Crypto’s Evolution From a ‘Store Of Value’ to a ‘Medium Of Exchange’

Despite its recent dip, 2021 was a breakthrough year for crypto, with its market capitalization rising by 188% to reach ~$3 trillion in November 2021. Crypto’s profile and growth to date has derived from its utility as a store of value, but we are finally starting to see its potential as a ‘medium of exchange’. In this article, we examine how crypto payments are gaining relevancy in mainstream commerce, illustrate the current payments use cases, and evaluate their growth outlook.

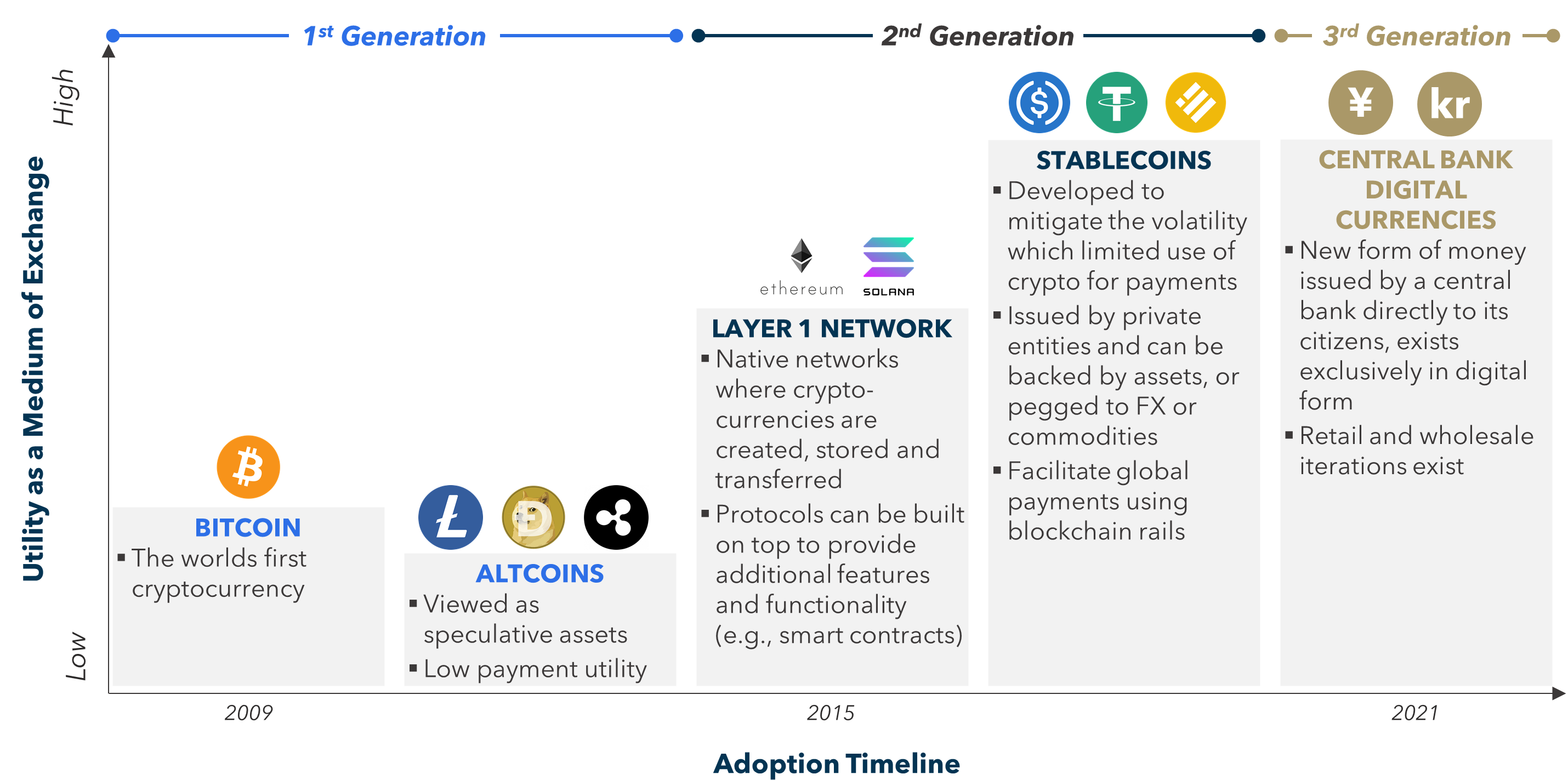

Bitcoin, the first cryptocurrency, was introduced in 2009 as an alternative medium of exchange to fiat-based currencies. This first generation of cryptocurrencies (bitcoin then others) never gained meaningful traction as payment methods due to their high volatility, low transaction processing speeds, and lack of acceptance. Bitcoin was highly successful as a validation of blockchain technology, which subsequently inspired the development of new generations of crypto across a wide range of applications (as shown in figure 1). Today, select cryptocurrencies (e.g., Solano) and next generation crypto innovations such as stablecoins (e.g., Tether, USDC, Dai) and central bank digital currencies (CBDCs) are driving a radical shift in consumer and merchant perceptions and accelerating usage of crypto payments.

FIGURE 1: Evolution of Crypto & Relevance as a Medium of Exchange

Source: Flagship market observations

Drivers of Crypto as a 'Medium of Exchange’

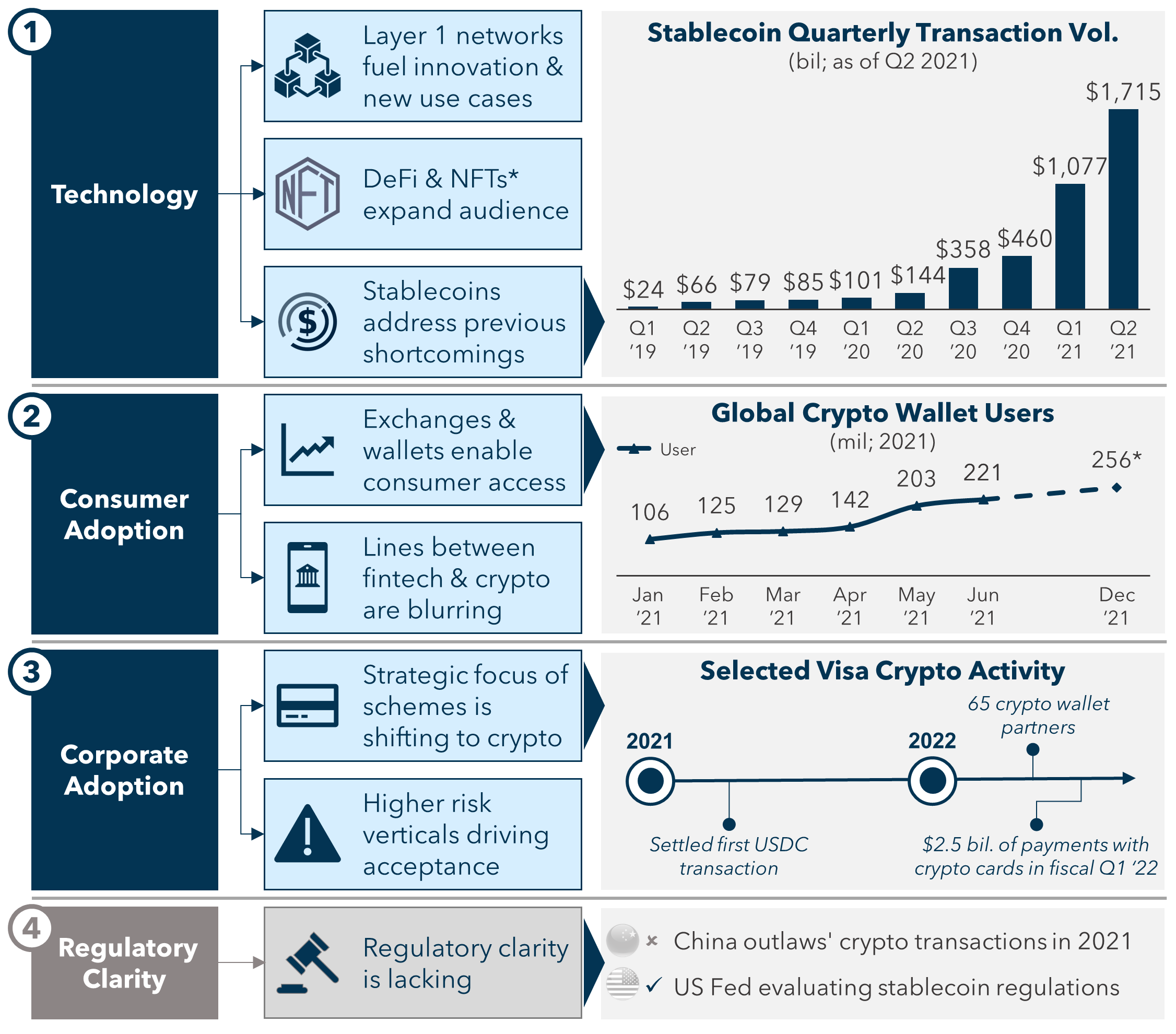

As we outline in figure 2, crypto currencies are evolving beyond a ‘store of value’ to relevance as a ‘medium of exchange’. Emergence of new technological innovations such as stablecoins, NFTs (non-fungible tokens, which are essentially digitized tokens of ownership against digital assets) and DeFi (decentralized finance, a new breed of financial securities and investment vehicles built on the blockchain network) have accelerated consumer curiosity and adoption. Traditional PSPs have invested in crypto as a growth vertical and have further invested in strategic M&A. Visa and Mastercard have also adapted their rails to settle select crypto directly. Lastly, while regulations continue to be a double-edged sword, greater clarity in some markets is encouraging adoption by traditional actors.

FIGURE 2: Building Blocks of Crypto Payments Adoption

Source: Theblockcrypto.com, Chainanalysis.com, Flagship Advisory Partners analysis

Current State of Crypto Payments

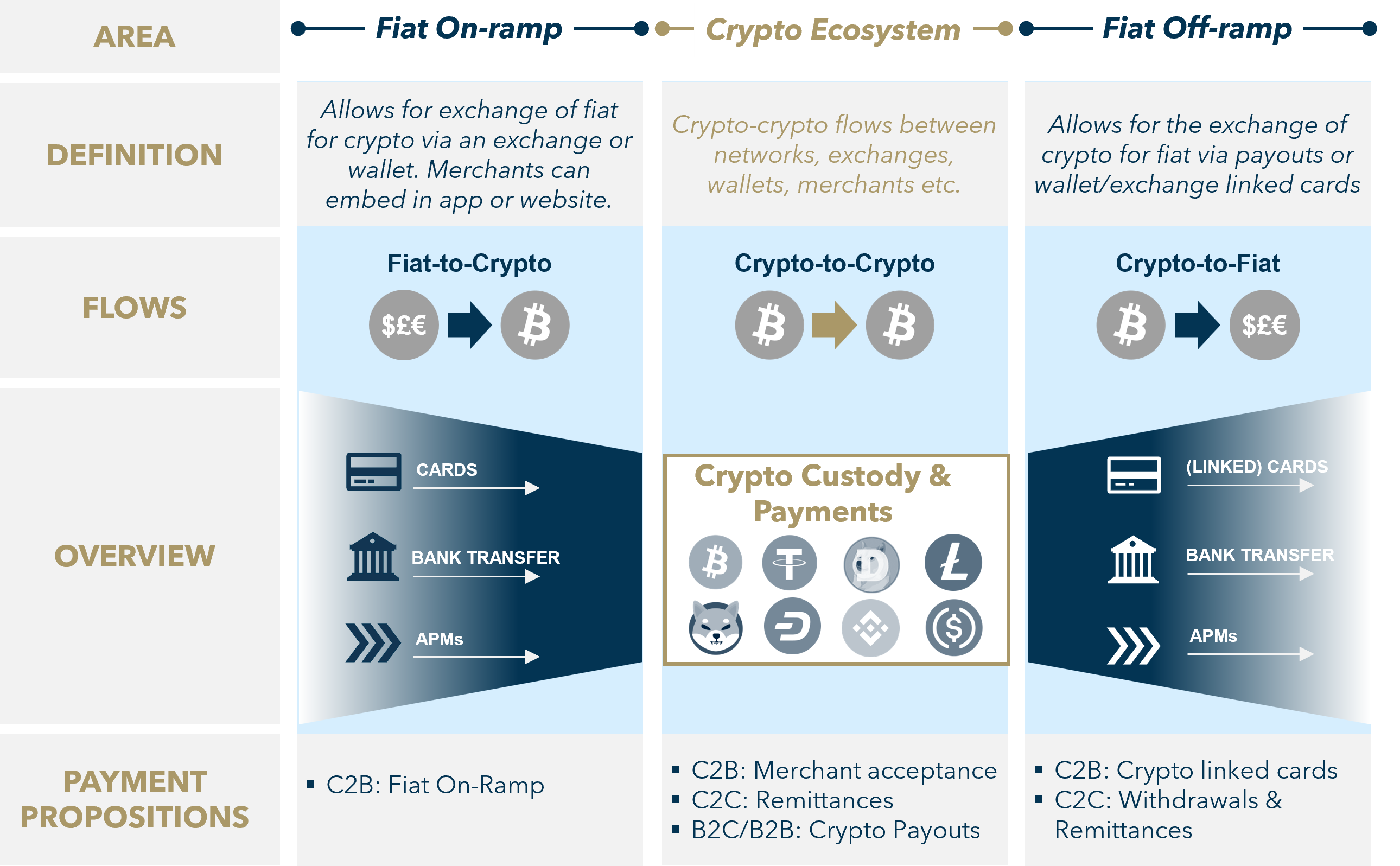

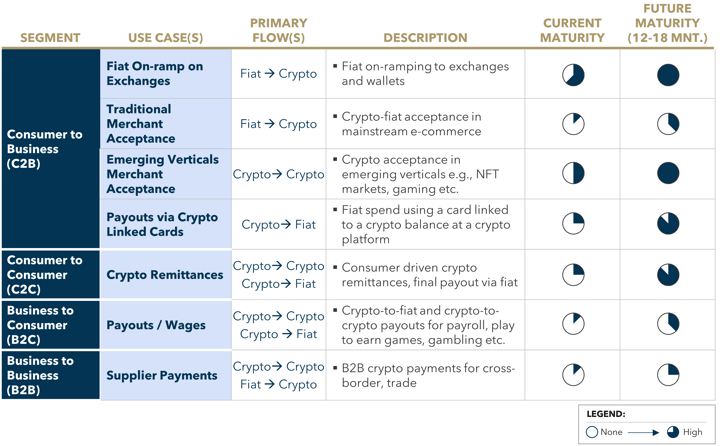

As illustrated in figure 3, crypto payments primary use case today is on-ramping and off-ramping fiat to crypto via exchanges (where volumes are huge). Several specialized fintechs that offer fiat on-ramps (buying crypto in exchange for fiat currency) have emerged on this basis (e.g., Ramp, MoonPay, Wyre), and many traditional PSPs have also thrived supporting these volumes (e.g., Checkout.com, Nuvei, Worldpay). New merchant segments, beyond exchanges, have also emerged (e.g., NFT marketplaces, GameFi, DeFi) accelerating the opportunity for C2B crypto acceptance. In traditional ecommerce, we have seen an acceleration of crypto acceptance as a payment method by merchants in select verticals such as online gaming, luxury travel, digital and adult services. In the last 12 months, Visa and Mastercard have partnered with over 80 crypto exchanges, enabling these exchanges to issue branded cards. These cards have accelerated the acceptance of crypto towards C2B online commerce. Visa recently announced the total card volumes exceeded $2.5 billion in its fiscal Q1 of 2022, already accounting for 70% from last year’s volumes. Select businesses are also facilitating B2C and B2B payouts using crypto, though this is specific to select verticals, mainly addressing payouts to contract and gig workers (independent, online platform contractors). Crypto payments are also evident in C2C remittances today, providing an economical way to remit payments especially for consumers in emerging markets.

FIGURE 3: Crypto Payments Proposition Models Overview

Source: Flagship market observations

Source: Flagship market observations

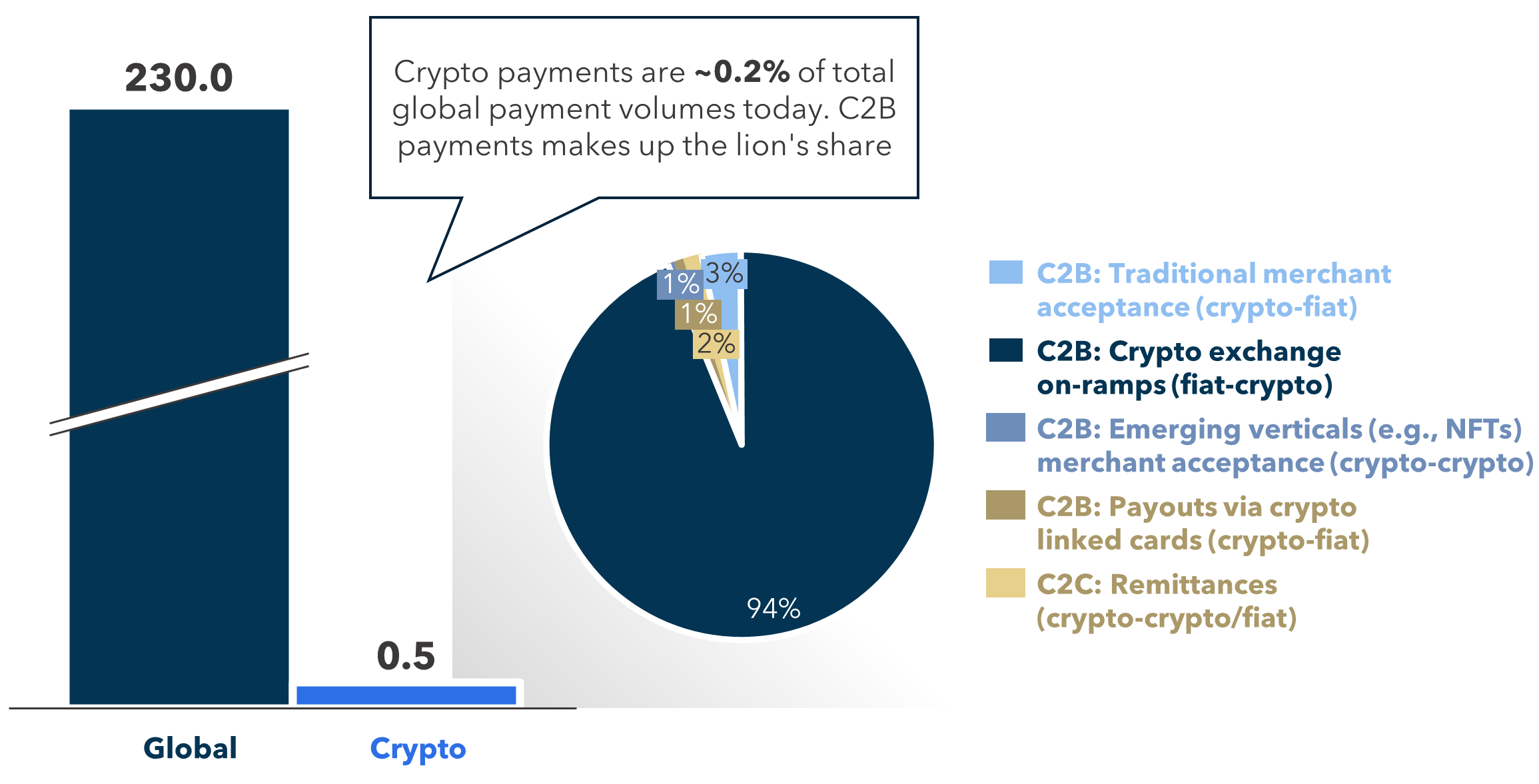

As we illustrate in figure 4, we estimate crypto payment volumes at €0.5 trillion today, a tiny fraction compared to the global aggregated C2B, B2B and B2C payments turnover. C2B Fiat on/off ramps account for 95% of this share, so general purchasing and other use cases remain small.

FIGURE 4: Global Volumes: Traditional Payments vs. Crypto Payments (USD trn.; 2021)

Global includes payment volumes in B2B, B2C, C2B and C2C services

Global includes payment volumes in B2B, B2C, C2B and C2C services

Source: Visa, Flagship analysis

While crypto payments are small today, we expect volumes to accelerate and grow rapidly in the next 12-18 months. As illustrated in figure 5, C2B crypto payment adoption will continue to grow as newer generations of crypto mature with the ability to support rapid, simple and low cost means of payment in everyday life. We consider cross-border C2C to be potentially disruptive to traditional fiat remittance payments, as consumers are likely to benefit from economical price points and to be able to remit money in real time. B2C and B2B may take a little longer to mature, as traditional businesses will take time to embrace crypto.

FIGURE 5: Crypto Payments Maturity by Use Case

Source: Flagship market observations

Source: Flagship market observations

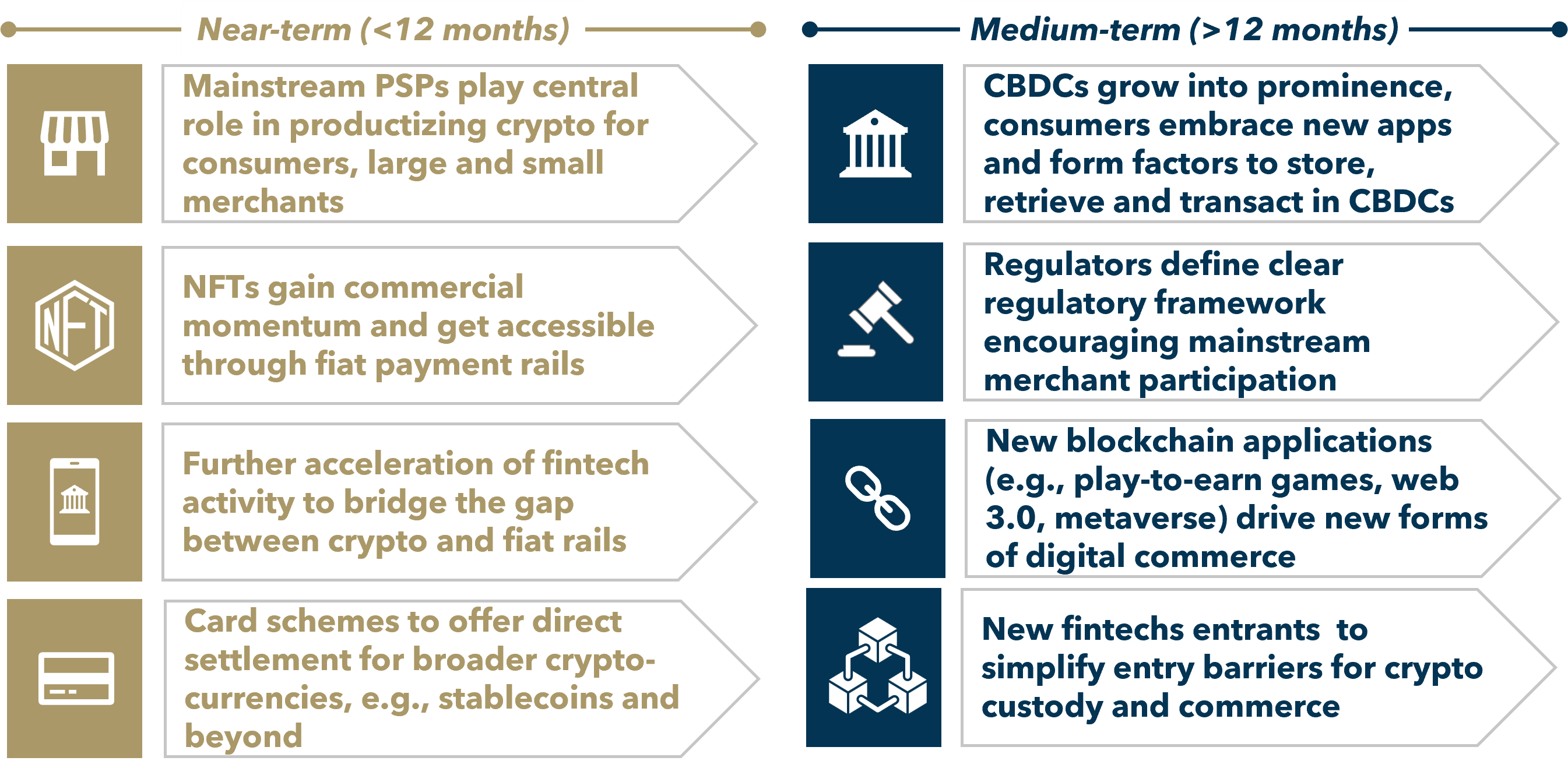

Our expectation for acceleration of crypto use cases is based on the growth drivers that we outline in figure 6. In the near term, we anticipate mainstream PSPs to play a central role in driving consumerization of crypto. New blockchain applications in the form of NFTs will gain momentum and be accessible through fiat rails. We anticipate card schemes and regulators to play an important role in creating the network and the rules for direct crypto settlement. In the medium term, we do expect a tipping point when crypto becomes more mainstream, due to 1) regulatory clarity and sovereign, acceleration of CBDCs, and 2) acceleration of new commerce activity in platforms such as Metaverses and platforms built on Web 3.0.

FIGURE 6: Growth Drivers

Source: Flagship market observations

Conclusion

Payments has been an elusive aspiration of the cryptocurrency ecosystem since its inception many years ago. However, the key building blocks are now in place and a series of growth drivers are coming that we expect will accelerate the digital enablement of crypto payments in everyday commerce. We remain optimistic of the upsides in crypto and its appeal to both consumers and merchants as a long-term vehicle of commerce.

Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Dan Carr at Dan@FlagshipAP.com with comments or questions