Omnichannel commerce and payments, once forward-looking concepts, are now mainstream. A majority of merchants (excluding micro-segment) in the U.S. are today, selling through both physical and digital channels. In the enterprise segment, omnichannel infrastructure (payments being just one piece) has been a priority for more than a decade. It used to be that enterprise merchants' own commerce infrastructure (SW, HW) was the primary bottleneck, not payments. But today, we frequently encounter merchants that have transformed their commerce stack to be omnichannel but still lack a corresponding omnichannel payments service. The message here is clear, whether you are a PSP focused on small business or a PSP focused on enterprise clients, delivering omnichannel payment propositions is critical for success in merchant payments..

Most Merchants Are Now Omnichannel

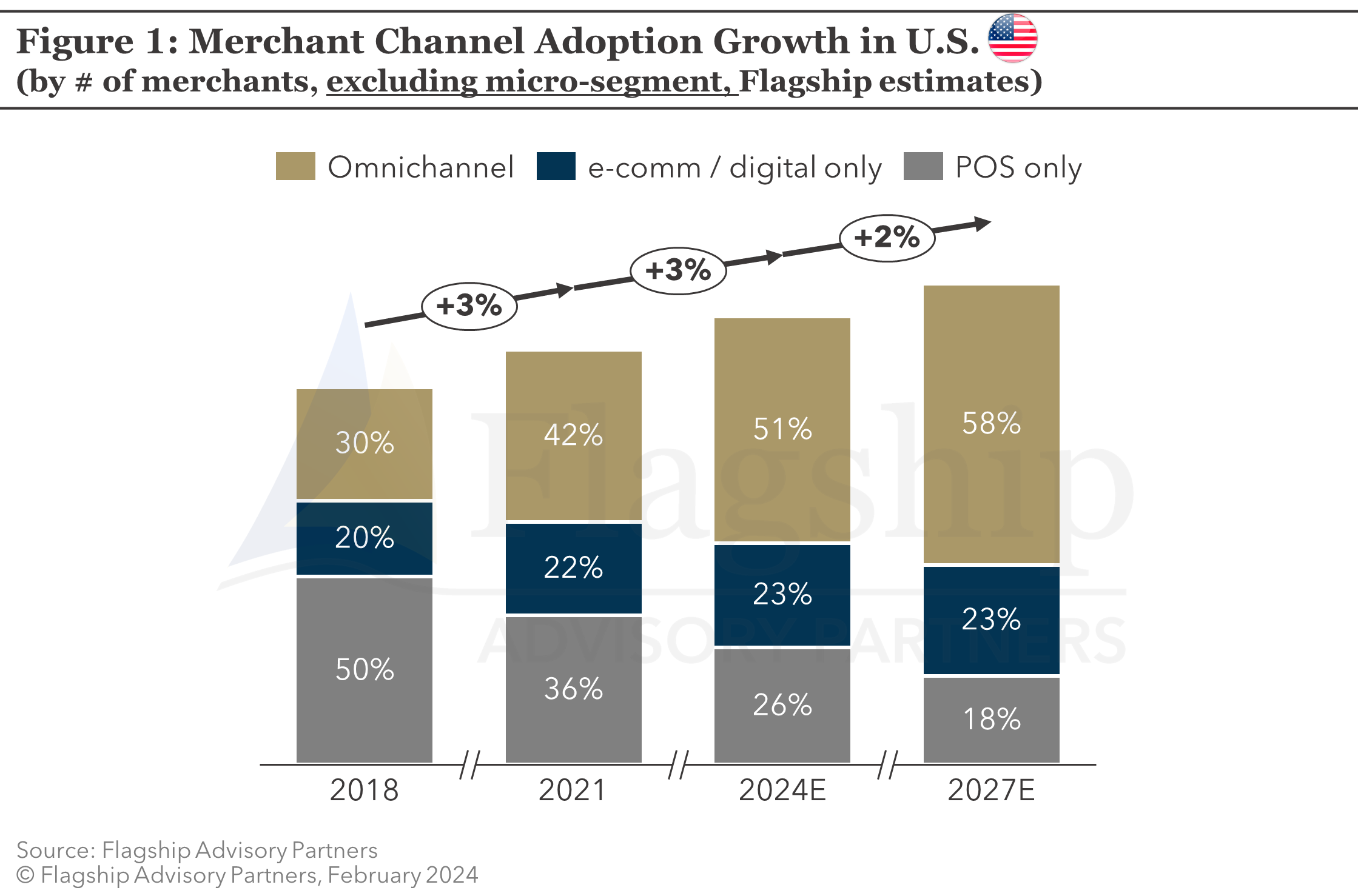

As shown in Figure 1, we estimate that 2024 will be the first year in which a majority of U.S. card-accepting merchants are omnichannel (defined as selling and accepting card payments in both face-to-face and digital channels including a website, mobile app, etc.). Merchants today want and need to sell through multiple channels. Payment service providers that do not embrace all of these channels’ needs miss easy value creation, leaving the door open to competitors.

Until now, merchants have been mostly reactive in their payment strategies, creating a fragmentation of services, tech stacks, and payment partners. Today, even small merchants frequently rely on multiple PSPs (2+ on average according to our research in the U.S.) to facilitate channel, geography, and local payment methods coverage. This fragmentation of payment partners inhibits the enablement of some of the more advanced omnichannel use cases (but is also a catalyst for the emergence of payment orchestration which we explain in this article).

While the enterprise segment has a higher maturity of omnichannel payment enablement and prefers to own key aspects of the user experience for better control, SMEs (small and medium enterprises) are still grappling with siloed channel support. SMEs generally require more backend support for core multi-channel payment acceptance and offering value-added services such as loyalty and rewards.

Omnichannel Behavior is Prevalent across Verticals

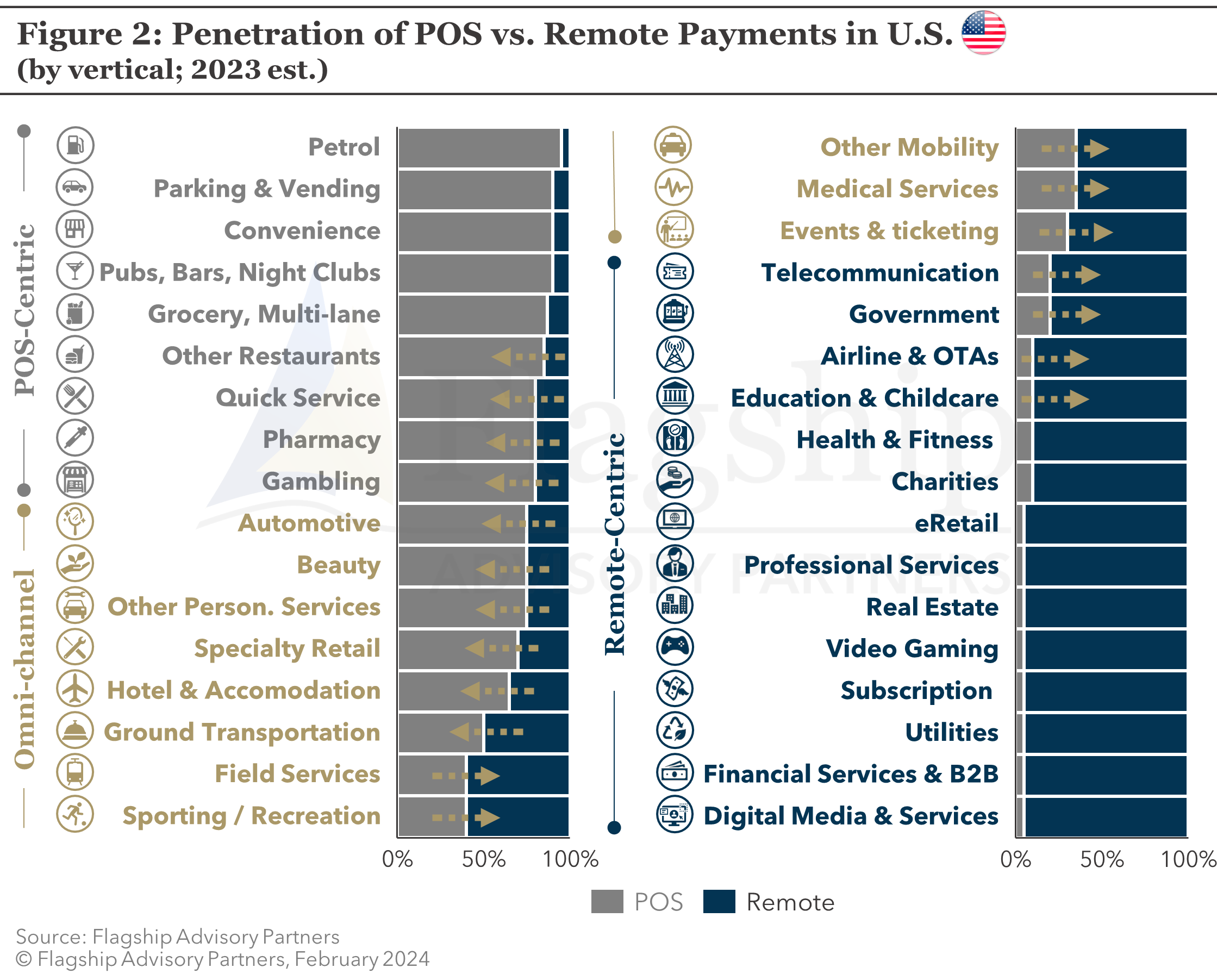

Omnichannel needs and developments are playing out at different paces and to varying degrees across verticals. Clearly, many verticals skew towards one channel, as shown in Figure 2 below. But we also see a development towards omnichannel across verticals.

The pandemic contributed to an acceleration in this shift as most traditionally POS-centric merchants were forced to move online to continue serving their clients. In the post-pandemic era where in-store payments are back, a majority of digital merchants also started to realize the importance of selling via face-to-face channels. There is a long list of historically traditional POS-centric verticals that shifted towards digital payments, most notable verticals include retail, beauty, pharmacy, transportation, and restaurants.

For example, COVID clearly stimulated an already notable shift in restaurants towards digital commerce and payments (in-app, online, via kiosk, etc.). In physical retail, most small merchants are also selling via a website or marketplaces such as Amazon.

For example, COVID clearly stimulated an already notable shift in restaurants towards digital commerce and payments (in-app, online, via kiosk, etc.). In physical retail, most small merchants are also selling via a website or marketplaces such as Amazon.

It is worth noting that merchant payments in the U.S. have traditionally been more omnichannel-centric while Europe was more traditionally siloed (i.e., POS specialists and e-comm specialists). This is due to the late adoption of EMV (chip and PIN technology), the lack of adoption of strong authentication in the U.S., and the prevalence of various forms of key-entered and non-traditional (not pure e-comm) remote payments.

Most PSPs Also Now Offer Omnichannel Payment Services

As a PSP, covering POS and digital payments is an increasingly relevant success factor. Offensively, introducing a new channel-enabling product broadens the addressable revenue base and customer lifetime value. Defensively, if you don’t do it, one of your competitors will. Our research indicates that a majority of SME merchants use multiple PSPs, citing channel enablement as the primary rationale.

It is becoming increasingly rare for merchant PSPs to not support POS and e-commerce. And there is a long timeline of PSPs making the move to augment channel coverage, for example:

- Nuvei (a leading global e-commerce payment service provider) announced the global roll-out of its Unified Commerce offering on 7 February 2024

- Shift4’s recently completed acquisition of Finaro

- Mollie announced in May 2023 the launch of its POS offering

- Buckaroo’s acquisition of Sepay in July 2022

- Stripe’s acquisition of BBPOS, an OEM provider, in January 2022

- Planet’s acquisition of Datatrans in November 2021

- Amongst others

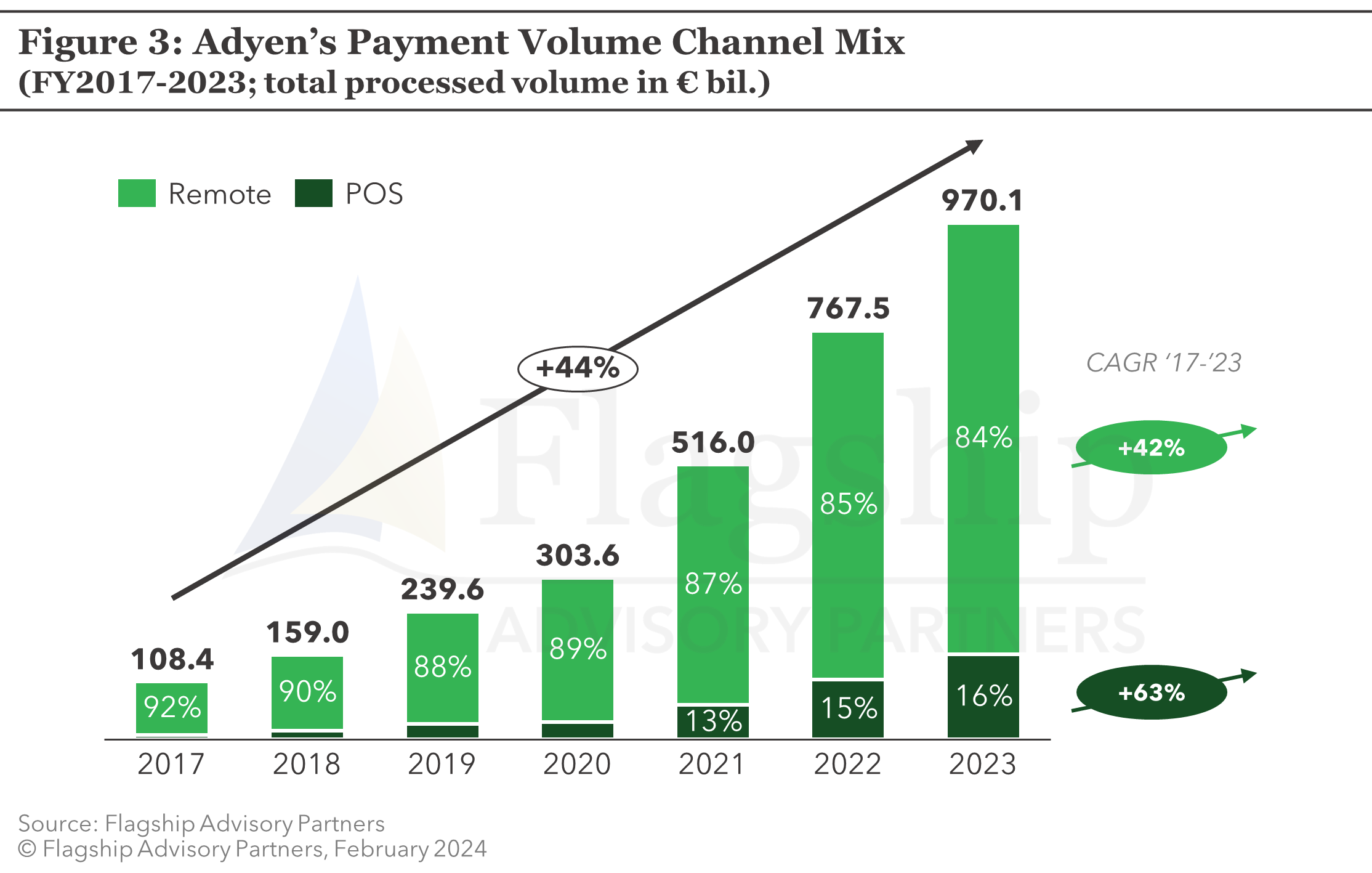

Adyen’s unified commerce success is particularly notable among merchants who prize a rich and unified customer experience across channels and tracking of customer purchase data across channels to fuel loyalty investment (e.g., fashion, experience-focused hospitality, etc.).

Adyen clearly has a winning unified commerce proposition, although it is not limitless. Merchants working with Adyen cannot use 3rd party acquirers for POS transactions and they must select from a limited range of payment devices (not bring their own). These limitations help to limit the complexity of achieving a unified proposition.

What Makes a True Omnichannel Proposition?

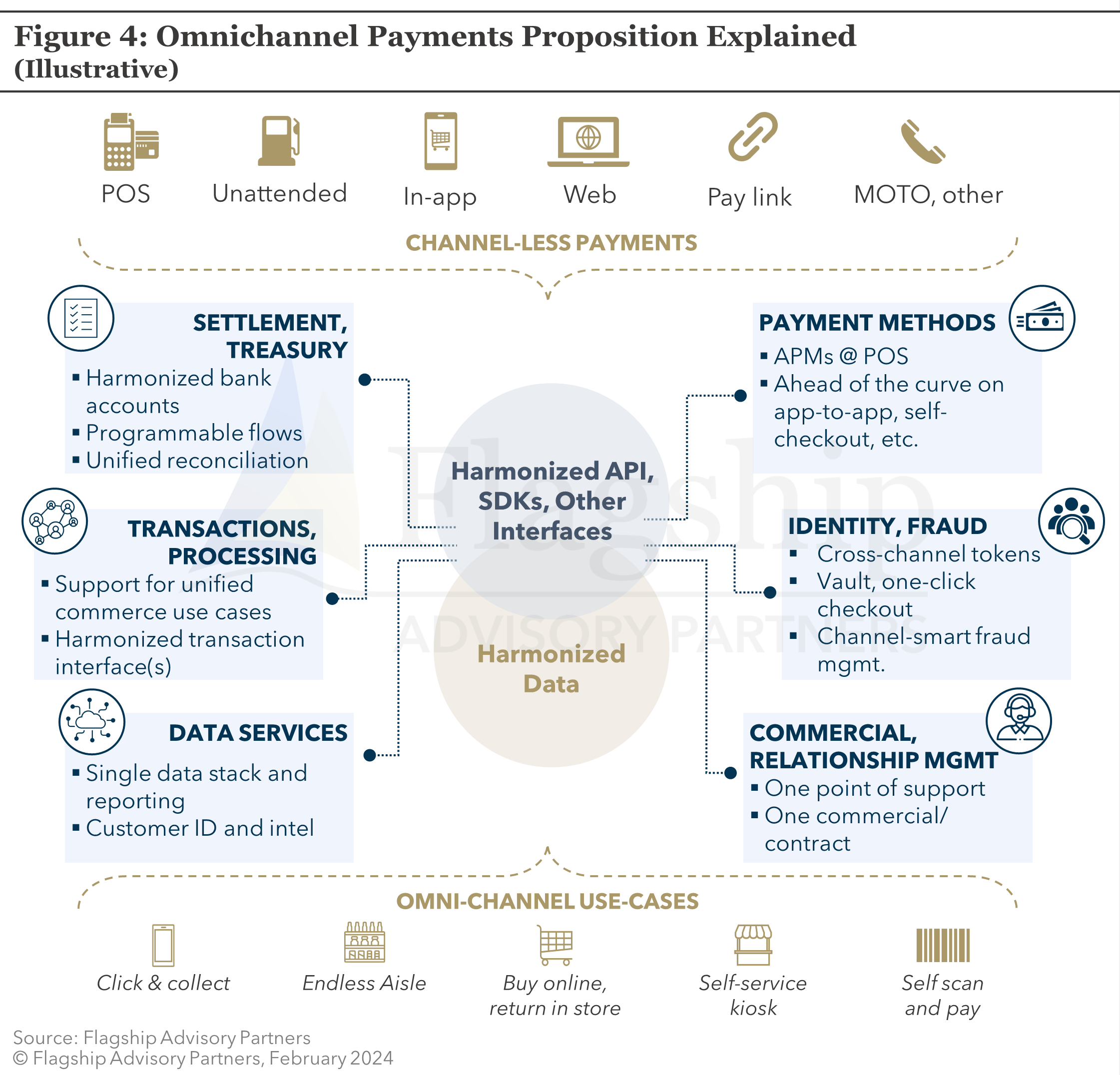

At its core, omnichannel payments is the ability to recognize customers, securely store credentials, cover all relevant payment use cases and payment methods with a common experience, and provide a single set of data and dashboard services to the merchant. We illustrate these concepts in Figure 4.

Omnichannel payments is not a complex concept, but many PSPs and merchants struggle with infrastructure designed around a single channel, or disparate infrastructure resulting from acquisitions. We see omnichannel payments as driven by a handful of foundational principles:

- For small merchants, it just has to be easy:

- Frictionless integration into the merchants' SaaS (WooCommerce plugins, etc.)

- Single dashboard

- Single point of service

- Single set of settlement flows, etc.

- For enterprise merchants, you also need a unified payment proposition …

- Technical Integration Toolkit: a common set of technical tools (documentation, support, etc.), even if payment channels involve different APIs

- Cross-channel tokenization: single tokenization service for recognizing customers across channels and, as needed, securely storing, and presenting the customer’s payment credentials

- Settlement & Treasury: Automated and unified reconciliation across these channels achieved by the customers’ bank account harmonized in one single database

- Data: Single data service with consolidated reporting for transactions across different channels and ideally, value-added analytics on customer behaviors

- Commercial, relationship management: Single point of contact for account servicing, a common commercial and contracting model, and unified billing

-

- Transacting Platforms:

- Web

- In-app

- POS device

- Kiosk

- Paylink (e-bill, chat, email, etc.)

- Use Cases (noting that the commerce software does most of the work to enable these use cases, not the PSP):

- Click and collect

- Endless aisle

- Buy and return across channels

- Self-checkout

- Pre-auth or pay-as-you-go

- Transacting Platforms:

Conclusion

PSPs must be omnichannel because most merchants (in mature markets) are now omnichannel and they increasingly demand an omnichannel payment proposition. Merchants need to be proactive and forward-looking when choosing a PSP that can facilitate their omnichannel strategy. PSPs, in turn, must adapt their offerings to deliver a unified proposition that is not channel siloed. Payment service providers that remain channel fragmented or limited will increasingly struggle to compete.

Please do not hesitate to contact Charlotte Al Usta at Charlotte@FlagshipAP.com or Sameer Verma at Sameer@FlagshipAP.com with comments or questions.