We recently analyzed the contrast between B2B payments in the U.S. and Europe, focusing on the integration of financial services with accounting/ERP, accounts receivable (A/R), and accounts payable (A/P) management software. The results are a stark contrast between the market fundamentals in these two geographies, due to the differences in the bank-to-bank payments infrastructure, penetration of integrated software payments, and monetization models for B2B payments.

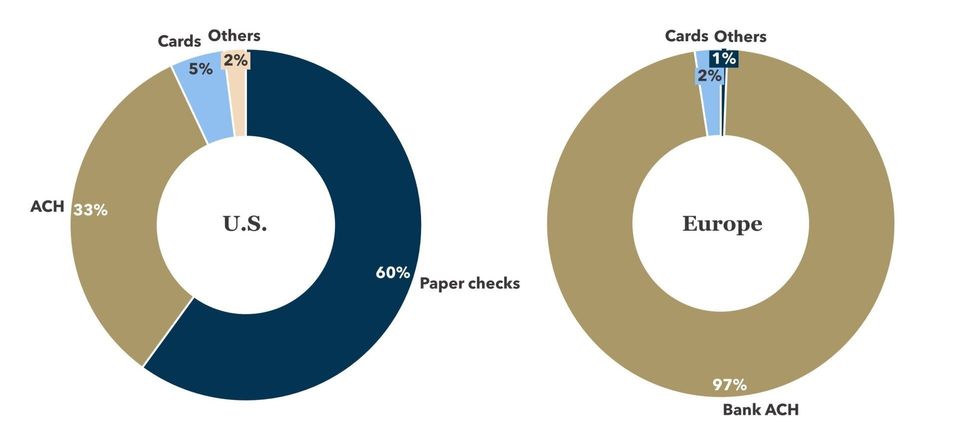

B2B payments in the U.S. are typified by the ongoing of prevalence of paper checks and invoices as well as a legacy ACH system which has not yet been fully replaced/updated for real-time, rich-data payments. US businesses still issue and accept massive volumes of checks, making various forms of check digitization and processing a critical service within the domain of B2B payments. Additionally, the legacy ACH rails are often not a reliable B2B payments network without additional value-added services. ACH+ (with enriched data and early payment rebates) is a common product model to fill gaps in standard ACH payments. Instant payments via RTP (The Clearing House Real Time Payments) and OCT (Original Credit Transaction) are growing rapidly in the U.S., but not yet at true scale. The upside to network infrastructure inefficiencies in the U.S. is a significantly larger revenue pool, given the premium value created by check digitization, virtual cards, and ACH+. In contrast, Europe bank payments infrastructure is often real time, rich-data capable, and low cost. Virtually all European B2B payments flow through these bank payment rails, with low usage of alternative payment networks or value-added services. We contrast these differences in payment mix in Figure 1 below.

FIGURE 1: B2B Payments Mix, U.S. vs. Europe (2019 estimate)

B2B ISV-Payments in the Enterprise Segment

While legacy U.S. B2B payment rails remain creaky and widely used, we observe significantly more maturity in the software enablement of A/R and A/P workflow automation, including deep integration of payments. Software first companies such as Tipalti and Coupa have embedded automated payouts into their core software services and support payouts through multiple payment methods: ACH+, digital checks, virtual cards, international wires as well as supply chain financing solutions. Broad acceptance of payment methods and work-flow automation are key value-adds given the prevalence of use cases in the U.S. The U.S. market also saw an emergence of payments-first A/P and A/R fintechs such as PayCertify, FastPay, MineralTree that are thriving by providing a cloud-based, one-stop shop for invoice-to-cash and procure-to-pay services in addition to processing card payments.

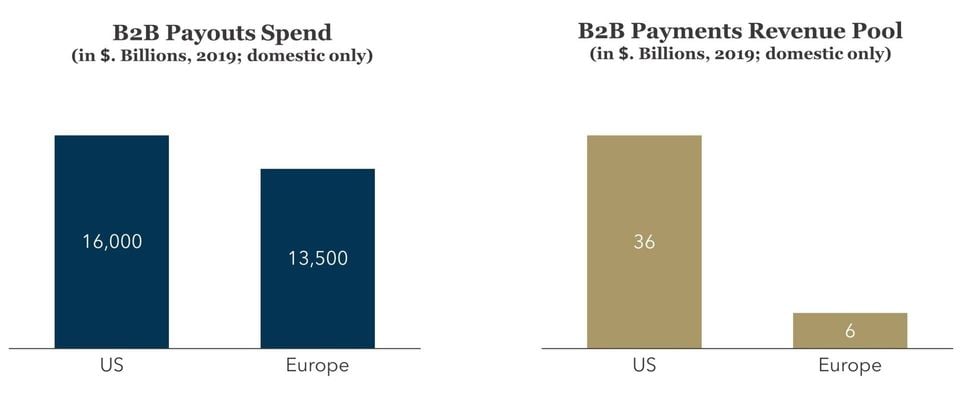

Business SaaS platforms with integrated payments offer tremendous value creation potential by eliminating paper and manual processes, by accelerating cashflow and capture of payment term discounts, by reducing payment risk, and by enhancing the customer and supplier experience and satisfaction levels. This value-creation allows for payment service providers to earn premium payments take-rates (1-2%). These value-added payments are significantly more penetrated in the U.S. (c. 10%) relative to Europe (c. 3%) making the U.S. revenue pool for B2B payments roughly six times larger than Europe (as shown in Figure 2).

FIGURE 2: B2B Payouts Spend and B2B Payments Revenue Pool

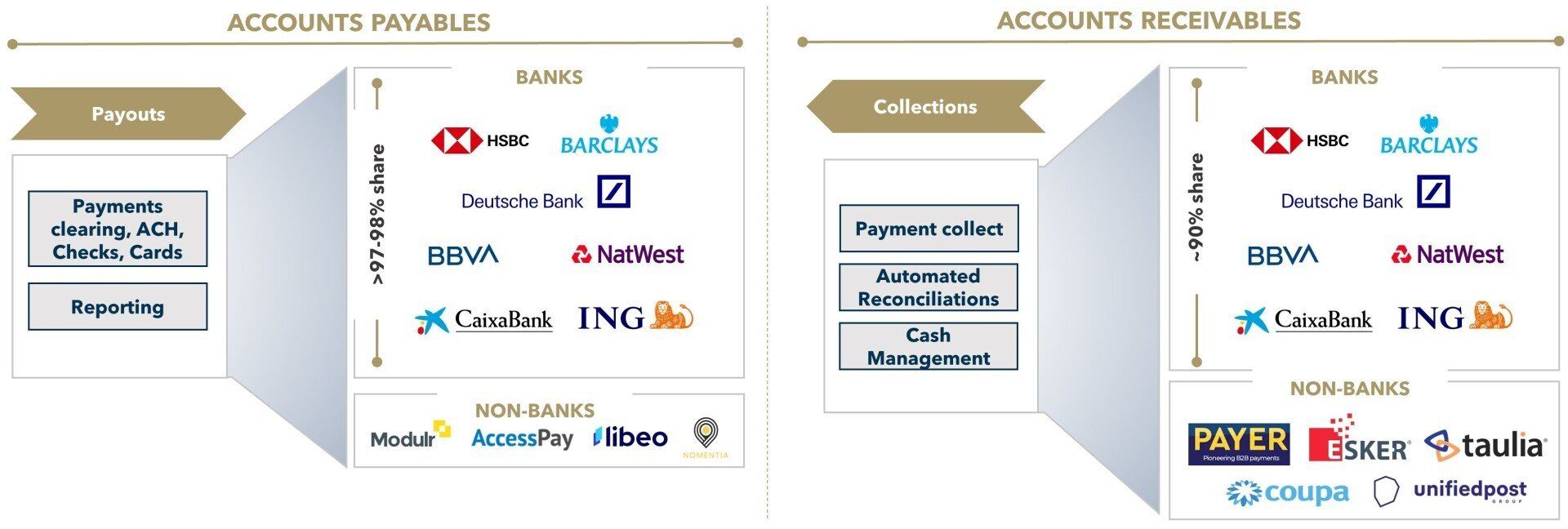

In Europe, bank payment rails are modern, but the development of software integrated payments is less mature than in the U.S. Europe’s addressable revenue pool is significantly lower compared to the US (see Figure 2) mainly because most of the B2B spend today is served by general-purpose bank transfers which cost only a few cents. Banks, not fintechs or ISVs market integrated payments, and are therefore still the dominant payment services providers for A/P (payouts) and A/R (payment acceptance) today in Europe (see Figure 3).

Enterprises typically maintain direct connectivity to banks through file-based host-to-host channels and generally view payments as a separate process, disconnected from their A/P and A/R management. We believe the potential for end-to-end automation of A/R and A/P software and payments initiation and reconciliation is tremendous. We are seeing more software companies addressing this need, for example procurement / ERP companies integrating virtual cards for payouts (e.g. Basware, Jaggaer). Because card acceptance is still limited in European B2B commerce however, this revenue pool is still limited (though we expect strong growth).

FIGURE 3: European Payouts and Payment Collections Landscape

While Europe lacks the scaled monetization of virtual cards as seen in the U.S., we do see ongoing integration of bank payments and e-invoicing and A/R management software from both SaaS providers and fintechs. For example, Payer, a Swedish fintech offers an integrated invoice-as-a-service allowing businesses to issue an e-invoice and collect receivables through direct integrated payments as well as supply chain financing. Another example is Unifiedpost, a Belgian A/R SaaS company that offers a cloud-based platform for e-invoicing, procurement, digital identity, payouts (bank and cards), pay-ins and working capital financing, all in a one-stop integrated model.

B2B SaaS-Payments in the SME Segment

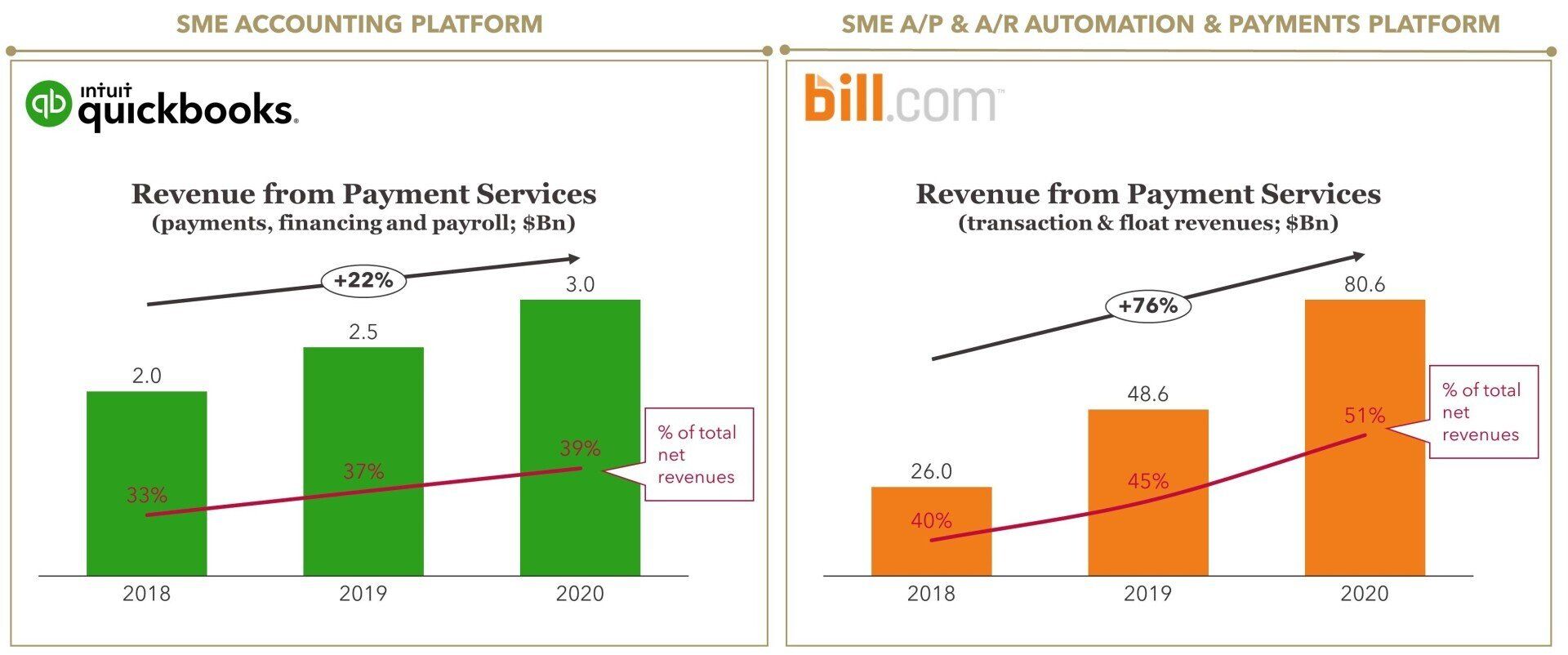

For SMEs, accounting software is well positioned to serve as a ‘one stop shop’ for integrated financial services. In the US, companies such as Intuit are already mature with the integration of accounting and various forms of pay-ins and payouts. Intuit Quickbooks, the U.S. market leader for small business accounting, generates close to 40% of its net revenue through payment services with a 20%+ growth in payment revenues over the last 3 years (as shown in Figure 4). Intuit has been successful in driving these upsides through a wide network of fintech partners that help to power payments acceptance, payouts (digital checks, ACH, cards), payroll and working capital financing. Intuit also used selective M&A to build its fintech business.

FIGURE 4: Performance of Select US B2B SaaS-payments Platforms

A/R and A/P software companies in the U.S. are thriving by evolving into fintechs. Bill.com, a U.S. SME market leader, started as a SaaS online bill payments platform and grew into an integrated A/P and A/R payments fintech, integrating e-invoicing, pay-ins and pay-outs through ACH, credit/virtual cards and international wires. As shown in Figure 4, more than half of Bill.com’s net revenue today comes from payment services (transaction fees and interest float income). Much of the success of Bill.com comes from its distribution focus – including many partnerships across the A/P and A/R ecosystem (Bill.com has partnerships with 80% of the top US 100 accounting firms).

The maturity of integrated accounting and payments in the SME segment in Europe is again, less mature than in the U.S. Leading European accounting platforms are still filling in their potential to offer and monetize end-to-end automation and financial services (as shown in Figure 5). While we see players such as Visma and Exact taking the right steps in integrated payments, payment services contribute only a small portion (<10%) of net revenue

FIGURE 5: Integrated Payments Coverage of EU Accounting Platforms

Although we only see the tip of the iceberg today in Europe, we have high expectations for growth as accounting/ERP platforms move aggressively into the fintech opportunity around the world. Sage, for example, has rapidly expanded its network of fintech partners in Europe (e.g. ModulR for bank-to-bank payouts). A strong B2B SaaS-fintech operating model will generally involve multiple partners because there are multiple, different fintech opportunities associated with this play as described in Figure 6.

FIGURE 6: Integrated Payments Opportunities for SaaS Based Accounting / ERPs

In Summary

The state of B2B integrated payments in the U.S. and Europe are quite different. In the U.S., the payment rails are old and imperfect, but software providers generally offer end-to-end automation plus payments to fill the native gaps in payment rails and automate a broad set of use cases. In Europe, B2B payment rails are modern, but business often lack end-to-end integration between business software and payments. U.S. market structure results in a massive, high-growth revenue pool with many unicorns and happy investors (though ongoing growth from displacement of legacy is still tremendous). European market structure results in a smaller revenue pool, although similar growth potential as SaaS providers and fintechs increasingly address the opportunity for end-to-end process automation via integrated payments.

Please do not hesitate to contact Anupam Majumdar Anupam@FlagshipAP.com or Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.