Designed by FreePik

Perspective on Key Events

Perspective on Key Events

Image Credit: Designed by FreePik

Peter Taylor and Salvatore LoBiondo • 20 February, 2024

General Commentary & Highlights

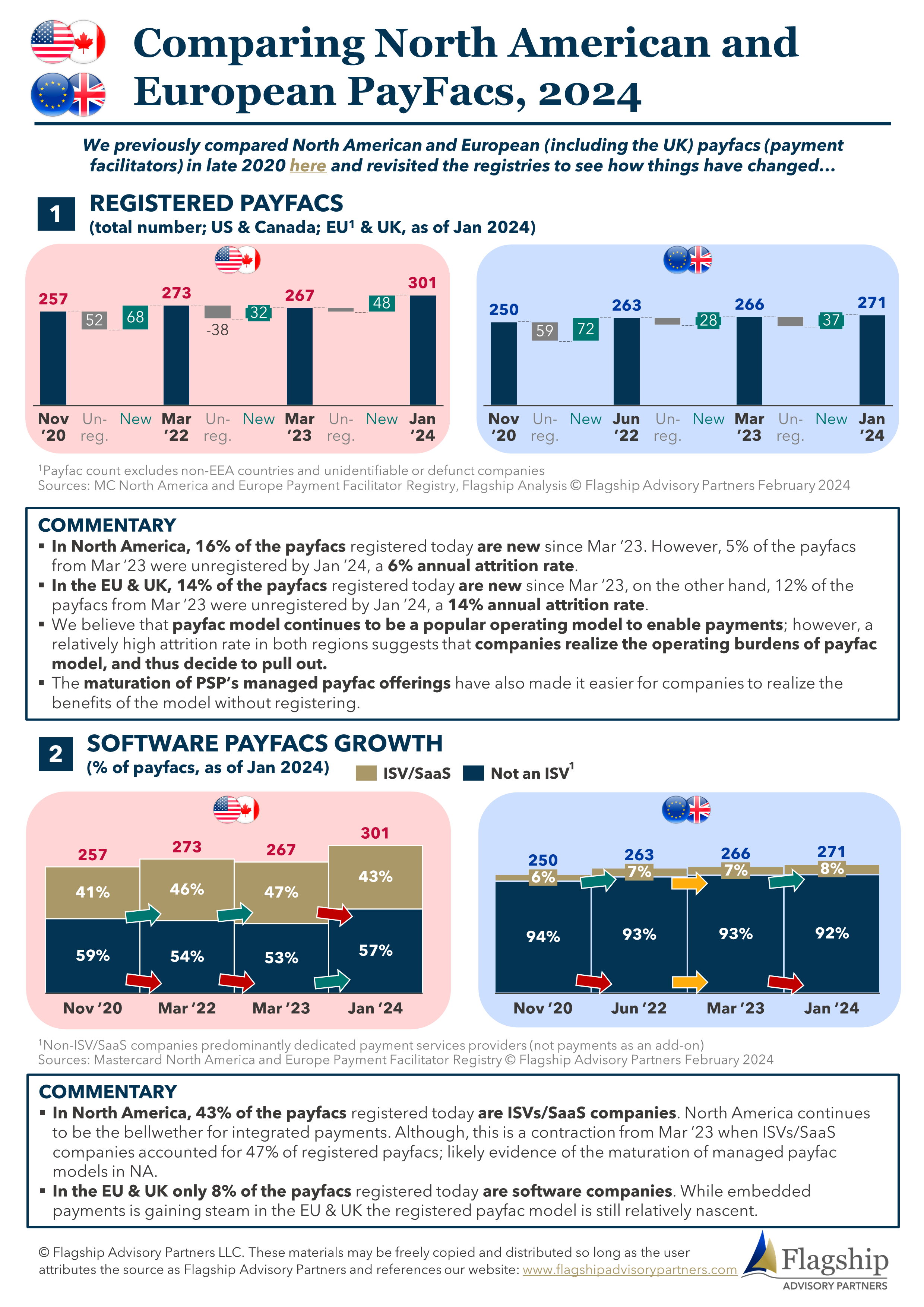

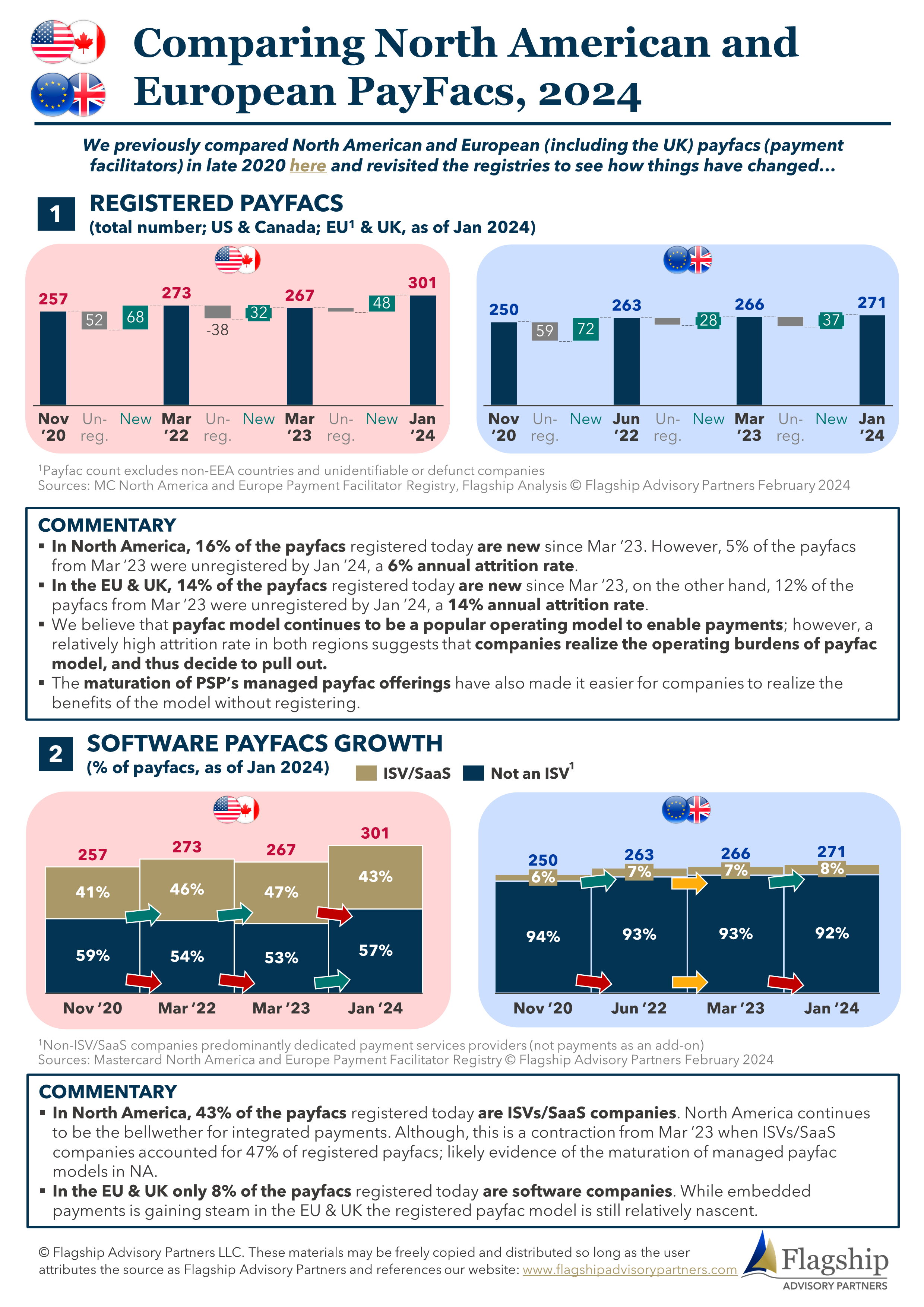

- In North America, 16% of the payfacs registered today are new since Mar ’23. However, 5% of the payfacs from Mar ’23 were unregistered by Jan ’24, a 6% annual attrition rate.

- In the EU & UK, 14% of the payfacs registered today are new since Mar ’23, on the other hand, 12% of the payfacs from Mar ’23 were unregistered by Jan ’24, a 14% annual attrition rate.

- We believe that payfac model continues to be a popular operating model to enable payments; however, a relatively high attrition rate in both regions suggests that companies realize the operating burdens of payfac model, and thus decide to pull out.

- The maturation of PSP’s managed payfac offerings have also made it easier for companies to realize the benefits of the model without registering.

- In North America, 43% of the payfacs registered today are ISVs/SaaS companies. North America continues to be the bellwether for integrated payments. Although, this is a contraction from Mar ’23 when ISVs/SaaS companies accounted for 47% of registered payfacs; likely evidence of the maturation of managed payfac models in NA.

- In the EU & UK only 8% of the payfacs registered today are software companies. While embedded payments is gaining steam in the EU & UK the registered payfac model is still relatively nascent.

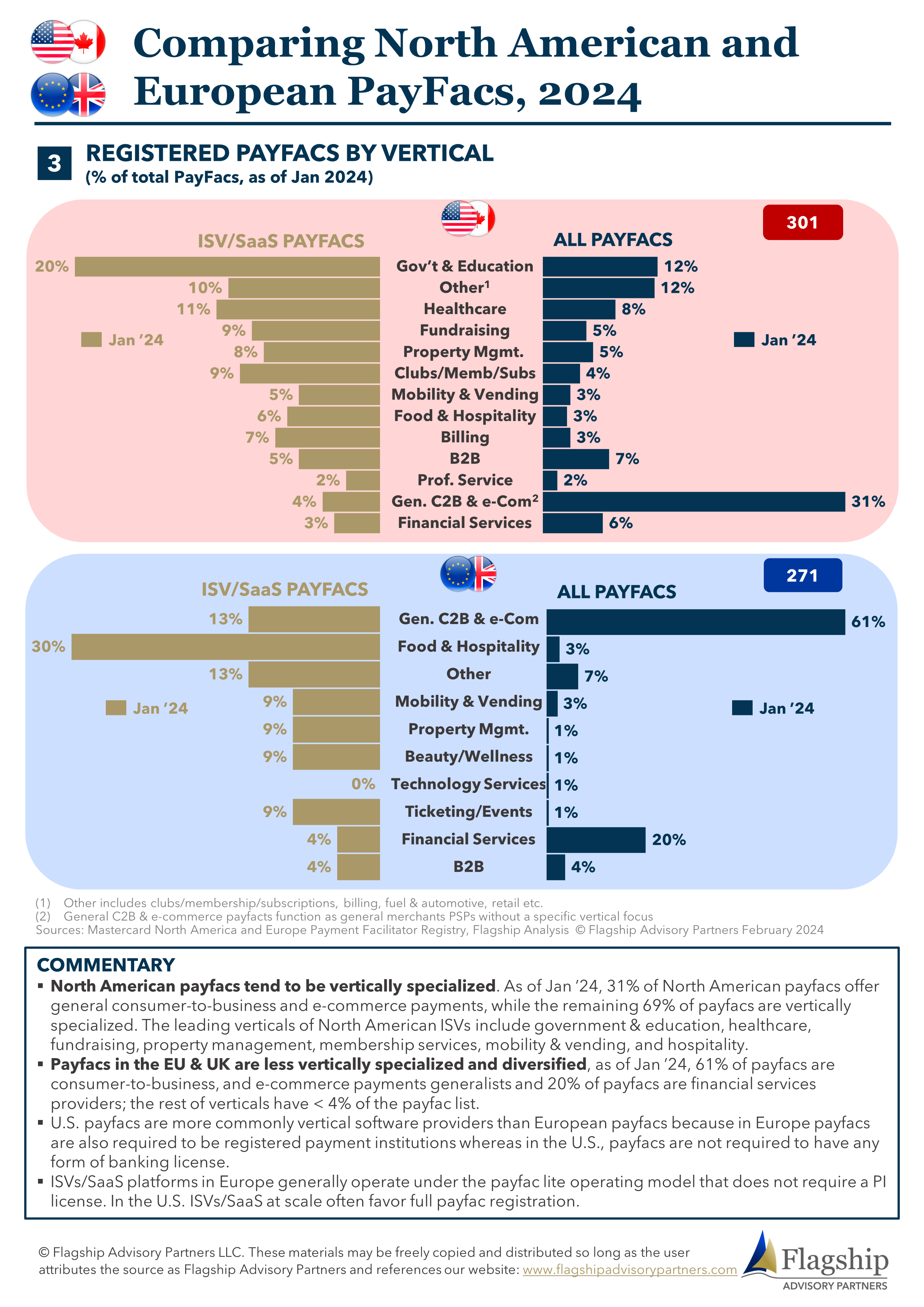

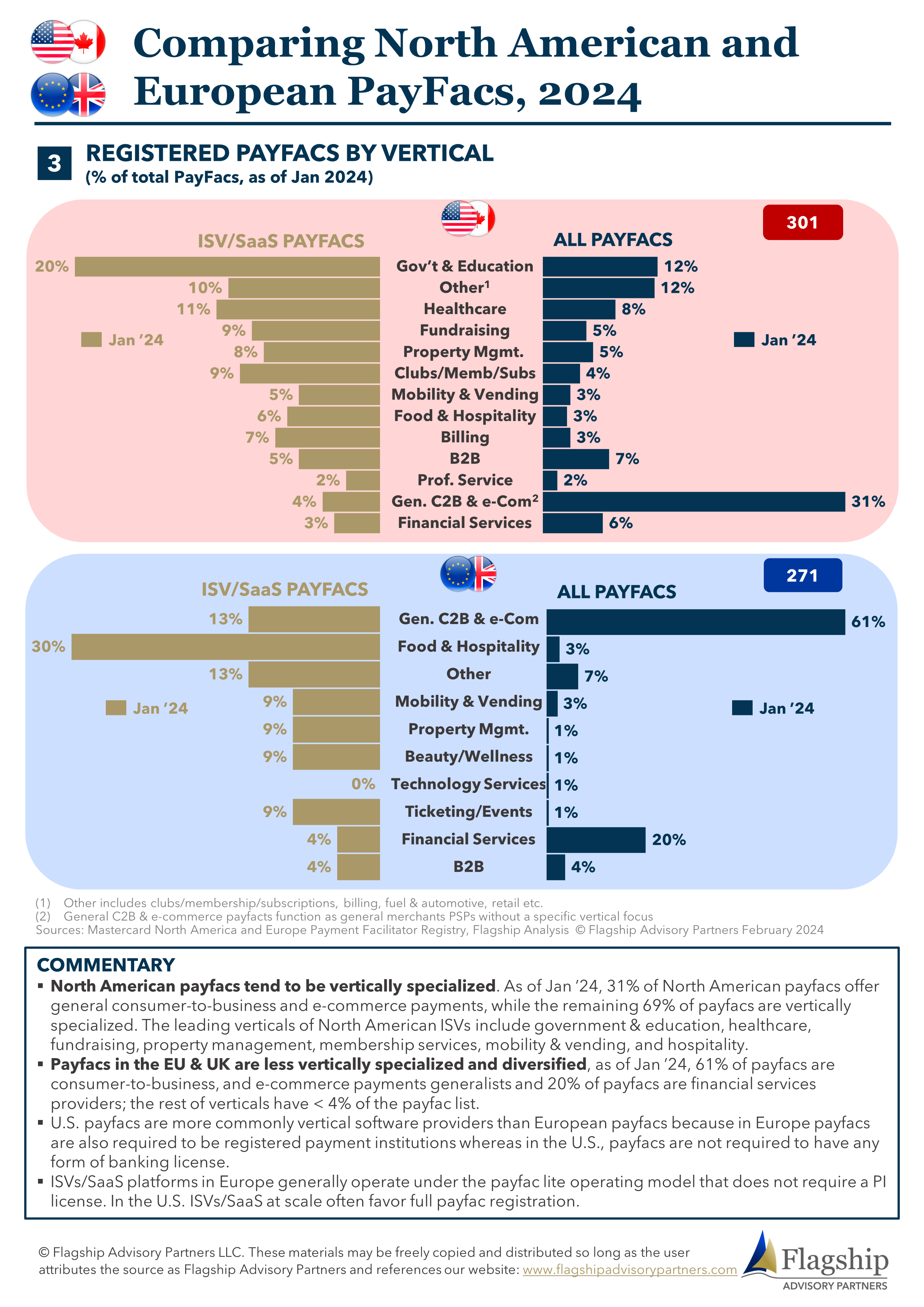

- North American payfacs tend to be vertically specialized. As of Jan ’24, 31% of North American payfacs offer general consumer-to-business and e-commerce payments, while the remaining 69% of payfacs are vertically specialized. The leading verticals of North American ISVs include government & education, healthcare, fundraising, property management, membership services, mobility & vending, and hospitality.

- Payfacs in the EU & UK are less vertically specialized and diversified, as of Jan ’24, 61% of payfacs are consumer-to-business, and e-commerce payments generalists and 20% of payfacs are financial services providers; the rest of verticals have < 4% of the payfac list.

- U.S. payfacs are more commonly vertical software providers than European payfacs because in Europe payfacs are also required to be registered payment institutions whereas in the U.S., payfacs are not required to have any form of banking license.

- ISVs/SaaS platforms in Europe generally operate under the payfac lite operating model that does not require a PI license. In the U.S. ISVs/SaaS at scale often favor full payfac registration.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

.jpg)

Image Credit: Designed by FreePik

General Commentary & Highlights

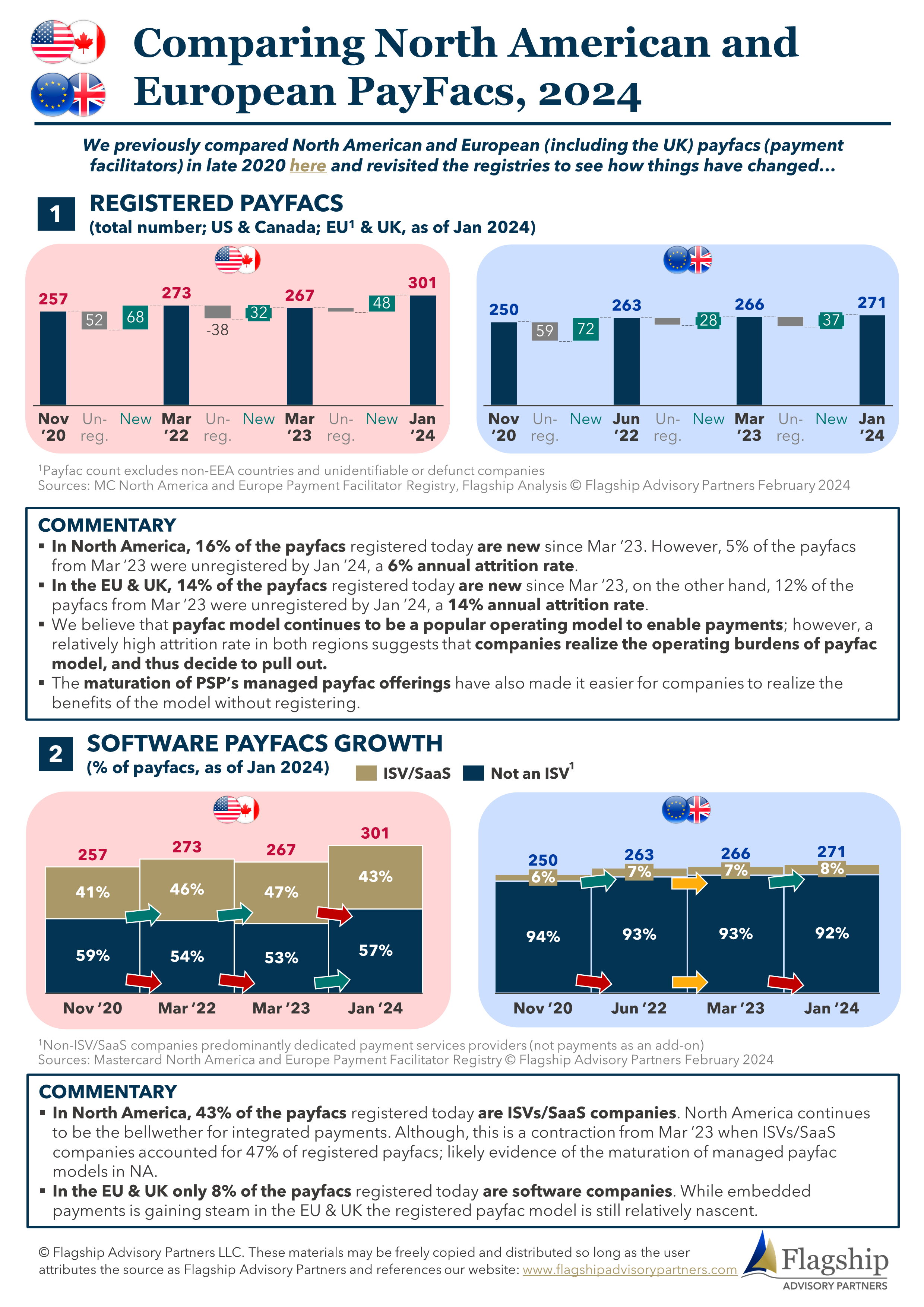

- In North America, 16% of the payfacs registered today are new since Mar ’23. However, 5% of the payfacs from Mar ’23 were unregistered by Jan ’24, a 6% annual attrition rate.

- In the EU & UK, 14% of the payfacs registered today are new since Mar ’23, on the other hand, 12% of the payfacs from Mar ’23 were unregistered by Jan ’24, a 14% annual attrition rate.

- We believe that payfac model continues to be a popular operating model to enable payments; however, a relatively high attrition rate in both regions suggests that companies realize the operating burdens of payfac model, and thus decide to pull out.

- The maturation of PSP’s managed payfac offerings have also made it easier for companies to realize the benefits of the model without registering.

- In North America, 43% of the payfacs registered today are ISVs/SaaS companies. North America continues to be the bellwether for integrated payments. Although, this is a contraction from Mar ’23 when ISVs/SaaS companies accounted for 47% of registered payfacs; likely evidence of the maturation of managed payfac models in NA.

- In the EU & UK only 8% of the payfacs registered today are software companies. While embedded payments is gaining steam in the EU & UK the registered payfac model is still relatively nascent.

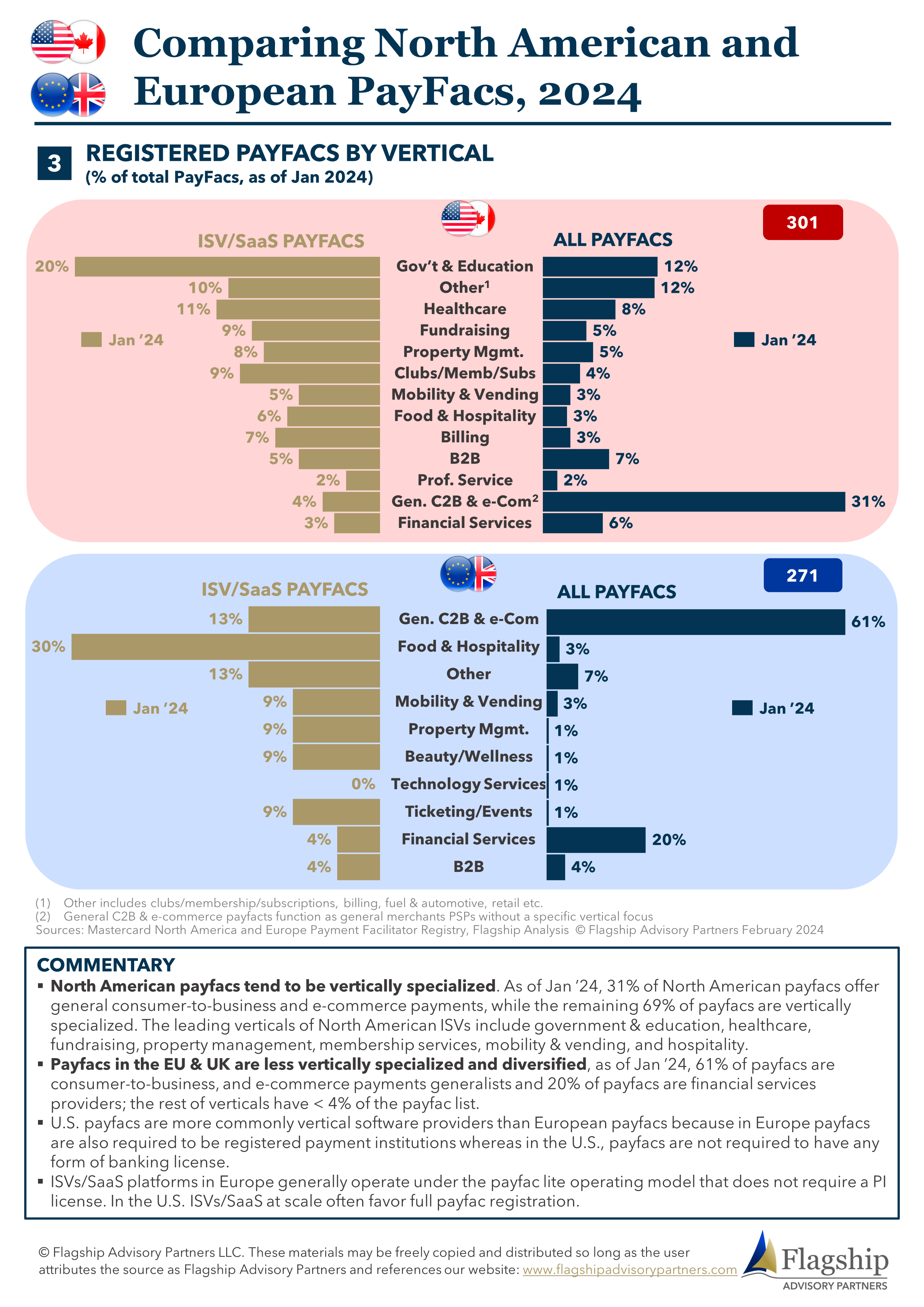

- North American payfacs tend to be vertically specialized. As of Jan ’24, 31% of North American payfacs offer general consumer-to-business and e-commerce payments, while the remaining 69% of payfacs are vertically specialized. The leading verticals of North American ISVs include government & education, healthcare, fundraising, property management, membership services, mobility & vending, and hospitality.

- Payfacs in the EU & UK are less vertically specialized and diversified, as of Jan ’24, 61% of payfacs are consumer-to-business, and e-commerce payments generalists and 20% of payfacs are financial services providers; the rest of verticals have < 4% of the payfac list.

- U.S. payfacs are more commonly vertical software providers than European payfacs because in Europe payfacs are also required to be registered payment institutions whereas in the U.S., payfacs are not required to have any form of banking license.

- ISVs/SaaS platforms in Europe generally operate under the payfac lite operating model that does not require a PI license. In the U.S. ISVs/SaaS at scale often favor full payfac registration.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

Please do not hesitate to contact Peter Taylor at Peter@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

.jpg)