Conventional wisdom suggests that consolidation within merchant payments is principally driven by M&A. From c.1995 to 2015, this conventional wisdom was indeed accurate. As the U.S. market matured over the last five years, the dynamics of market consolidation shifted. From 2016 to 2021, our analysis suggests that organic share movement was more impactful than M&A as a force of consolidation within the U.S. merchant payments market.

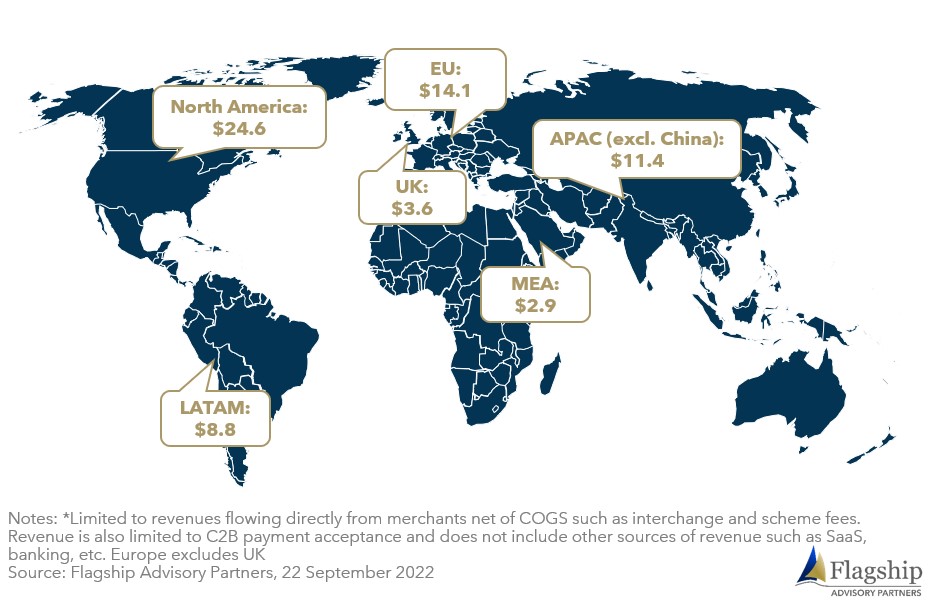

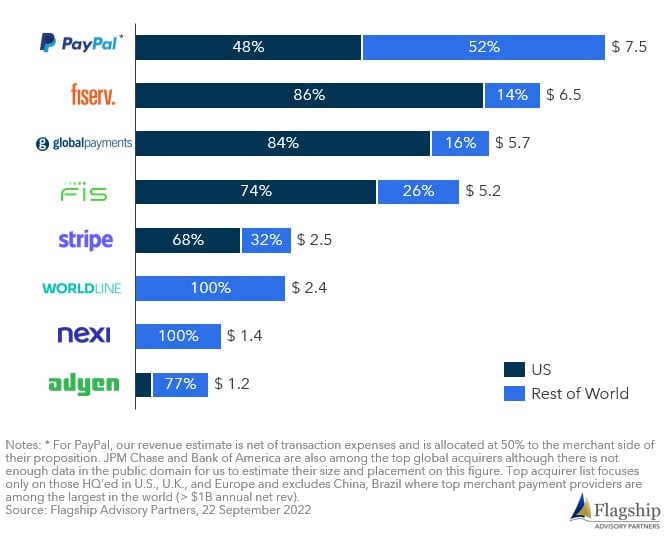

Merchant payments (isolating C2B) is a lucrative but fragmented global industry. In 2021, providers of merchant payment services earned c. $65 bil. in revenue globally (excluding China) and c. $25 bil. in net revenue in the U.S*. No provider owns more than c. 12% of the global revenue pool, and no provider owns more than c. 22% of the U.S. revenue pool.

FIGURE 1: Global Merchant Services* Net Revenue by Region (2021, $BN)

FIGURE 2: Largest Merchant Payments Providers by Estimated Net Revenue

(2021, $BN, Global and U.S.)

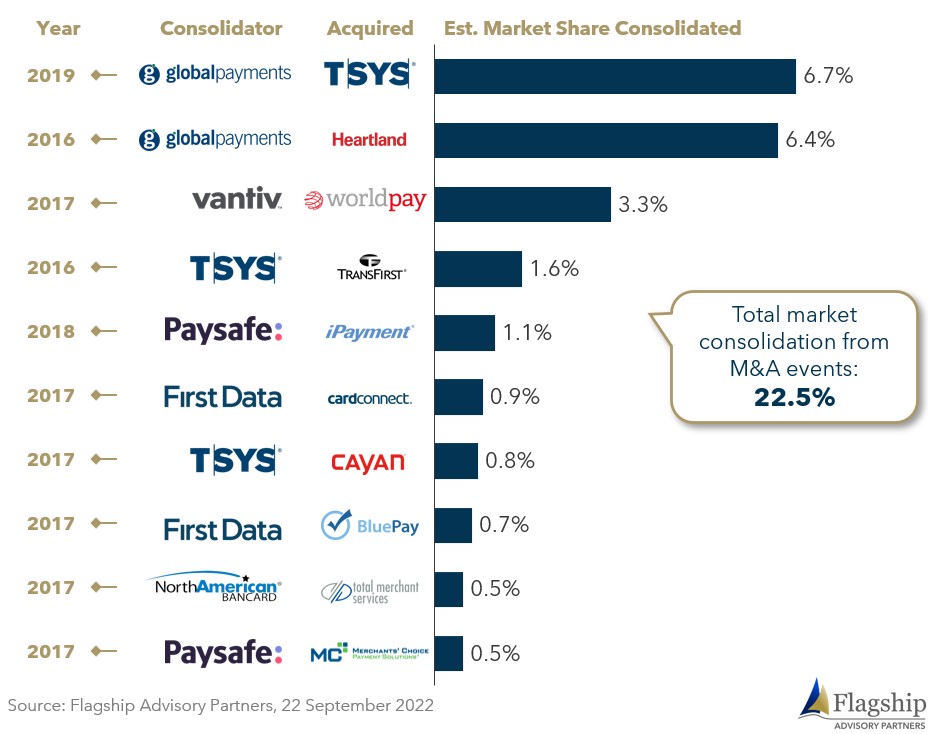

Consolidation of this fragmented business is ongoing, as it has been for decades, and will continue for the decades to come. We commonly think of M&A as the primary driver of consolidation in merchant payments, as it was in U.S. merchant payments from 1995 until 2015. Companies such as Fiserv, Global Payments, FIS, Worldline, Nexi, and others used M&A to drive their presently leading global scale. However, in recent years, differential organic growth outcomes and the resulting share shifts have become more impactful than M&A in consolidating the U.S. merchant payments market.

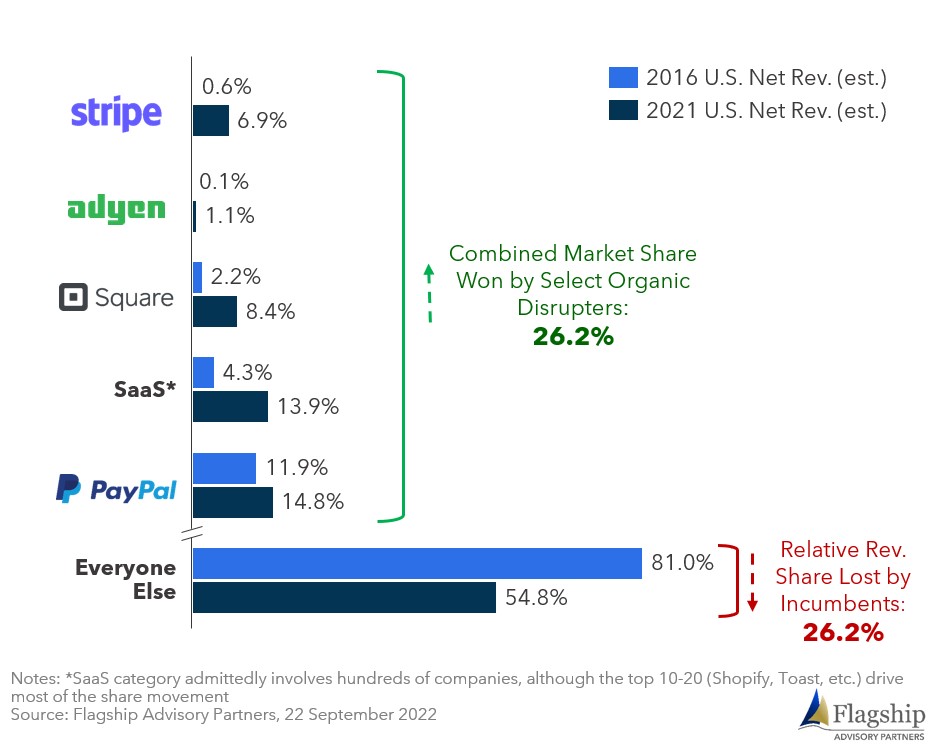

Flagship Advisory Partners recently conducted an analysis to measure the relative impacts of organic share movement and M&A on the consolidation within U.S. merchant payments. The results are shown in Figure 3 (M&A consolidation) and Figure 4 (organic consolidation).

FIGURE 3: Revenue Share Consolidation Impact of Top 10 M&A Events in U.S. Merchant Payments (2016-2021)

For the M&A consolidation impact, we estimated 10 deals in total from 2016-2021 that consolidated at least $100 mil. of net revenue. Limiting the M&A consolidation impact to only the top 10 deals does underestimate the total impact of M&A, but not significantly (and the same limitation of sample exists in our organic sample). As illustrated in Figure 4, M&A consolidated approximately 22.5% net revenue market share across the five years measured.

FIGURE 4: Revenue Share Consolidation Impact of Top Organic Disrupters in U.S. Merchant Payments (2016-2021)

For the organic consolidation impact, we isolated four individual disruptive companies (PayPal, Stripe, Square, and Adyen) and, collectively, the SaaS community as a general disruption segment. As shown in Figure 4, the organic impacts of share wins by Stripe, Square, and SaaS providers were significant. In total, our organic disrupter sample gained 26.2% market share from 2016 to 2021. This market share consolidation was a function of significantly higher growth for these winners than the net revenue pool. As with the M&A disruption sample, we only measure a sample of the overall organic disruption population; other smaller providers also achieve high organic growth rates. Admittedly, we also recognize that considering SaaS as a singular consolidating group is misleading as hundreds of different companies exist within this group. However, it is also the case that a relatively small number of companies, most notably Shopify, account for the majority of this share movement.

In summary, based on our approach and samples utilized, organic growth disruption drove the consolidation of 26.2% of the market share, while M&A accounted for 22.5%. In a mature market such as the U.S., we may now be past the days in which M&A is the primary source of market consolidation. The same analysis (2016 to 2021) in Europe would have produced a different conclusion, but we also expect organic forces to become more impactful in the coming years relative to M&A.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com or Sameer Verma at Sameer@FlagshipAP.com with comments or questions.