(Part 2* – Dramatic Sectorial Impacts)

*This is the second in a series of blogposts in which we compare our original, bearish hypotheses related to COVID-19’s impact on the payments marketplace back in April versus the reality of where we are today. In this second part, we examine the impact of the pandemic on sectorial spending patterns.

Our Bearish Outlook from April on COVID-19’s Expected Sector Impacts

In April, we expected that dramatic changes in spending behavior arising from social distancing would ripple through marketplace sectors idiosyncratically. The travel and entertainment sectors would be most negatively impacted, with little hope of a broad-based return to historically high 2019 spend levels for years to come. We expected demand for both international leisure travel and business travel to be devasted. Airlines, cruise lines, and hotels would come under financial pressure and would need government support.

We also expected that restaurants would try to adapt to delivery and take-out, but many would struggle to survive if the pandemic dragged on through the summer. However, we did expect demand for restaurants, cafes, and certain types of local travel to rebound in parallel with market opening. Digital entertainment would benefit so long as consumers continued to isolate. If the pandemic continued through the summer, fall, and winter of 2020, we expected high levels of business failure within the restaurant and entertainment sectors.

We expected that impacts on the retail sector would vary dramatically based on channel and product type. Grocery merchants would thrive as people would be forced to displace eating-out with eating-in. Online merchants would generally benefit from a dramatic channel shift as buying would shift almost entirely online for a time (with some lasting effect).

As a result of GDP contraction and these expected changes in consumption behavior, we forecast that suppliers of payment services would experience corresponding impacts. Those providers that are over-indexed on travel and entertainment (e.g., Amex) would be harmed, while those most favorably impacted by channel and sector shift (e.g., PayPal) would thrive relative to the broader market.

Reality of Today – Dramatic and Unfortunate Impacts on Many Sectors

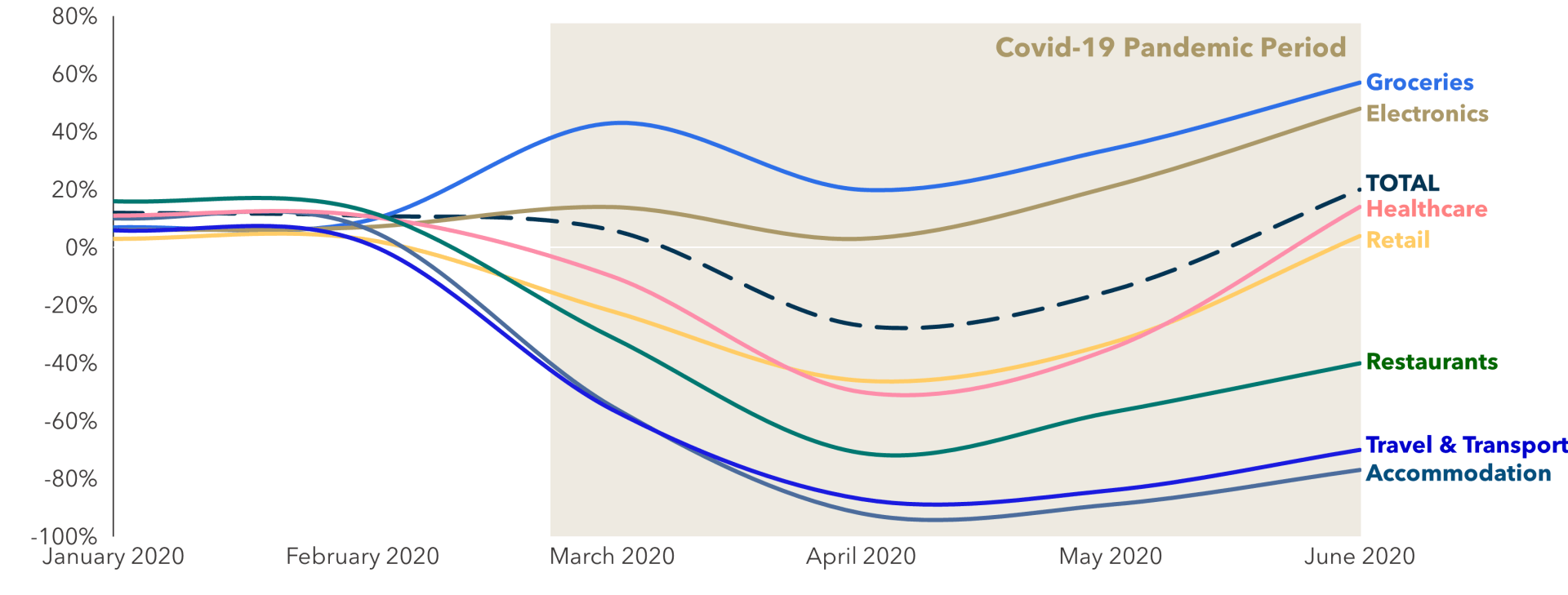

Sadly, our bearish predictions from April have proven largely true; travel, entertainment, and restaurant merchants have been dramatically impacted as have their respective payments providers. Figure 1, based on card spend in Ireland, illustrates the dramatic sectorial spending impacts inflicted by COVID-19. Government assistance is helping to buffer the financial impacts of spending shortfalls across these sectors, but business failure rates are likely to accelerate in 2H 2020 if these trends continue.

FIGURE 1: YoY % Card Turnover Changes in Selected Sectors

(Ireland Example, from January to June 2020)

Source: Central Bank of Ireland

Source: Central Bank of Ireland

COVID-19 Impact on Travel

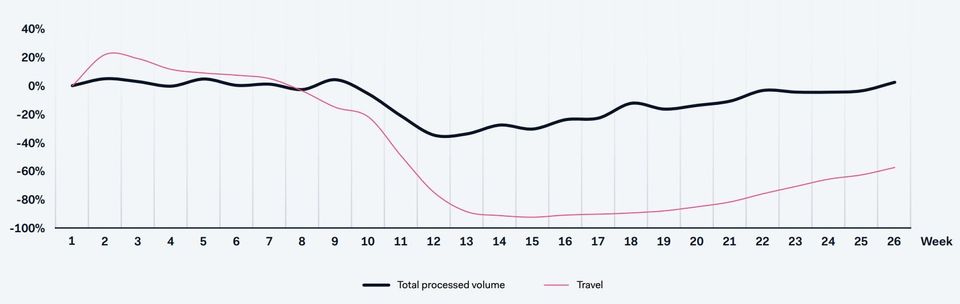

No industry has been more negatively impacted than travel and tourism, which accounts for 10% of global GDP and employment. As of today, there remains little room for optimism and the industry is retrenching, hoping for an eventual vaccine or other measures to control the transmission of COVID-19. As shown in Figure 2, Adyen, a leading provider of payment services in the Travel sector, illustrates the massive and ongoing impact of the pandemic on travel spending.

FIGURE 2: Adyen Weekly Processed Volumes, Total vs. Travel

Source: Adyen H1 2020 Shareholder letter

Source: Adyen H1 2020 Shareholder letterAIR TRAVEL

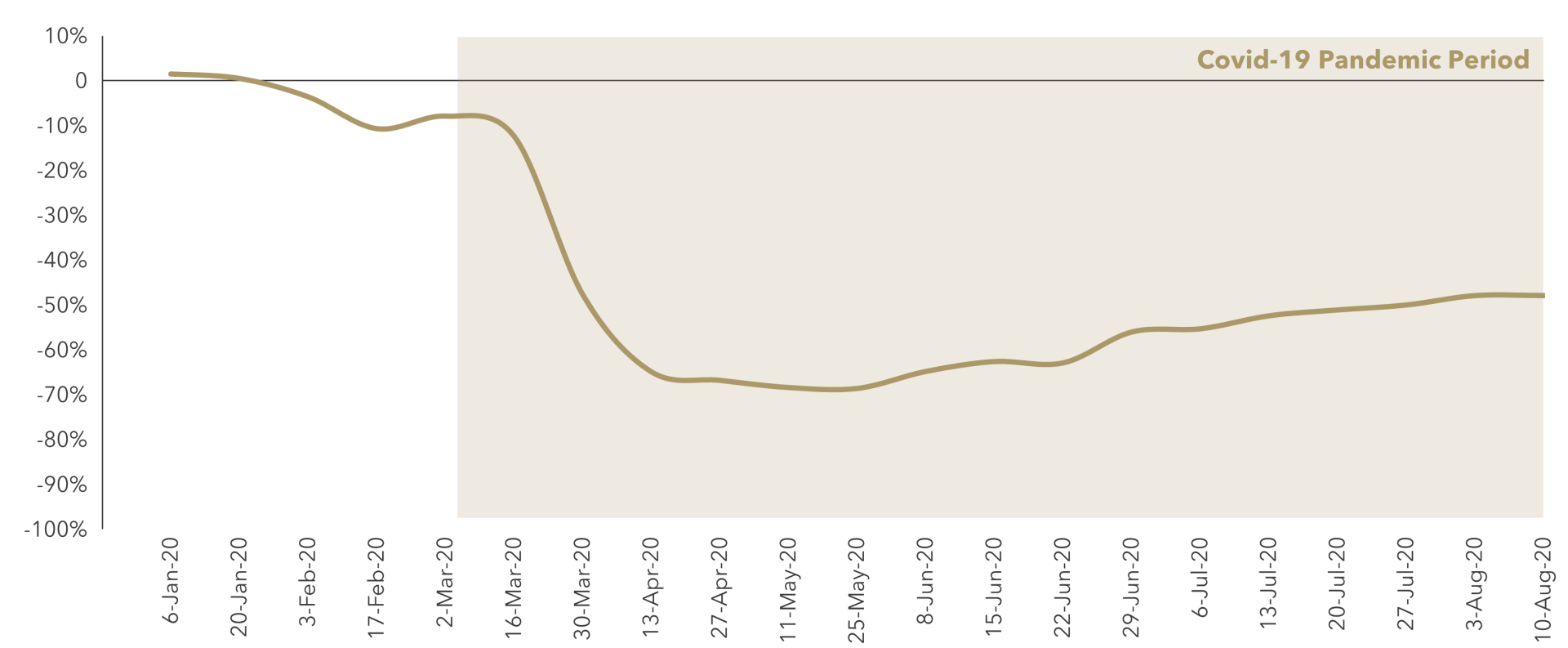

Air travel was down 90% during the height of infections and has today, only partially recovered in most global markets (as shown in Figure 3). IATA forecasts a global reduction in air travel of $84 billion in 2020 (a reduction of 55% from 2019). Air Travel in the U.S. in June and July remained down 70% relative to 2019[1]. Positively, domestic air travel in China, where infection rates are low, travel frequency has approached 2019 levels in recent months.

FIGURE 3: YoY Change of Weekly Flight Frequency of Global Airlines

(January 6- August 10, 2020, globally)

Source: Statista https://www.statista.com/statistics/1104036/novel-coronavirus-weekly-flights-change-airlines-region/

Source: Statista https://www.statista.com/statistics/1104036/novel-coronavirus-weekly-flights-change-airlines-region/CRUISE TRAVEL

The cruise industry was an unfortunate poster child for COVID impacts and vulnerabilities. As of June, according to the Financial Times, all of the industry’s 338 cruise ships were docked[2]. Some cruises, for example in the Mediterranean, have now returned but the industry outlook remains gloomy, given what could be permanent damage to the perception of safety in the industry.

LOCAL TRAVEL

Local travel spending provides a glimmer of optimism. People are escaping their homes, but they are now generally doing so via local travel, within driving distance, and with a focus on outdoor activities. According to Airbnb CEO Brian Chesky, “Tourism as we knew it is over … the model we knew has died and will not return. We are going to get in our cars, drive a few kilometers to a small community and stay in a house.”[3] Consumers looking to buy boats or other recreational vehicles in July were out of luck with inventories dry.

BUSINESS TRAVEL

Business travel, which dropped to near zero in April and May, remains limited as employers are cautious not to put employees at risk. Experts forecast a 50-75% return of business travel spend, but not until 2022[4] and with some lasting effects. Businesses have realized that remote working can be effective, and the cost savings of remote work help to offset the lost value of face-to-face interaction. Several of our clients have told us that their reduction in business travel expense as a major upside to offsetting the EBITDA impact of lower payments volumes and revenue, and we expect this pressure on travel expense to continue.

ACCOMMODATION

According to Booking Holdings, accommodation bookings declined 91% in Q2 and the company is planning a 25% workforce reduction[5]. There are some signs of hope (i.e., local travelers), but also concerns about lasting impacts. Here in Amsterdam, local merchants describe a more limited population of tourists from mostly neighboring countries (i.e., German) returning in July and August.

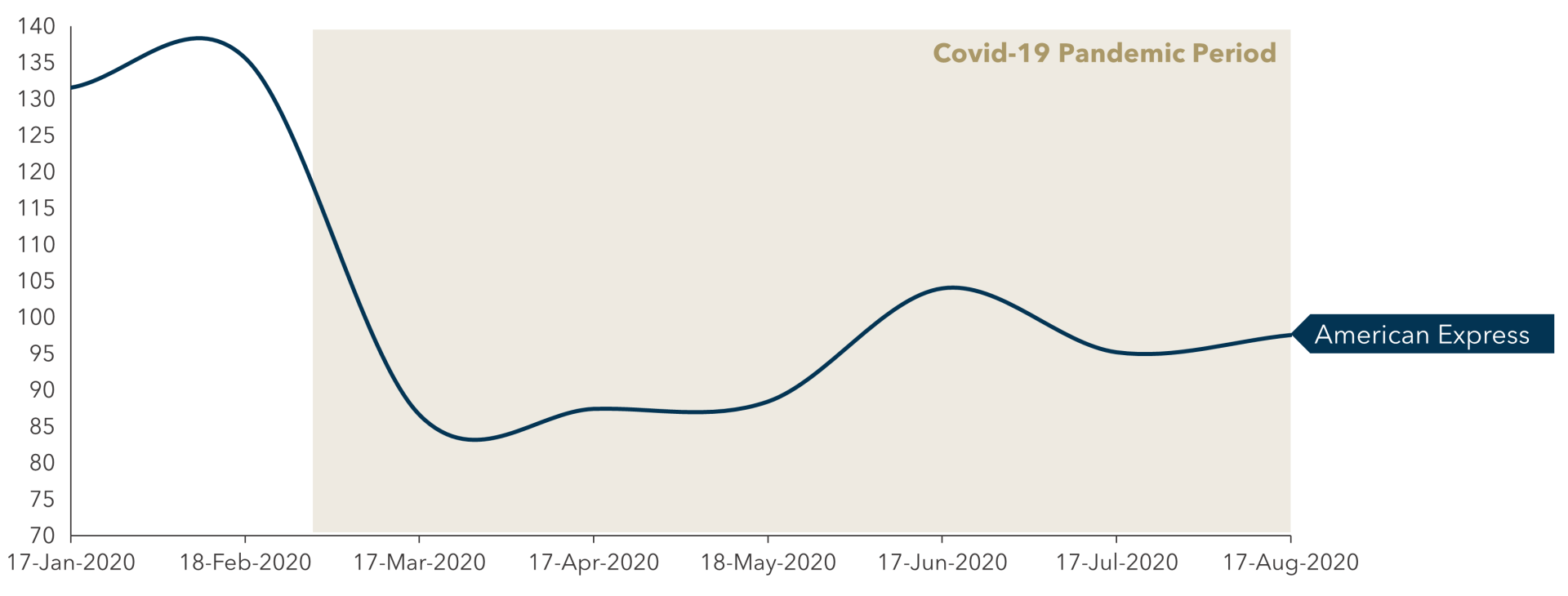

Payments providers over-indexed on travel are seeing significantly negative impacts on business performance. American Express revenues declined 29% in Q2 with a corresponding 29% decline in the share price since its high in February[6] (see Figure 4).

FIGURE 4: Share Price Development of American Express Stock

(17 January -17 August 2020, in USD)

Source: Yahoo Finance

Source: Yahoo Finance

COVID-19 Impact on Entertainment and Restaurants

As with tourism, the impact of COVID on the entertainment and restaurant and pub industry has been devastating. There are now terrible expectations for significant business failure across these sectors.

ENTERTAINMENT

In-person entertainment including concerts, movie theatres, and other events has been ravaged by the pandemic. The movie theatre industry is expected to be permanently damaged with large numbers of theatre closings. AMC, the largest movie theatre chain in the U.S., has cautioned investors that it may not survive the pandemic[7].

Digital entertainment, however, has clearly benefited from the pandemic. Netflix subscriptions doubled during the initial months of the pandemic and its share price has increased nearly 50% this year[8]. Disney is on the downside of in-person entertainment (earnings down 90% in 2020 YTD), but its Disney+ unit had already generated 54 million paying subscribers by the end of May[9].

Merchants providing conference, wedding, and similar event services have seen revenues plummet to zero in countries in which infections and associated lockdowns persist. Many of these merchants will go out of business, creating significant potential risk exposure for acquirers. Video gaming has thrived during the pandemic. U.S. video gaming revenue was up more than 50% in May compared to 2019 (LATimes).

RESTAURANTS

Restaurants were overwhelmed by the pandemic and the market expects significant business attrition by year-end, although there are signs of hope in June and July turnover in countries less impacted by the virus (i.e., in parts of Europe). In a desperate bid for survival, many restaurants pivoted to online ordering and delivery and take-out services during the lock-down. According to McKinsey and City Pantry, U.K. food delivery order volume increased 40% during the lockdown[10] and 20% of U.K. restaurants started offering take-out for the first time.

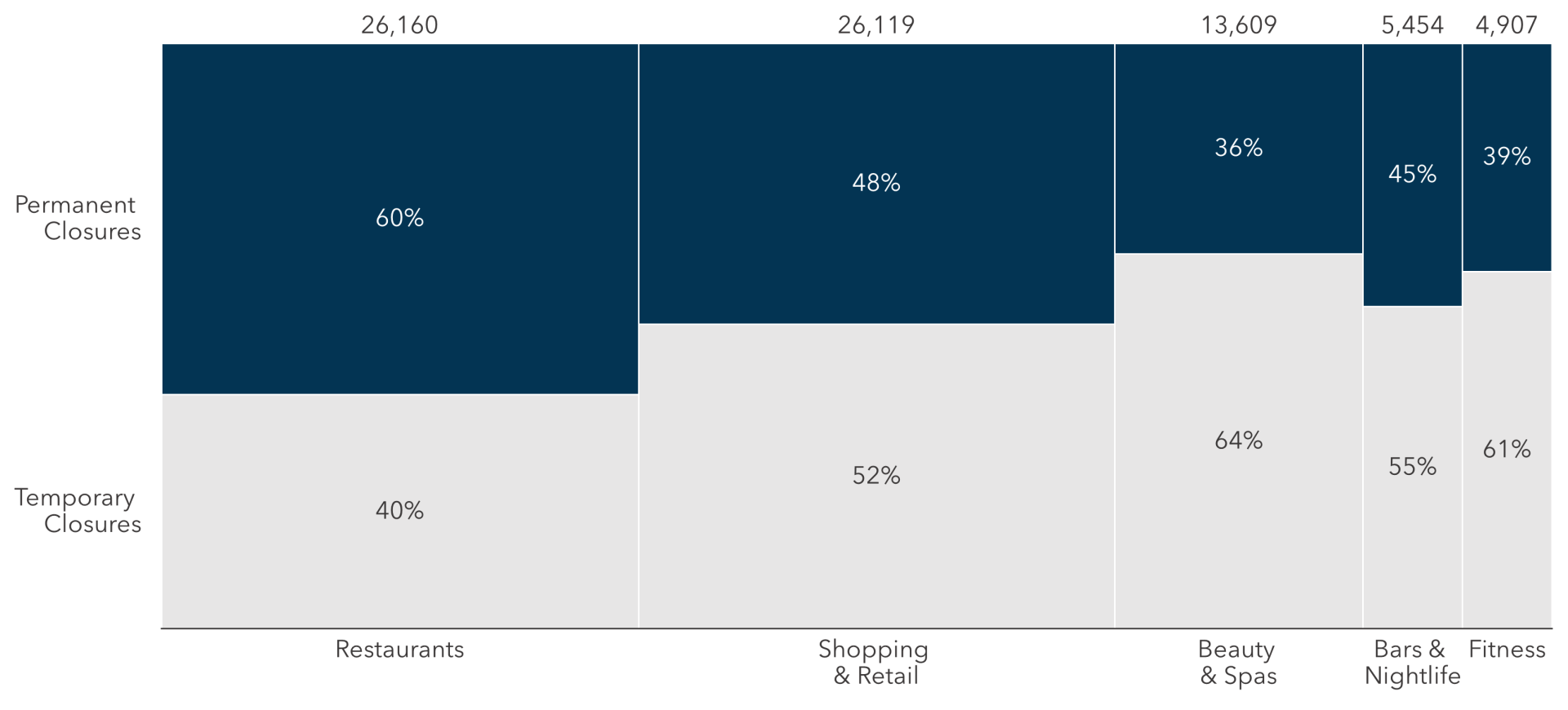

The market expects permanent or long-term impacts on a restaurant marketplace which is emerging from many years of steady growth. According to Bloomberg, one-third of restaurants in the U.S. (231,000 from a total of 660,000) will shut down in 2020[11]. And according to Yelp, 55% of the businesses listed on their service which have closed since 1 March will never re-open.

FIGURE 5: Number of Permanent and Temporary U.S. Business Closures Since March 1, 2020

Note: Among US businesses that were open on March 1. Closures updated through July 10.Sources: MarketWatch, Yelp https://www.marketwatch.com/story/41-of-businesses-listed-on-yelp-have-closed-for-good-during-the-pandemic-2020-06-25

Note: Among US businesses that were open on March 1. Closures updated through July 10.Sources: MarketWatch, Yelp https://www.marketwatch.com/story/41-of-businesses-listed-on-yelp-have-closed-for-good-during-the-pandemic-2020-06-25

COVID-19 Impact on Retail

The pandemic has driven consumers online at the expense of in-store retail.

IN-STORE RETAIL

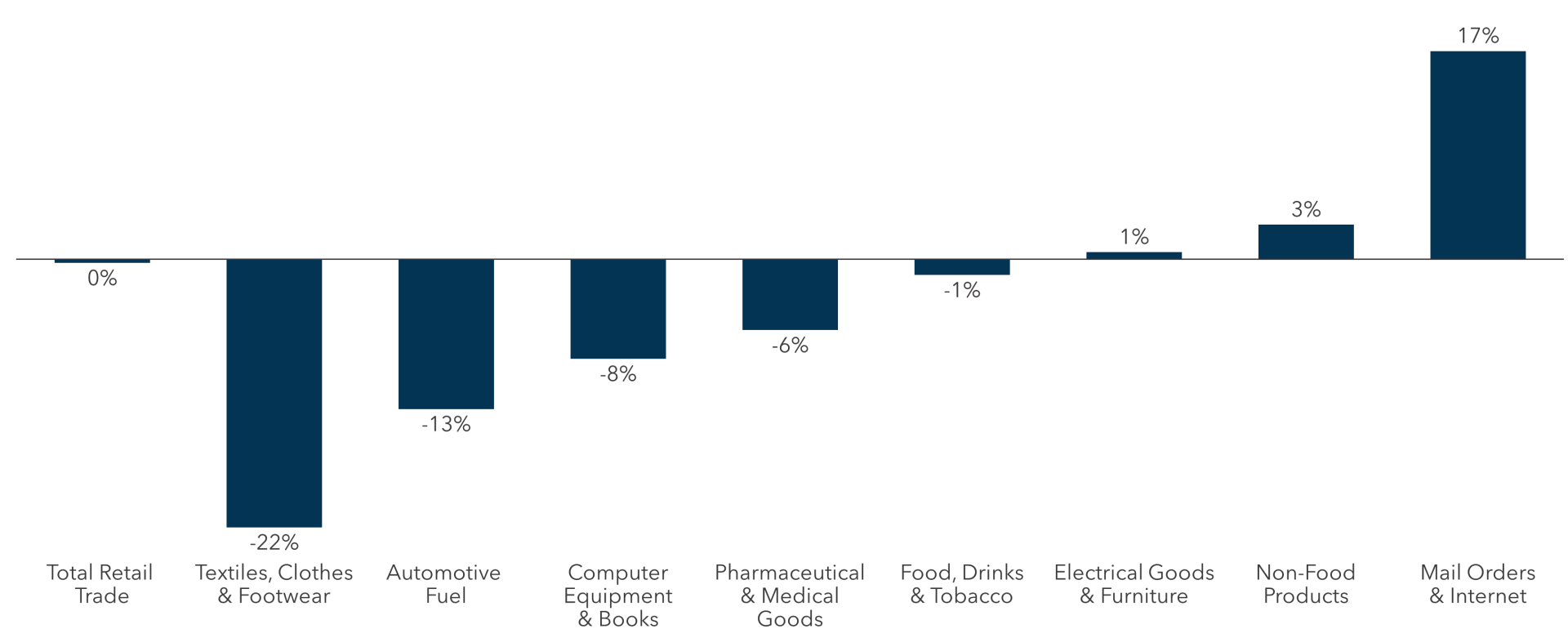

In-Store retail has been significantly damaged by the pandemic as social distancing was a unique one-time shock to in-store retail buying behavior. Sectors such as apparel, which tend to rely more on in-store buying, have been most impacted by consumer reluctance to return to stores (as shown in Figure 6, European apparel sales dropped 22.4% from February to June).

FIGURE 6: Retail Trade Volume Growth Rates by Product Type, EU

(June 2020 compared with February 2020)

Sources: Eurostat https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Retail_trade_June_2020.jpg

Sources: Eurostat https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Retail_trade_June_2020.jpg ONLINE RETAIL

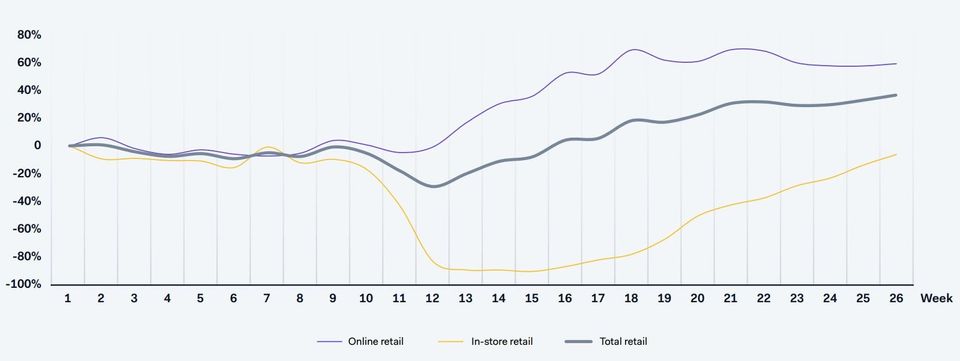

The pandemic has accelerated the ongoing shift from offline to online retail. Online retailers have generally thrived during the pandemic. According to Adobe, online sales increased between 49-78% a month in April through July relative to 2019 (peaking with 78% YOY growth in May)[12]. Figure 7 (Adyen retail sector weekly volumes) illustrates the dichotomy of pandemic impacts on online vs. in-store retail spending.

FIGURE 7: Adyen Weekly Processed Retail Volumes by Channel

Sources: Source: Adyen H1 2020 Shareholder letter

Sources: Source: Adyen H1 2020 Shareholder letter

Payments providers with a healthy exposure to online retail and digital have benefited. PayPal added more than 20 million active users in Q2, helping to drive transaction value growth of 30% (the highest growth since PayPal’s separation from ebay) and PayPal’s share price has increased 130% from its low in March[13].

Outlook

GDP growth for most of the world declined dramatically in Q2 (-9.5% in the U.S. [14] and -12.1% in the Euro area[15].As we unfortunately expected in April, this GDP contraction along with significant changes in buying behaviors rippled across the economy, inflicting brutal impacts on numerous sectors including travel, entertainment, restaurants, and in-store retail. We expect some of these behavior changes to affect lasting impacts. We remain hopeful that improvements in controlling COVID-19 will help many of these sectors to rebound. In the meantime, providers of payment services will suffer along with their customers, and we remain concerned about the impact of business failures on payments providers with credit exposure in these heavily impacted sectors.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.

[1] https://www.cnbc.com/2020/07/06/air-travel-jumps-july-4-weekend-but-still-down-sharply-from-2019-amid-covid-19pandemic.html

[2] https://www.ft.com/content/d8ff5129-6817-4a19-af02-1316f8defe52

[3] https://www.entrepreneur.com/article/352419

[4] https://www.bbc.com/worklife/article/20200731-how-coronavirus-will-change-business-travel

[5] https://www.phocuswire.com/booking-holdings-q2-2020

[6] https://www.investors.com/news/american-express-earnings-q2-2020-american-express-stock/

[7] https://www.cbsnews.com/news/amc-movie-theater-chain-survive-coronavirus-pandemic/

[8] https://www.marketwatch.com/story/netflix-in-the-age-of-covid-19-streaming-pioneer-may-have-new-edge-on-competition-2020-04-07

[9] https://www.marketwatch.com/story/disney-in-the-age-of-covid-19-for-now-disney-may-be-the-only-plus-2020-04-07

[10] https://www.mckinsey.com/industries/retail/our-insights/reimagining-european-restaurants-for-the-next-normal#

[11] https://www.bloomberg.com/news/articles/2020-07-31/one-third-of-u-s-restaurants-face-permanent-closure-this-year

[12] https://www.digitalcommerce360.com/article/coronavirus-impact-online-retail/

[14] https://www.statista.com/chart/18095/quarterly-gdp-growth-predicted-growth-selected-industrialized-nations-oecd/

[15] https://ec.europa.eu/eurostat/documents/2995521/11156775/2-31072020-BP-EN.pdf/cbe7522c-ebfa-ef08-be60-b1c9d1bd385b