*This is the third of a three-part series in which we examine the evolution of software-integrated payments and fintech. In this third part, we look at how integrated payments are driving value creation for SaaS public equity investors.

Investors love the story of integrated SaaS and fintech. Leading SaaS providers are growing rapidly boosted by the revenue potential of fintech. Leading SaaS providers achieve massive growth, deep penetration of payments, and frequently earn robust revenue take rates (including Shopify’s whopping 2.4%). The success of SaaS Fintech crosses verticals and is rapidly globalizing. We discuss these fundamentals and why investors love the story.

SaaS has tremendous tailwinds, boosted by rapid movement of business services into the cloud (which accelerated during the pandemic). SaaS platforms are ideally suited to integrate financial services, although this potential is most meaningful for small businesses. The SaaS Fintech proposition is unlocking a new and highly profitable growth for SaaS platforms, which in turn is fueling investor excitement and equity valuations for SaaS Fintech winners.

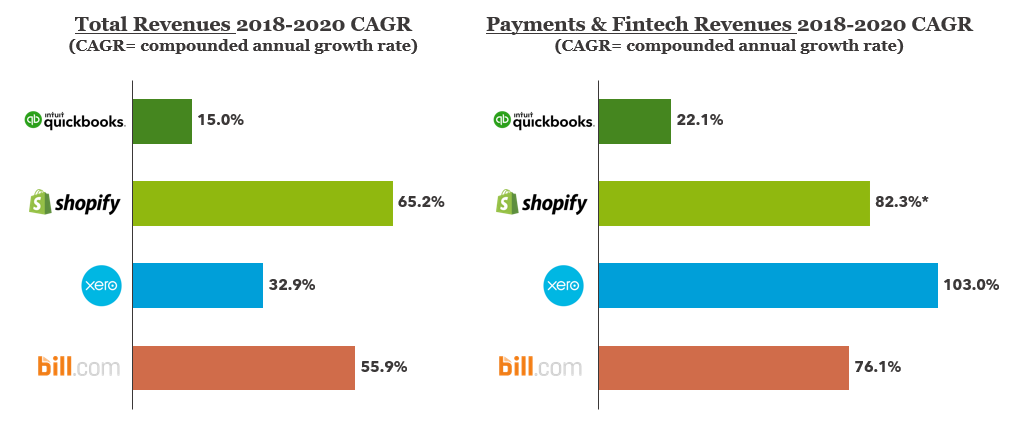

Revenues arising from fintech (mostly payments) are a major driver of leading SaaS providers’ top-line growth, outpacing total revenue growth. In Figure 1, we compare the 2018-2020 CAGR of payments and fintech to total revenues for select SaaS market leaders.

FIGURE 1: Revenue Performance of Select SaaS + Payments Platforms

*Revenues from Shopify Merchant Solutions

Source: Annual Reports; Flagship Advisory Partners

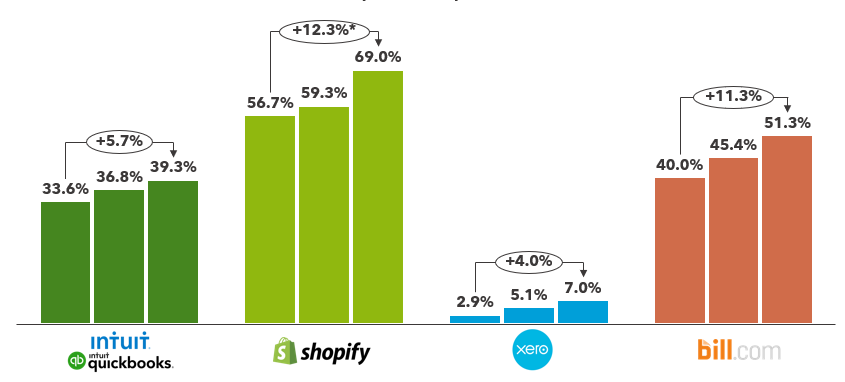

As illustrated in Figure 2, financial services now account for a majority of revenue for Shopify and Bill.com and are an impressive 39% and growing for Intuit (Quickbooks). Xero, another global SME accounting platform is still growing into its finte ch potential, demonstrating tremendous growth (Xero’s fintech revenues grew from 3% to 7% of total revenues from 2018 to 2020).

FIGURE 2: Payments & Fintech Revenues as of % of Total Revenues (2018-2020)

Source: Annual Reports; Flagship Advisory Partners

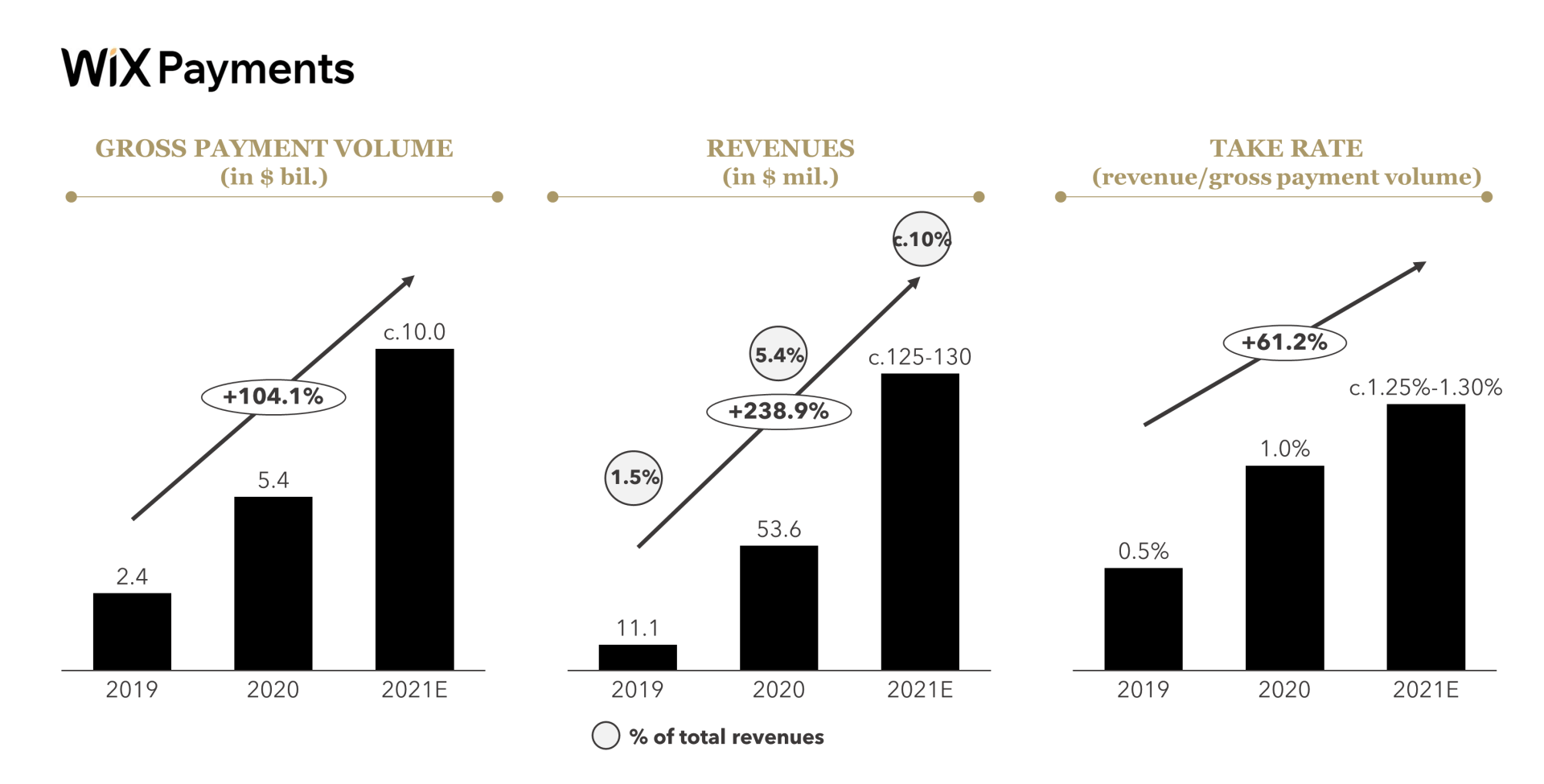

WIX, a leading e-commerce platform, launched its strategic payment solution WIX Payments in Brazil at the end of 2018, later expanding its payment proposition into the US and Europe. The solution is deployed to 14 countries and is achieving rapid adoption.

In its Q4 2020 earnings results, the management declared that c. 80% of new WIX users in geographies where the service is available have opted to include payments as part of their subscription. As shown in Figure 3, revenues generated through WIX Payments already accounted for 5.4% of total revenues in 2020, two years post-launch.

FIGURE 3: WIX Payments - Key KPIs (2019-2021E CAGR; 2021 estimated)

WIX earned a 1% take rate on gross payment volume in 2020, forecasted to increase to 1.25%-1.30% in 2021. The management stated that the company is on track to exceed its goal of 1.25% to 1.30% take rate in 2021.

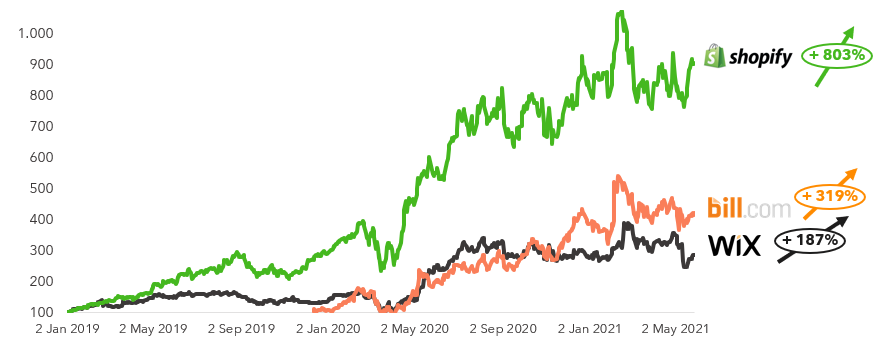

The value creation of SaaS Fintech is driving tremendous share appreciation for market leaders as shown in Figure 4.

FIGURE 4: Share Performance Growth of Individual Equities (indexed of 100; share price growth)

Note: Bill.com started trading in December 2019

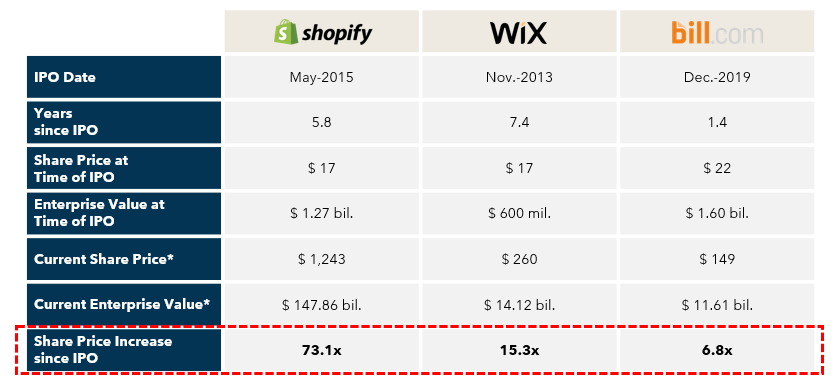

As illustrated in Figure 5, the market valuations of these companies have surged since their IPO date. Early public and private investors have been richly rewarded for betting on the potential of SaaS Fintech.

FIGURE 5: Share Price and Enterprise Value Development since IPO

Source: Seeking Alpha; Company News; Flagship Advisory Partners

There is a massive value creation potential for SaaS providers who successfully imbed and cross-sell payments and fintech services. A well-crafted SaaS fintech strategy enhances the merchant proposition and expands platform revenue generation (take rates). Public equity investors love this story as much as we do, rewarding SaaS Fintech winners with outsized valuations based on ongoing delivery on the value-creation story. We expect many more SaaS providers to attack this opportunity and for winners to be richly rewarded.

Please do not hesitate to contact Joel Van Arsdale Joel@FlagshipAP.com or Charlotte Al Usta Charlotte@FlagshipAP.com, with comments or questions.