Investors love SaaS and integrated payments, as we recently showed here. Marqeta, a next generation issuer processor, went public on June 9 with a market cap at close of $16 billion, 13% above the IPO price. Based on Marqeta’s historical revenue growth rate of cca. 100%, this valuation corresponds to approximately 68x forward twelve months’ gross profits, illustrating that investors’ love of digital payments also extends to the issuing side of the business.

Marqeta’s IPO prospectus (available here) provides several insights into the company:

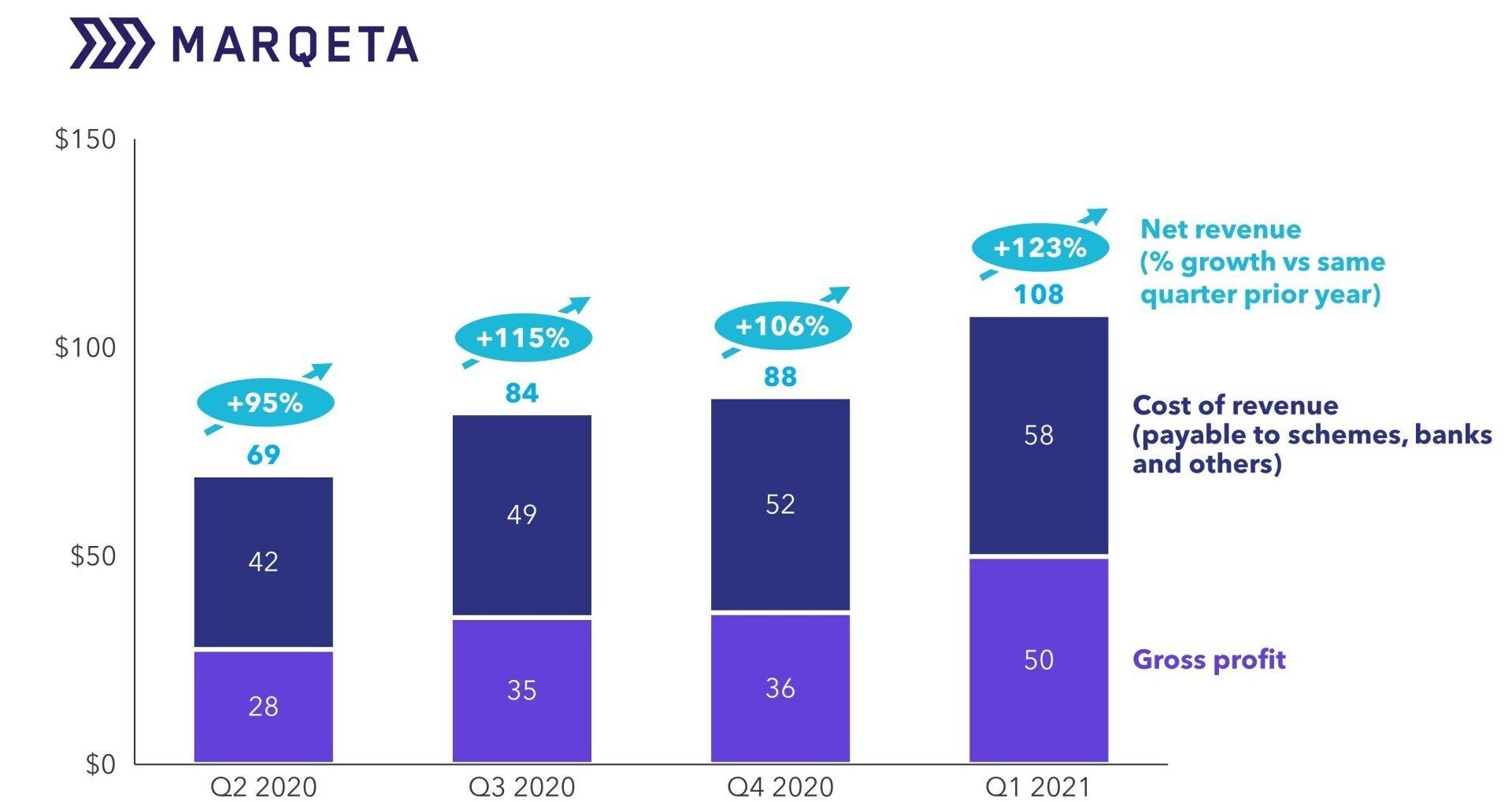

- Marqeta has achieved truly impressive revenue growth due to its use of modern architecture and APIs to target virtual cards, integrated payments, and other segments not well served by incumbent issuer processors - gross revenue grew by 103% between 2019 and 2020, and y/y quarterly growth has been over 100% for the last three quarters, as shown in Figure 1 below.

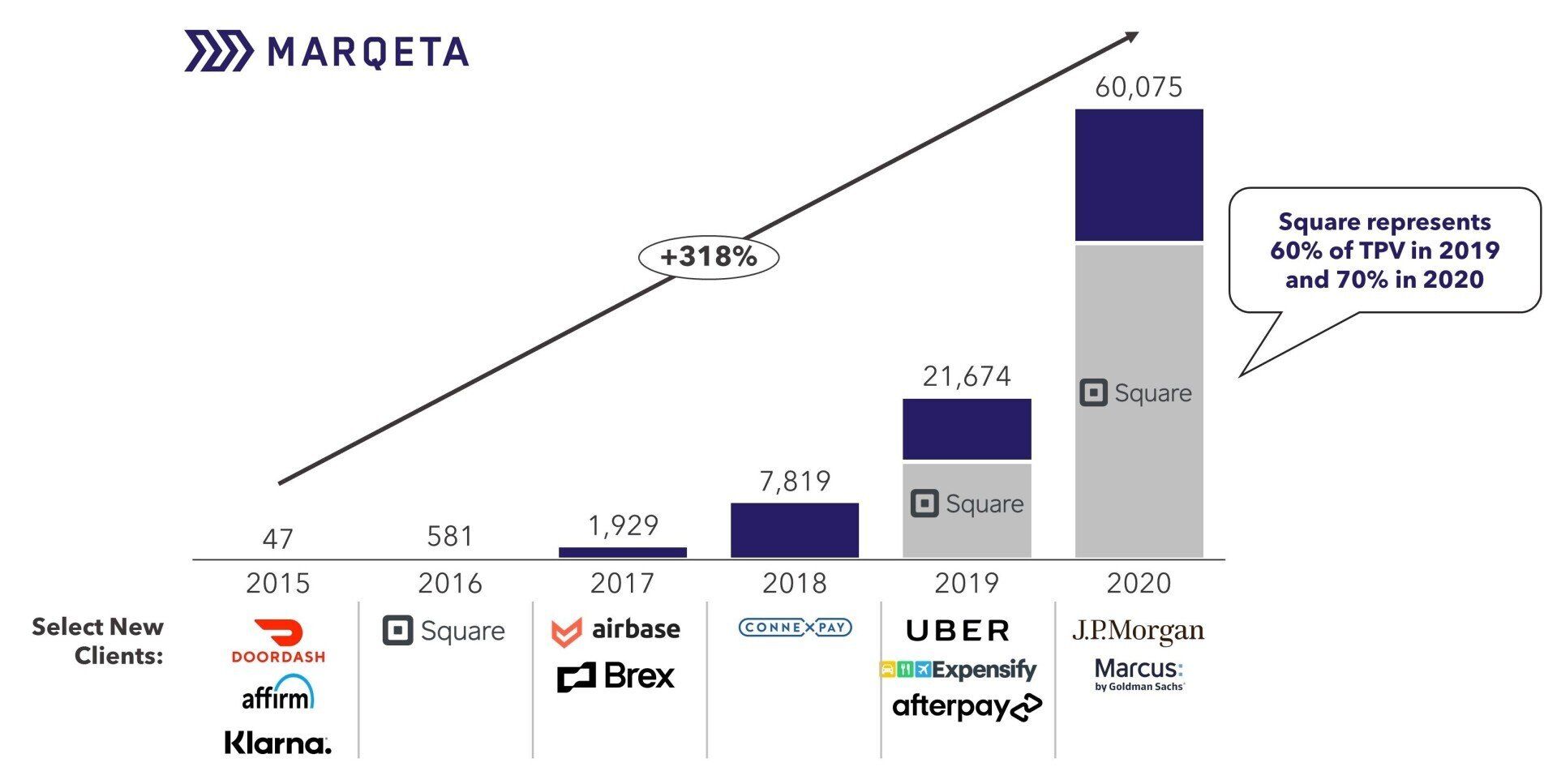

- However, Marqeta’s revenue and growth is highly concentrated in Square, which accounts for 70% of net revenue and volume in 2020, and comprised 80% of growth in 2020 processed volume as shown in Figure 2 below.

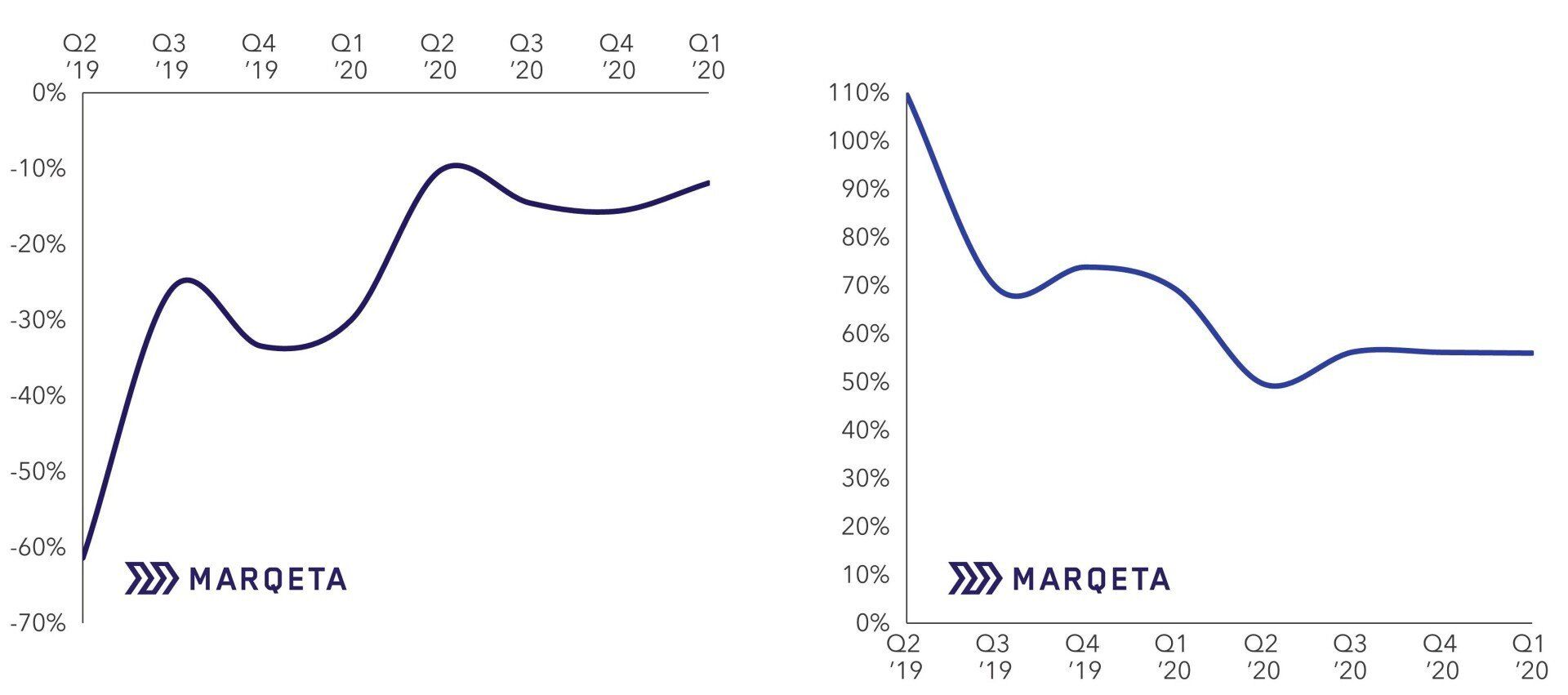

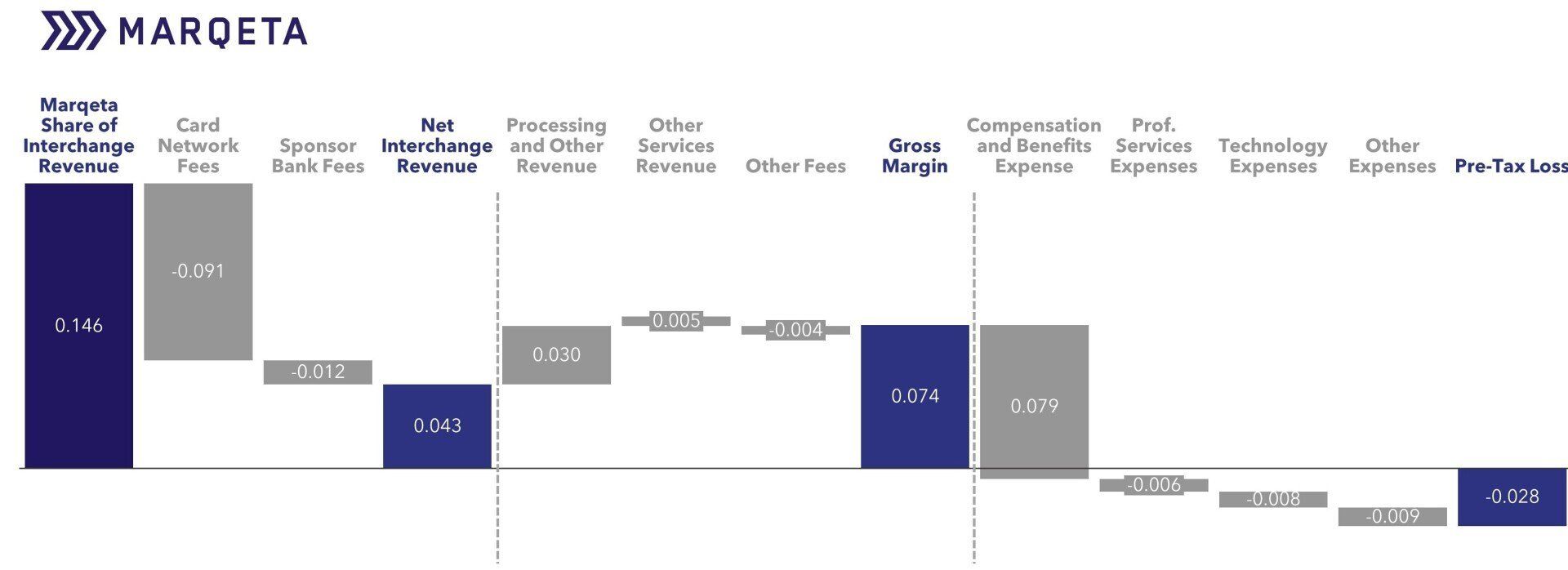

- Marqeta runs at a loss (Figure 4), although bottom line performance is improving as shown in Figures 3 and 4 below. Employee compensation comprises 77% of the expense base, and averages $296,000 per full-time employee, indicating the continued need for scale.

- Less than 2% of net revenue is from outside the U.S.

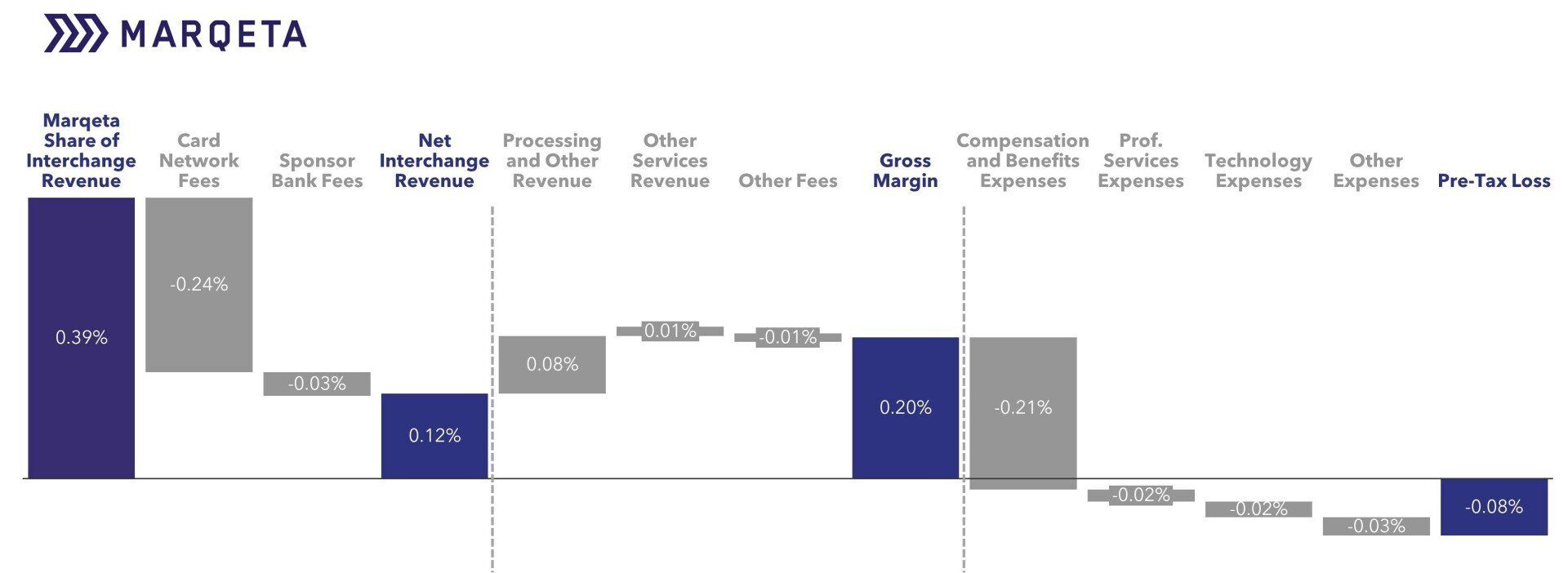

- Unlike traditional issuer processors, about half of Marqeta’s revenue is from interchange sharing, similar to a prepaid card program manager (shown in Figure 5 below). In 2020, Marqeta netted 11bps in interchange revenue plus $0.03 per transaction in processing and other revenue.

FIGURE 1: Marqeta Quarterly Revenue Growth ($ mil.; % net revenue growth vs same Quarter prior year)

Cost of Revenue: Share of revenue payable to card schemes, partnered banks and other engaged parties

Gross Profit: Profit after deduction of cost of Revenues and before deduction of OPEX

Source: Marqeta, Flagship analysis

The success of Marqeta and other next-gen processors has driven a renaissance in the formerly staid world of issuing processing (discussed in more detail here). Next-gen processors’ impressive growth has been driven by combining modern architecture and APIs with a focus on fintech segments such as integrated payments, virtual cards, and B2B. Incumbent processors are less well positioned to serve these segments, so the high growth rates achieved by Marqeta and other next-gen processors begs the question of how incumbent processors will compete in these high-growth segments, or whether they will continue to focus on their traditional customer bases (primarily banks). Incumbent processors will also need defensive strategies as next-gen processors begin to target smaller banks and “bolt on” products for larger banks.

FIGURE 2: Marqeta Total Processed Volume ($ mil.)

For their part, next-gen processors will need to address how to maintain their growth curves. While the next Square may be out there, the next-gen processor sales strategy leans towards signing many initially small clients in anticipation of a few growing into blockbusters. A logical question for next-gen processors is if and how to attack the traditional bank issuer segment of the market. The downsides of selling processing to banks are well known (banks lack the growth characteristics of fintechs, and banks have idiosyncratic and slow buying processes), but they do bring huge volumes, and many need technology upgrades. At the same time, next-gen processors will also need to broaden their product catalog (Marqeta launched credit cards in February 2021) and add higher margin value-added services (managed services offerings, add-ons such as customer onboarding tools, etc.) to fuel continued revenue and margin growth. North American next-gen processors will also need to address how to expand internationally, particularly into markets such as Europe where the B2B account-to-account (bank transfer) infrastructure is much stronger, and there are different sets of needs (e.g., cross-border payments).

FIGURE 3: Net loss as % of Net Revenue FIGURE 4: OPEX as & Net Revenue

While many fintechs choose next-gen processors for their issuing processing needs due to modern architecture and APIs, most traditional banks have steered clear, partially due to most next-gen processors’ limited product set that is primarily focused on debit and prepaid. Banks need new payments revenue sources and the high growth offered by segments like B2B and Buy Now Pay Later, but many will be hesitant to migrate away from existing processing arrangements. Next-gen processors could fill the gap here, by offering (relatively) quick and easy “bolt-on” products to supplement banks’ core cards businesses and processing. Next-gen processors can also appeal to medium and small banks that often have simpler product catalogs and are more receptive to non-traditional offerings.

FIGURE 5: Marqeta 2020 P&L Breakdown (as % total processed volume)

Click to expand image

FIGURE 6: Marqeta 2020 P&L Breakdown (as per transaction in $)

Click to expand image

Marqeta’s valuation illustrates the huge value-creation opportunities in digital payments, and that growth opportunities still abound on the issuing side of the business, albeit in less traditional market segments. These successes have recently driven leading digital acceptance players such as Stripe and Adyen to enter issuing, setting the stage for continued innovation.

Please do not hesitate to contact Erik Howell Erik@FlagshipAP.com or Anton Zoldak Anton@FlagshipAP.com with comments or questions.