European alternative payment methods (APMs) have a long history of failed attempts to succeed at the physical point of sale (POS). In contrast, Apple Pay has achieved tremendous success. Apple’s tight control over the iPhone’s NFC chip has fueled iOS’s dominance in contactless payments (see Figure 1) while blocking APMs from delivering a comparable user experience (UX). A regulatory push by the EU has now forced Apple to open NFC access, giving European APMs a new opportunity to compete in-store.

However, NFC access alone is unlikely to guarantee success. Even if other wallets match Apple Pay’s UX, they still face major hurdles: achieving broad merchant acceptance and convincing users to switch their default mobile wallet. In this article, we review European APMs’ historical attempts to gain traction in-store and analyze early initiatives and adoption barriers they must overcome to succeed at the POS.

1. Apple OS vs Alternative

European APMs' Past Struggles to Penetrate POS

Many European APMs have been highly successful online, but their attempts to gain traction in physical stores have largely fallen short. As shown in Figure 2, most European APMs hold only negligible share at the POS.

Prior efforts using QR codes and BLE-based payment flows failed because of clunky user experiences and low customer uptake. For example, Vipps MobilePay reported in 2023 that just 2 out of 1,000 transactions (0.2%) occurred via its QR payment flow at the payment terminal—leading the company to discontinue the service 2.5 years after launch.

2. Examples of Failed Attempts of APMs @ POS vs Apple Pay

Apple's NFC Access - a Point of Inflection

Apple’s mandated opening of the NFC chip could be an inflection point for APMs at the POS. As shown in Figure 3, Apple has unlocked core NFC features: third-party wallets can now be set as the default wallet on iOS devices and can access critical UX capabilities such as field detect (to prompt payment), “double click” (to confirm), and Face ID (to authenticate).

3. Select Key Unlocked iOS Features to 3rd Parties

(select screenshot examples)

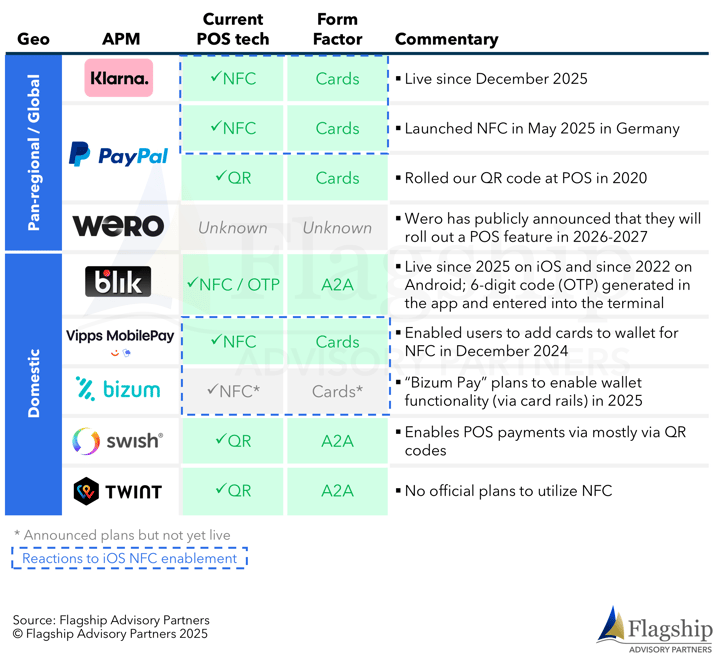

Access to these features has triggered a wave of APM activity. Klarna announced the rollout of tap-to-pay across 14 European markets in December 2025. Vipps MobilePay launched its NFC solution in Norway and Denmark in December 2024. Bizum, Spain’s leading A2A payment scheme, has confirmed development of a wallet using card rails to enable NFC payments at the POS, targeted for Q4 2025 (still not in public promotion as of December 3, 2025). Examples of these launches appear in Figure 4.

Access to these features has triggered a wave of APM activity. Klarna announced the rollout of tap-to-pay across 14 European markets in December 2025. Vipps MobilePay launched its NFC solution in Norway and Denmark in December 2024. Bizum, Spain’s leading A2A payment scheme, has confirmed development of a wallet using card rails to enable NFC payments at the POS, targeted for Q4 2025 (still not in public promotion as of December 3, 2025). Examples of these launches appear in Figure 4.

4. APM Enablement at POS

(select examples)

Three Hurdles APMs Must Clear to Win In-Store

In our view, to succeed at the POS, an APM must overcome three major hurdles:

- Offer a compelling transaction UX: The UX must be at least on par with market leaders such as Apple Pay.

- Ensure a broad acceptance network: The payment method must be supported by all merchant segments and PSPs.

- Change consumer behavior: APMs need tools that motivate users either to switch their default wallet away from Apple Pay or, for non-wallet users, to adopt their digital wallet in the first place.

We assess these hurdles through the recent experiences of Vipps MobilePay and BLIK:

Example 1) Vipps MobilePay, Norway

Launched in December 2024, Vipps MobilePay in Denmark and Norway became the first European digital APM to introduce a ‘tap-to-pay’ solution on iOS devices. We assess Vipps MobilePay’s proposition in the context of the adoption hurdles outlined below:

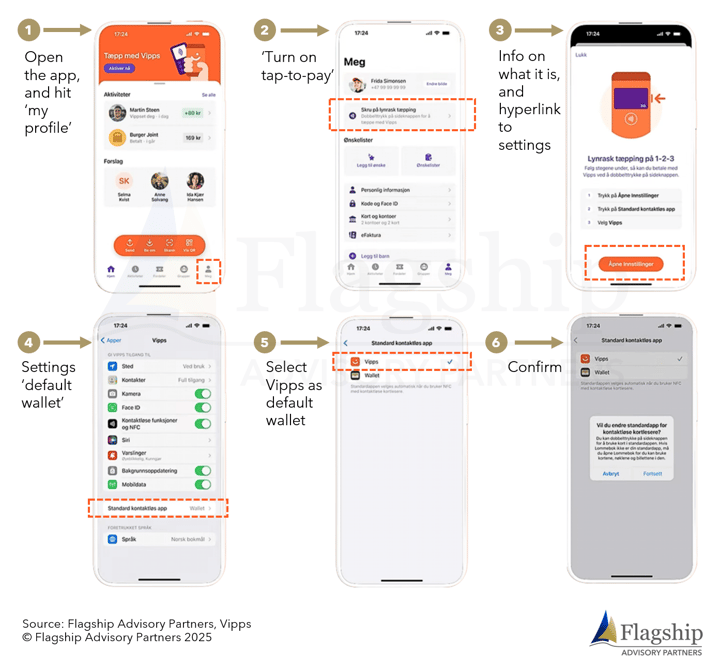

- Easy and intuitive UX: As shown in Figure 5, Vipps offers a user experience on par with Apple Pay.

- From limited to international merchant acceptance: Vipps was initially set up using BankAxept (local debit card) tokens, limiting transactions to domestic debit cards. As of September 2025, Vipps expanded compatibility to Visa and Mastercard, enabling near-universal merchant acceptance in Norway and extending usability internationally.

- Consumer behavior hurdle remains: The biggest challenge yet, is convincing users to complete a multi-step setup process to make Vipps their default wallet, which can be a real hurdle—especially for those already using Apple Pay. Figure 6 illustrates the activation flow needed to set Vipps as the default wallet.

5. Apple Pay & Vipps Offer the Same User Experience

6. Setting up Vipps for NFC

Example 2) BLIK, Poland

BLIK launched its NFC POS proposition for Android in the first half of 2022, and at iOS devices in 2025 after the unlocking of Apples NFC. BLIK’s NFC transactions have grown substantially faster than its legacy non-NFC POS solution, which relied on a six-digit passcode (roughly 95% growth vs. 40% from 2022–2024). BLIK NFC now represents an estimated 2–3% of total POS payment value in Poland. Figure 7 illustrates the product. We examine the adoption hurdles in context of BLIK NFC below:

- Easy and intuitive UX: BLIK NFC offers a UX comparable to Apple Pay and is a major improvement over BLIK’s earlier POS flow, which required entering a 6-digit code at the terminal.

- Wide merchant acceptance: Unlike Vipps MobilePay, BLIK is a pure account-to-account payment method with no reliance on card schemes for POS acceptance—an approach that materially increases the complexity of building out merchant acceptance. BLIK solved this by investing in partnerships with several acquiring banks and PSPs to develop the POS acceptance network. As of today, 100% of all POS terminals that are compatible with Mastercard contactless technology accept BLIK NFC transactions. In a strategic partnership with BLIK, Mastercard powers the technology to tokenize NFC transactions from consumer bank accounts.

- Gaining consumer traction, though adoption hurdles remain: As of November 2025, BLIK’s NFC product is used by c.3.9 million consumers (c. 20% of BLIK users). BLIK NFC found early success due to relatively lower penetration of Apple iOS in Poland. Despite this, adoption hurdles remain: To enable BLIK NFC payments, a user is required to go into their bank’s mobile app, activate “BLIK contactless payments”, confirm activation (often with PIN or biometric), enable NFC on the phone, set a secure screen lock (PIN or biometrics), and (in many cases) make the banking app the default for contactless payments.

7. BLIK Success @ POS

Although Vipps MobilePay and BLIK are still early in their POS lifecycles, the takeaway is clear: technology and UX are necessary, but the real test is whether they can get consumers to use their wallet at the POS.

Conclusion

Apple’s opening of the iOS NFC chip is not yet the game-changer many expected. The real hurdle for European APMs is no longer technological—it’s scale and habit. Early movers like Vipps and BLIK are only beginning to test what it takes to shift consumer behavior, and others such as Klarna, Bizum and PayPal will soon add more data points. The story about APM’s inroads at POS in Europe is still being written, and the winners will be those that persuade Apple Pay users to switch and convert non-wallet users into active users of their wallet and achieve a broader merchant acceptance network.

Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com, or Elisabeth Magnor at Elisabeth@FlagshipAP.com with comments or questions.