Since the introduction of PSD2 and open banking regulations in early 2018, 451 third party providers (TPPs) have procured licenses for payment services (PIS) and account services (AIS). Out of the 451, 422 are currently active.

We recently analyzed the landscape of these active TPPs from the EBA register, examining their licensing demographics, the segments served and the underlying business models. We present some of our key findings in this article.

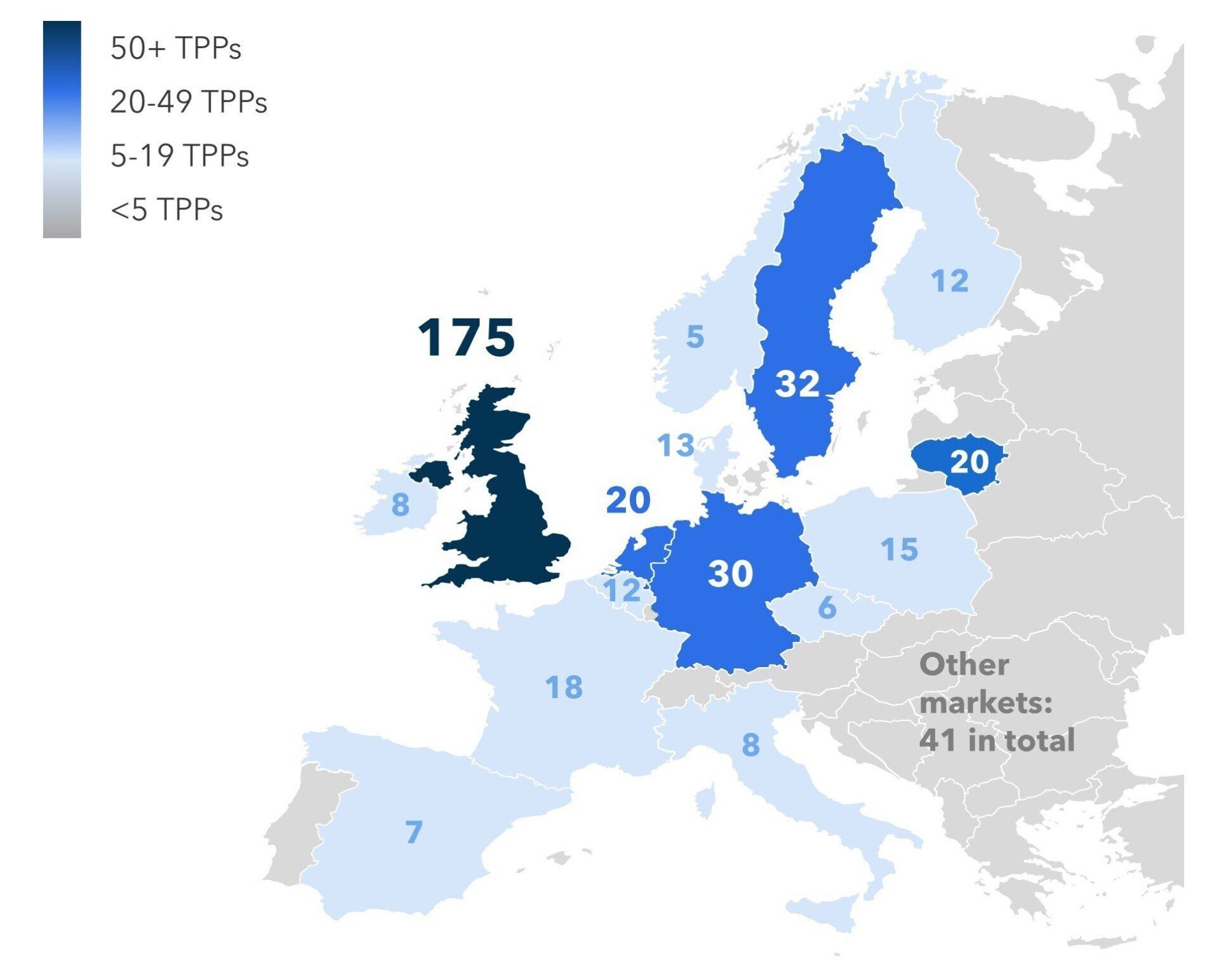

As shown in Figure 1, UK continues to be the European open banking powerhouse accounting for c. 40% of all registered TPPs in Europe. UK’s open banking regulations offered TPPs with a standardized account to account (A2A) technical interface which has not surprisingly attracted a larger number of TPPs. In rest of Europe, the PSD2 technical standards and interfaces continue to be fragmented, and banks have been slow to offer the end points to access the A2A infrastructure, broadly explaining why TPPs growth in rest of Europe has lagged the UK.

FIGURE 1: Number of TPPs Across Licensed Countries (May 2021)

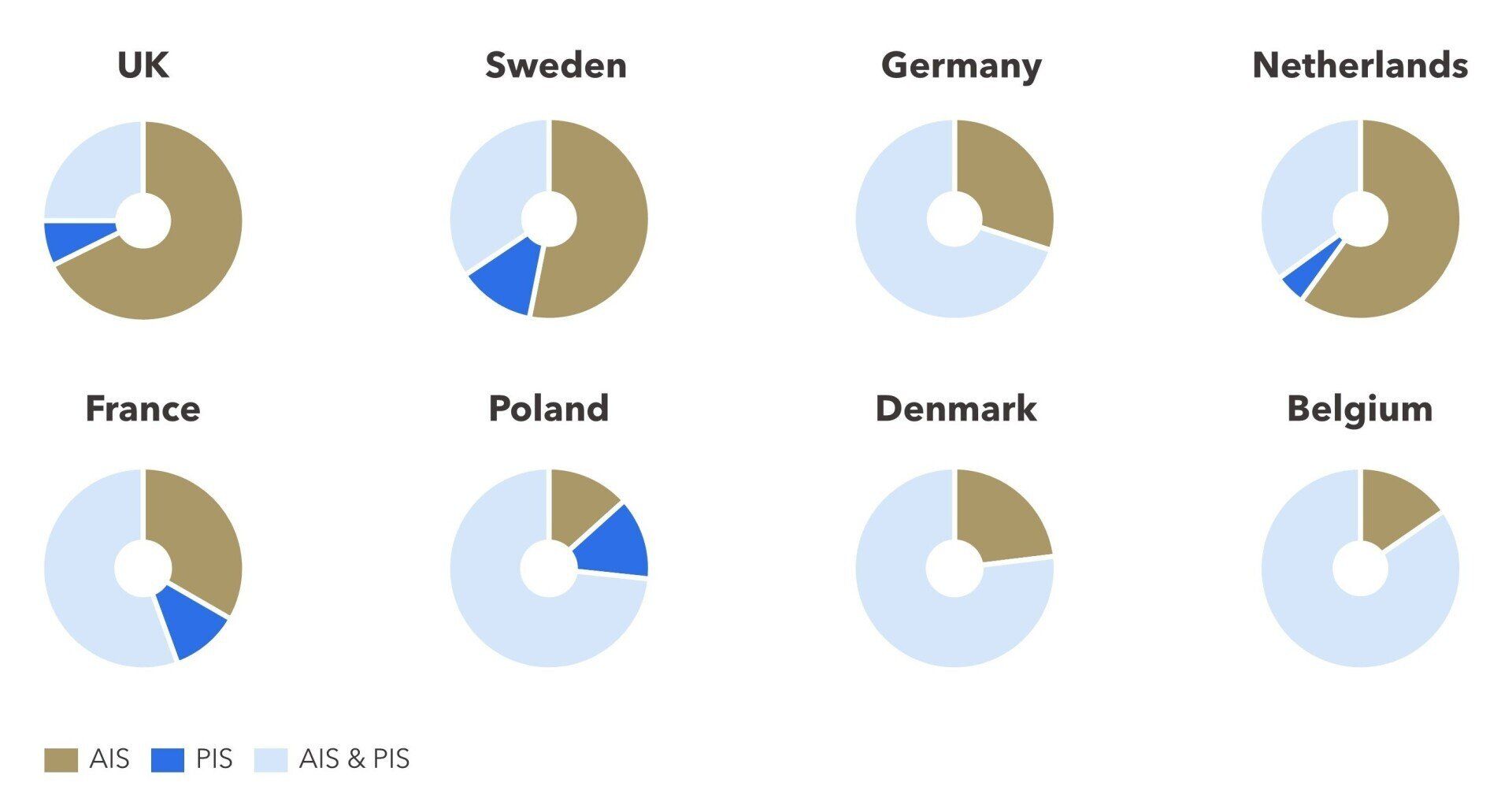

More than 90% of the TPPs today have an AIS license, indicating a strong interest in account aggregation services. This emphasis on AIS is evident across top TPP markets such as UK, Sweden and the Netherlands (see Figure 2) which are mature European fintech hotbeds. Fintechs in these markets, such as Klarna, Monner, Trustly and Monthio are enhancing their digital products and services with account aggregation services to drive value for both consumers and businesses. However, in other markets such as Poland, Denmark and France, we see a greater interest in PIS licenses. The prevalence of a higher number of ecommerce PSPs and wide prevalence of A2A payments (e.g. Poland) in these market are contributing factors to explain this trend.

FIGURE 2: Break-Up by License in Top 8 Markets (% of registered TPPs)

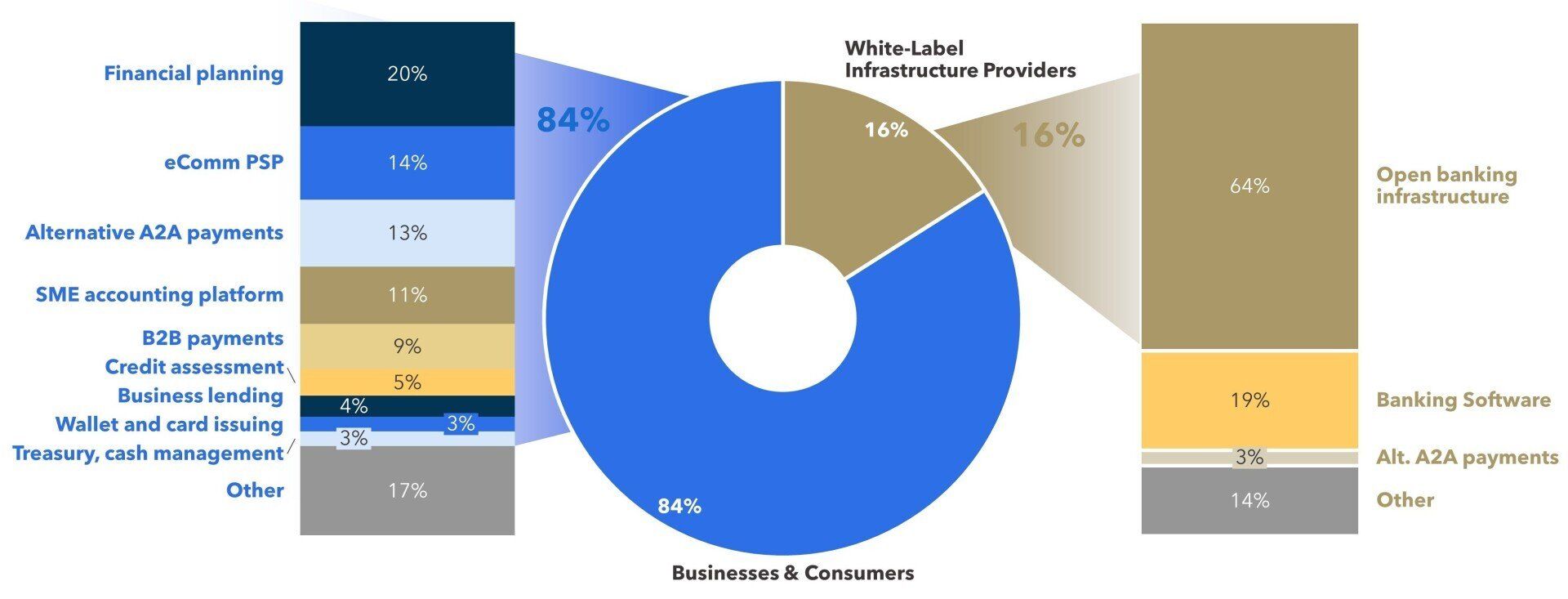

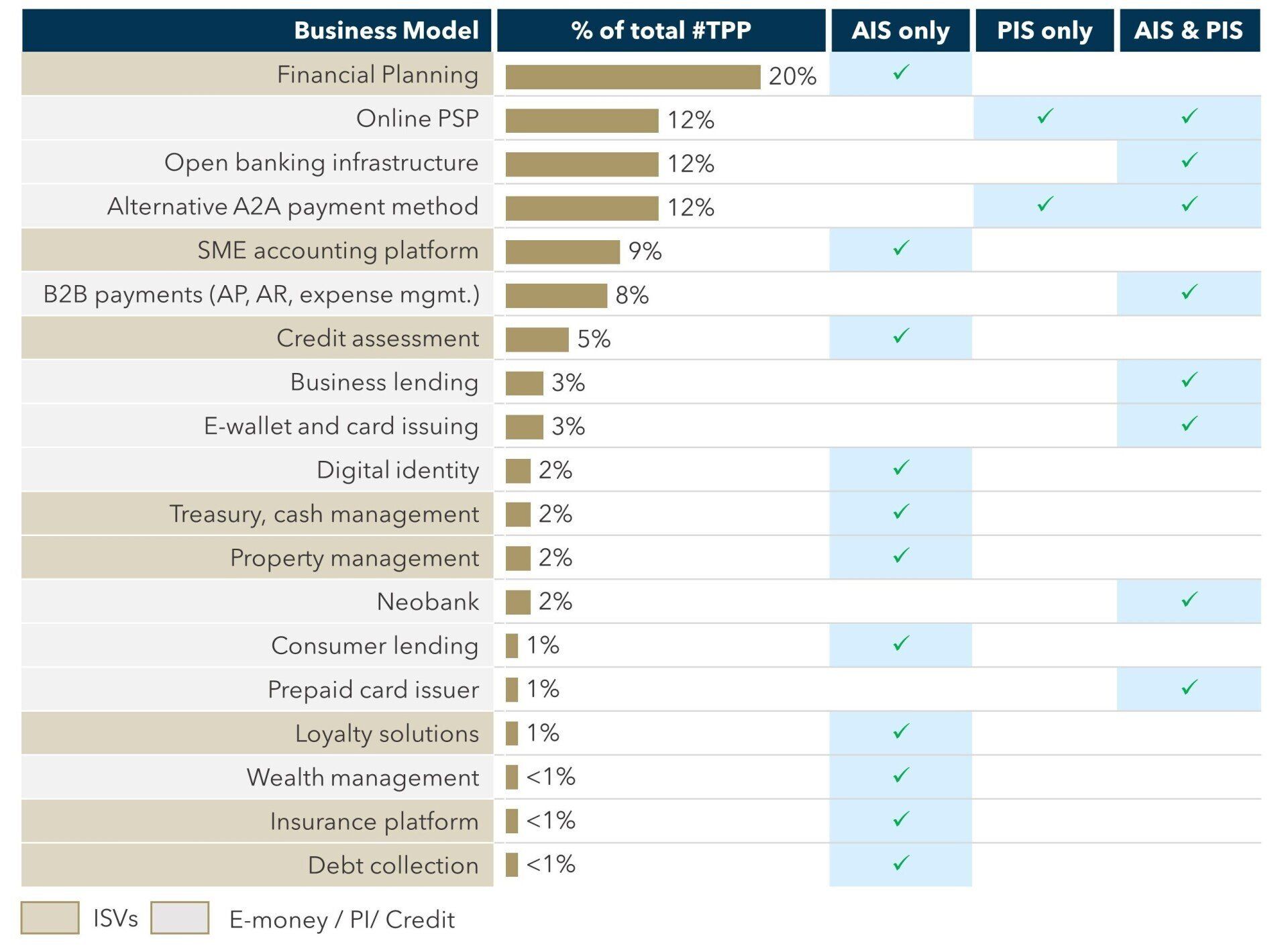

As we depict in Figure 3, c.85% TPPs serve consumers and businesses (with businesses being the largest sub-segment), the rest being fintechs that serve banks and businesses through infrastructure services. Of the TPPs that serve businesses and consumers, financial planning providers emerge as the largest segment making up c.20% of the TPPs. These fintechs are essentially AIS licensees that serve mainly consumers (and some businesses) by aggregating account data from banks and offer value added services in financial planning, investments, or savings. Online ecommerce PSPs and alternative A2A payments are the next largest segments making up more than 25% of the TPP break-up. Online PSPs view A2A payments as a complementary payment method (next to cards and APMs) that can serve specific verticals (such as recurring, gaming, non-profits, wealth management) better. SME accounting platforms and B2B payment fintechs are also a sizeable segment, contributing to c.20% and value the open banking rails to drive payments and efficiencies in the B2B payables /receivables and expense management processes.

Infrastructure providers are generally newer fintechs that offer next-generation bank payment rails to connect businesses to banks and fuel the A2A payment connectivity. We also see a few specialized banking software vendors that have diversified into areas such as digital identity or PSD2 consent management services.

FIGURE 3: Split Across Segments & Business Models Served (% of registered TPPs)

Examining the regulatory licensing segmentation of the TPP business models in Figure 4, we observe a significantly higher adoption of AIS licenses (rather than PIS) among European software/SaaS companies. This illustrates that open banking payment services are still nascent in the European ISVs/SaaS community. PIS licenses hand have largely attracted registered e-money, payments and credit institutions that already play a role in payment services. The primary PIS use cases are allowing consumers to perform an ecommerce checkout with an alternative A2A payment method or funding wallets or e-money through A2A payment rails. We also see emergence of PIS services with select B2B payment use cases, e.g., employee expense payments, payroll, or supplier payables.

FIGURE 4: Dominant Regulatory Licenses Observed Across the TPP Business Models

Three years after the implementation of the regulations, the development of PSD2 and open banking as disruptive forces in the European payments industry is still a developing story. The TPP landscape has many entrants into the PSD2 paradigms, but a slow pace of development and no major disruptions. There is an early emphasis on account aggregation services, less so on payment initiation services. As the saying goes, people tend to overestimate near-term disruption and underestimate the long-term disruption, which seems to be the case for PSD2 to date. We do anticipate acceleration of use cases and scale running through PSD2 licenses and rails in the next couple of years.

Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Joel van Arsdale at Joel@Flagshipap.com, with comments or questions.