Freepik

Card Issuing, Compliance & Security

Card Issuing, Compliance & Security

Rom Mascetti and Ryan Vincent • 14 November, 2023

General Commentary & Highlights

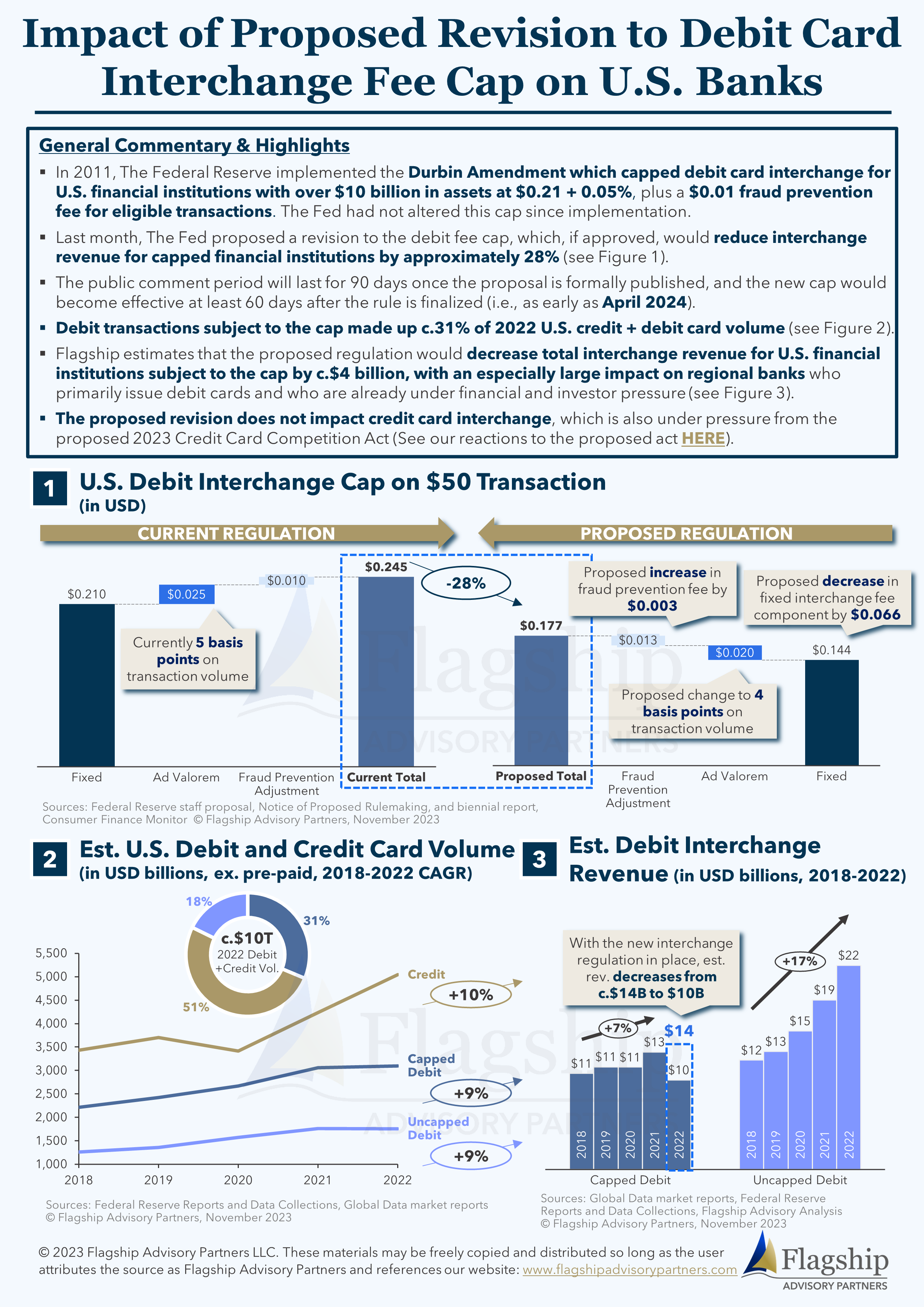

- In 2011, The Federal Reserve implemented the Durbin Amendment which capped debit card interchange for U.S. financial institutions with over $10 billion in assets at $0.21 + 0.05%, plus a $0.01 fraud prevention fee for eligible transactions. The Fed had not altered this cap since implementation.

- Last month, The Fed proposed a revision to the debit fee cap, which, if approved, would reduce interchange revenue for capped financial institutions by approximately 28% (see Figure 1).

- The public comment period will last for 90 days once the proposal is formally published, and the new cap would become effective at least 60 days after the rule is finalized (i.e., as early as April 2024).

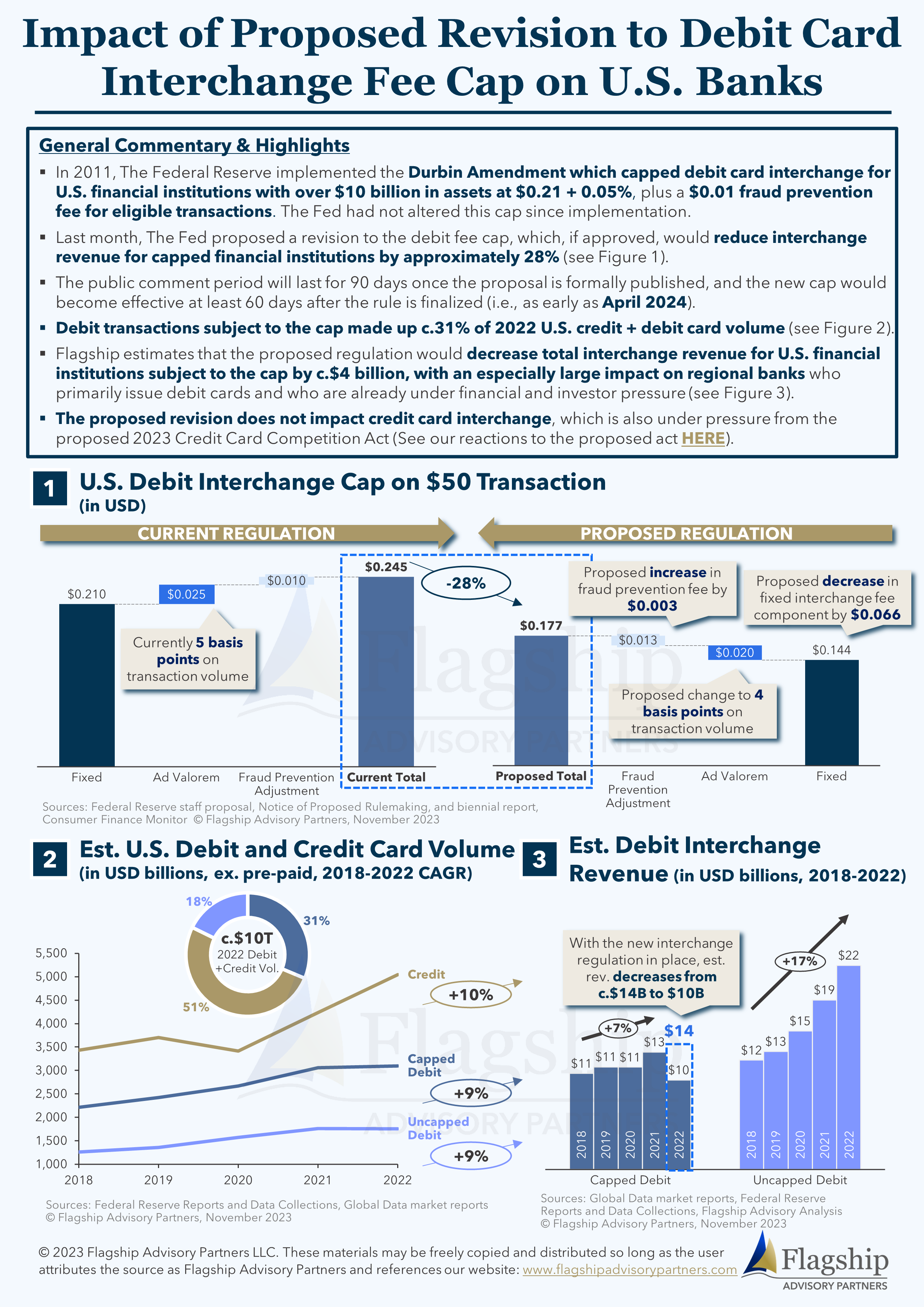

- Debit transactions subject to the cap made up c.31% of 2022 U.S. credit + debit card volume (see Figure 2).

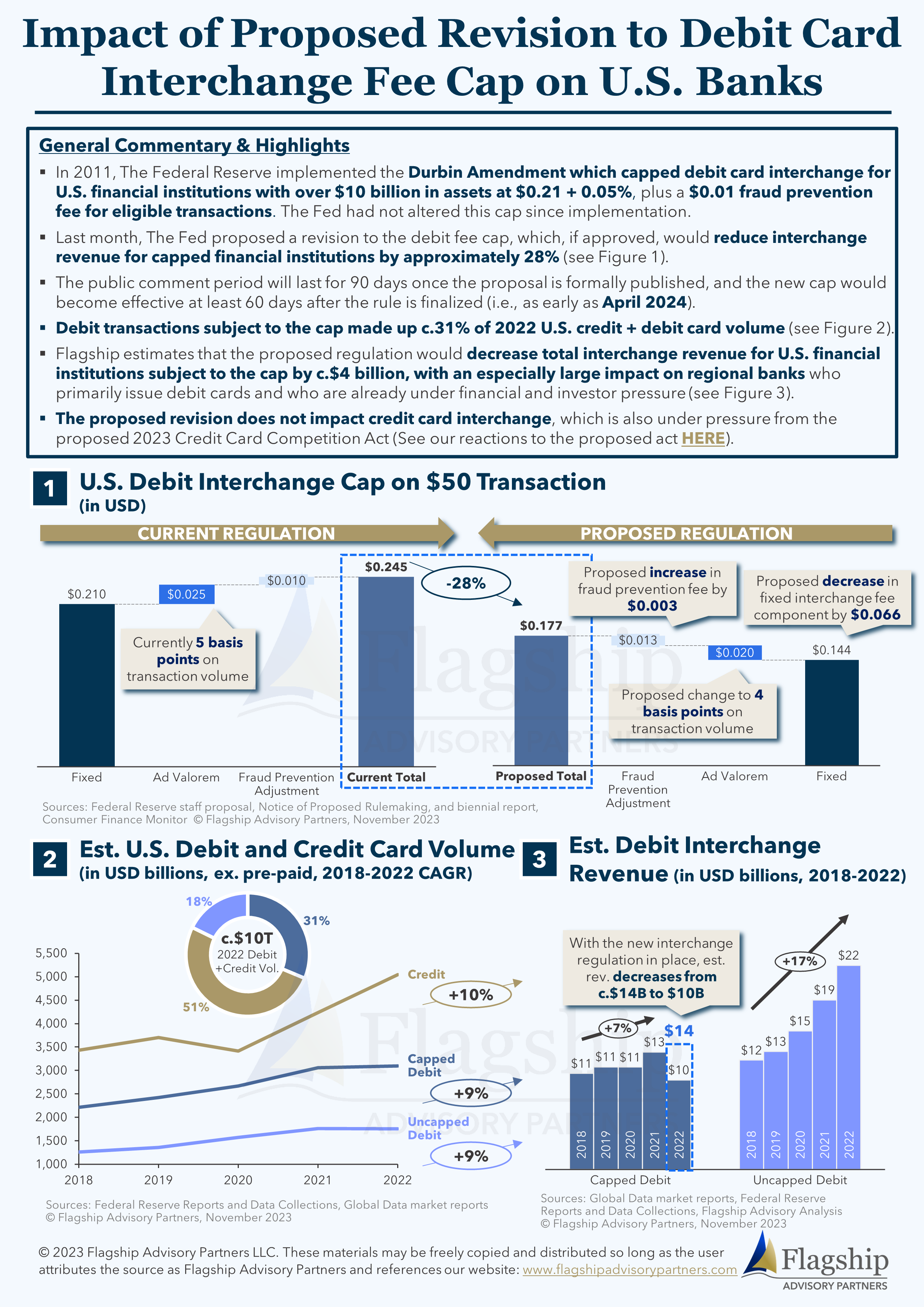

- Flagship estimates that the proposed regulation would decrease total interchange revenue for U.S. financial institutions subject to the cap by c.$4 billion, with an especially large impact on regional banks who primarily issue debit cards and who are already under financial and investor pressure (see Figure 3).

- The proposed revision does not impact credit card interchange, which is also under pressure from the proposed 2023 Credit Card Competition Act (See our reactions to the proposed act HERE).

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com with comments or questions.

General Commentary & Highlights

- In 2011, The Federal Reserve implemented the Durbin Amendment which capped debit card interchange for U.S. financial institutions with over $10 billion in assets at $0.21 + 0.05%, plus a $0.01 fraud prevention fee for eligible transactions. The Fed had not altered this cap since implementation.

- Last month, The Fed proposed a revision to the debit fee cap, which, if approved, would reduce interchange revenue for capped financial institutions by approximately 28% (see Figure 1).

- The public comment period will last for 90 days once the proposal is formally published, and the new cap would become effective at least 60 days after the rule is finalized (i.e., as early as April 2024).

- Debit transactions subject to the cap made up c.31% of 2022 U.S. credit + debit card volume (see Figure 2).

- Flagship estimates that the proposed regulation would decrease total interchange revenue for U.S. financial institutions subject to the cap by c.$4 billion, with an especially large impact on regional banks who primarily issue debit cards and who are already under financial and investor pressure (see Figure 3).

- The proposed revision does not impact credit card interchange, which is also under pressure from the proposed 2023 Credit Card Competition Act (See our reactions to the proposed act HERE).

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com with comments or questions.