B2B payments, long the bastion of commercial banks, remains fertile ground for fintech innovation and market penetration. While the pace of innovation and consolidation in B2C payments has been brisk, large cross-sections of B2B payments remains relatively traditional and undisrupted. B2B payments have lagged in digital innovation due to:

1. Slow lead times for changing procure-to-pay and order-to-cash processes.

2. Fewer imperatives to optimize the customer buying experiences (as compared to B2C payments).

3. Stubbornly resilient paper-based payment instruments.

Infrastructure improvements (e.g., real-time payments) and enabling technologies (e.g. open banking) have created a perfect nexus for an acceleration of innovation in B2B payments. As discussed throughout this article, we expect a wave of fintech growth and shareholder value-creation as new products and business models attack traditional transaction banking and decoupled B2B workflows.

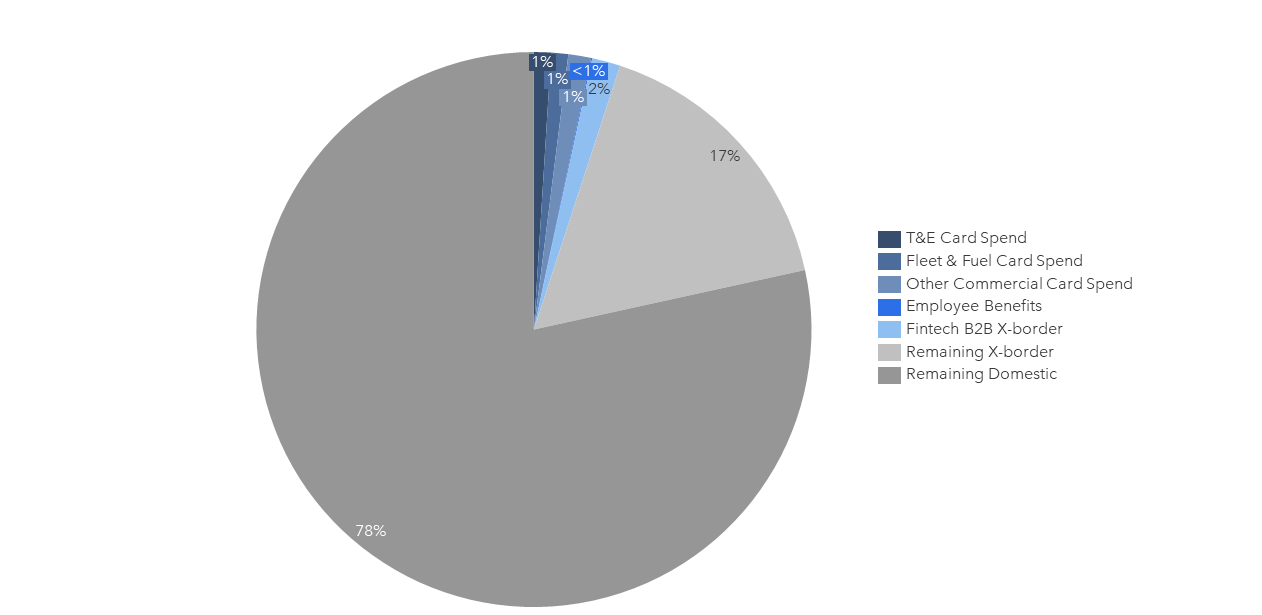

Trillions in Untapped Opportunity

Global annual B2B commercial consumption spend in 2019 was $150 trillion. As of today, only c. 5% of this $150 trillion total market is addressed by fintechs. The remaining $140+ trillion remains unaddressed by fintech, running over legacy domestic and cross-border banking rails. Fintechs will increasingly address this $140T of global spend exploiting new technologies to enable faster and richer integrated payment flows.

FIGURE 1: Global B2B Consumption Spend ($Trillions; est.2019)

Total commercial B2B consumption is c. $150T

Maturing B2B Segments

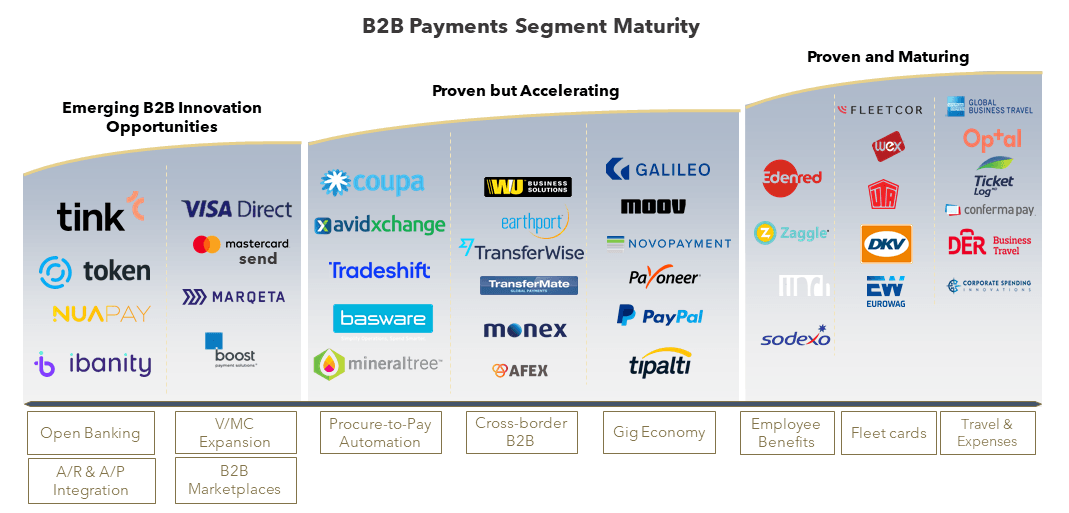

There is wide variability in the relative maturity of different B2B payment services segments (as shown in Figure 2). There are segments of B2B payments which are well addressed by specialists/fintechs. For example, travel and entertainment business credit cards and central billing are well-penetrated (though far from saturated). Similarly, business fuel spend is relatively well addressed by fleet cards. And lastly, employee benefits in some countries and contexts, such as meal vouchers, are well-addressed by specialists such as Edenred and UpDejeuner. Note that these segments are far from reaching the end of their innovation and growth cycles, but there is clearly maturity as defined by the global scale achieved by category leaders. Each of these segments of spend illustrates the value-creation potential that specialized providers of payment services can introduce to the marketplace.

FIGURE 2: Maturity in B2B Payments Segments

Proven but Accelerating B2B Segments

As shown in Figure 2, there is a second category of B2B payments segments where the value-creation storyline is clearly proven, but where today’s scale is a fraction of the global market potential and there promises years of ongoing rapid growth. We consider cross-border B2B payments and cross-border payout services to fall into this category as well as Procure-to-pay automation.

The vast majority of cross-border B2B payments still flow through traditional correspondent banking, typified by high costs, often slow speeds, and lack of traceability. Fintechs such as Banking Circle and Currencycloud are attacking correspondent banking with new, rapid virtual global payment and account networks. Other fintechs such as TransferMate are focused on developing and distributing end-user propositions for cross-border payment users (in particular innovating the technical toolkit and integration with B2B software platforms).

In parallel, fintechs are also addressing the unique needs of the rapidly growing (17.5%*) gig economy (i.e., distributed workforces). The gig economy cannot be well served by traditional banking networks that underserve cross-border needs, particularly for small businesses. Fintechs such as Payoneer and Transpay have introduced a range of easy-to-use and fast propositions for global payments, exploiting new technologies such as virtual cards and Visa/MasterCard original credit transaction (OCT) technologies.

Lastly, fintechs have served as a proven ground for automating workflows in the procure to pay processes, addressing inefficiencies in these processes, which tend to be manually intensive. Fintechs such as Tradeshift and Basware offer possibilities to automate the entire procure-to-pay processes by digitizing the interfaces across procurement, ERP, invoicing and reconciliation systems.

* 17.5% annual growth as estimated by MasterCard: https://newsroom.mastercard.com/wp-content/uploads/2019/05/Gig-Economy-White-Paper-May-2019.pdf]

Less Proven B2B Opportunities with Massive Growth Potential

There is then a category of opportunities which we consider to be relatively unexploited and where we see great opportunity for fintechs to thrive in B2B payments by exploiting the expanding array of technologies well-suited to address B2B needs. Open banking is one innovation enabling access to real-time bank payment networks via APIs (which then in turn allows for expanded integrated software functionality). Fintechs and banks alike are now positioning to innovate beyond the basic API plumbing to enable new value-added services through this plumbing. Visa and Mastercard are also a driving force for innovation with each introducing a range of innovations which can be levered to address the B2B market. Software providers and fintechs are also increasingly integrating the traditionally fragmented end-to-end workflows of B2B commerce with real-time payments and banking services. Finally, marketplaces are increasingly common in B2B commerce and marketplaces necessitate innovation so that buyers and sellers can easily enter the marketplace and transact in real-time on a trusted basis. Each of these innovations are enhancing the opportunities available to fintechs focused on B2B payments.

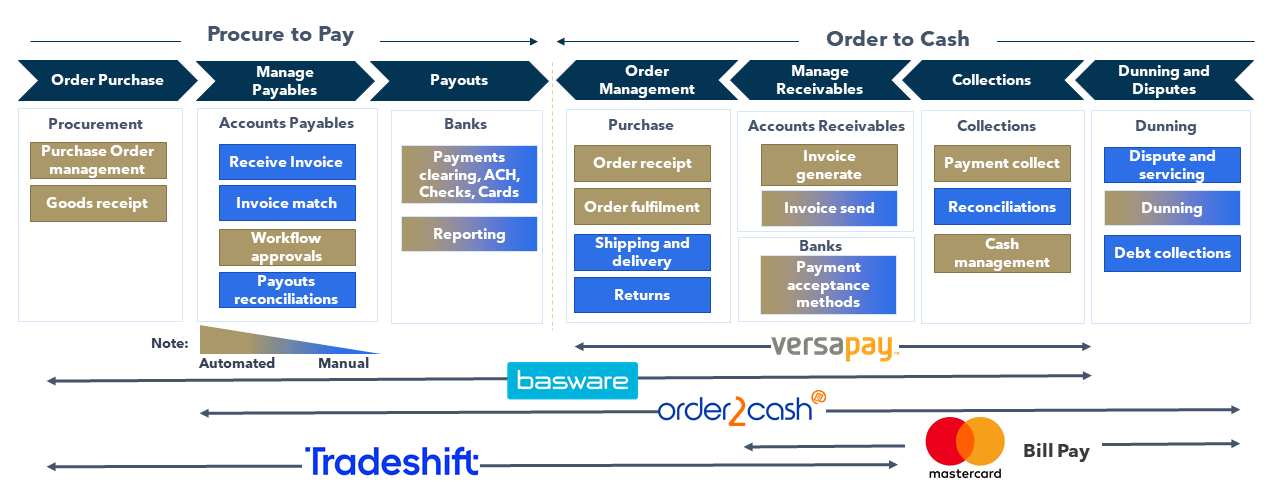

Emerging Opportunity #1: Payments Integration in B2B Procure-to-Pay and Order-to-Cash Lifecycles

Figure 3: ‘Procure to Pay’ and ‘Order to Cash’ Workflows Often Exist in Silos, We Expect Fintechs to Automate These Workflows

In mid-sized and large businesses, accounts payable and accounts receivables continue to be separate processes, often managed by separate departments. In addition, the fragmented landscape of IT systems responsible for A/R and A/P functions (ERP, CRM, billing, payouts, reconciliation) makes the end-to-end supply chain complicated and inefficient. Large businesses often spend millions of dollars filling the gaps and manually managing exceptions arising from this far-too-siloed ecosystem. The ongoing preference of paper-based instruments (especially in the US, APAC) further compounds the efficiencies and needs for manual processes and expenses.

Fintechs will play an increasing role in automating end-to-end supply chains, breaking traditional siloes between the order-to-cash and procure-to-pay processes, and delivering integrated payment services which are automated and intelligent. This innovation is already visible with fintechs such as VersaPay, MineralTree, and AvidXchange serving businesses with automated payout solutions integrated into ERP systems. Fintechs are also increasingly integrating payments with accounts receivable systems to drive automated reconciliation (which remains a sharp pain point for most businesses).

Given that many mid/large businesses tend to be multi-banked, fintechs are also now offering services to integrate incoming and outgoing payments data across service providers and countries. For example, Cobase, a fintech investment of ING group, offers businesses with a multi-banking portal and a single integration point for all banking accounts and cash balances. Worldpay acquired fintech provider Payzein, provides a solution which consolidates acquiring data across providers in order to streamline reconciliation.

Emerging Opportunity #2: Innovation via Open Banking

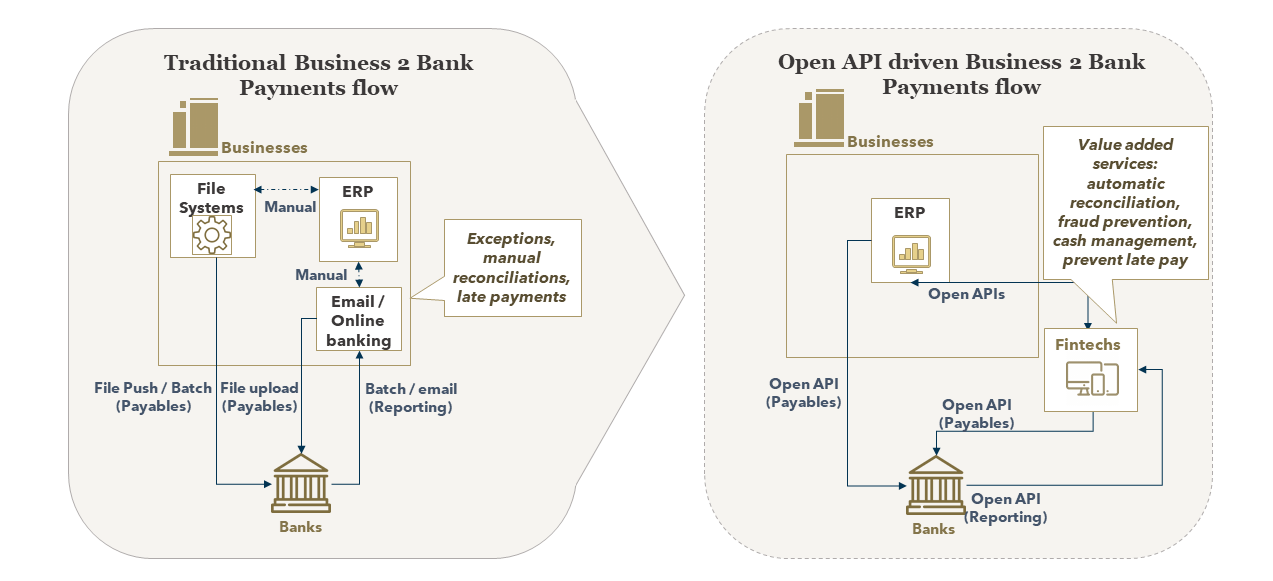

FIGURE 4: Open API driven Business 2 Bank payment flows likely to disrupt traditional Business 2 Bank flows

Traditional banking is limited by poor integration technologies. Thus, even in cases where various workflows software components are integrated, there is often a reliance on bespoke file-transfers based payment execution. Banks today also do not generally offer a robust set of value-added tools to manage payment exceptions and reconciliation mismatches. Thus, even if the payment transactions can be processed at low cost, the systemic efficiencies around failures and exceptions still leaves lots of opportunity for value creation.

Open banking enabled by modern API technology will enable fintechs to address these unmet needs. Software and workflow service providers will increasingly partner with fintechs to access real-time, value-added payment services (such as invoice issuance, fraud prevention, online notifications, chasing late payments, automated reconciliations, payee confirmations). New commercial models will arise to reward these innovations beyond the basic cents per transaction of traditional bank payments.

Open banking fintechs such as Tink or token.io offer businesses banking gateway services allowing access to hundreds or even thousands of banking via a single API. We also see emergence of fintechs offering integrated end-user open banking services such as Nuapay and Modulr, offering businesses with integrated accounts and payments with benefits of automatic payment alerts, automatic reconciliations and real time visibility.

Emerging Opportunity # 3: The Rise of B2B e-commerce Marketplaces

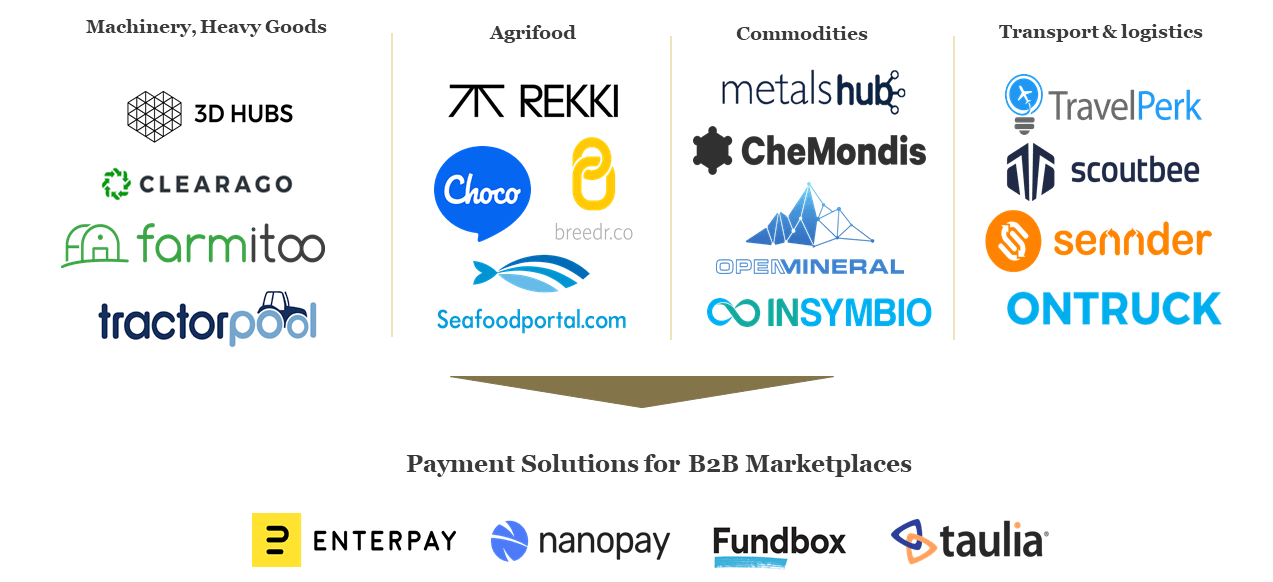

FIGURE 5: Vertical B2B Marketplace

B2B commerce is increasingly driven by marketplaces, which can greatly simplify the typically complex B2B supply chains. In fact, many expect B2B marketplaces to exceed the scale of B2C marketplaces in the relatively near term. These B2B marketplaces are often vertically focused, for example specializing in machinery, agrifood, commodities, transport & logistics, retail, and chemicals. Marketplaces have complex requirements for payments as there are many sellers and pay-in needs as well as many buyers and pay-out needs. B2C marketplace PSPs such as MangoPay or Lemonway (along with Stripe and Adyen) are increasingly expanding their focus to B2B marketplaces. So too we see new fintechs entering the market or adapting existing services to serve the needs of B2B marketplace payments. For example, Enterpay offers automated credit management and invoice payment services to B2B marketplaces. Nanopay, another fintech, offers cash and liquidity management functionality (allowing companies to more intelligently move and monitor liquidity) alongside its B2B payment services.

Beyond the many requirements of a B2C marketplace (complex underwriting, compliance, and hierarchies, varying legal/commercial models, x-border facilitation, etc.), B2B marketplace PSPs often fill requirements specific to B2B commerce. For example, supporting payment terms and need for credit/float, complex regulatory reporting, and multi-stage procurement flows.

Other important tactics for authorizations and digitalization include optimizing settings for contactless transactions via PIN-request limits and chip counter resets, checking that fraud monitoring systems are not producing an undue amount of declines, and reviewing mobile and digital banking self-service functionality to allow customers to quickly and easily change daily limits, turn cards on/off, etc.

Emerging Opportunity #4: Visa and MasterCard Technologies Stimulate B2B Disruption

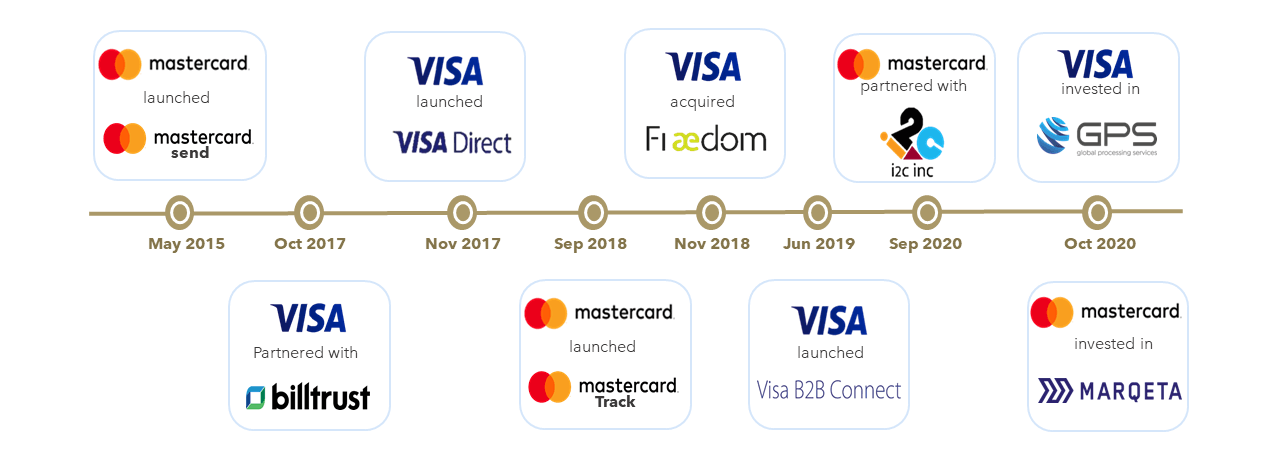

FIGURE 6: V/MC B2B Product Launches, Investments & Partnerships

Visa and MasterCard recognized the massive potential of B2B payments many years ago, though penetration of the B2B market was relatively slow (particularly outside of the U.S.) until recent years. Today, Visa and MasterCard have a powerful toolkit for enabling B2B payments innovation headlined by virtual card, OCT (Visa Direct and MasterCard Send), and specialized bank-to-bank payment networks leveraging blockchain technology. Used in combination, these new tools allow businesses to both better control and to instantly pay their suppliers in real-time.

Travel specialists such as WEX have for years leveraged the power of virtual cards for both managing travel spend and facilitating payouts to distributed travel providers. Payout specialists such as Payoneer are increasingly leveraging V/MC networks to support their GIG economy payout services, where OCT technology is particularly powerful. B2B payments fintechs such as Boost Payment Solutions are increasingly enabling virtual card issuance (for buyers) and acceptance (for supplier) as well as converting card payments to bank payments as needed to facilitate B2B network transactions. Finally, next generation, cloud-based card processors are also benefitting from V/MC innovations and even the direct investments of Visa and MasterCard themselves. For example, Mastercard recently invested in next-gen processor Marqeta and Visa invested in Global Processing Services (GPS).

An expanding array of technology innovations such as open banking, B2B marketplaces, workflow automations, software integrations, and V/MC virtual accounts and real-time push payments are enhancing the ability for fintechs to enter and thrive in addressing the unique payment needs in the massively scaled B2B payments market. As the last decade was the age of fintech in B2C payments, so too we see the next decade as the age of fintech in B2B payments.

To share your views or discuss those above, please contact Anupam Majumdar at Anupam@FlagshipAP.com or Joel van Arsdale at Joel@FlagshipAP.com.