The race to scale in European Payments leapt forward yesterday with the news of Nexi’s acquisition of SIA and rumors of a sale of Nets, for which Nexi is also a rumored potential buyer. These announcements follow a pattern of furious consolidation in the last 5-7 years in a race to achieve preeminent scale in the European market for payments processing and merchant services.

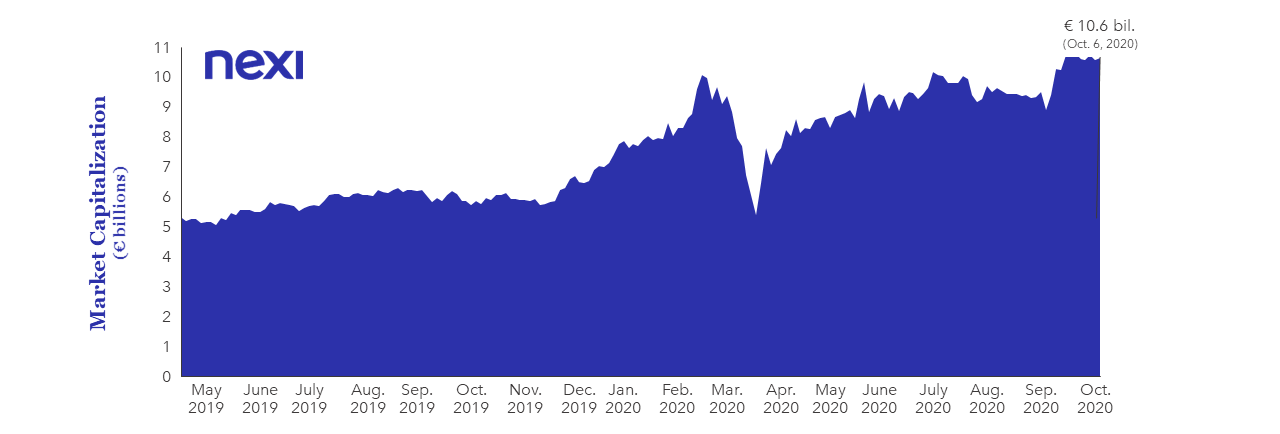

FIGURE 1: NEXI Market Cap and Financial Profile

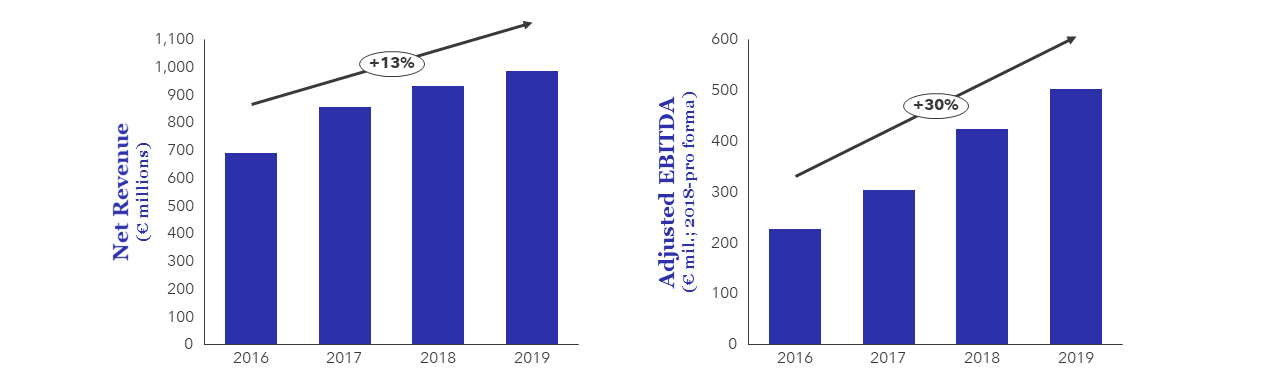

Nexi is a tremendous success story, evolving from a traditional interbank utility to become a modern and vast fintech champion in Italy. The acquisition of SIA would solidify Nexi’s market leadership position and infrastructure in Italy as well as fueling an international expansion ambition supported by SIA’s strong position in pan-European instant payments. SIA is a leading technical processor for payments in Italy a well as the technical backbone for EBA Clearing and much of the pan-European instant payments clearing (described further in Figure 2 below).

FIGURE 2: SIA Company Overview

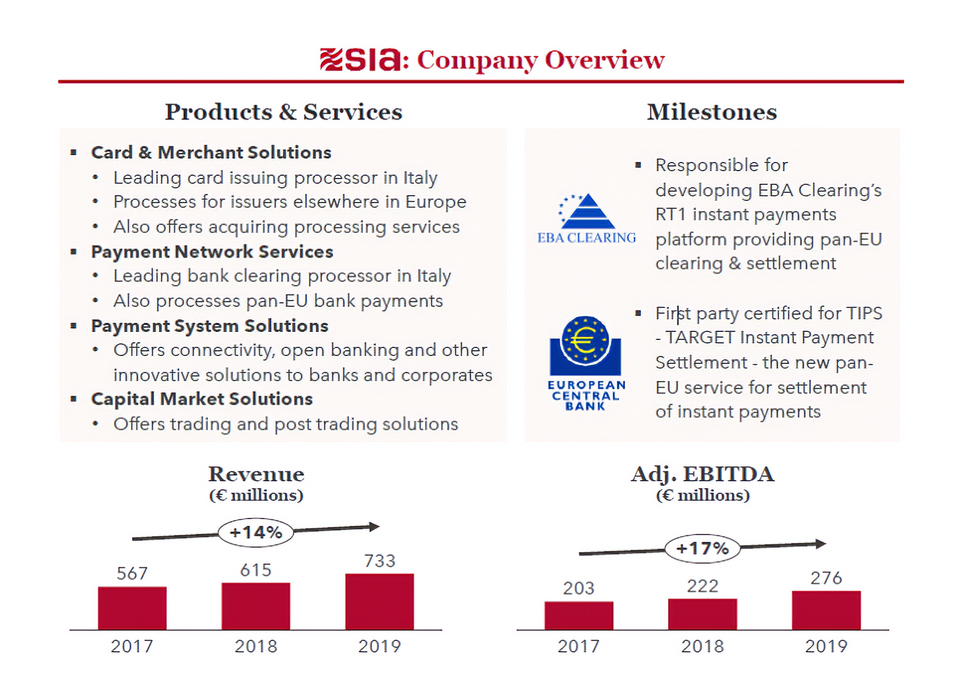

Nets is a desirable target with a unique footprint across Northern Europe. Nets also underwent significant expansion and modernization efforts during its recent years of private ownership and is well-built for sustained EBITDA growth via expanding scale efficiencies. There is clear rationale for payments consolidators to focus on Nets as an acquisition candidate given its unique Nordic / DACH (Germanic) / Baltic / Polish footprint.

FIGURE 3: Nets Select Performance Metrics

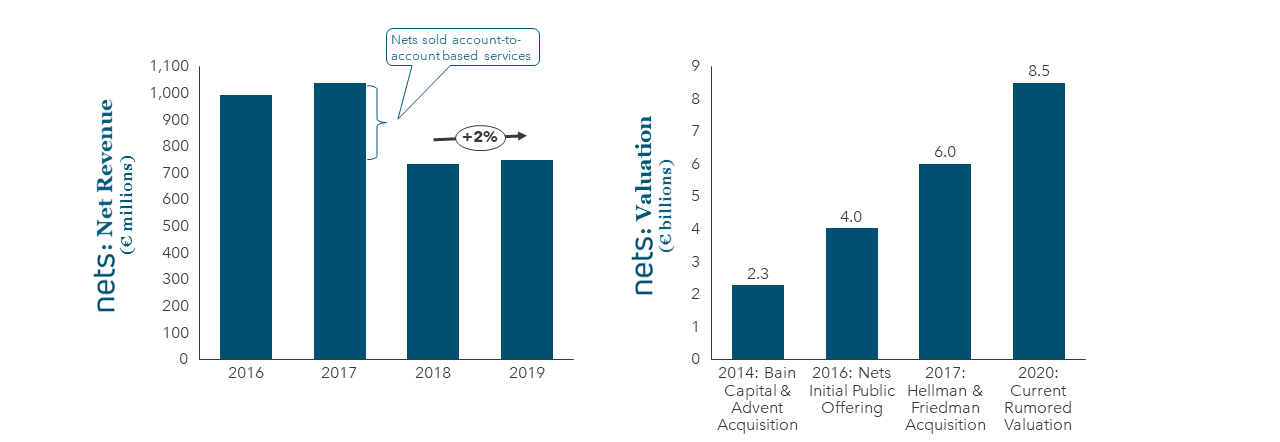

The fit between Nexi and Nets is undeniable, given somewhat similar interbank backgrounds, development curves, and the companies’ highly complementary European footprints (as well as some common shareholders). There is also clear acquisition rationale for the global, U.S. multi-national processors (Global Payments, Fiserv, FIS) to target both Nets and Nexi who are each a desirable target for scaling a European market position.

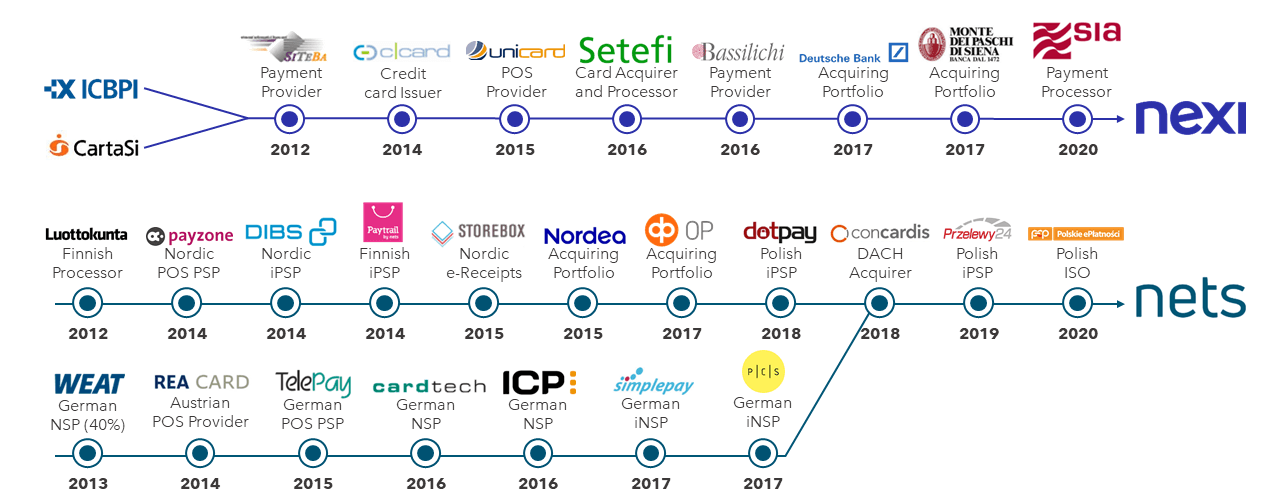

Below, we profile the impressive expansionary paths of Nexi and Nets.

FIGURE 4: Nexi and Nets Key Acquisitions

(since 2010)

With the likely acquisition of Nets to playout in the coming weeks or months, the European market for processing has morphed from being largely domestic (15 years ago) to a highly consolidated European marketplace led by Worldline, Fiserv, Global Payments and Nexi (presuming that one of these companies also acquires Nets). Shareholders should continue to benefit from ongoing operating model efficiencies, where robotics and other technologies offer great potential. The most attractive revenue growth engine for these groups remains the merchant services franchises, where consolidation and scale efficiencies are a key theme, but so too there is a growth and innovation imperative to compete with the likes of Adyen and Stripe who are gaining market share rapidly in Europe.

To share your views or discuss those above, please contact Joel Van Arsdale at Joel@FlagshipAP.com.