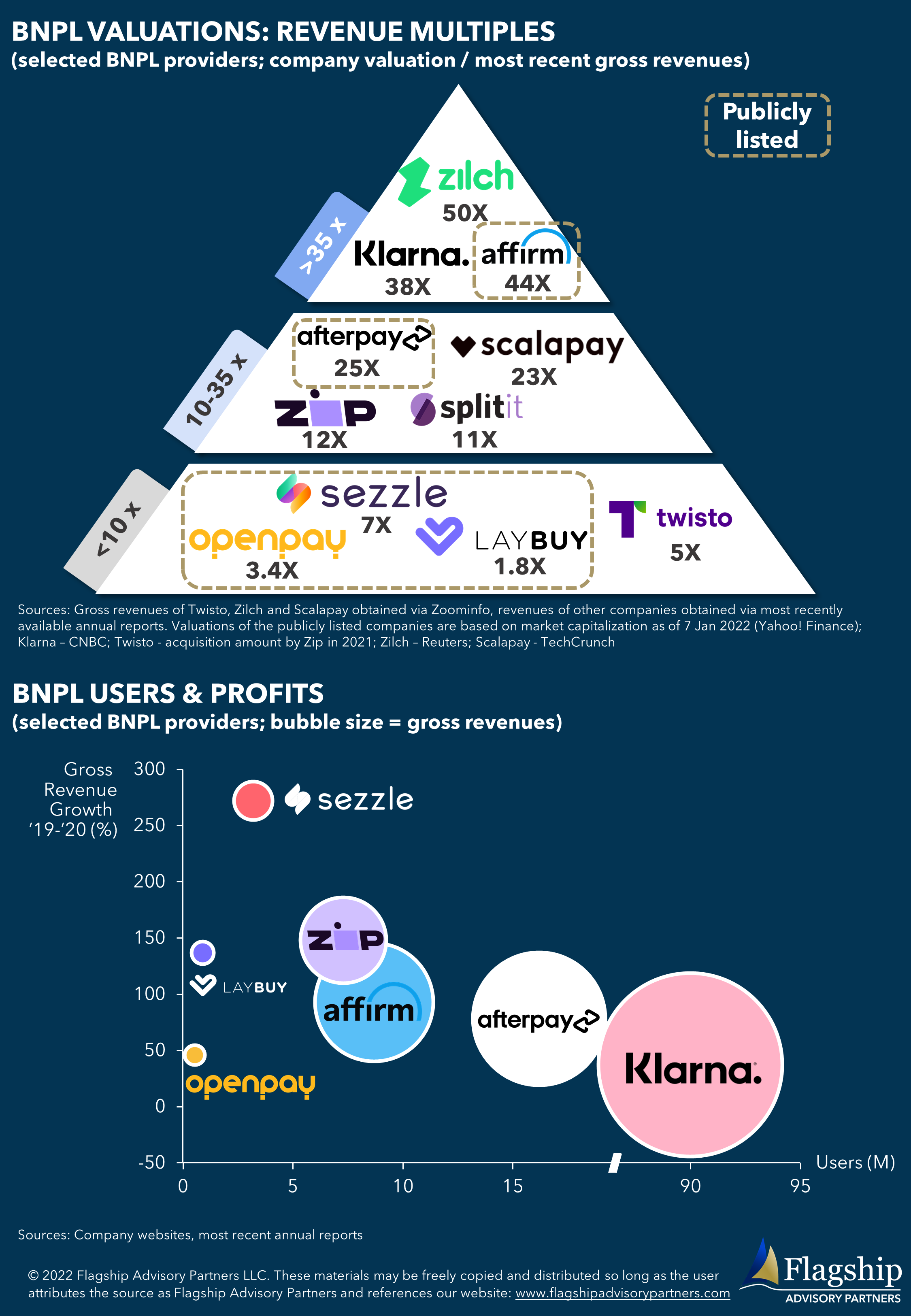

Observations on BNPL Valuations

- The market space for BNPL providers is increasingly crowded

- BNPL providers that have gained traction locally typically execute geo expansion strategies

- Klarna and PayPal Credit are the most global, followed by Afterpay (called Clearpay in Europe) and Sezzle

- Valuations correlate to geographic reach and size of the user base

- Valuations are attractive and are increasing (e.g. UK-based Zilch’s valuation rose from $500M to $2BN in just eight months)

- Australian-listed BNPL providers (e.g. Sezzle, OpenPay and Laybuy) have lower valuations compared to peers, likely driven by a combination of a boom of publicly listed BNPL companies, weaker than expected revenue performance, and a less favorable regulatory outlook

Outlook on Valuations

- Investors will closely monitor regulatory developments for revenue impacts (which we will explore in a subsequent article)

- We can expect further IPOs and M&A in the space

INFOGRAPHIC: Open Banking Tech Platforms

Please do not hesitate to contact Erik Howell Erik@FlagshipAP.com or Elisabeth Magnor Elisabeth@FlagshipAP.com with comments or questions.