(Part 3* – Channel and Form Factor Impacts)

*This is the third in a series of blogposts, in which we compare our original hypotheses related to COVID-19’s impact on the payments marketplace at the onset of the pandemic versus the reality of today. In this part III, we examine the impact of COVID-19 on retail spending channels and consumer choices on means of payment.

Our Outlook from April 2020 on COVID-19’s Expected Sales Channel Impact

Back in April, we expected a significant shift towards digital commerce channels and away from physical shops given the direct impacts of a lockdown as well as perceived safety advantages of distance commerce. Even with traditional POS categories such as groceries, we anticipated spend to shift online. We also expected some consumers to shift away from cash in favor of safer contactless means of payment.

Realities of Today – Consumers Prefer Digital Commerce and Contactless Payment Form

Our expectations from April 2020 played out as expected: the pandemic shifted retail spending online and dramatically increased the use of contactless means of payment (even beyond our high expectations). COVID-19 accelerated the multi-decade shift in retail spending from point-of-sale (POS) to e/m-commerce. Online retailers as well as their payment service providers clearly benefited from this shift. In parallel, there was a significant shift away from cash and towards contactless means of payment at point-of-sale. There is also a more subtle ongoing shift from credit cards to debit cards. We further detail these behavioral changes in the observations that follow.

Retail Spend: POS to Online Shift

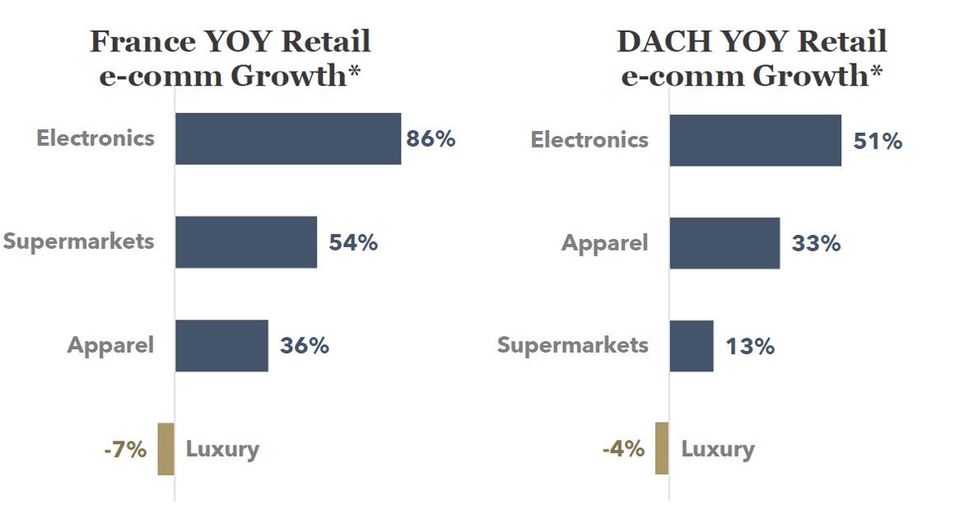

As anticipated, COVID-19 lockdowns drove retail spend online. This was particularly pronounced in April and May when lockdowns were most severe. We also now expect similar impacts now given the expanding lockdown. As discussed in Part II of the COVID Impact, sector impacts varied widely. Within retail, electronics and spend at supermarkets were most impacted by the shift from POS to e/m-commerce channels (as shown in figure 1). Luxury, on the other hand, declined both offline and online, although some of this is attributable to the luxury industry’s lagging position in enabling e/m-commerce.

FIGURE 1: COVID Impact on Online Retail (YOY Change as of July 5, 2020)

Many e-commerce PSPs, those overweight retail and underweight travel, have seen a significant boost in growth since the pandemic. We expect a number of these PSPs to use the accelerated growth momentum as a catalyst for a capital event. TCV’s investment in Mollie appears to be one such example given the tremendous valuation multiple relative to 2019 performance.

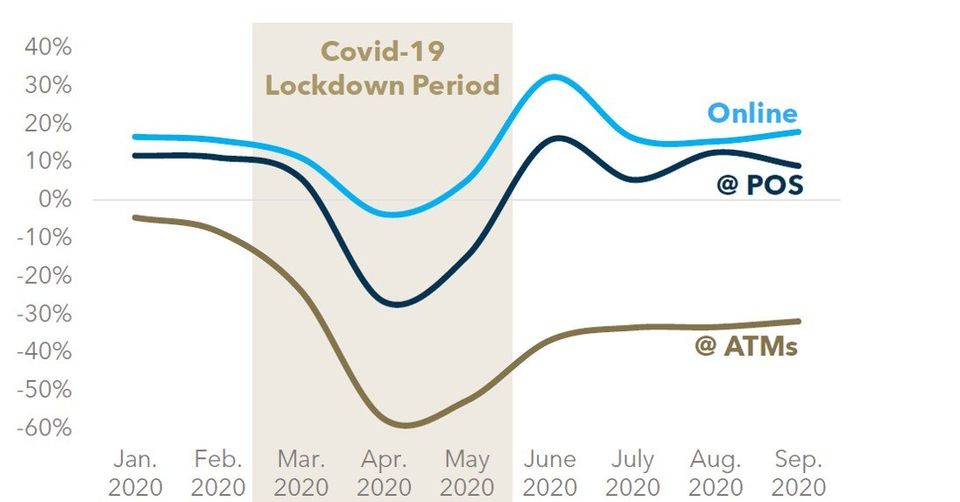

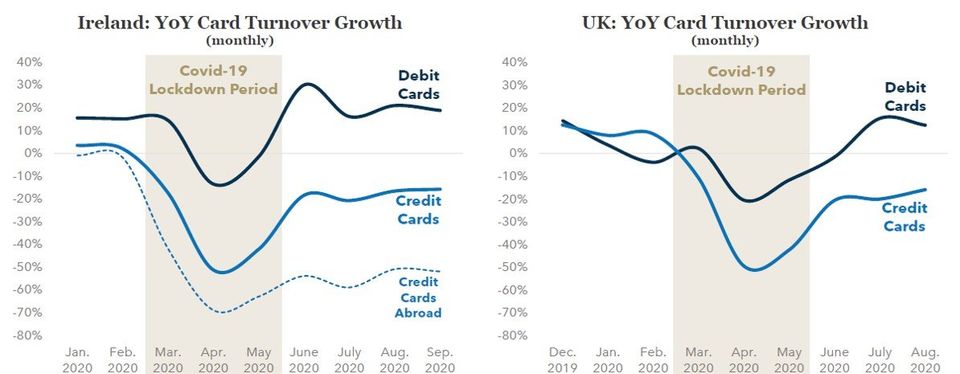

Note that the point-of-sale is far from dead. In fact, POS card spend generally rebounded well in Europe during the summer as prevention measures were relaxed and consumers happily returned to cafes and retail shops. As shown in Figure 2, POS card spend in Ireland returned to pre-COVID levels during the summer (noting that card POS spend was boosted by a shift away from cash as we discuss next).

FIGURE 2: Ireland: Y0Y Card Turnover Growth (monthly vs. pre-Covid)

Card Spend at POS: Cash to Cards Shift

Cash has been shifting to cards for many years and is a major catalyst for the ongoing growth of the payments industry. This shift has generally been driven by generational preferences as well as the impact of mobile technologies and digital commerce.

COVID-19 accelerated the shift from cash to cards by incrementally influencing cash-payers to use cards instead of cash, which is perceived as unclean. According to an article in the Washington Post1, 2017 study of $1 bills in New York City discovered that the bills were rampant with bacteria and viruses from humans and animals and that small bills change hands more than 600 times in their lifetime.

As shown in figure 2, consumer usage of cash dropped dramatically from mid-March and this change in behavior seems to be persisting and unlikely to ever revert. Cash usage in Ireland during the summer was down 40% from the prior year. According to Hubert O’Donoghue, GM of AIB Merchant Services, card payments went from half of payments turnover to 70% due to COVID-19.

“The shift from cash to cards in Ireland has been pretty marked. Prior to COVID-19, payment mix was 51% cash and 49% cards. Post COVID, the mix changed in favor of cards to 30% cash and 70% cards”

--- Hubert O'Donoghue, General Manager at AIB Merchant Services (Visa podcast 9 July 2020)

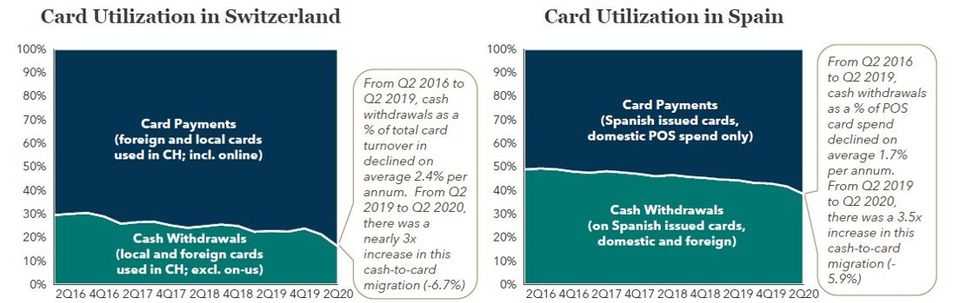

As shown in figure 3, the pace of cash-to-cards shift in Switzerland accelerated 3x during the pandemic. In Spain, the cash to card shift increased 3.5x in 2Q 2020.

FIGURE 3: Cash Withdrawals vs. Card Payments as a Percentage of Total Card Turnover in Spain and Switzerland

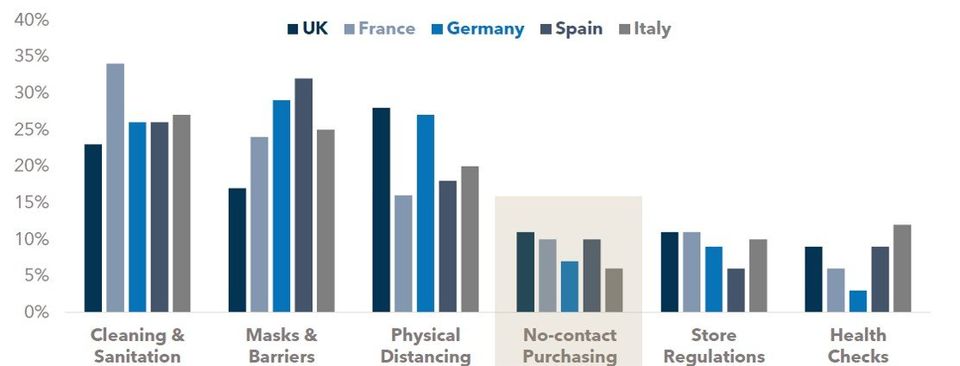

The pandemic has also accelerated consumers’ preference towards contactless payments. As with paper cash, card pin pads are touched hundreds and even thousands of times per year, often without proper cleaning. COVID-19 heightened consumer awareness of the hygiene advantages of transacting in a contactless manner (as shown in Figure 4).

1Washington Post, ‘Will the pandemic finally kill cash’,10 August 2020

FIGURE 4: Most Important Consumer Criteria When Shopping In-Store (% respondents; June 2020; select European markets)

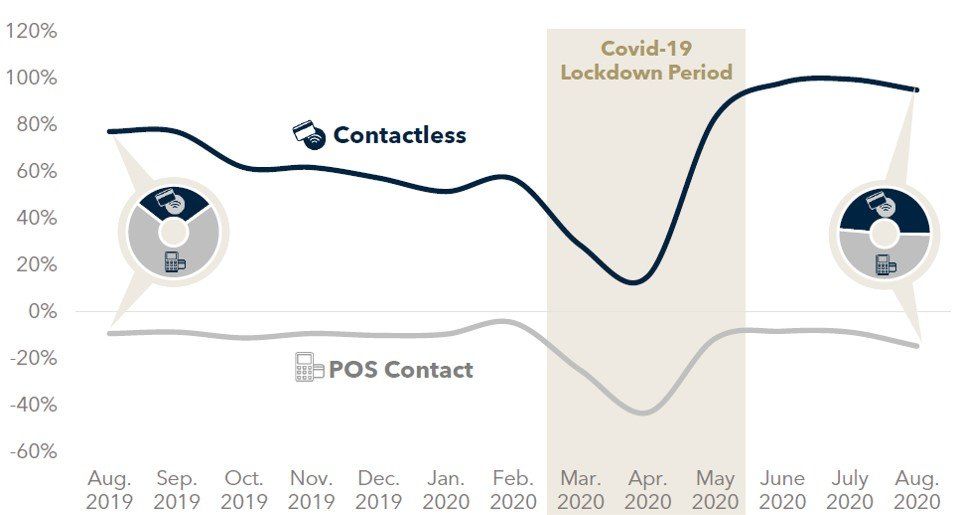

Contactless payments were already growing rapidly prior to COVID-19, but the pandemic has clearly accelerated this growth. As shown in Figure 5, monthly year-over-year growth in contactless payments in Switzerland was 60% during the six months leading up pandemic, but this growth accelerated to 100% this past summer. According to Visa Europe, 80% of all Visa card transactions at point-of-sale in Europe are now contactless.

“Consumers are increasingly demonstrating a clear preference for touch-free payments, with 80% of face-to-face Visa payments in Europe now being touch-free”

--- Antony Cahill, Managing Director of the European Region at Visa Inc. (18 Nov 2020)

FIGURE 5: YOY Growth in Local Card Turnover in Switzerland

Contactless payments benefited from increases in maximum contactless transaction limits early in the pandemic. By April, Visa and Mastercard had doubled contactless limits across many global markets. In Spain, contactless limits increased from €20 to €50, in Switzerland from SFr. 40 to SFr. 80, in Australia from AU$100 to AU$200, and in Canada from CA$100 to CA$250. We see global markets increasingly following the examples set in Australia and Canada (that introduced high limits) with the objective to eventually enable contactless for the vast majority of transactions.

Card Spend: Debit Card to Credit Card Shift

COVID-19 also appears to be steering consumers towards debit cards and away from credit cards. Some of this shift is a by-product of the massive downturn in travel. But even considering only domestic spend, there is still a notable shift from credit cards to debit cards. As shown in figure 6, credit card spend in Ireland and in the U.K. declined significantly while debit card spend returned to its pre-Covid growth levels. We attribute some of this trend to the substitution of debit cards for cash. It is also possible that this debit-to-credit shift is driven by other categorical spending impacts (e.g. more groceries and less restaurant spend).

FIGURE 6: YOY Growth in Credit and Debit Cards in Ireland and the U.K.

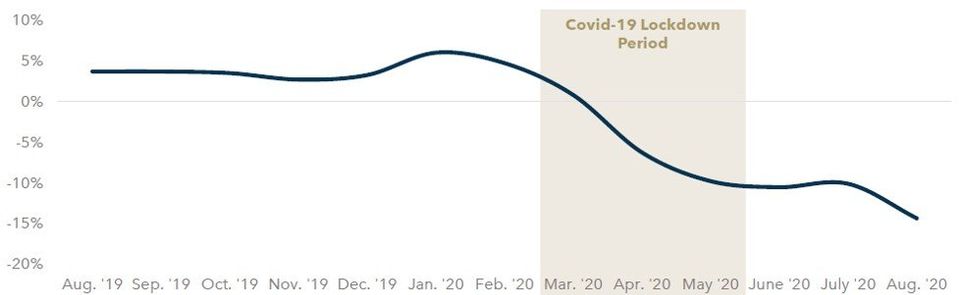

In revolving credit card markets such as the U.K., we also see expanding conservatism on supply and usage of credit as issuers and consumers shift their mindset towards a potentially prolonged macro-economic contraction (see figure 7).

FIGURE 7: YOY Growth in Credit Card Outstanding Balances in the U.K.

COVID-19 Impact on Cash and POS Spend: Outlook

So long as lockdowns continue, POS retail spend will shift online. We expect POS spending to mostly, but not entirely, return when COVID-19 is under control, given that some of the behavioral shift towards e/m-commerce is likely to persist. Fortunately, the shift from cash to cards will help to offset the decline in overall POS spend for providers of POS payment acceptance services. Consumers’ love for contactless payments accelerated and will remain, where we expect other global markets to follow Europe’s lead towards 80%+ contactless penetration.

Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com or Joel Van Arsdale Joel@FlagshipAP.com should you have any comments or questions.