(Part 1* – Impact on M&A)

*This is the first in a series of blogposts in which we compare our original, bearish hypotheses related to COVID-19’s impact on the payments marketplace back in April versus the reality of where we are today. In this first part, we examine the impact of the pandemic on payments M&A and funding activity (with a focus on Europe and North America).

Our Original, Bearish Outlook from April on COVID-19’s Impact on Payments M&A Activity

In April, we expected the pandemic to drive a significant decline in deal activity in Q2 and Q3 2020 as buyers, sellers, and investors would need time to assess the new normal. We expected that some fortunate prospective sellers (those benefited by sectoral and channel shifts) would accelerate potential exit timing based on one-time boosts in business growth, but that many sellers (those negatively impacted by sectoral and channel shifts) would retreat and reevaluate the best timing for a monetization event. We expected that private equity buyers could see the greatest slow-down, as leveraged debt markets (which where historically favorable in 2019) became more dovish. We expected that venture and growth equity investors would continue to be opportunistic, but also far more discerning in where they placed capital. Finally, we expected institutional investors to hold fast in payments stocks through a likely downturn in equity values given the long-term safe-haven status of the sector.

Reality of Today - Payments M&A and Funding Activity

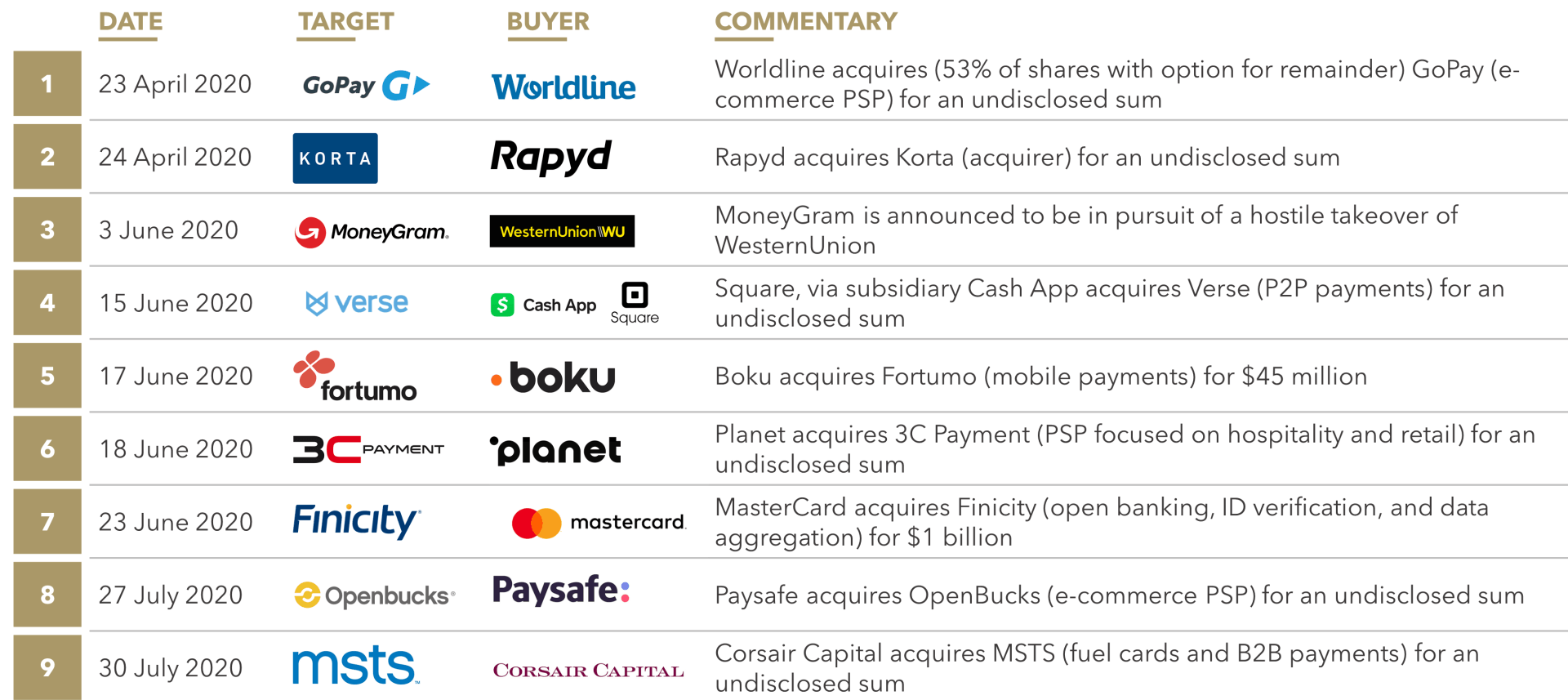

Payments M&A Deals Q2 2020 Review

M&A activity was healthy in Q2 2020 despite the pandemic, down slightly from Q2 2019. According to FT Partners (Q2 2020 Quarterly Fintech Insights), there were 409 fintech M&A deals globally announced in 1H 2020 compared to 479 M&A announced deals in 1H 2019 with the vast majority of these acquisitions made by strategic buyers. Notable recently announced payments M&A deals include:

Based on our own work, activity levels continue to be brisk among prospective buyers and sellers. On the buy-side, we continue to see aggressive strategic buyers as well as many billions of dollars in sponsor capital in search of quality investments globally. In fact, among both strategic and private equity investors, we perceive as much eagerness as ever to do deals. There has been some rationalization of perceived asset quality; for example, we observe less appetite for payments companies which are over-indexed in travel or in POS payments. On the sell-side, we see sellers (often smaller companies) increasingly considering opportunistic 2020 monetization events, motivated by founders looking for greater wealth stability or from shareholders capitalizing on beneficial impacts from the pandemic (i.e., retail e-commerce PSPs who are often benefiting significantly from changes in customer buying behaviors).

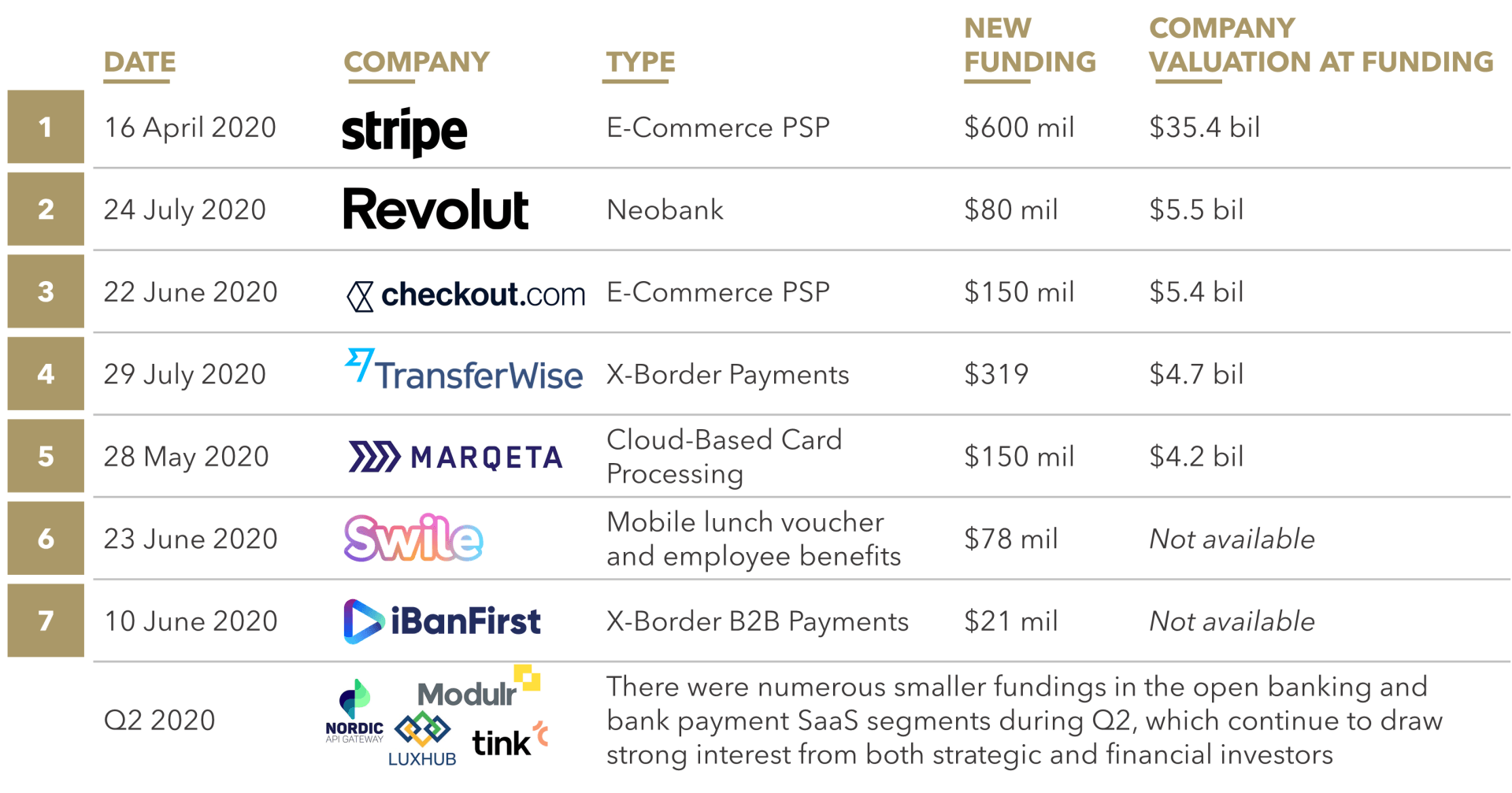

Payments Funding Deals Q2 Review

Funding activity in payments also remained healthy in recent months despite the pandemic with only a modest downturn in activity in Q2 2020 relative to Q2 2019. According to FT Partners (Q2 2020 Quarterly Fintech Insights), there was $9.3 billion of fintech funding activity globally in Q2 2020 (479 funding deals in total, c. 20% being payments related), just slightly down from $11.3 in Q2 2019 (437 total financing deals). Notable recent payments company funding rounds include:

IPOs and Public Equity Markets Q2 2020 Review

There was only one payments IPO which we noted in Q2 2020 – Shift4’s highly successful IPO on 4 June. The IPO price of $23 immediately rose to $33 and now trades at $38.

As noted in our prior article Payment Stocks Perform Well During Pandemic, institutional investors continue to love payments, even more so during the pandemic. Each of these publicly listed payments companies recently reached all-time highs during:

In conclusion, our bearish views in April fortunately proved to be overly pessimistic as M&A and investment activity within the payments industry continued to be brisk during Q2 and into July. Our outlook is now bullish for this healthy activity to continue, even as the roller coaster ride of COVID-19 and its economic impacts continue throughout 2020.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.