European bank management boards typically view credit cards as a cash cow business with good returns on equity but challenging to invest in growth. Recent trends largely reinforce this skeptical view:

- Stagnant or declining receivables;

- impacts from Covid-19 (e.g., tightened underwriting, regulated payment holidays);

- decreasing transactional revenues (e.g., interchange caps, FX margin competition); and

- increasing regulatory burden (e.g., PSD2) driving ever-increasing operating burdens.

This negative view of credit cards in Europe is misplaced. Credit cards, like many aspects of banking, have challenges, but the potential for growth and differentiation is good. Quantitatively, penetration of unsecured short-term credit in most European countries is still relatively low. Qualitatively, the underlying concept of a flexible credit facility accessible as a means of payment is a strong value proposition that meets a variety of consumer needs. Admittedly, success in revolving credit cards requires adaptation and investment beyond what most EU banks do today.

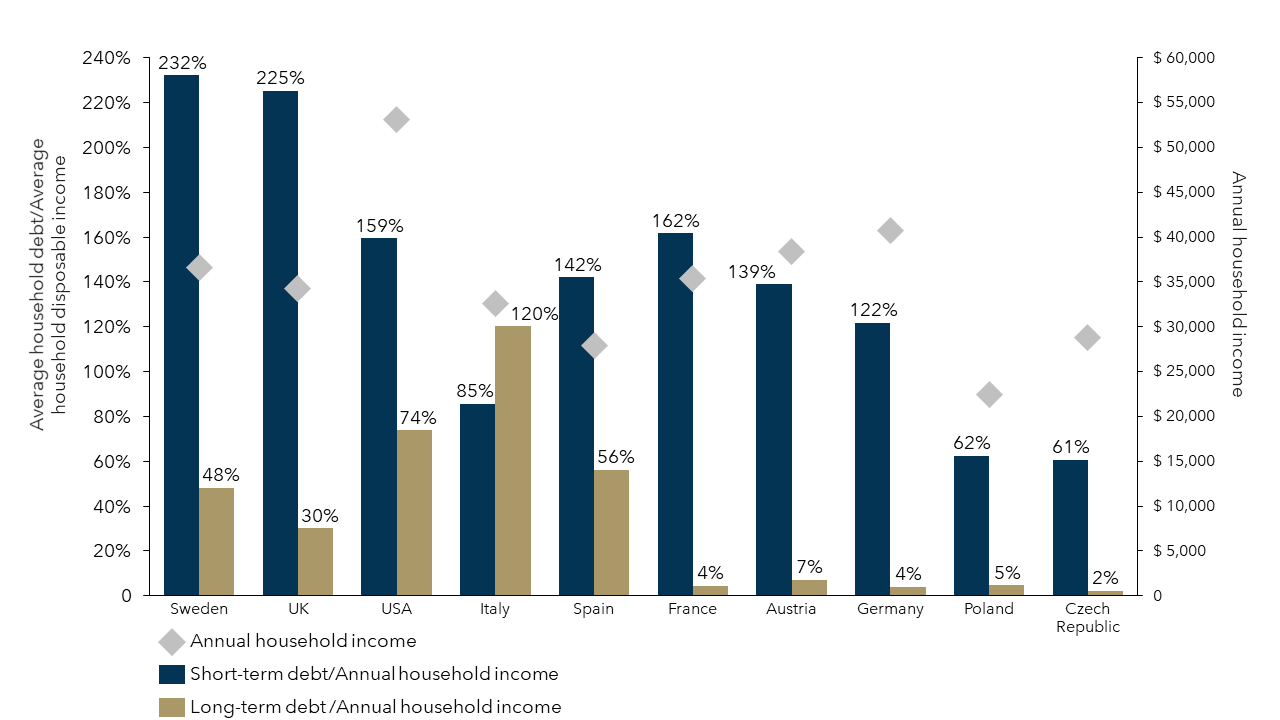

FIGURE 1: Household Debt vs. Income

1 Annual household income is defined as total income less employers’ social insurance contributions, employees’ social insurance contributions, taxes on income and regular taxes on wealth.

2 Short-term debt is defined as debt that has maturity of one year or less. Maturity can be defined either on an original or remaining basis.

3 Long-term debt has an original maturity normally of more than one year, except that, to accommodate variations in practice between countries, long-term may be defined to require an original maturity in excess of two years.

Source: OECD.

Despite economic uncertainty due to the pandemic, now is a good time for European bank credit card issuers to optimize their businesses and then lay out a clear plan to grow when conditions are right. Most European banks are likely to keep their credit card businesses in cash cow mode, therefore those banks that optimize now will be well-positioned to win market share and achieve profitable growth in the future.

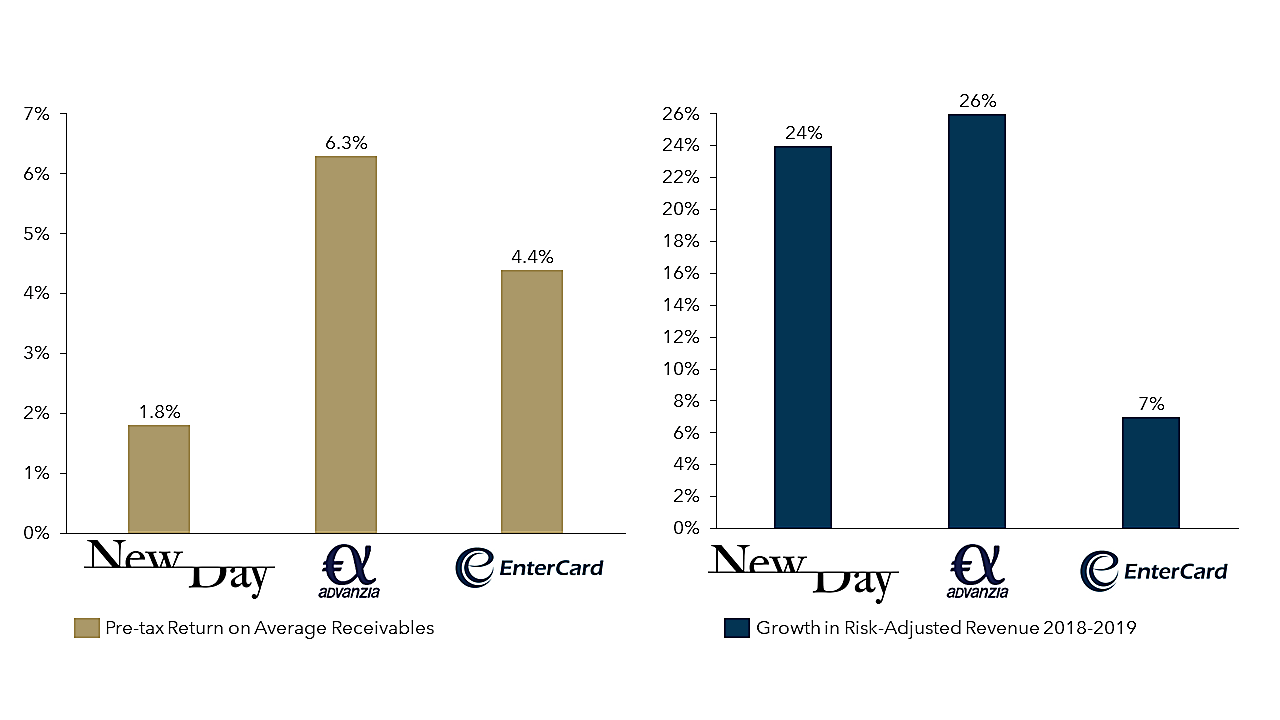

The potential for growth and high returns in European credit cards is illustrated by specialized lenders such as NewDay and Advanzia, who have found significant success via focus, targeting underserved niches (store cards, co-brands, near-prime), and investing to build strong competencies in distribution, risk management, and CRM.

FIGURE 2: Example Specialized Credit Card Lender 2019 Pre-Tax Return on Receivables and Growth in Risk-Adjusted Revenues

Fintechs are often considered to be potential disruptors in the unsecured credit space due to their ability to innovate, strong user experience, modern tech stack, and ability to leverage data. The success of credit-oriented fintechs like Klarna supports this view, and certainly banks need to ensure that their unsecured credit businesses are not eroded in the same manner as their basic banking businesses have been. However, credit is not an easy win for most fintechs: they have significant capital disadvantages vs. banks, much smaller operating scale, and lack the ability to integrate credit into a broader proposition and cross-sell it via multiple channels. Many neobanks still do not offer unsecured credit, and the bankruptcy of Kreditech/Monedo is a red flag for over-emphasizing innovation in underwriting.

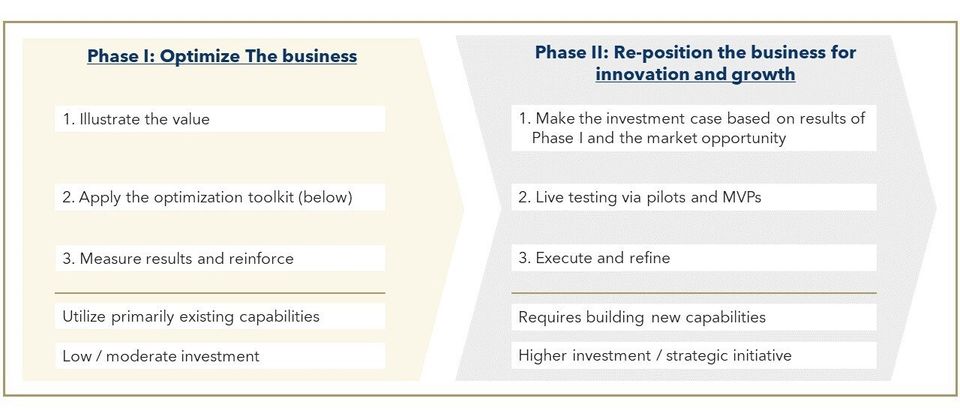

At Flagship, we believe that European banks can grow shareholder value in credit card issuing via a two-phased approach: optimizing the existing business now, and then re-positioning the business via innovation to grow when market conditions are more favorable. The first optimization phase uses a “toolkit” of tactics that we detail below and requires a moderate amount of investment. The second growth phase, which requires more significant investment, will be detailed in a subsequent article.

FIGURE 3: Bank Credit Card Issuer Vision for Growth

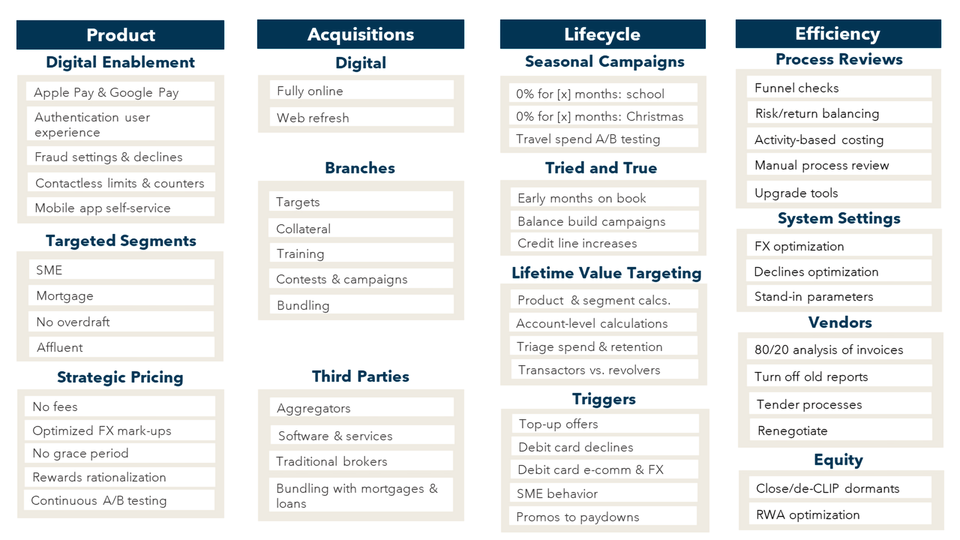

The optimization toolkit is designed to enable an issuer to improve their business using tools available today, and then prioritize based on their individual needs (an example of how to do so is described here). We have categorized the catalog of tactics into four areas: product, marketing, distribution, and operational efficiency.

FIGURE 4: Credit Card Issuer Optimization Toolkit

Toolkit: Product

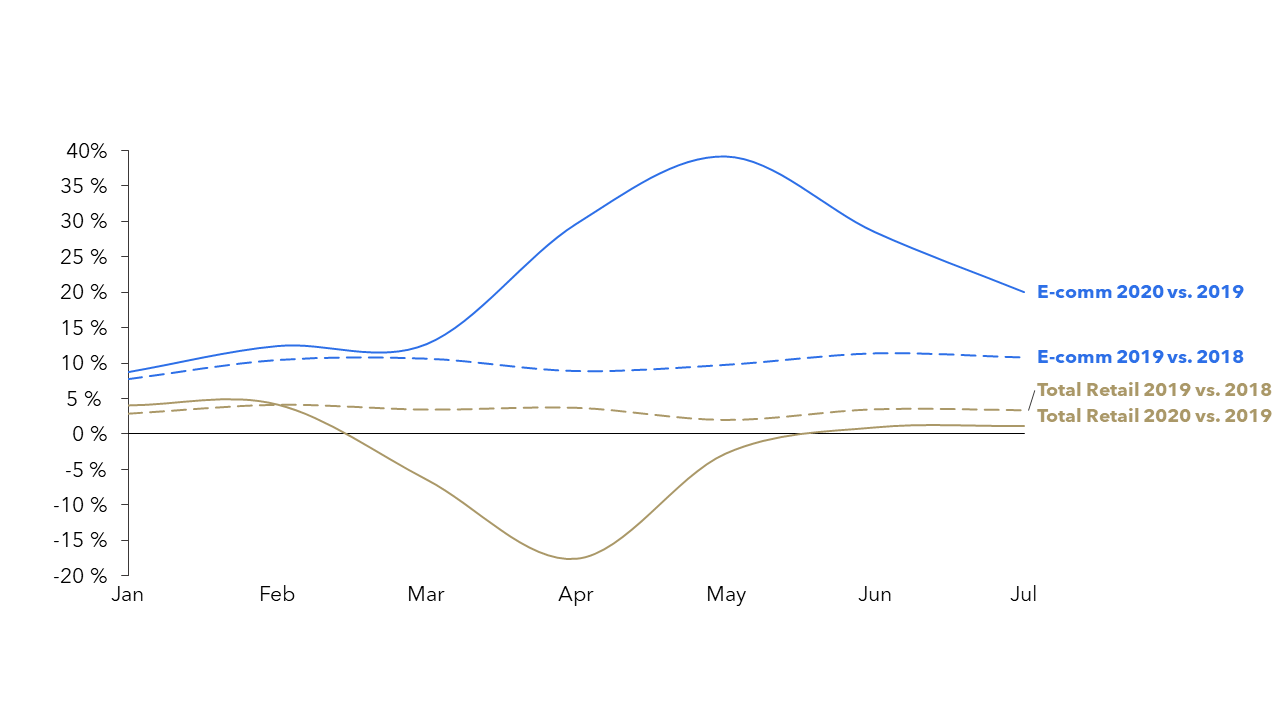

Enabling digital commerce is a critical prerequisite for future growth due to the continuing shift from physical channels to digital and omni-channel and the huge increase in e-commerce sales as a result of Covid-19 (as illustrated in the figure below) have made digital enablement even more urgent.

FIGURE 5: EU Sales vs. Same Month of Prior Year

Beyond the basics such as enabling Apple Pay and Google Pay, issuers should carefully review their plans for implementing Strong Customer Authentication (likely via 3D Secure 2.1) to create a better user experience. The digital experience for using cards online has suffered in recent years compared to other forms of payment (e.g., PayPal) as the security measures for cards grew more cumbersome and issuers have been generally unwilling to invest to innovate and improve the user experience.

While some components of authentication are mandated via PSD2, there are often ways to introduce a smoother interface (e.g., biometric authentication in mobile banking instead of separate apps and additional passwords) and to optimize fraud controls. European issuers often have relatively blunt rules-based authorization strategies that err on the side of hard declines, and therefore could take a page from U.S. issuer playbooks, and approve transactions but request cardholders to confirm the validity after the fact (via e-mail or push notifications) coupled with customer-friendly chargeback procedures.

Other important tactics for authorizations and digitalization include optimizing settings for contactless transactions via PIN-request limits and chip counter resets, checking that fraud monitoring systems are not producing an undue amount of declines, and reviewing mobile and digital banking self-service functionality to allow customers to quickly and easily change daily limits, turn cards on/off, etc.

Tailoring products to segments is an opportunity for most issuers, although this of course needs to be balanced with not having an overly large product catalog. SME cards are under-penetrated at most issuers, and while attractive unregulated interchange rates present an easy business case for SME cards, the underlying customer needs (credit and expense management tools) make a strong case for an attractive SME card proposition. Other typical segments include sharpening the cross-sell pitch and process to new mortgage customers, clients without overdraft, and affluent clients (although the business case of the latter is becoming challenging as FX revenues decrease).

Strategic pricing that emphasizes long-term value rather than cash-cowing is critical to growth. While it is often tempting for issuers to maintain existing (often high) prices, future profitability often requires sacrificing some short-term price points to defend against attrition and make the overall proposition more attractive. Example tactics can include removing monthly/annual and ATM withdrawal fees to create a “no reason not to take it” proposition, and lowering FX mark-ups (either as a defensive move or as part of an acquisition key selling point). Revenue declines from these tactics can be offset by removing the grace periods on revolver-oriented cards (boosting interest revenue while simplifying the product pitch to customers that are confused by grace periods), reducing or eliminating rewards programs and other spend incentives that cannot be justified quantitatively by either a clear lift in profitability, or decreases in attrition or increases in acquisitions (the latter two measured on the basis of bank-wide profitability), and cross-selling value-added services.

Customer bases and market conditions can vary widely across Europe, so continuous A/B testing of price points and tactics can ensure that propositions optimally balance attractiveness to customers to support long-term growth with near-term profitability objectives.

Toolkit: Acquisitions

Setting the right marketing mix is important under normal conditions, and the pandemic has made optimizing multi-channel marketing (supplementing branches with digital channels, call center, and outbound marketing) even more important.

Building digital channels via strong customer onboarding journeys is necessary to position the business for future growth and to supplement branch production in current pandemic conditions. If fully digital onboarding has not been built yet, creating the solution design (e.g., mapping out technical solutions and processes) is a necessary first step, and refreshing web pages can typically be done quickly and easily (e.g., does the web page clearly communicate two to three key selling points for the product and create a call to action?).

Optimizing branch acquisitions can be done via “tried and true” tactics such as setting sales targets for bankers supported by an incentive system, checking that sales collateral is clear and compelling, running periodic sales contests/campaigns, regularly refreshing sales training, and providing strong sales scripts. Testing bundling credit cards into current account packages (e.g., free credit card and/or overdraft facility with current account) can also boost acquisitions.

Distribution via third parties is increasingly important, as credit markets mature and become more digitally oriented, aggregators and other digital third parties are large (if not the largest) channel for new acquisitions (e.g., as in the UK). Actively managing and optimizing these partner distribution channels is increasingly important, and is likely to become even more so as payments and credit become more integrated into other services. In less mature credit markets, traditional brokers still play a large role, and they can also be effective distributors (albeit often via bundling credit cards with mortgages and other lending products). Many of the branch tactics noted above can be used here as well, but incentive levels and effective bundling with other lending products play a larger role.

Toolkit: Lifecycle

Most European banks under-market to existing credit card customers. Banks (logically) will typically allocate existing customer marketing budgets to either general relationship building (e.g., mobile app feature education) or to products with or high-volume/certain return products (mortgages, installment loans, investment funds). Credit cards often receive little marketing support, therefore, issuers must focus on building the case for relatively small investments to find and optimize the most valuable campaign types and channels, and making the case based on ROI.

Seasonal campaigns are a basic starting point. Well-timed 0% interest for [x] months offers (e.g., before back to school or before Christmas) can generate profitable lift in acquisitions and balances. Capturing travel spend profitably via broad campaigns can be done but is trickier (even pre-Covid) and usually requires more testing.

Tried and true lifecycle management tactics including early months on books (EMOB) campaigns to activate new cardholders, periodic balance building campaigns (promotional interest rates, etc.), and credit line increase programs (CLIP) provide many options for well-targeted and profitable campaigns.

Lifetime value calculations at the product or segment level, and ideally at the individual account level, provide a strong quantitative base for targeting all types of campaigns. Performing this analysis can help remove unprofitable “spend and get” campaigns, unprofitable retention offers, and generally re-orienting focus and investment away from unprofitable customers (often transactors) to more profitable customers (often revolvers).

Trigger-based campaigns can be highly profitable and can be done on a simplified basis even without a real-time campaign management software. Successful tactics typically include acquisition or top-up offers to current account customers that are overdrawn, acquisition offers to debit card customers who were declined due to insufficient current account balances, acquisition offers to debit card customers with e-commerce or foreign transactions, conversion offers to consumer card users with SME characteristics, and promotional balance offers to revolvers who are paying down their balances. Contact policy limitations are a common barrier, but lifetime value associated with the above tactics is often enough to justify at least rudimentary testing.

Toolkit: Operational Efficiency

While the tactics described above are focused on revenue growth, optimizing profitability requires that issuers continually drive operational efficiency. Business cycles tend to lead to an emphasis on either revenue growth or efficiency, as organizations naturally focus limited resources on a few initiatives. Ideally, issuers can form a culture of constant efficiency improvements even when they are in revenue growth mode.

Implementing a culture of continual operational efficiency improvements can be challenging as operational delivery often falls under the responsibility of different groups/departments within bank credit card issuers. These diverse responsibilities often create complexity that is ripe for cost and efficiency savings. Tactics here can include funnel checks for branch onboarding, digital onboarding, and risk/underwriting approvals to identify steps in the onboarding process with high drop-off rates, risk reviews to ensure that the risk appetite is commensurate with returns, and process efficiency checks to perform high-level activity-based costing and to remove manual processes from back office functions, and to utilize modern tools for disputes and settlement/reconciliation.

Optimizing processing system settings can yield profitability improvements by ensuring that foreign currency conversion rates and multi-currency settlement processes are optimized, and optimizing authorization decline rates by channel, product, and customer type can provide an improved customer experience (and incremental volumes). Checking stand-in processing settings from time to time is also useful to ensure that the business and customers are protected if online authorizations are down.

Vendor cost health checks can lower costs when done with a partnership mindset (please see additional discussion here). In addition to re-negotiating vendor rates given the changed situation due to Covid-19, tactics here can include performing 80/20 analysis of scheme and processor invoices to investigate and potentially eliminate high cost or unclear line items, eliminating reports and data files from card schemes and processors that are no longer needed, and tracking vendor contract expiration dates and running tender processes well in advance.

Balance sheet optimization, such as closing dormant accounts or reducing dormant credit lines to reduce line exposure, or optimizing product settings and customer terms and conditions to reduce Risk Weighted Asset allocations for credit cards, can also produce significant cost savings in the form of reduced equity allocations.

The Path Forward

Like all financial services, unsecured credit products and distribution are clearly becoming more digital, and banks must increasingly compete with challengers such as fintechs. The toolkit provided above gives issuers a set of actionable initiatives that can be executed now to improve the performance of the business, but positioning for increased market share and significant growth when market conditions stabilize requires further innovation. While this path forward via innovation is not without challenges, the underlying opportunities in the market are significant, and most European banks continue to under-invest in and under-market credit cards relative to their potential. We will present our vision for innovation-led in a subsequent article.

To share your views or discuss those above, please contact Erik Howell at Erik@FlagshipAP.com.