For the first time since its launch in 2008, Apple’s control over its App Store and its lucrative payment volumes, ~$72 billion in 2020, are under threat from regulatory interventions. Recent rulings have set the stage for developers to accept payments directly from users via “out-of-app” flows circumventing the 30% “Apple tax”. The App Store thrives on gaming transactions, accounting for ~75% of total revenue, and ~98% of in-app purchases with spending concentrated within a small number of large developers and the high-frequency customer segment. Changes to Apple’s in-app marketplace exclusivity rules expand the addressable market for PSPs that can best address out-of-app use cases. Within this article we describe the App Store model, explain recent events and market changes, size the new prize for PSPs, and explore the capabilities required to capture this newly addressable segment.

Apple App Store and In-app Payments (IAP) System

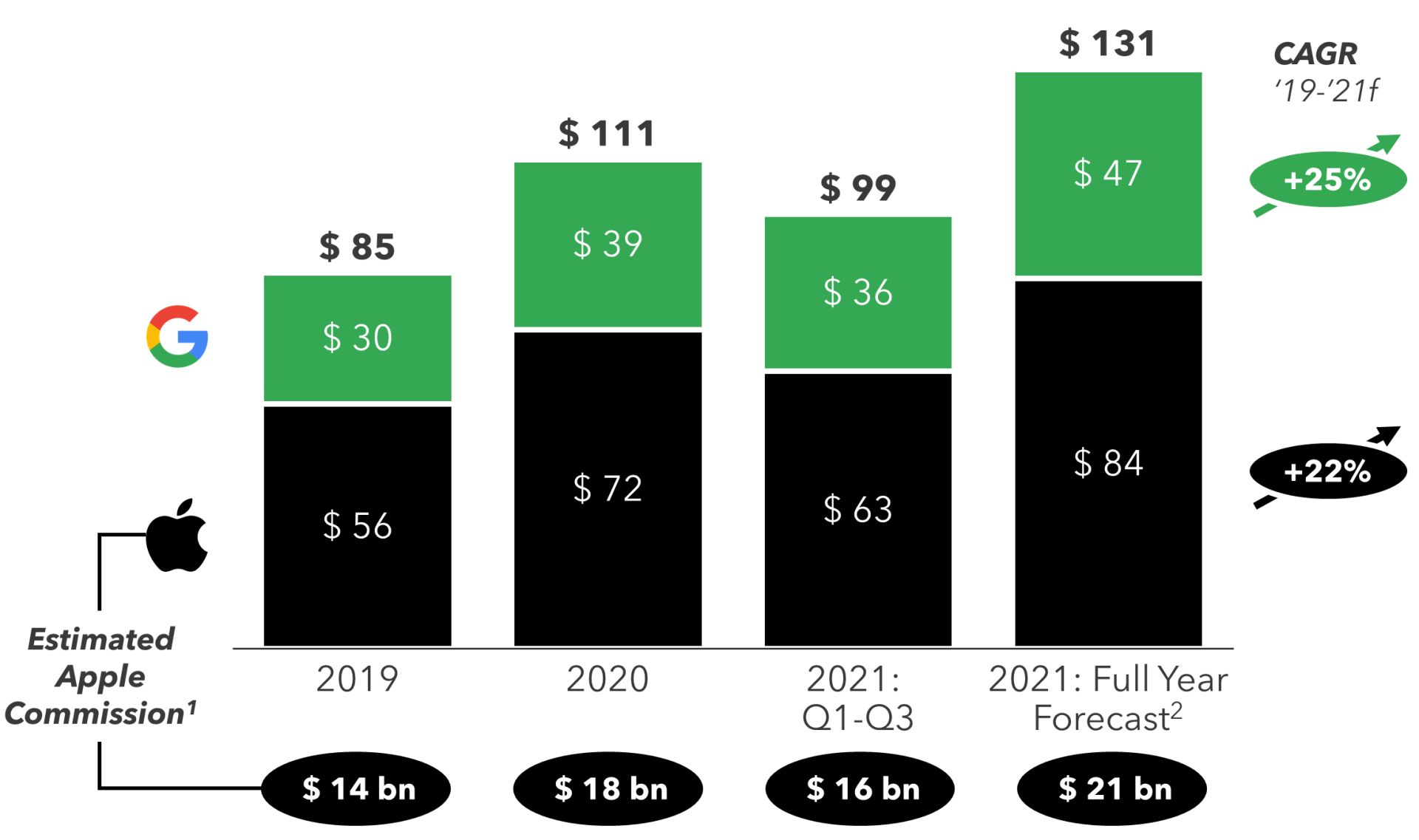

The App Store was revolutionary, kickstarting the post-PC era, spawning a prosperous app economy and fueling Apple’s meteoric growth. It is a symbiotic ecosystem for users to select from more than 2 million third-party apps and for developers to distribute to ~1 billion iPhone users globally. Figure 1 highlights the scale of its success with Apple collecting an estimated ~$18 billion in revenues in 2020 (~7% of overall revenues).

FIGURE 1: Global Consumer Spending in Mobile Apps & Games ($ billion)

Estimated spending on the App Store and Google Play between Jan. 1 and Sep. 30, 2021.

1Court disclosures put Apple’s average commission rate in 2019 at ~25%, due to the various discounts available.

22021 full year forecast based on extrapolation of year-to-date growth.

Source: Sensor Tower Store Intelligence, Flagship Advisory Partners analysis

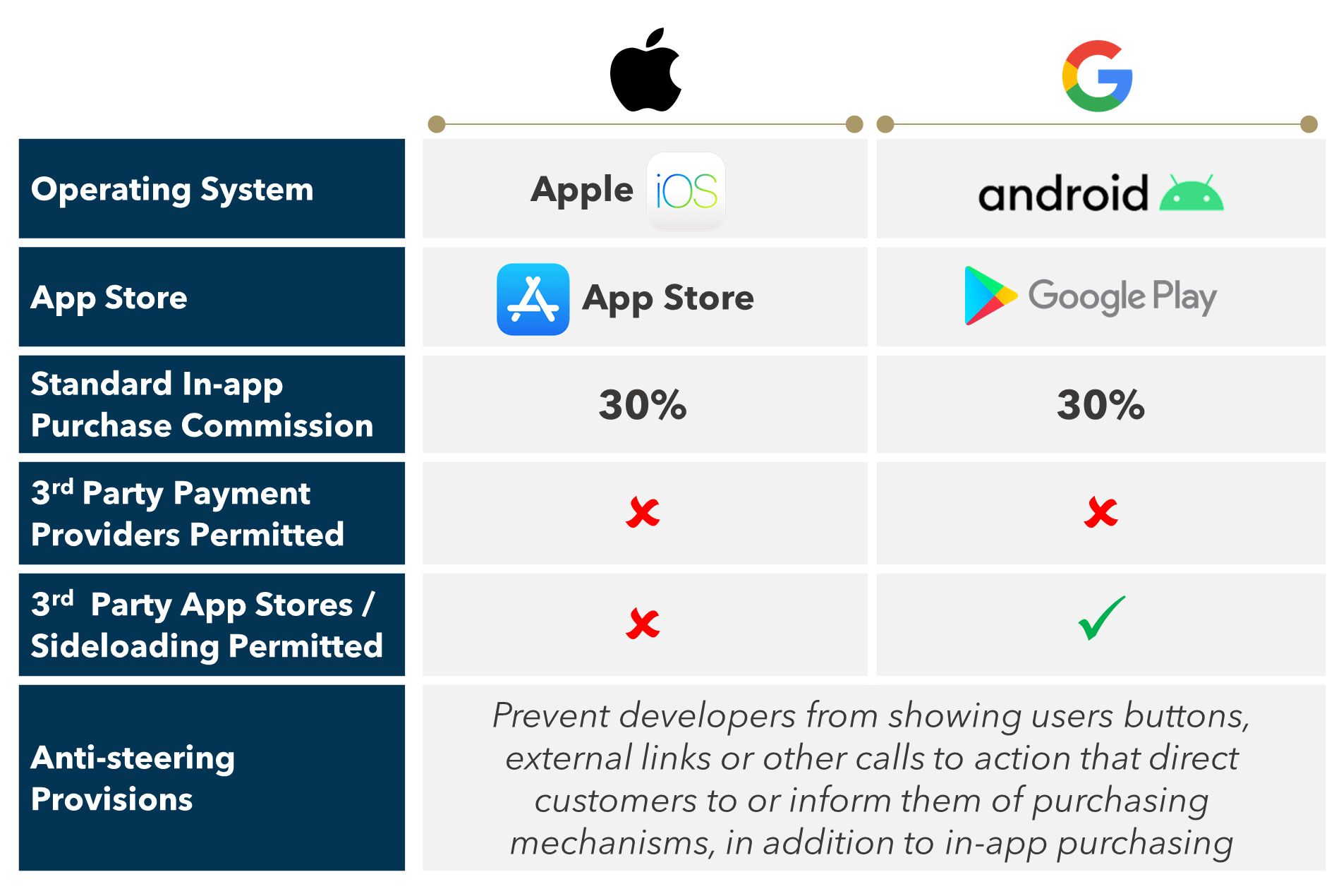

Much of its success is attributable to the "walled garden" model cultivated by Apple, a vice-like grip on rules and underlying infrastructure that preserve security and the user experience within the iOS ecosystem. Figure 2 highlights the rules that developers distributing via Apple or Google must abide by.

FIGURE 2: Apple & Google Rules

Source: Flagship market observations

In the App Store, all digital purchases, whether an initial download or an in-app purchase, must be processed by IAP, Apple’s "in-app purchasing" system which facilitates payments and manages transactions within its ecosystem. Apple collects all commissions via IAP and strictly enforces a range of provisions to ensure compliance, including an "anti-steering" rule prohibiting developers from directing users to third-party payment options.

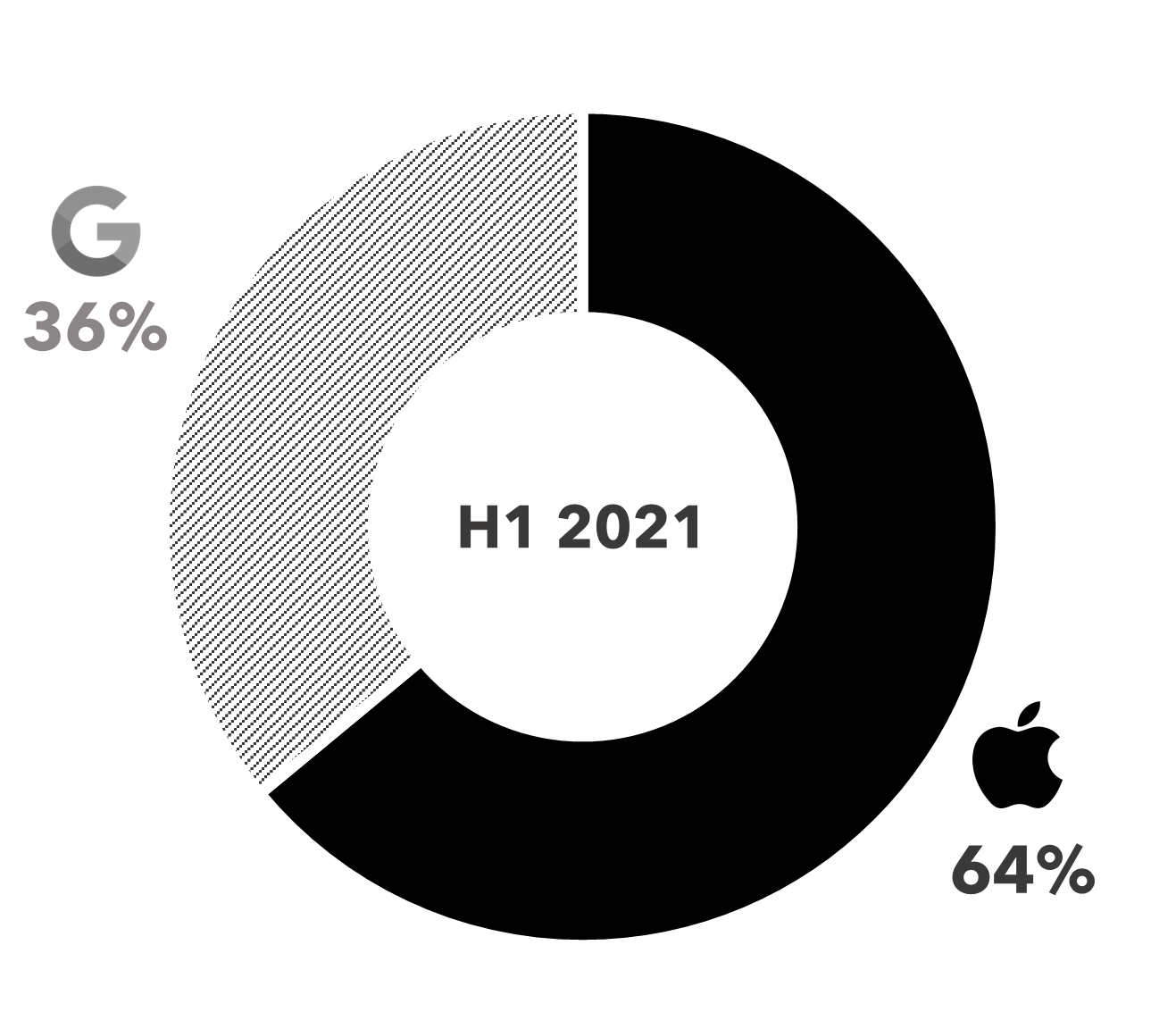

Google has similar rules but has generally been more lenient on steering or similar circumventions, although in recent years Google has begun to align more closely with Apple. Digital purchases made via the Play Store must use its billing system but unlike Apple it supports third-party app stores. The stakes are lower for Google as its business model is built on monetizing apps indirectly via advertising and its user base is less affluent than Apple’s (figure 3 below).

FIGURE 3: Apple vs. Google App Store Revenue Split

Source: Sensor Tower Store Intelligence

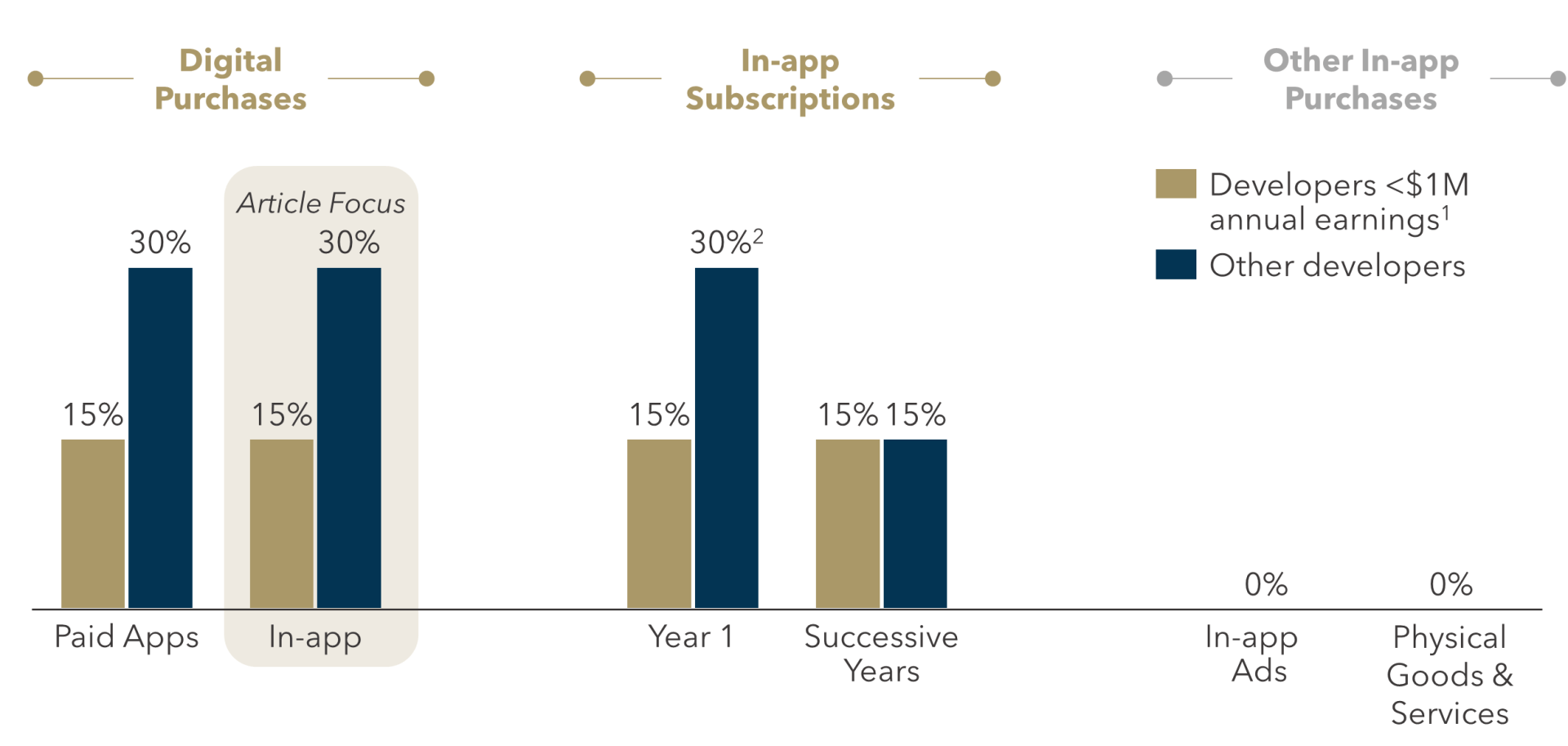

Apple levies a 30% (or 15% as shown in Figure 4) commission, known as the “Apple tax” on all digital purchases including subscriptions to music or dating apps and in-app purchases. Purchases which are not digitally confirmed, such as those related to physical goods and services, (e.g., Uber rides, Amazon orders) are not included. Apple only recently instituted exceptions with the Small Business Program reducing the commission for developers making less than $1 million dollars annually.

FIGURE 4: Apple App Store Commission Structure

1For developers participating in Apple’s “Small Business Program”

Source: Apple Store Guidelines (as of 28th of October 2021)

Developer Pushback & Regulatory Activity

Developers view the Apple tax as excessive and App Store rules as overly burdensome. The App Store is top heavy, ~1% of all developers generate 93% of all revenue, and a small number of large developers are disproportionately impacted. Digital content publishers with marginal costs are particularly affected, with several (including Spotify and Netflix) no longer offering subscriptions through the App Store.

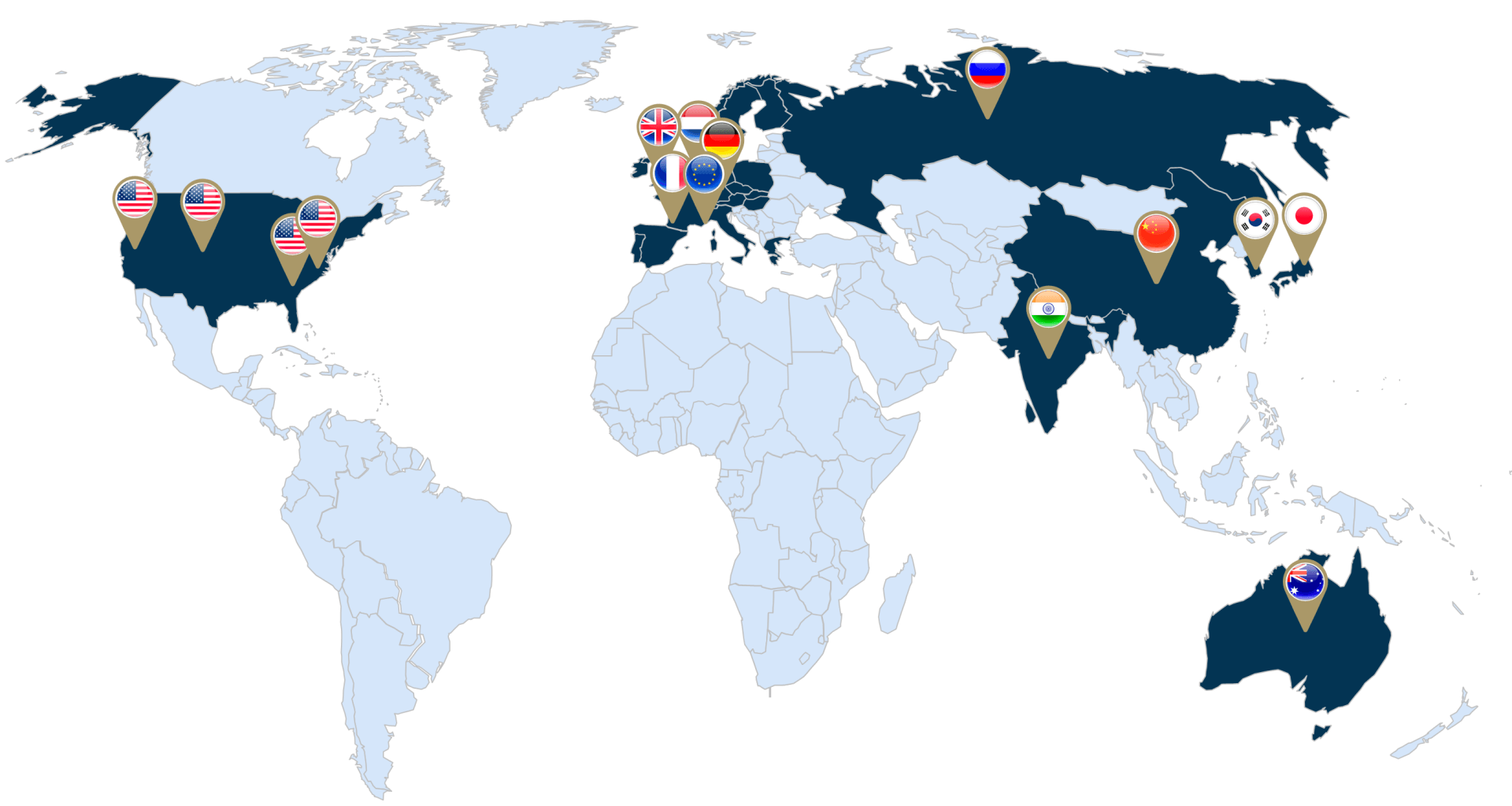

Major developers such as Epic Games, Match Group, and Tencent Holdings do not have the power to leave due to their reliance on in-app purchases. They have been crying foul over restrictive App Store practices culminating in a recent wave of cases challenging the legality of the App Store model on competition grounds. As intended, these high-profile cases have attracted regulatory scrutiny amidst a broader "BigTech" backlash. Figure 5 maps global legislation, court order and regulatory activity.

FIGURE 5: Regulatory Investigations into Apple App Store (in-flight and closed)

Source: Flagship market observations

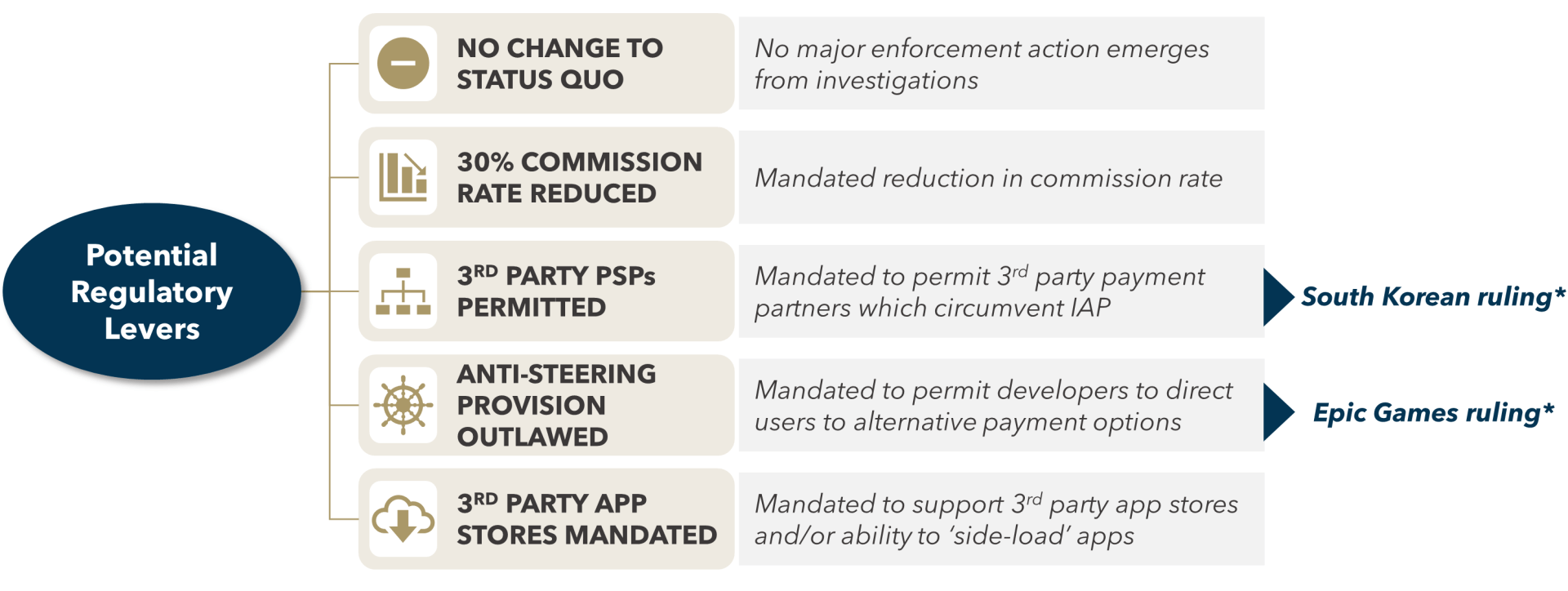

Figure 6 (below) outlines the potential spectrum of regulatory levers that could be used for ongoing regulation of the App Store.

FIGURE 6: Spectrum of Potential Regulatory Levers

*Verdict being appealed

Source: Flagship market observations

Disruption to Apple’s exclusive model can already be seen in recent outcomes, which have significant implications for the App Store. In Japan, Apple settled to allow reader apps (e.g., magazines, newspapers, books, music, etc.) to include an external payment link. The ruling was specific to the Japanese market, but Apple is applying it globally, highlighting the jurisdictional complexity of cases. In August, South Korea prohibited Google and Apple from forcing their payment system for all in-app purchases.

The recent "Epic Games vs. Apple" case highlights the impact that even seemingly small regulatory interventions can have. Epic, a multi-billion-dollar game publisher, vocally challenged Apple's App Store model since 2015. In 2020 it launched a payment system to collect in-app purchases directly from Fortnite users, circumventing IAP. Apple immediately removed Epic from the App Stores, prompting Epic to sue on antitrust grounds. “Epic Games vs. Apple” concluded in September 2021, with the court ruling in Apple's favor on nine out of ten counts. The court ruled against Apple on a single count relating to the "anti-steering" rule. The tech giant was ordered to let developers advertise alternative, cheaper payment methods outside the app store, representing the most significant change to the App Store since its launch. Apple has until December to implement the order but has appealed, with a hearing scheduled for mid-November.

Opportunities to circumvent the "Apple tax" and accept payments directly from consumers outside of Apple’s domain are becoming clear. Billions of dollars are at stake for app developers and their payments partners with the threat of further lawsuits against Apple already emboldening Facebook to trial payment flows which bypass IAP. In the next section, we examine the size and composition of the app-store purchases segment.

Value at Stake: App Store Revenues from Mobile Gaming

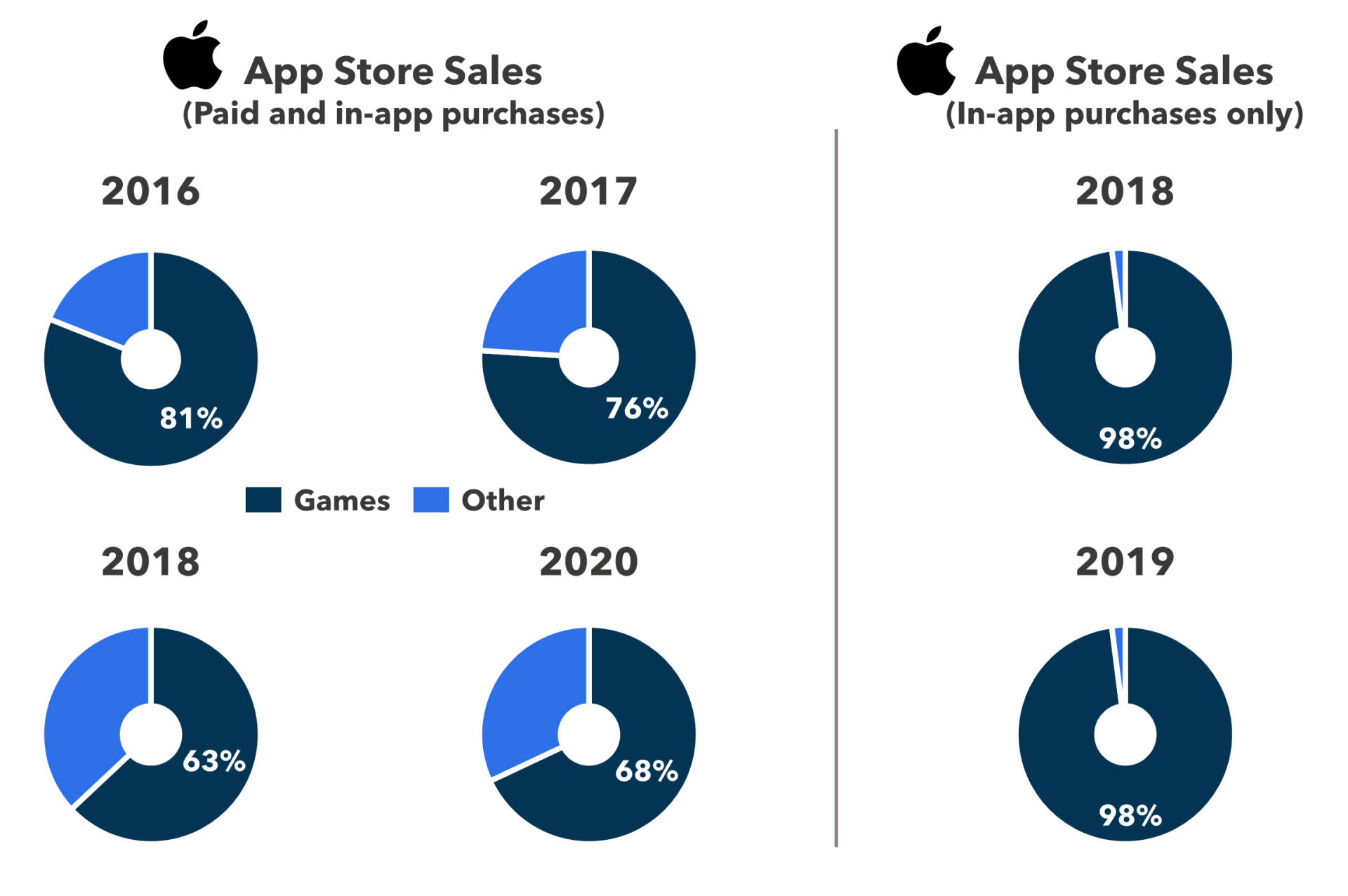

Data disclosed in the Epic Games case highlights that the App Store’s revenue foundation is gaming, accounting for ~75% of total revenue, and ~98% of in-app purchase revenue. Apple’s operating margins are extraordinarily high, estimated at ~75%. To put this in context Apple earned more profits from games in 2019 than Xbox Microsoft Corp., Nintendo Co., Activision Blizzard Inc., and Sony Corp combined.

FIGURE 7: App Store Sales

Source: Court documents, Apple, Flagship analysis

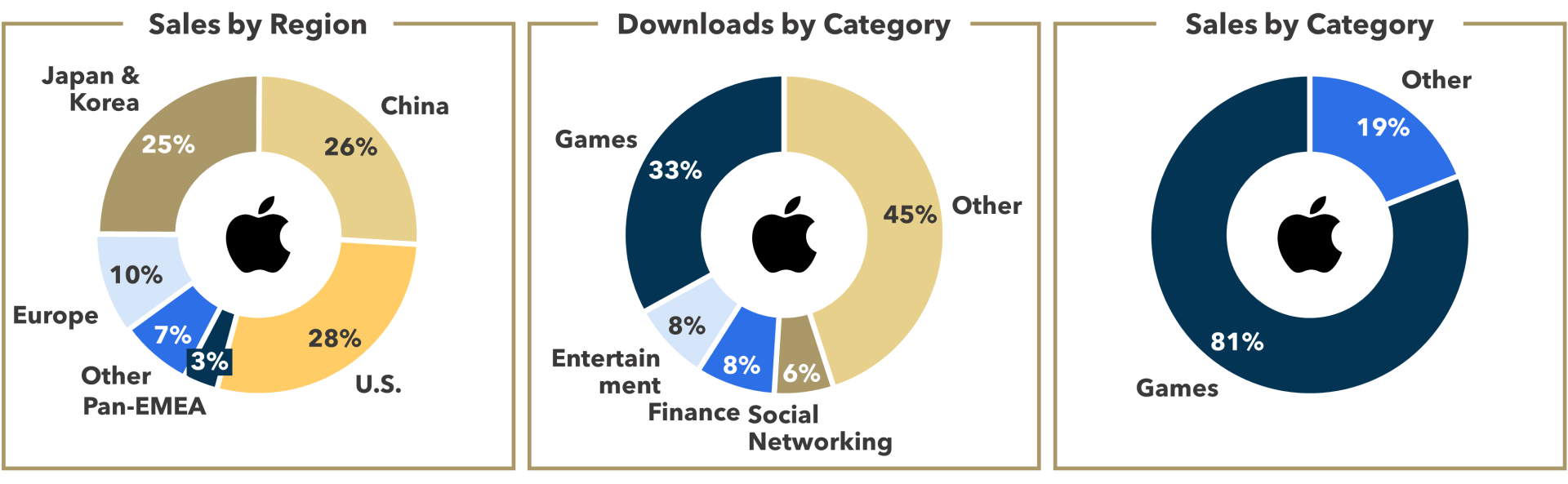

Figure 8 (below) provides a snapshot of App Store sales by region and category in 2016, which is unlikely to have changed significantly. Despite game apps only accounting for ~33% of all app downloads, they accounted for 81% of sales in that year.

FIGURE 8: App Store Sales

Source: Court documents, Apple, Flagship analysis

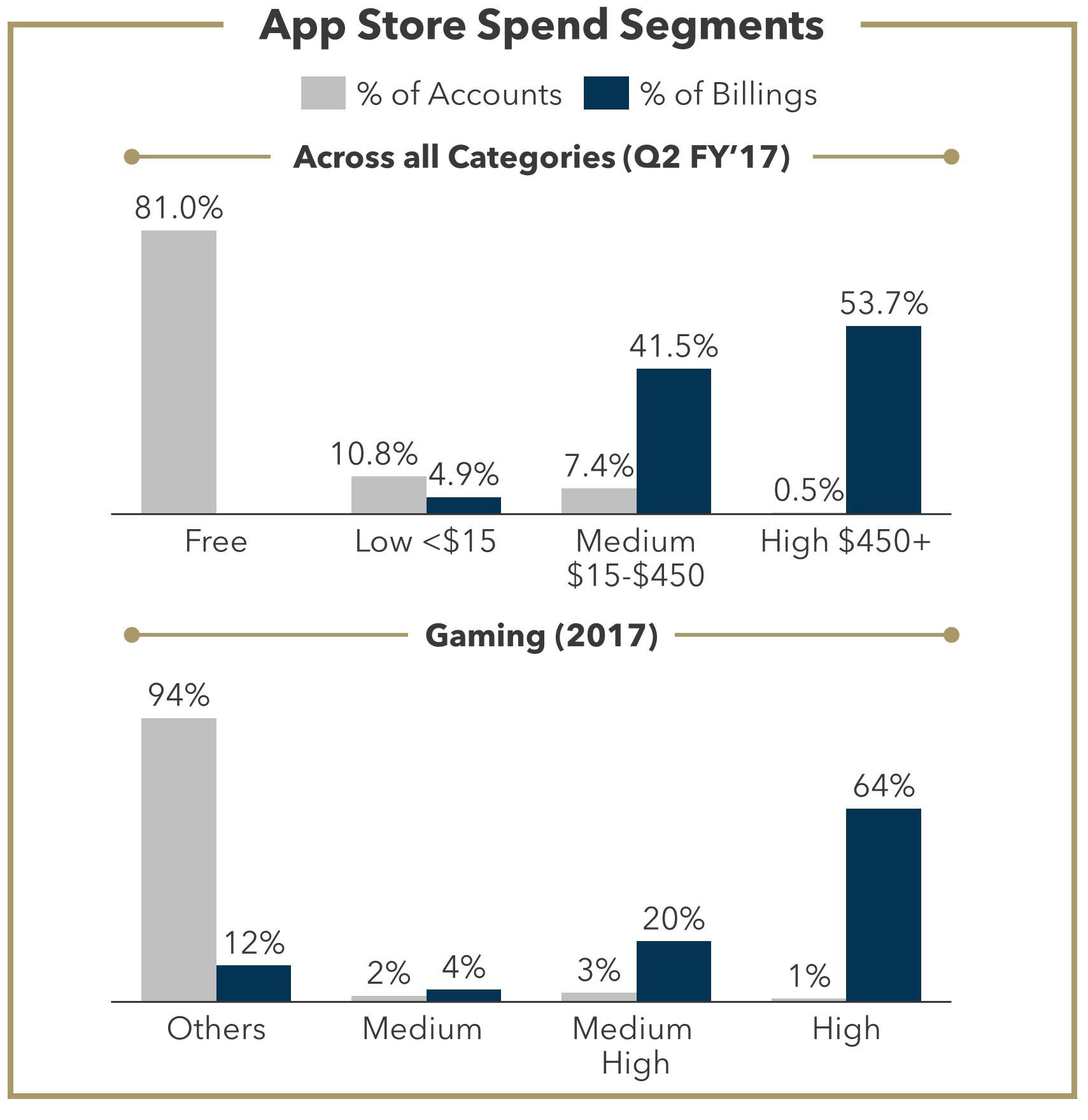

Consumer spend is heavily concentrated on the high-frequency segment. Figure 9 highlights that in Q2’17 high-spenders, accounting for 0.5% of all Apple accounts, generated 53.7% of all App Store sales. This trend is also visible in gaming. In 2017, just 6% of App Store game customers accounted for 88% of game sales for the year. High spenders, who made up 1% of Apple gamers, generated 64% of revenue and spent on average $2,694 annually.

FIGURE 9: App Store Spend Segments

Source: Court documents, Apple, Flagship analysis

Out-of-app Payment Flows

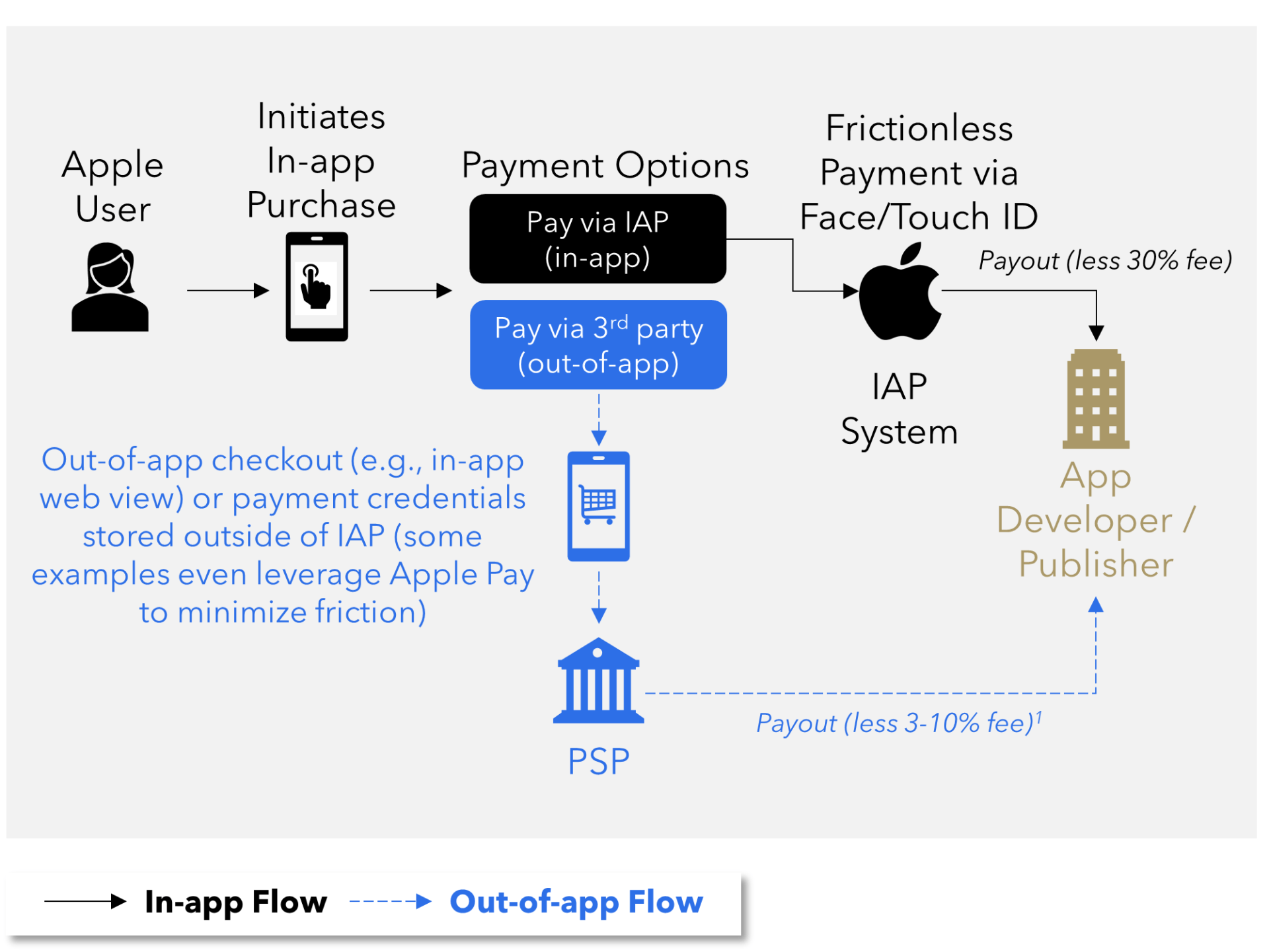

The expected prohibition of anti-steering gives rise to a new App Store payment flow we term “out-of-app”, visualized in figure 10. This flow will require redirects to web pages via links/buttons. An important question is how many users will switch given the extra clicks necessary to transact outside of IAP? Out-of-app top-ups are prevalent in mobile gaming in Southeast Asia (more concentrated on Google), where developers provide loyalty and value incentives for transaction via other platforms.

FIGURE 10: Out-of-app Payment Flow vs. IAP (illustrative)

1Flagship estimate. Exact fee will depend on market, vertical and payment method.

Source: Flagship market observations

Out-of-app payment flows give rise to clear winners and losers:

Winners

- PSPs: Most app store volume ($72 billion in 2020) will continue via IAP. However, a proportion is now addressable for PSPs particularly within the gaming industry where high spenders can be targeted.

- Developers / Publishers: Will benefit from reduced payments/marketplace expenses (Match Group has highlighted in recent guidance that any change to App Store rules would “represent material upside”.) Must, however, be mindful of the increased burden to deliver a safe and frictionless out-of-app payment experience.

- Emerging Business Models: Out-of-app flows will stimulate and encourage emerging business models which are not feasible with existing App Store rules including NFT marketplaces, top-up schemes, subscription models, advanced in-game economies, and the nascent metaverse offerings being developed by Epic and Facebook.

- Consumers: Could be rewarded with value-in-kind from developers when transacting out-of-app.

Losers

- Apple: Removal of the “anti-steering” rule will impact revenue and sets the stage for potentially broader regulatory interventions. IAP remains a powerful solution in terms of ease and experience but comes with a huge price premium to normal payment process economics.

- Consumers: IAP consumer experience is best-in-class. Deviations from the model have the potential to cause confusion or introduce risk.

- Small Developers: The app store model provided a level playing field for developers of all sizes. More prominent developers will be more successful in diverting consumers to out-of-app payments.

PSPs vs. Apple/IAP

We expect PSPs to rush to serve the expanded out-of-app segment. Paddle, for example, recently announced, an IAP alternative which offers cost savings, more flexible subscriptions, additional payment methods, and the choice of more billing models. PSPs potentially well positioned to benefit include digital commerce leaders such as Stripe, Adyen, Nuvei, PayPal, and gaming-focused PSPs with existing publisher relationships such as Xsolla, Paysafe, Coda Payments, UniPin, and Razer. Mobile gaming specialists such as Coda, UniPin and Razer already thrive with out-of-app mobile gaming payments across Southeast Asia.

The strength of the IAP system will remain the primary barrier to shifting users to new use cases. It provides a consistent and trusted payment experience, tailored for card-centric developed markets, and optimized for frictionless spending. Via a single integration Apple provides merchants with global acceptance, acting as merchant of record and handling operational complexity and localization (e.g., taxes, risk, chargebacks, etc.). However, IAP does have limitations related to non-card payment method support, maturity of fraud management, refund support, and subscription and pricing inflexibility.

In Summary

Regulatory disruption of Apple’s exclusive in-app payments model is underway, with an initial move to prohibit Apple’s anti-steering provisions (thus allowing out-of-app payments for digital goods and services). App developers will clearly benefit from lower-cost, out-of-app payments as will PSPs who have the capabilities to deliver flexible and frictionless out-of-app payments to large publishers and high-frequency gamers. Apple will retain payments volume given the natural convenience of IAP, but the success of out-of-app payments in Southeast Asia suggests massive potential to shift payment behaviors and volumes off of Apple.

Please do not hesitate to contact Dan Carr at Dan@FlagshipAP.com with comments or questions.