The convergence between financial services and business services (delivered as Software as a Service) is accelerating, creating tremendous shareholder value along the way. Fintechs such as Square or PayPal are increasingly expanding their portfolio of both business and financial services. Meanwhile, SaaS providers such as Shopify and Lightspeed are rapidly expanding into payments with the potential to expand from there into other financial services. These market leaders are already achieving great success via convergence, but today, we see only the tip of the iceberg for value creation potential. Under the surface lies the enormous potential of commerce data intelligence, where commerce and payments data could drive new, Google-esque business models.

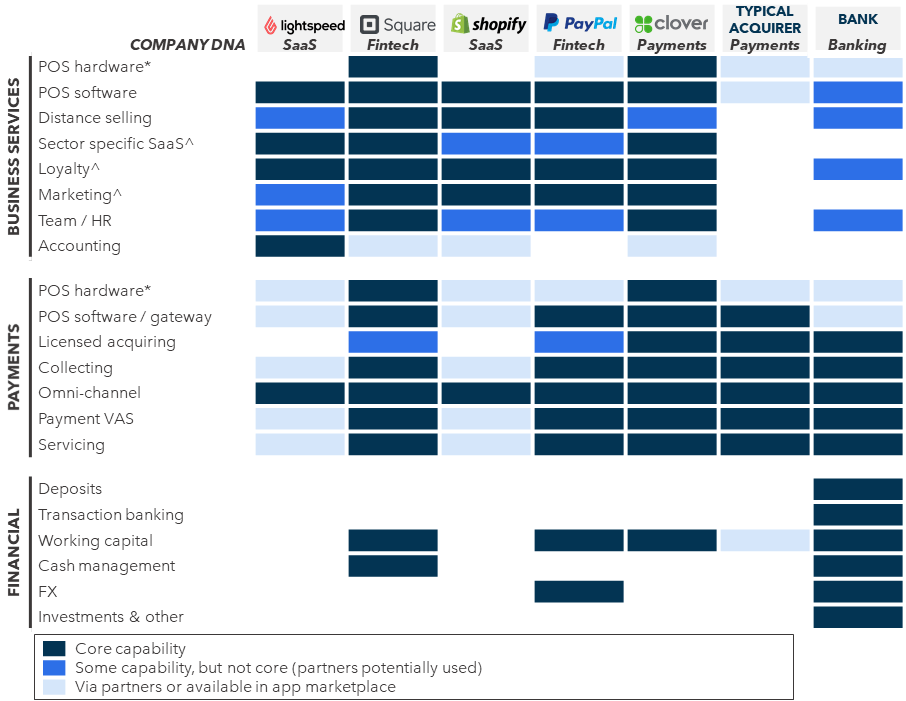

FIGURE 1: Convergence Landscape

^These capabilities vary widely across channels and may be visible online, but not in POS and vice versa

Source: Company websites, Flagship Advisory assessment

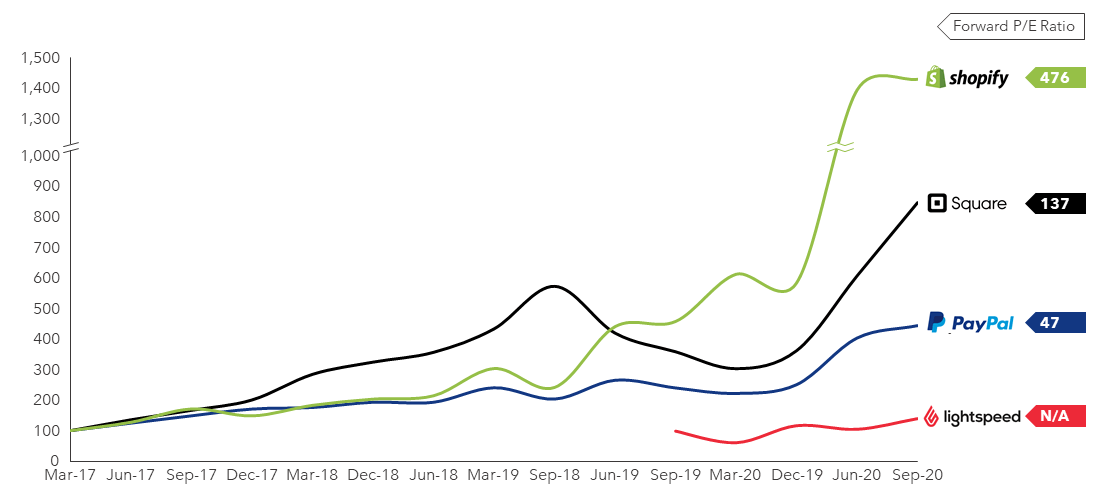

Shareholders clearly love this story (as they should). Convergence has the potential to create tremendous value for customers and their providers. At the core of this convergence lies tremendous technology and business model innovation. These SaaS-centric market leaders have completely reinvented traditional product and services using modern technology (cloud, mobile, digital experience, etc.) as well as reinventing distribution and customer servicing models (no more face-to-face sales and “please call back during business hours” servicing.)

FIGURE 2: Notable SaaS & Fintech Share Performance

Source: Yahoo Finance

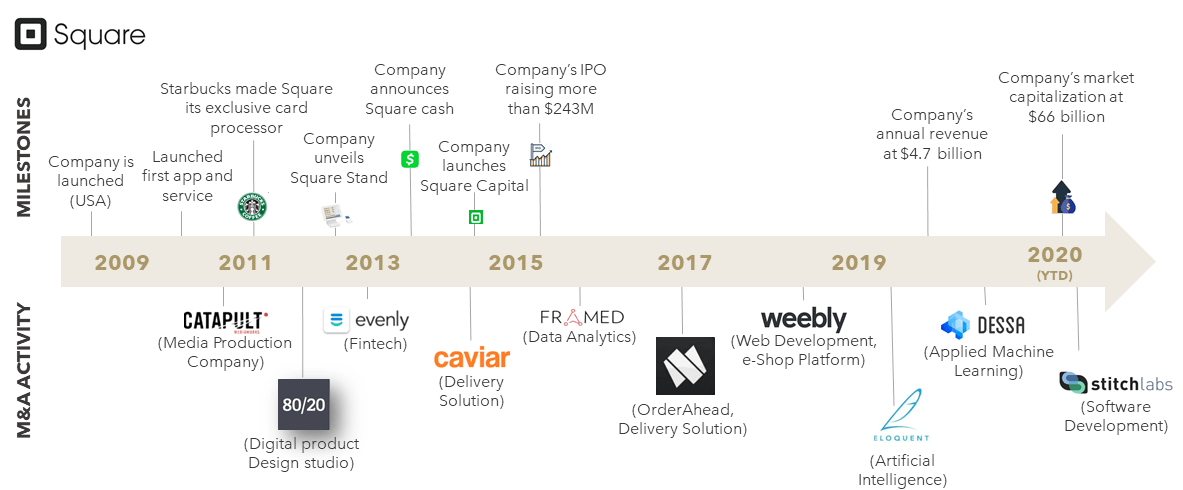

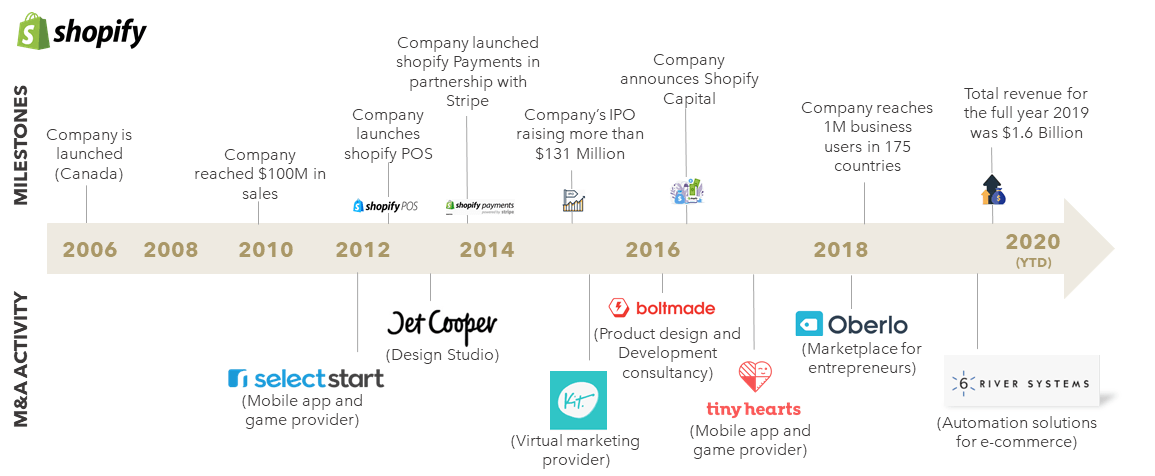

SaaS and Fintech convergence leaders are rapidly expanding their portfolio of business and financial services as well as their geographic footprint, although their individual expansion strategies are a somewhat varied mix of organic and inorganic expansion. Square has largely focused on organic services expansion (although both M&A and partnerships to obtain capabilities have been enablers) and has been somewhat slower to scale outside of its core North America market. Shopify is accelerating its global expansion organically, although it has engaged in a series of generally small, capability-focused acquisitions. PayPal is already highly global and in recent years has focused on large-scale capability acquisitions. Lightspeed is generally using M&A to drive both geographic and sector expansion. Figures 3 and 4 summarize the expansion paths of Square and Shopify respectively alongside their revenue scaling.

FIGURE 3: Square Development Timeline

FIGURE 4: Shopify Development Timeline

Within this increasingly bundled and technology driven intersection of business software and services and financial services, do banks and traditional merchant payments companies have a chance to compete? In short, yes, but it will require significant effort and well-crafted investments and partnerships. SaaS providers challenge traditional business models of merchant payment companies, who now must adapt. As an example, Fiserv, a traditional payments company, appears to be succeeding with its convergence platform Clover. The Clover product continues to expand its breadth of services, vertical specialization, and global footprint. Highly visible in the market for some years in North America, we are now also seeing the product within shops in Europe (Fiserv, then First Data, reported that Clover surpassed the 1 million units milestone in 2018). Smaller merchant payments companies will struggle to achieve the massive and patient investment poured into Clover, but there is a growing array of partners who can help to enable SaaS packages.

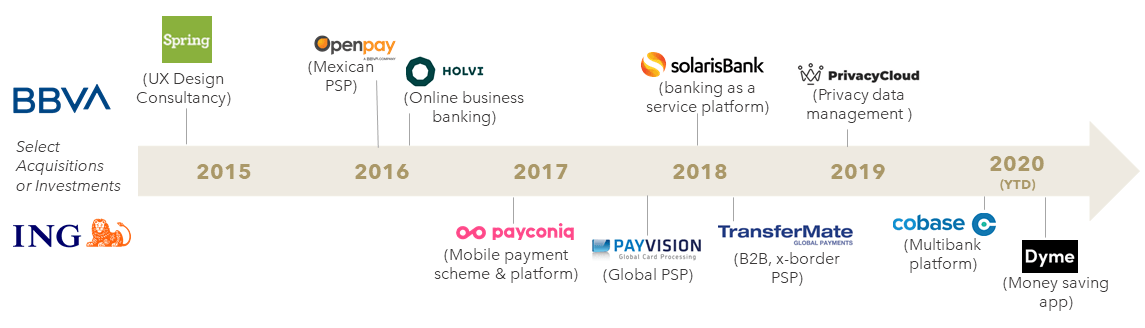

FIGURE 5: Notable Fintech Investments of BBVA and ING

Banks are most challenged to innovate given the natural capital profile and pre-existing innovation/reinvention challenges arising from digitization. However, there are glimpses of potential for leading bank franchises to market SaaS services. Commonwealth Bank achieved some early success with Albert and Credit Agricole has an interesting suite of commerce services (ePOS, web shop, etc.), although it is not clear if these expansions can be considered a resounding success at this point. Banks have the advantage of trusted brands and massive stores of data to leverage for SaaS services; but banks have not yet positioned significantly for the convergence between fintech and SaaS. Banks (such as BBVA and ING) remain primarily focused on fintech investments as a defensive measure against threats on their core banking business.

The great convergence of SaaS and fintech, fueled by technology and business model innovation, is reshaping the marketplace for business and financial services. This trend will clearly continue given the vast potential for ongoing service and geographic expansion. Traditional providers of busines and financial services have an imperative to adapt in the face of more innovative competition. Finally, we expect data-driven services to emerge from convergence, with vast value-creation potential in the coming years.

To share your views or discuss those above, please contact Joel Van Arsdale at Joel@FlagshipAP.com.