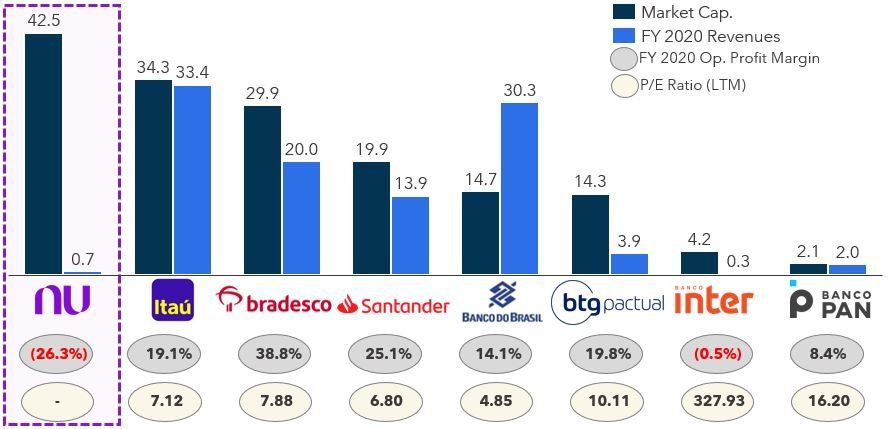

On 9 December 2021, Brazil-headquartered neobank Nubank made an impressive debut on Wall Street, raising $2.6 bil. on the NYSE, with an implied market capitalization of $50 bil. at IPO (now down to $43 bil.). Nubank is now the third-largest company by market capitalization in Brazil. Although the company is still unprofitable, it has a higher valuation than Brazil’s largest bank, Itaú Unibanco.

FIGURE 1: Market Capitalization of Nubank vs. Incumbent Brazilian Banks (in $ bil.; close Tuesday 21st December 2021)

Source: Bloomberg, Yahoo finance

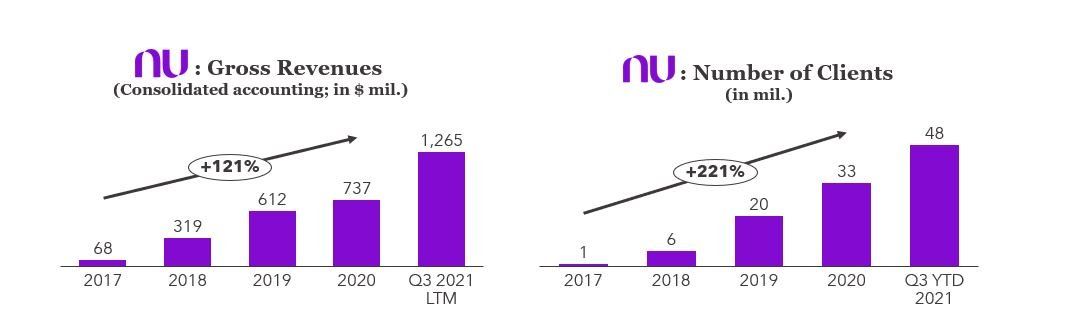

FIGURE 2: Nubank's Historical Performance

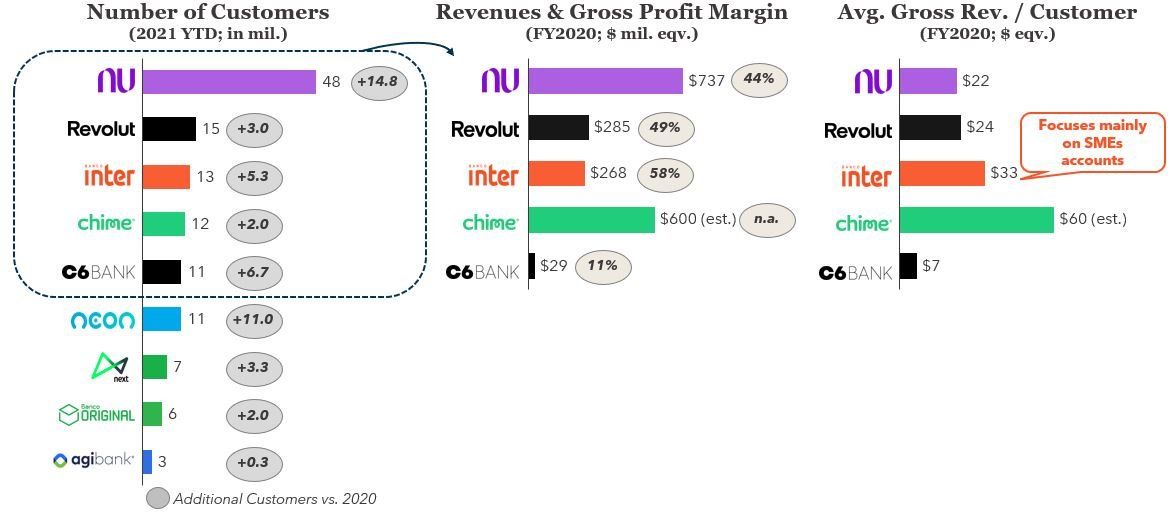

The addressable market in LatAm is huge and Nubank has proven that emerging markets represent a massive yet largely untapped opportunity. Nubank has the largest customer base among neobanks globally (e.g., 3.2x than its European peer, Revolut!).

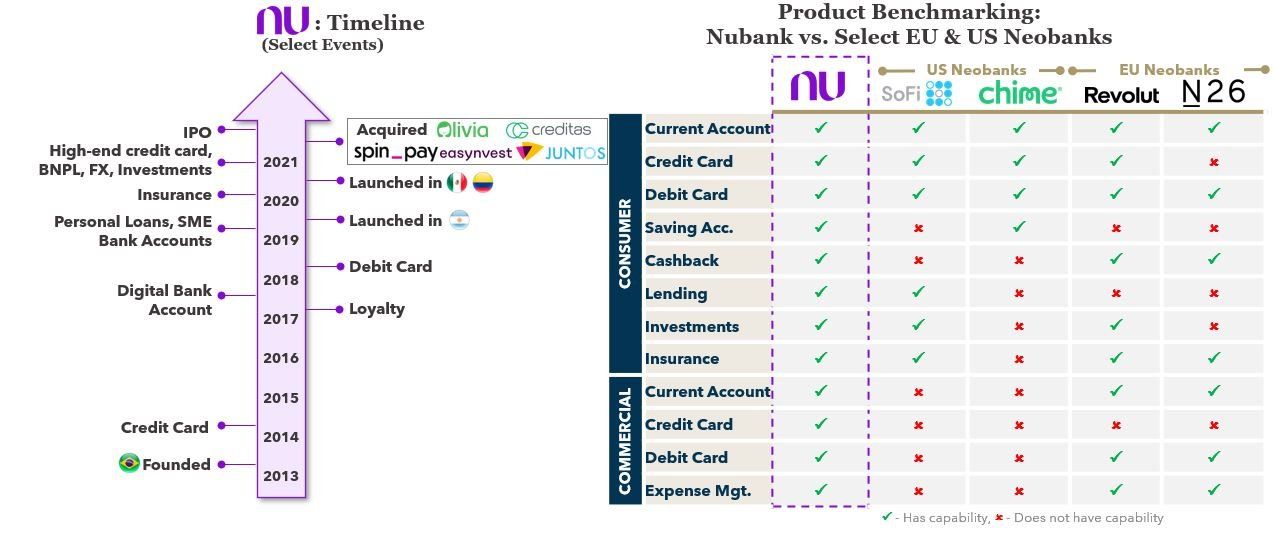

Unlike other fintechs, Nubank took a “reverse” product path to market, as it started acquiring customers via lending (credit cards) and then expanded three years later into transactional banking, vs. most neobanks, which lead with transactional banking and then add credit products over time. The company has now a fuller product catalog than European and North American neobank peers, yet most products (e.g., lending, investments, SME products) have been launched recently and are still at the beginning of their development journey. In parallel with expanding via products, Nubank expanded geographically into Argentina, Mexico, and Colombia, although c.98% of its revenues are still generated in Brazil.

FIGURE 3: Nubank’s Product Offering vs. Select NA & EU Players

FIGURE 4: Nubank's KPIs vs. Select Neobanks

Sources: Nu Holdings Ltd. IPO prospectus (Link), Flagship Advisory Partners, company’s press releases, Bloomberg, Brazilian central bank

Nubank’s IPO illustrates that LatAm has a huge market potential and that there is still room for new entrants, and that fintechs can successfully build on a credit offering prior to expanding into transactional products. Ultimately, other fintechs and neobanks need to think about reinforcing their credit strategy, as we discuss in a prior article here.

Please do not hesitate to contact Erik Howell Erik@FlagshipAP.com, Charlotte Al Usta Charlotte@FlagshipAP.com or Pedro Giesta Pedro@FlagshipAP.com with comments or questions.