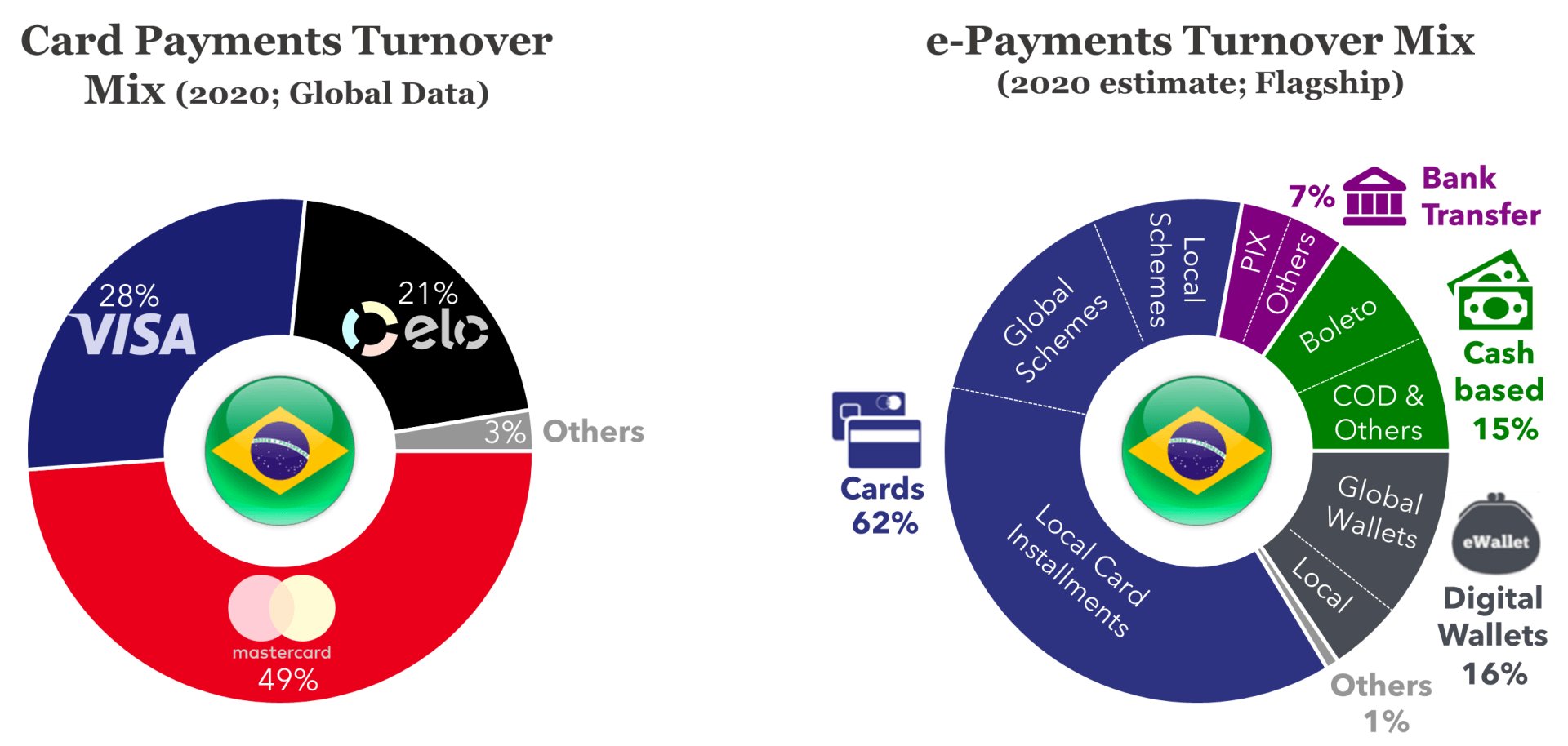

The landscape of Brazilian payments is a complex network of both local and global payment methods, which is constantly changing. Local debit card scheme Elo has 21% of the cards market and shows no signs of losing share to international schemes (see Figure 2). Installment payments via cards are ingrained in the Brazilian consumer payments culture. Brazil has several local digital wallets as well as a paper-based local scheme, Boleto, that is still popular among older online consumers (see Figure 3).

FIGURE 3: Payments Mix

Source: Global Data (2020 est.), Flagship Advisory Partners (2021 est.)

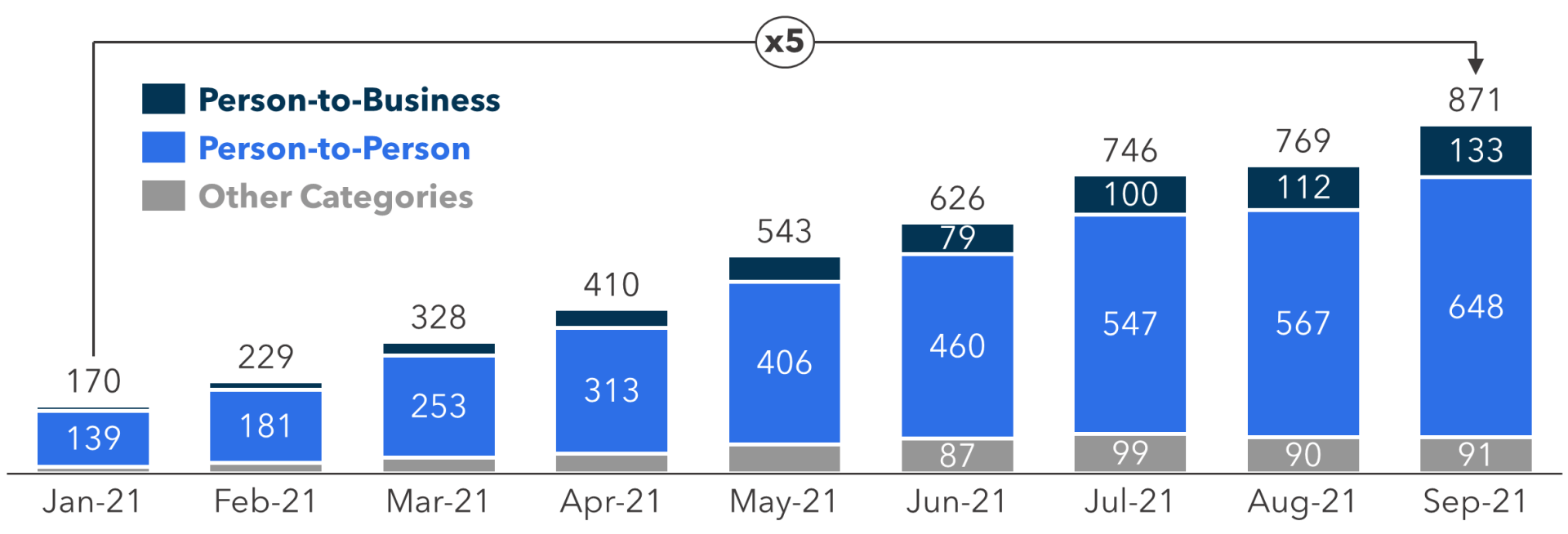

In parallel with the roll-out of open banking and a push for financial inclusion, recently launched real-time bank transfer payment scheme PIX is the new face of Brazilian payments. PIX offers merchants lower processing costs than cards, and is free for end customers. Heavily promoted by the Central Bank of Brazil, adoption of PIX is rapidly growing for both person-to-person transfers and person-to-business payments and has gained early traction (see Figure 4) by actively displacing cash and the legacy Boleto payments scheme. PIX could disrupt aspects of the traditionally lucrative cards market, while continuing to stimulate high growth in the total base of digital payments. The plethora of local payment methods means that merchant payment service providers must be highly localized to succeed.

FIGURE 4: PIX Payments in Brazil (millions of transactions)

Source: Central Bank of Brazil

Intensifying Competition Among Payment Acceptance Providers

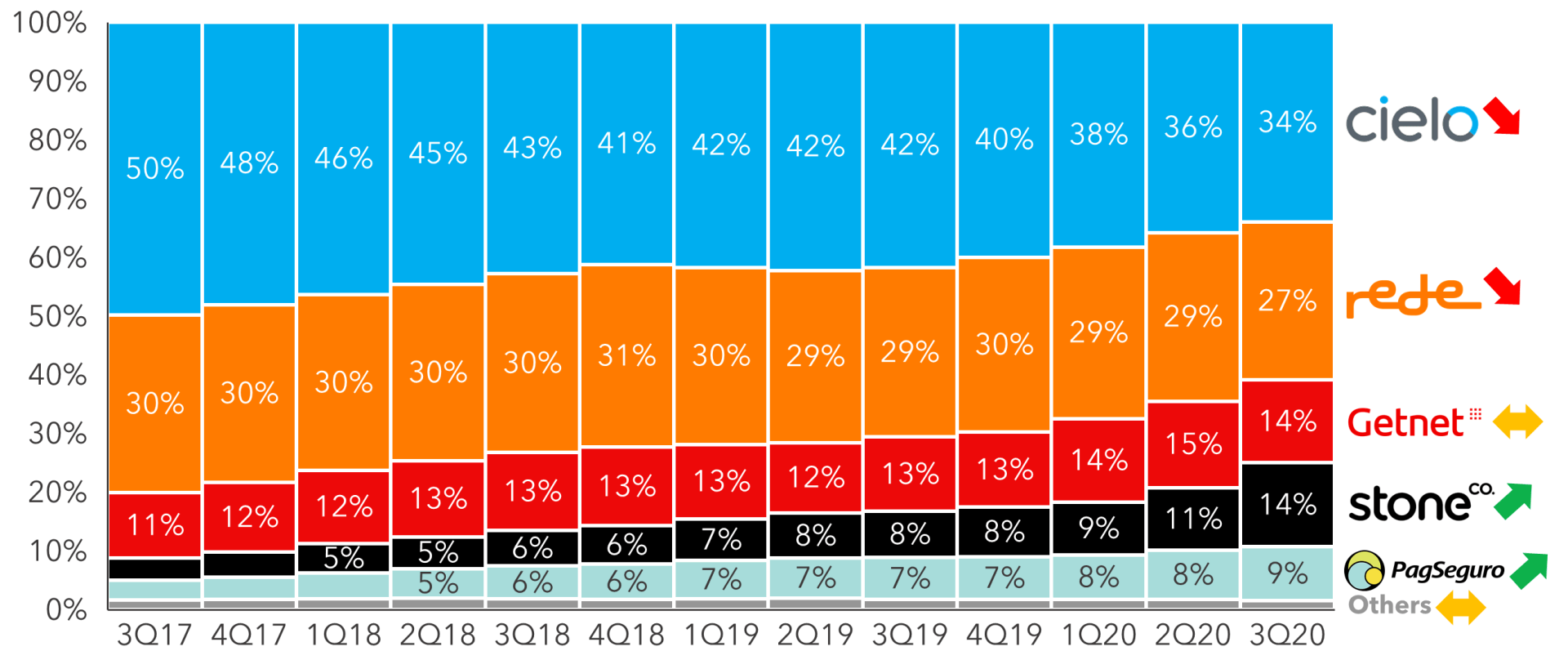

The Brazilian market for merchant payment services is intensely competitive. Traditional market leaders Cielo and Rede have lost market share as a result of fintech innovators better positioning for small merchants and digital commerce (see Figure 5). Fintechs including Stone and PagSeguro initially gained traction in the small merchant segment with inexpensive and easy-to-use mPOS products and are now moving up market and thriving in e-commerce and SaaS-integrated payments.

FIGURE 5: Top Card Merchant Payment Providers (% card payment turnover)

Source: Company Quarterly Earnings, Cielo Management Presentations

Profitability in Brazilian merchant payments has traditionally been one of the highest in the world. However, ongoing price competition is eroding gross margins. Cielo’s and PagSeguro’s net revenue margins, for example, compressed at a consistent rate of ~15% per annum in the last five years. Past reductions in interchange by the Central Bank of Brazil did not offer much breathing room to these providers with most of the surplus revenue quickly passing through into lower merchant pricing. Providers such as Stone are not shy in applying aggressive pricing strategies to move up-market, and with competition from PIX as a new low-cost payment method, the pricing pressure faced by Brazilian payment acceptance providers is far from over.

To offset core payments price pressure, fintechs are increasingly expanding into broader digital banking services. Stone, dubbed by many as the “Square of Brazil”, offers a full suite of money management products to its small merchant segment, including digital bank accounts, cash advances, and insurance products. PagSeguro’s PagBank has ambitions to be the next digital banking leader and is attempting to become an Alipay-style super app with its own digital wallet, lending products, softPOS, and even payments via Tiktok.

Outlook on Brazilian Payments

Brazil is and will continue to be a high-growth market for digital payments. The already deep penetration of cards and card acceptance is now being augmented by acceleration of e/m-commerce. The next wave of growth and fintech innovators are digital commerce specialists such as d-local and Ebanx. Along with being a massive, lucrative, and innovative domestic market, Brazil also acts as a launching pad for global payment service providers keen to enter and expand across Latin America. Global providers such as Nuvei, Paysafe, Adyen, FIS, Global Payments, and others are investing to become more relevant across the region, although they face stiff competition from global-class Brazilian fintechs.

Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com with comments or questions