FreePik

Best Practices & Toolkits, SaaS, Credit, Payments Acceptance

Best Practices & Toolkits, SaaS, Credit, Payments Acceptance

Yuriy Kostenko • 8 December, 2023

General Commentary & Highlights

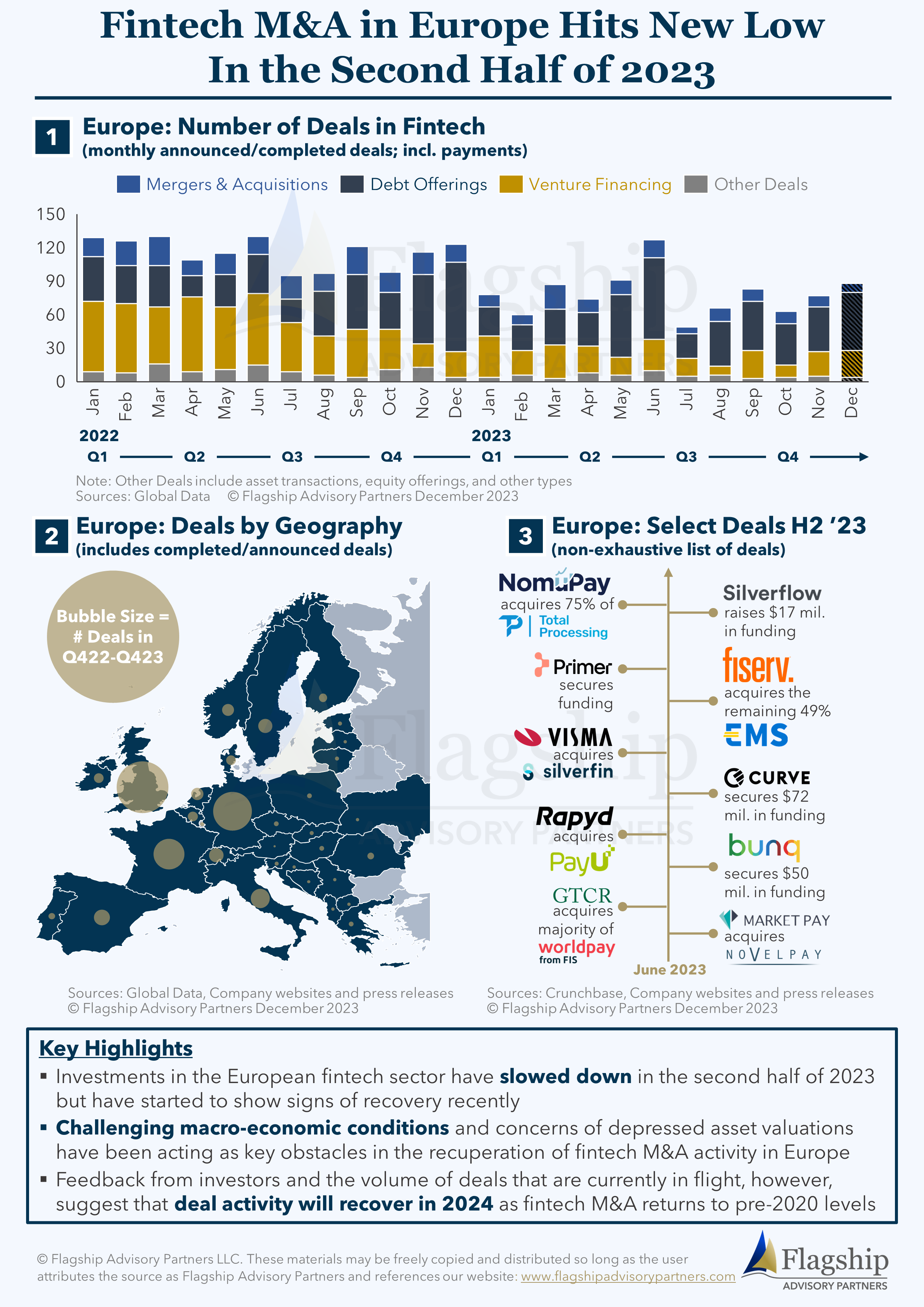

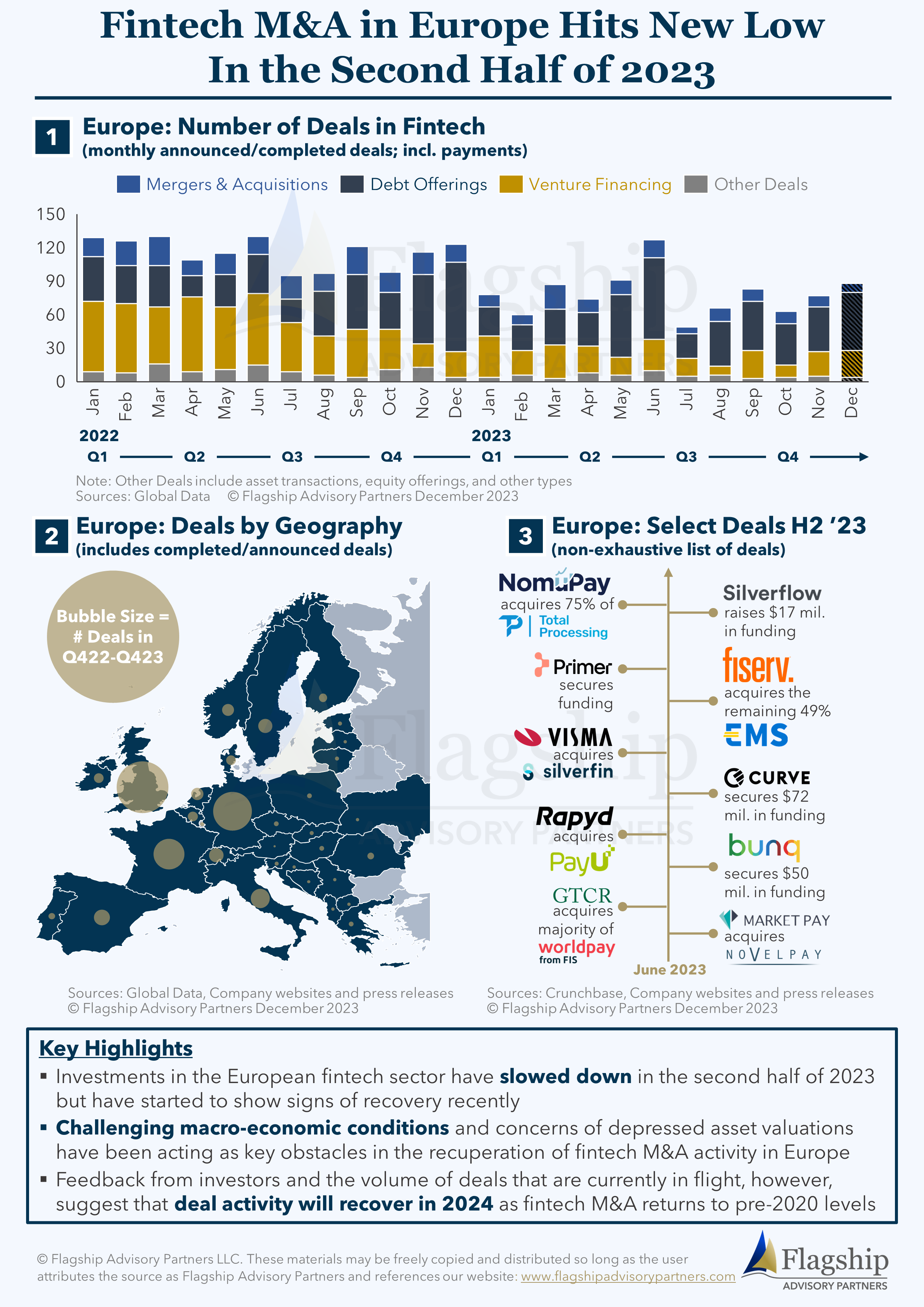

- Investments in the European fintech sector have slowed down in the second half of 2023 but have started to show signs of recovery recently

- Challenging macro-economic conditions and concerns of depressed asset valuations have been acting as key obstacles in the recuperation of fintech M&A activity in Europe

- Feedback from investors and the volume of deals that are currently in flight, however, suggest that deal activity will recover in 2024 as fintech M&A returns to pre-2020 level.

Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com with comments or questions.

General Commentary & Highlights

- Investments in the European fintech sector have slowed down in the second half of 2023 but have started to show signs of recovery recently

- Challenging macro-economic conditions and concerns of depressed asset valuations have been acting as key obstacles in the recuperation of fintech M&A activity in Europe

- Feedback from investors and the volume of deals that are currently in flight, however, suggest that deal activity will recover in 2024 as fintech M&A returns to pre-2020 level.

Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com with comments or questions.