Designed by Freepik

Innovations

Innovations

Image Credit: Designed by Freepik

Ryan McDonald, Abigail Karl • 10 December, 2025

Bank Card Programs Defy Expectations and Drive Stronger Profitability

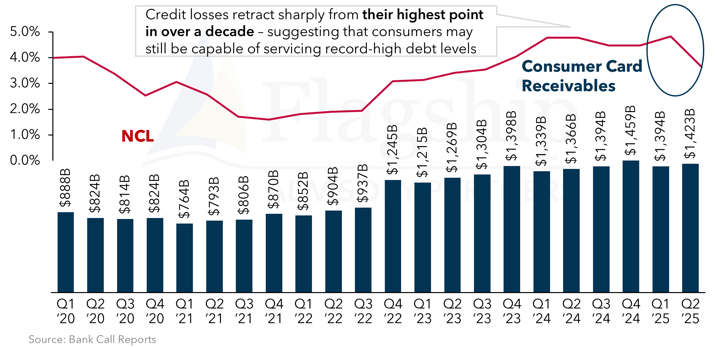

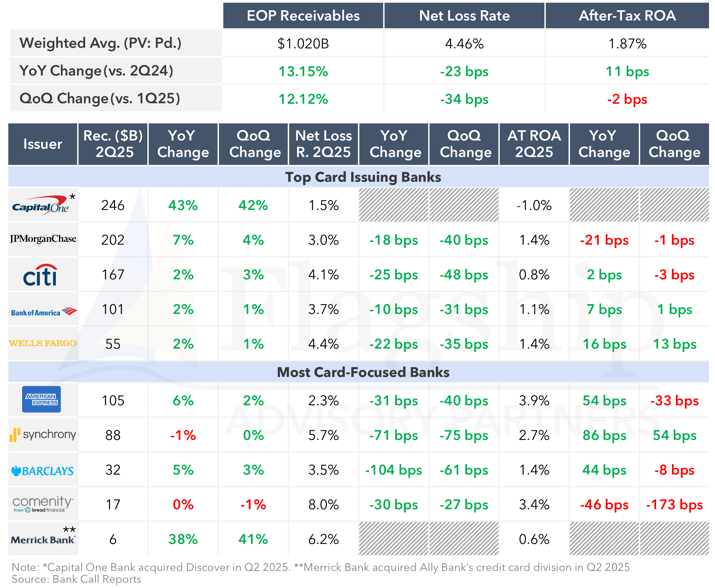

The second quarter of 2025 marked a significant rebound in bank credit card program NCL rates, reversing from what had been their highest levels in more than a decade. Coupled with near record-high loan balances and widening credit spreads, bank-managed credit card programs are outperforming expectations and delaying what many assumed would be an imminent profitability contraction.

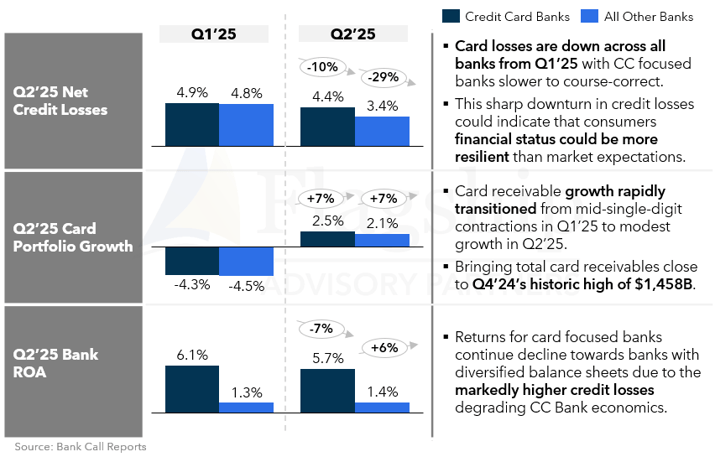

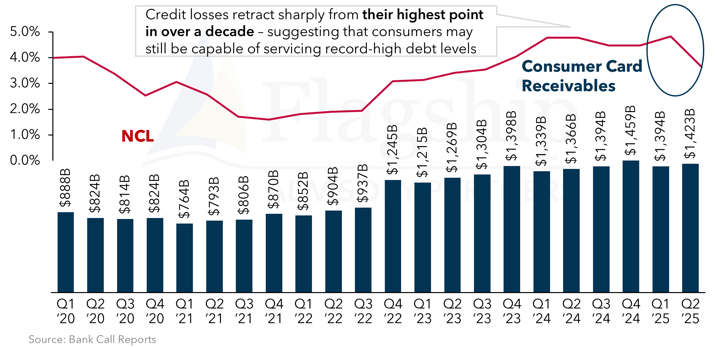

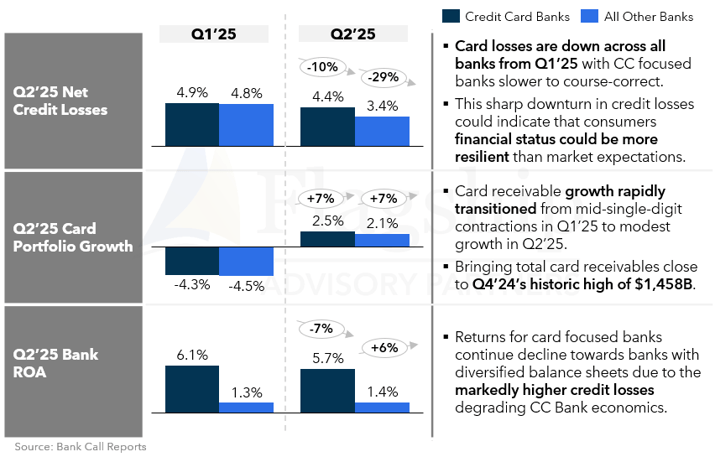

1. Non-Credit Card Banks Vs Credit Card Banks Key Metric Comparison

(Q1'25 vs. Q2'25 consumer receivables)

Q2'25 Net Credit Losses

- Card losses are down across all banks from Q1'25 with CC focused banks slower to course-correct.

- This sharp downturn in credit losses could indicate that consumers financial status could be more resilient than market expectations.

Q2'25 Card Portfolio Growth

- Card receivable growth rapidly transitioned from mid-single-digit contractions in Q1’25 to modest growth in Q2’25

- Bringing total card receivables close to Q4’24’s historic high of $1,458B.

Q2'25 Bank ROA

- Returns for card focused banks continue decline towards banks with diversified balance sheets due to the markedly higher credit losses degrading CC Bank economics.

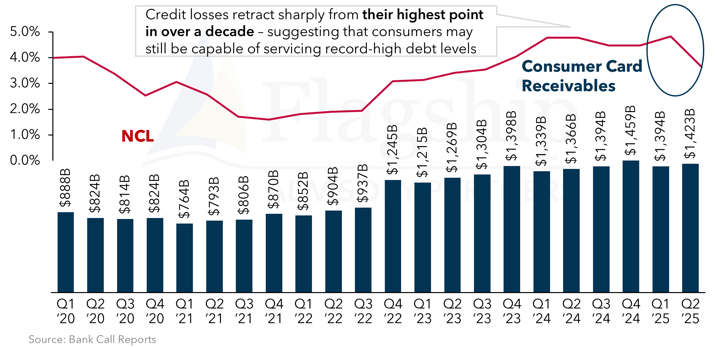

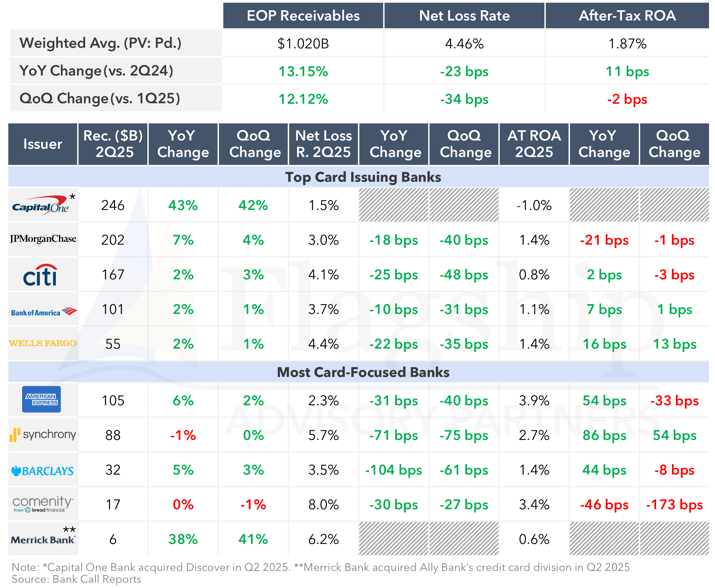

2. Market Size and Credit Loss Performance

(Q1'20 vs. Q2'25 consumer receivables)

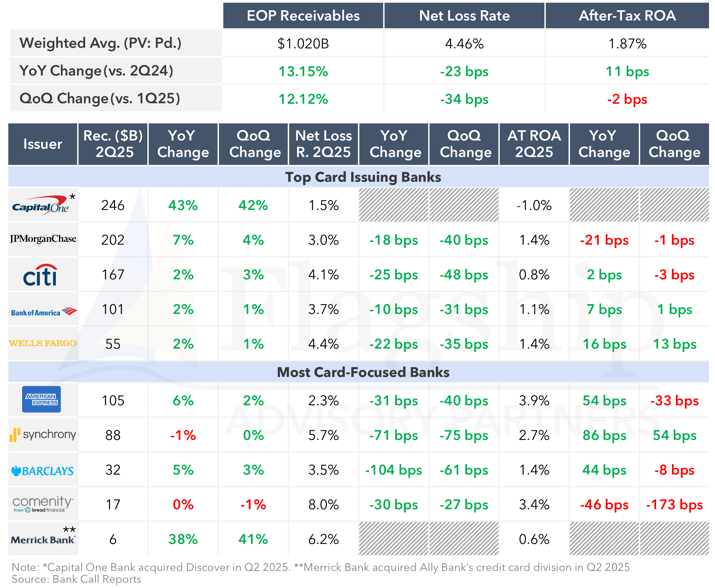

3. Market Size and Credit Loss Performance

(consumer receivables)

General Commentary & Highlights

- The sharp decline in Net Credit Losses across both credit card banks (-10% QoQ) and other banks (-29%) signals that U.S. consumers are continuing to service record-high debt levels effectively.

- After several quarters of muted growth, card portfolio receivables grew +7% QoQ - back towards the historic $1.458T range. This could suggest renewed appetite for revolving credit as the economy stabilizes, and rate cuts begin to filter into consumer sentiment.

- Bank ROA declined modestly for credit card banks (-7% QoQ) compared to diversified peers (+6%), reflecting how a high credit loss environment and narrower spreads are degrading credit card–centric issuers.

- Even as the prime rate eased to 7.5% in Q4’25, average APRs currently remain near 24.5%, showing that issuers have been slow to reprice portfolios downward. This could indicate higher margins for issuers or could be caused by issuers retaining wider spreads to offset rising program costs.

- High spread environments create an opening for aggressive issuers or fintech challengers to win share through rate-led acquisition offers while incumbents lag in repricing.

- The largest and most highly credit focused banks are showing appetite for increasing scale through inorganic acquisition — with both Capital One and Merrick Bank acquiring card assets that doubled their scale in Q2’25.

Please do not hesitate to contact Ryan McDonald at Ryan.McDonald@FlagshipAP.com with comments and questions.

Image Credit: Designed by Freepik

Bank Card Programs Defy Expectations and Drive Stronger Profitability

The second quarter of 2025 marked a significant rebound in bank credit card program NCL rates, reversing from what had been their highest levels in more than a decade. Coupled with near record-high loan balances and widening credit spreads, bank-managed credit card programs are outperforming expectations and delaying what many assumed would be an imminent profitability contraction.

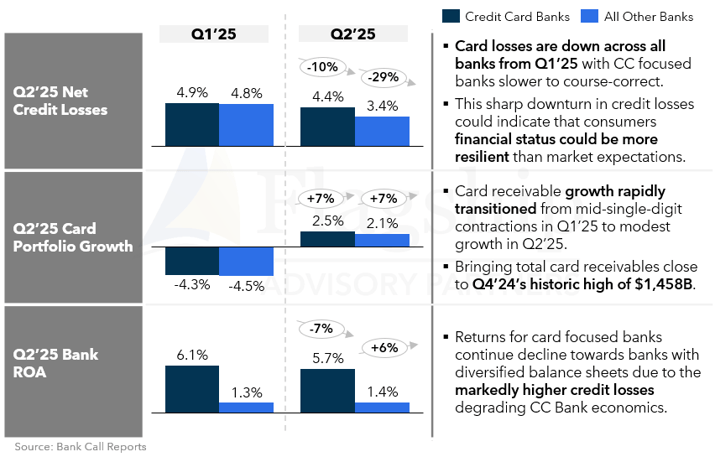

1. Non-Credit Card Banks Vs Credit Card Banks Key Metric Comparison

(Q1'25 vs. Q2'25 consumer receivables)

Q2'25 Net Credit Losses

- Card losses are down across all banks from Q1'25 with CC focused banks slower to course-correct.

- This sharp downturn in credit losses could indicate that consumers financial status could be more resilient than market expectations.

Q2'25 Card Portfolio Growth

- Card receivable growth rapidly transitioned from mid-single-digit contractions in Q1’25 to modest growth in Q2’25

- Bringing total card receivables close to Q4’24’s historic high of $1,458B.

Q2'25 Bank ROA

- Returns for card focused banks continue decline towards banks with diversified balance sheets due to the markedly higher credit losses degrading CC Bank economics.

2. Market Size and Credit Loss Performance

(Q1'20 vs. Q2'25 consumer receivables)

3. Market Size and Credit Loss Performance

(consumer receivables)

General Commentary & Highlights

- The sharp decline in Net Credit Losses across both credit card banks (-10% QoQ) and other banks (-29%) signals that U.S. consumers are continuing to service record-high debt levels effectively.

- After several quarters of muted growth, card portfolio receivables grew +7% QoQ - back towards the historic $1.458T range. This could suggest renewed appetite for revolving credit as the economy stabilizes, and rate cuts begin to filter into consumer sentiment.

- Bank ROA declined modestly for credit card banks (-7% QoQ) compared to diversified peers (+6%), reflecting how a high credit loss environment and narrower spreads are degrading credit card–centric issuers.

- Even as the prime rate eased to 7.5% in Q4’25, average APRs currently remain near 24.5%, showing that issuers have been slow to reprice portfolios downward. This could indicate higher margins for issuers or could be caused by issuers retaining wider spreads to offset rising program costs.

- High spread environments create an opening for aggressive issuers or fintech challengers to win share through rate-led acquisition offers while incumbents lag in repricing.

- The largest and most highly credit focused banks are showing appetite for increasing scale through inorganic acquisition — with both Capital One and Merrick Bank acquiring card assets that doubled their scale in Q2’25.

Please do not hesitate to contact Ryan McDonald at Ryan.McDonald@FlagshipAP.com with comments and questions.