Worldline recently completed its merger with Ingenico. In parallel, Nexi and Nets have agreed in principle to merge. These two events culminate a decade of consolidation in the European retail payments market. These two groups (assuming completion of the Nexi/Nets merger) become clear market leaders for diversified processing and pan-European merchant services (noting that e-commerce has a broader group of market leaders). On subsequent pages, we compare each group side-by-side via a series of figures:

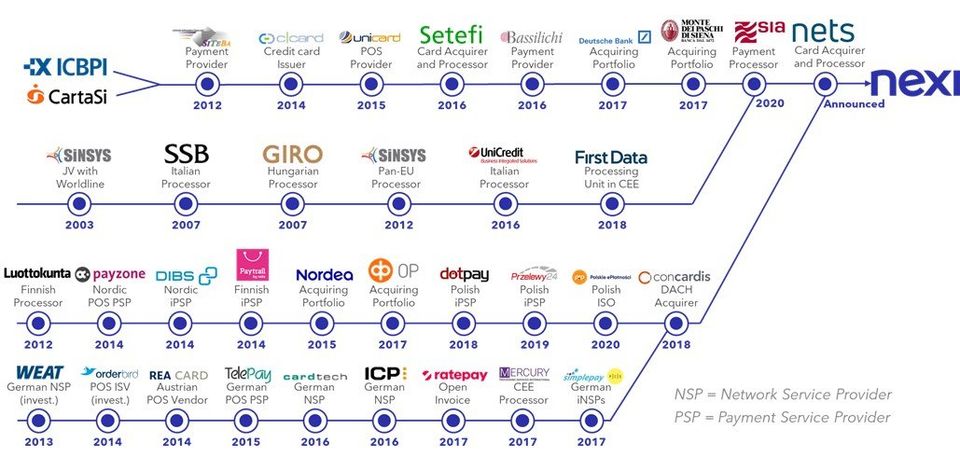

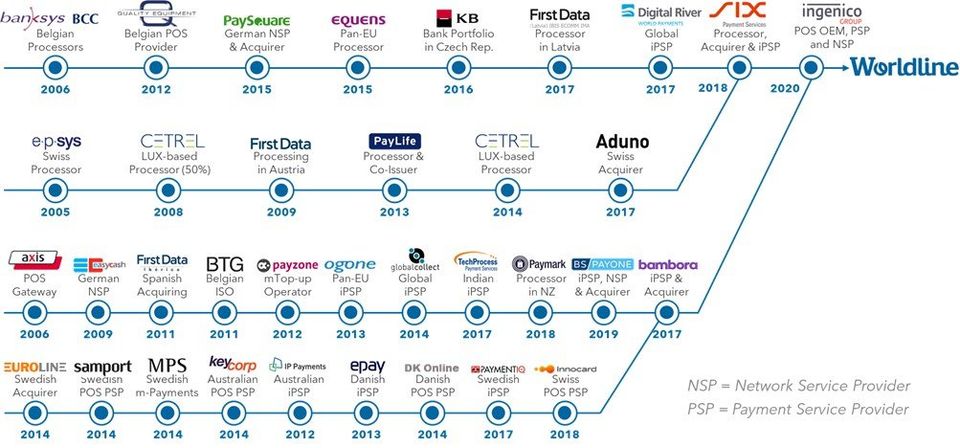

· Figures 1 & 2: compare the M&A development timeline for each group

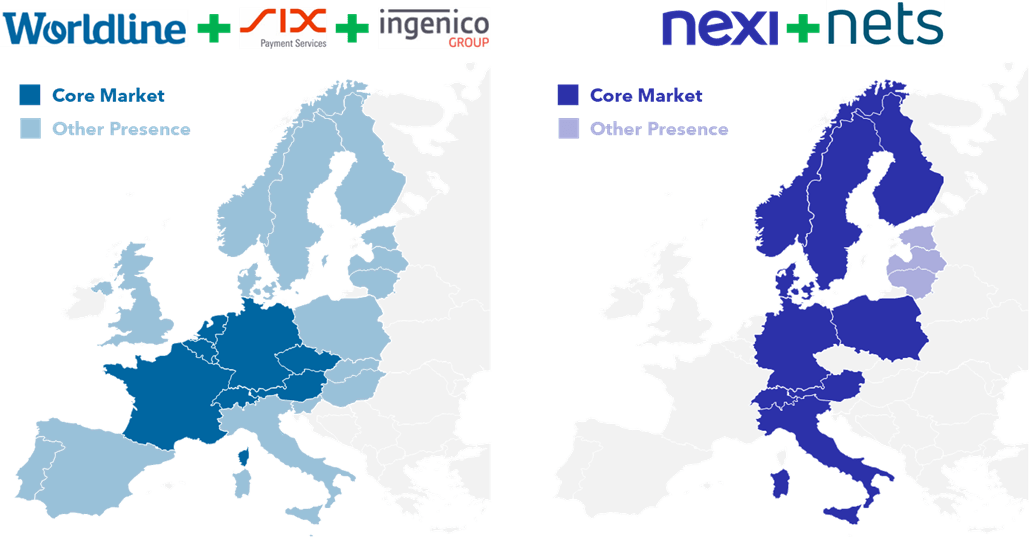

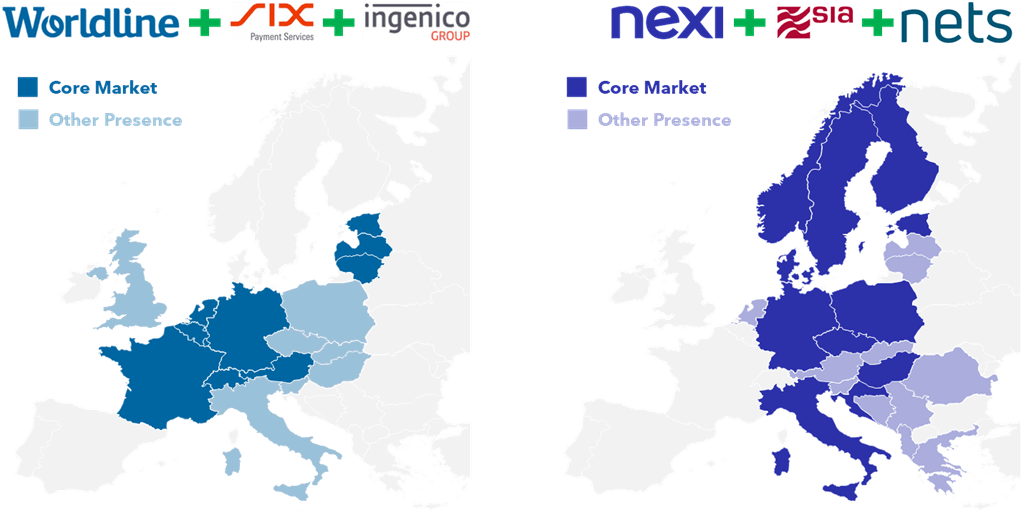

· Figure 3 & 4: compare the European geographic footprints for each group, focusing on their core businesses of merchant services and issuer services (processing)

· Figure 5: compares the product & service portfolio (focusing on issuing and merchant services) of each group

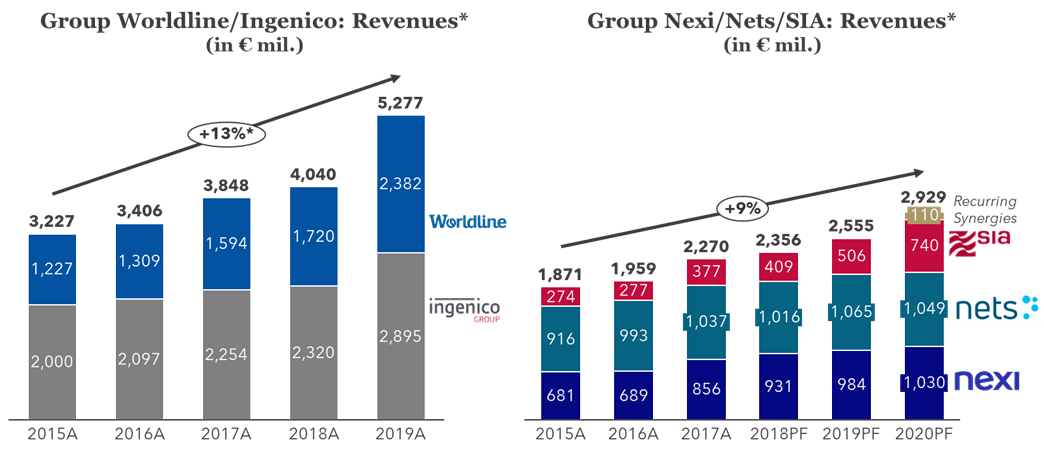

· Figure 6: compares the revenue scale and growth for each group

While each of the Worldline and Nexi groups now have significant work to do integrating their various businesses, we still see further M&A in the future, for example in France, Spain, Portugal or Central and Eastern Europe. It also feels inevitable that each group will either target or be targeted by North American multinational payments groups in the coming years.

FIGURE 1: NEXI + SIA + NETS M&A Timeline

FIGURE 2: Worldline + SIX + Ingenico M&A Timeline

Figure 3: Merchant Services Geographic Footprint in Europe

FIGURE 4: Issuer Services Geographic Footprint in Europe

FIGURE 5: Product Portfolios at Worldline Group and Nexi Group

FIGURE 6: Worldline Group and Nexi Group Revenue Development

| A: Actual; *Note that revenues for SIX Payment Services are included only as 1 Dec 2018, thus the 13% growth rate is not a true organic growth rate. Revenues are net of interchange including estimated Ingenico’s interchange fees for 2015-2017 Sources: Company data | A: Actual; PF: Pro-Forma PF incl. a.o. Concardis, Mercury Processing, Ratepay, Paypro, Poplapay, PeP *Revenues net of interchange Sources: Company data, Investor Presentation |

|---|

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com or Yuriy Kostenko Yuriy@FlagshipAP.com should you have any comments or questions.