We advise viewing the slides via the "PDF" icon button.

General Observations

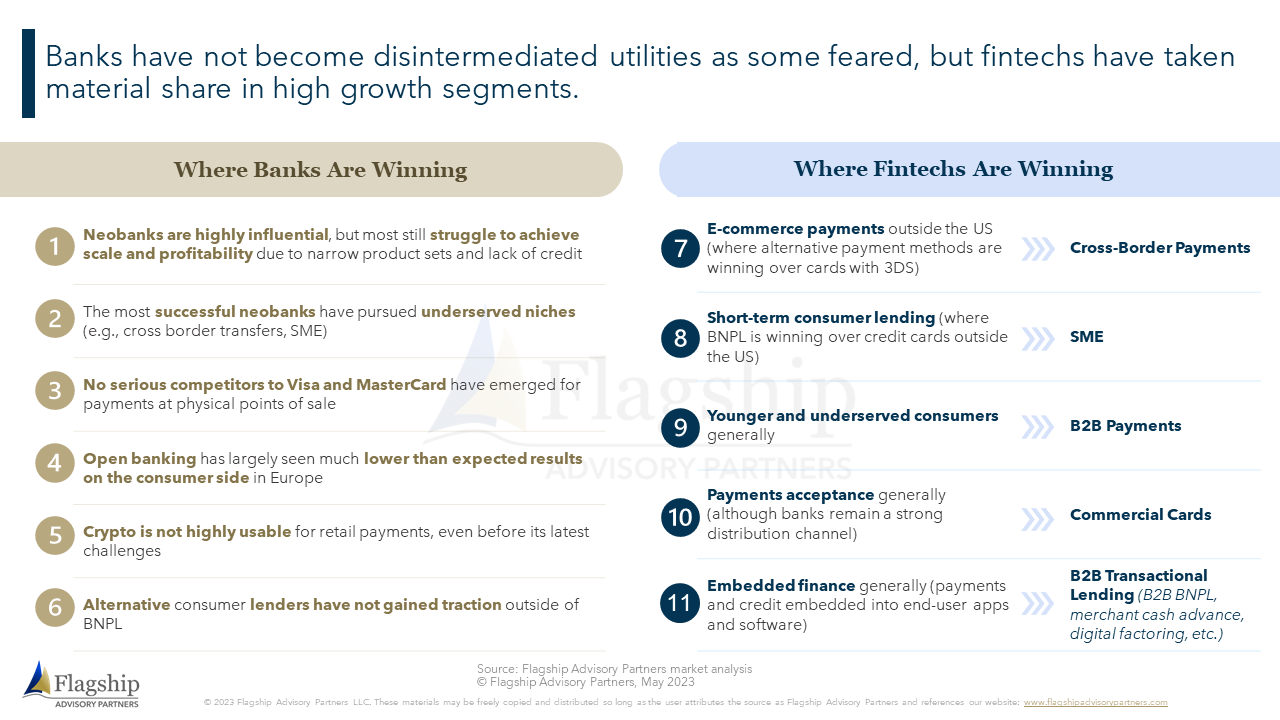

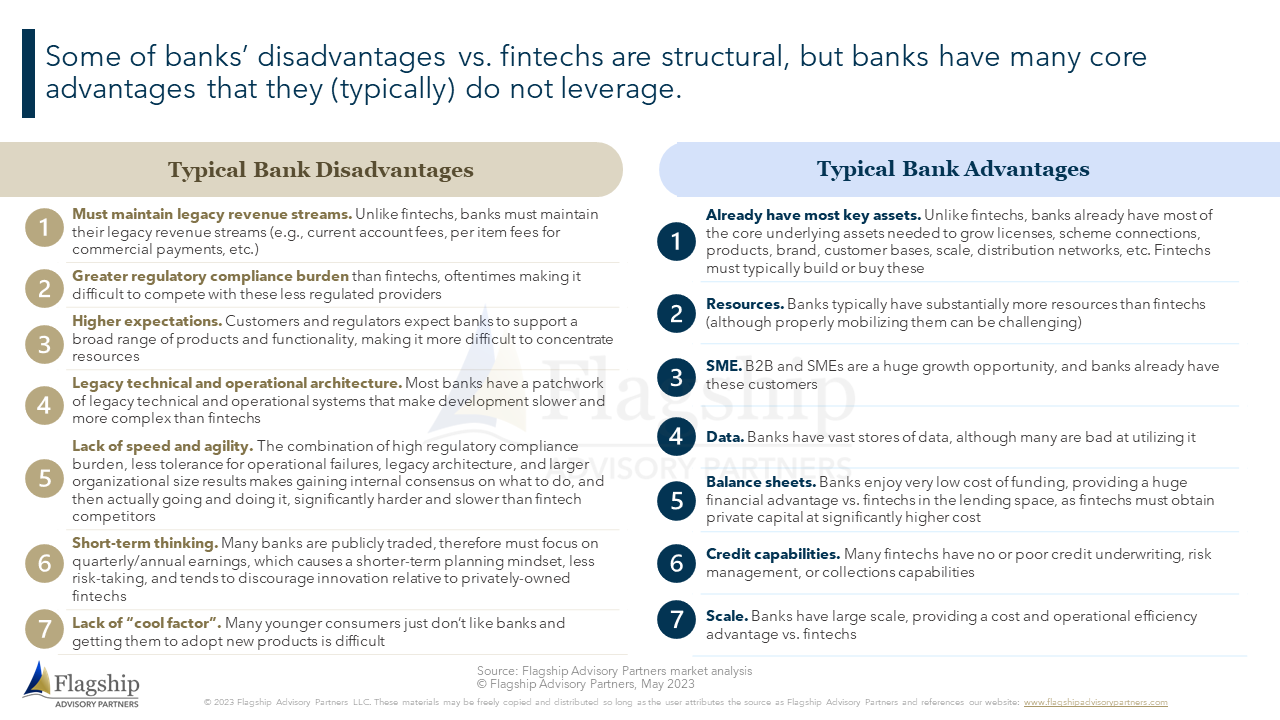

Banks have not become the commoditized utilities that many feared, but they are clearly losing out on many growth opportunities in payments and fintech. Nevertheless, banks do have strong capabilities that can help them compete and many opportunities to win in payments in fintech.

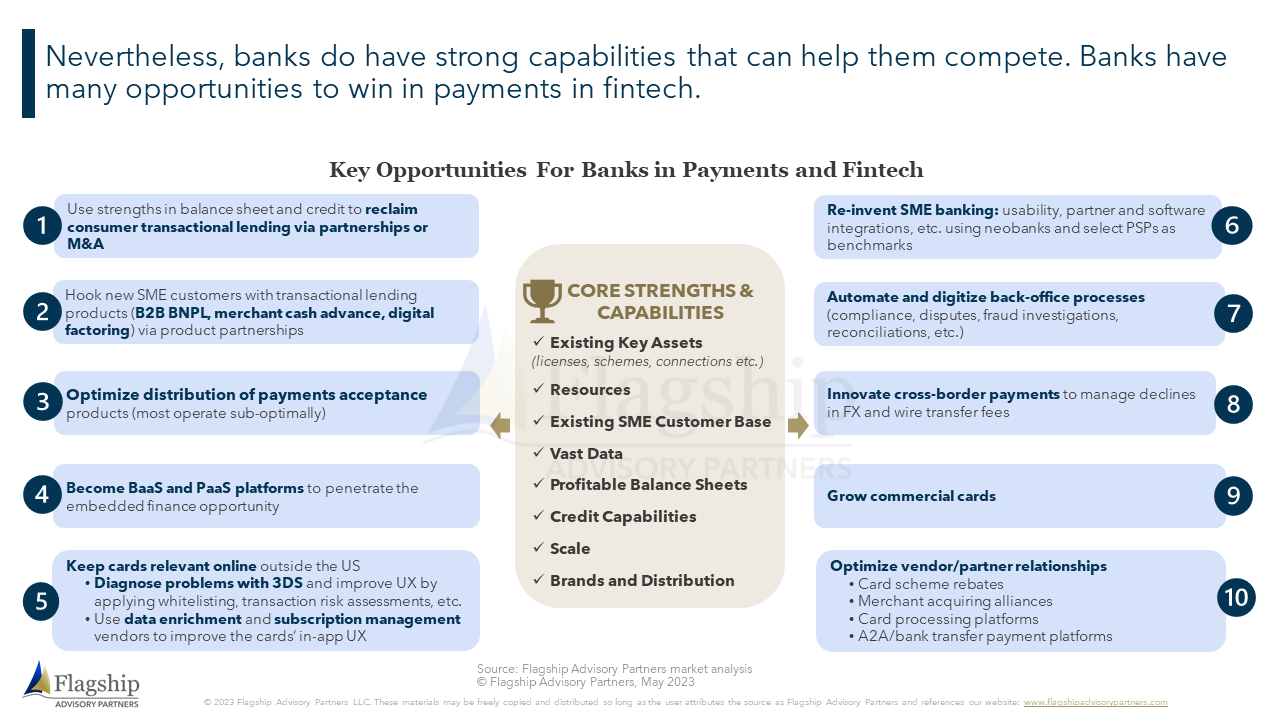

Key Opportunities For Banks in Payments and Fintech:

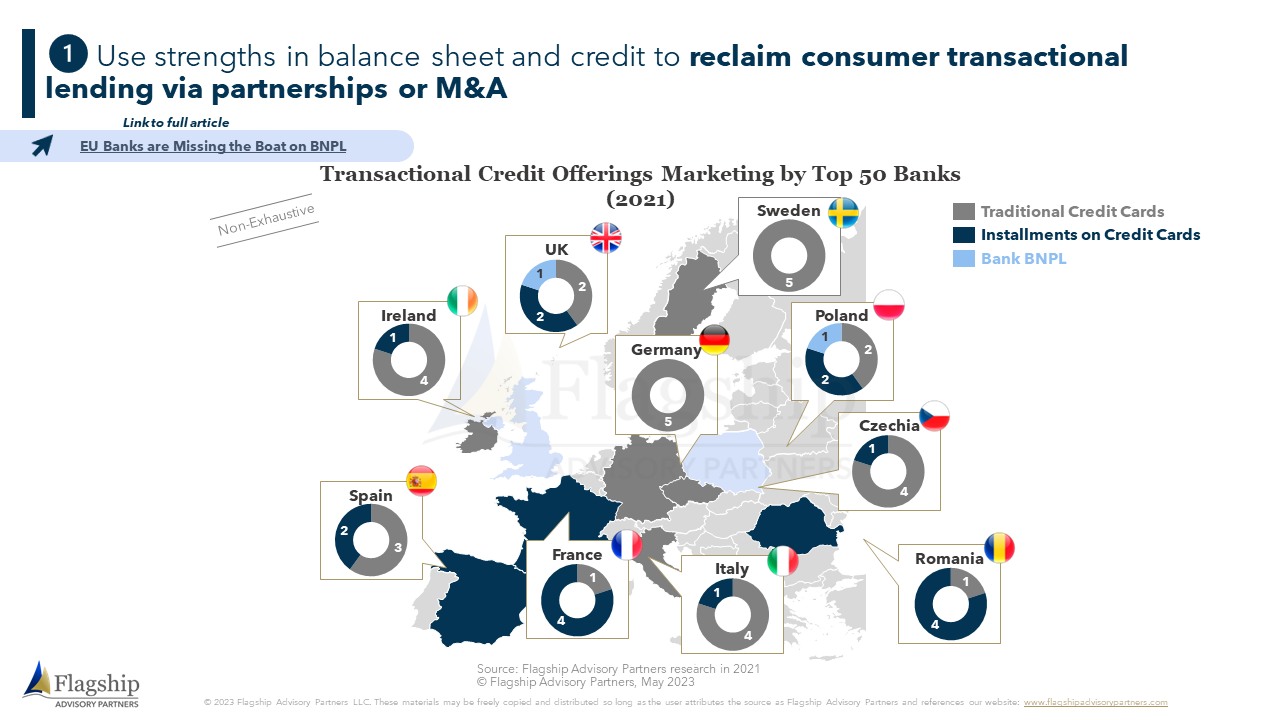

- Use strengths in the balance sheet and credit to reclaim consumer transactional lending via partnerships or M&A

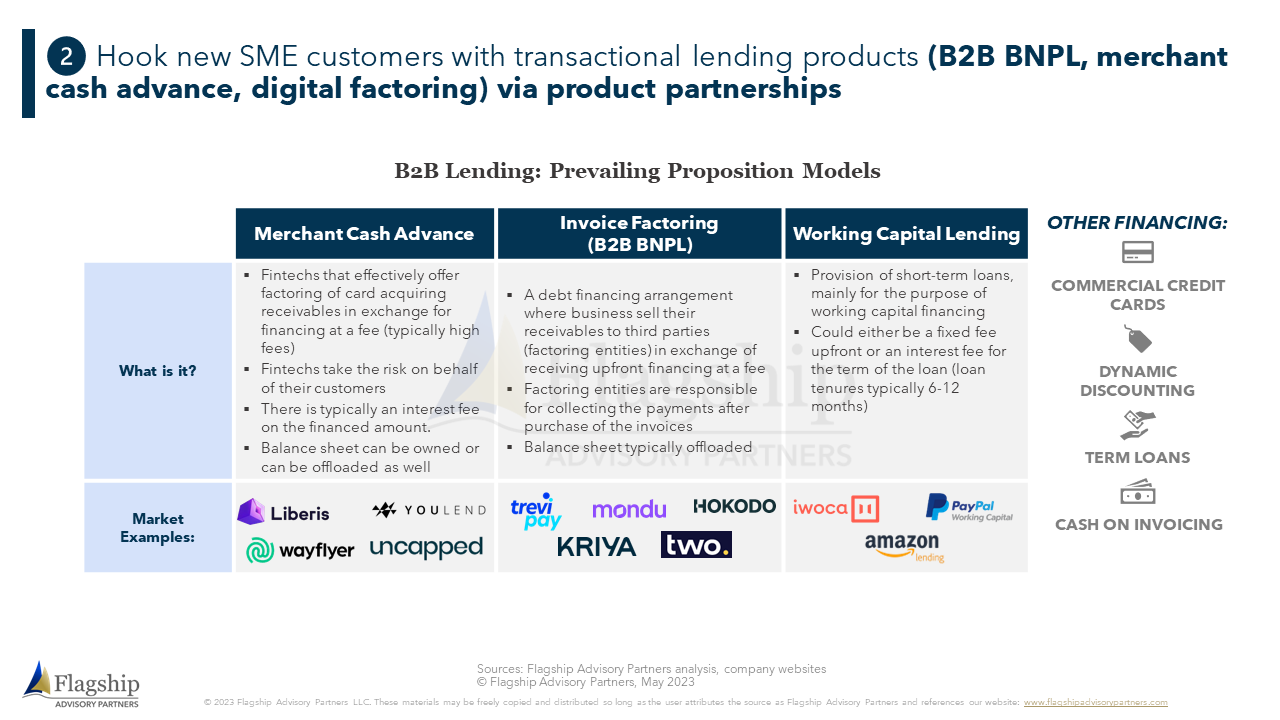

- Hook new SME customers with transactional lending products (B2B BNPL, merchant cash advance, digital factoring) via product partnerships

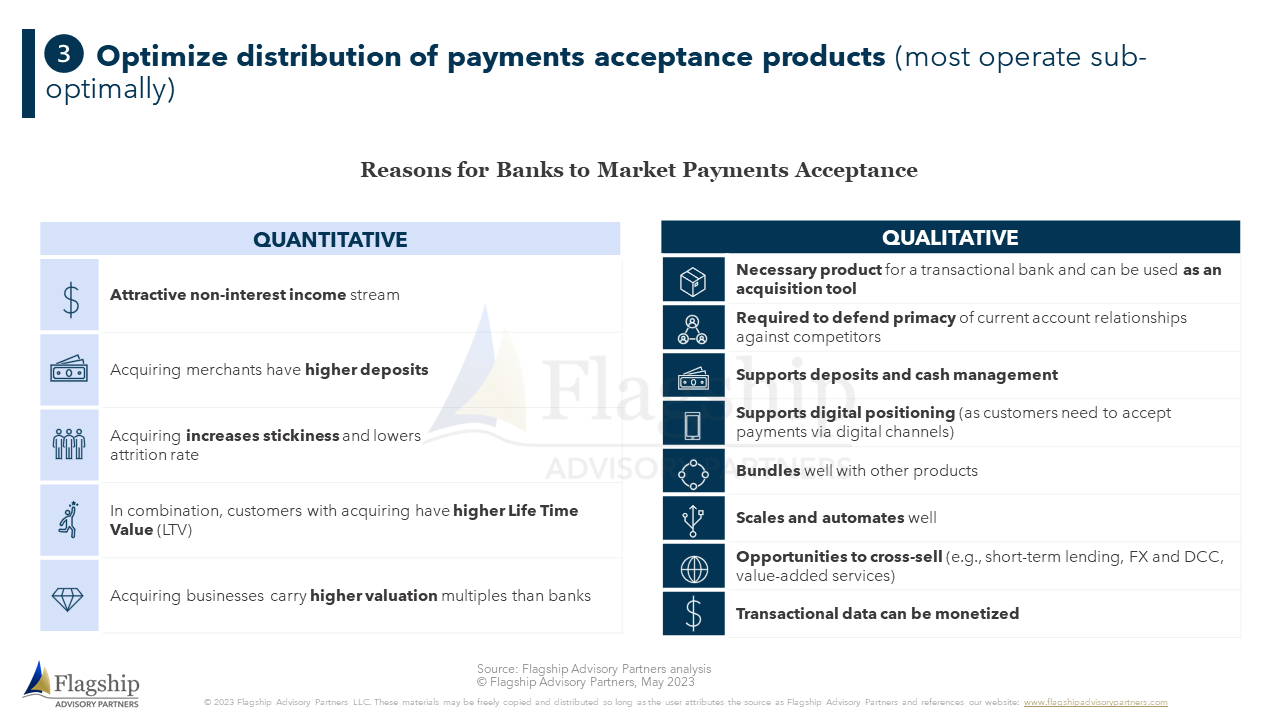

- Optimize distribution of payments acceptance products (most operate sub-optimally)

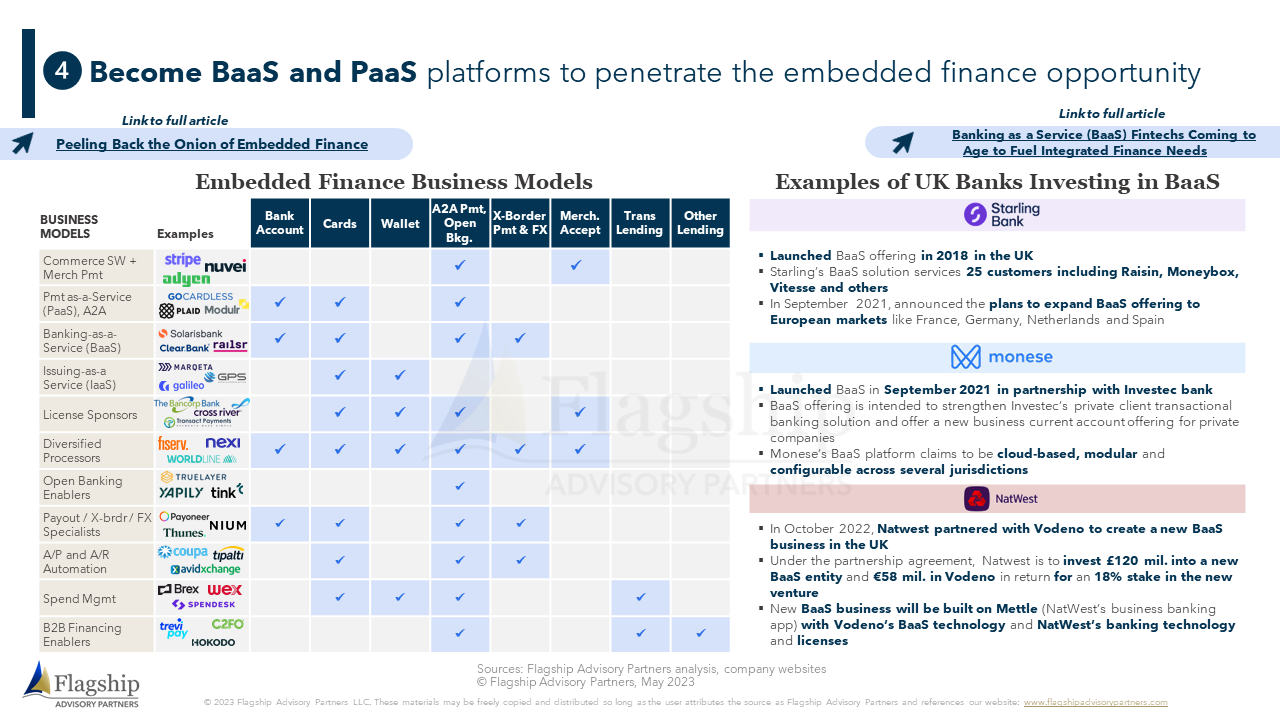

- Become BaaS and PaaS platforms to penetrate the embedded finance opportunity

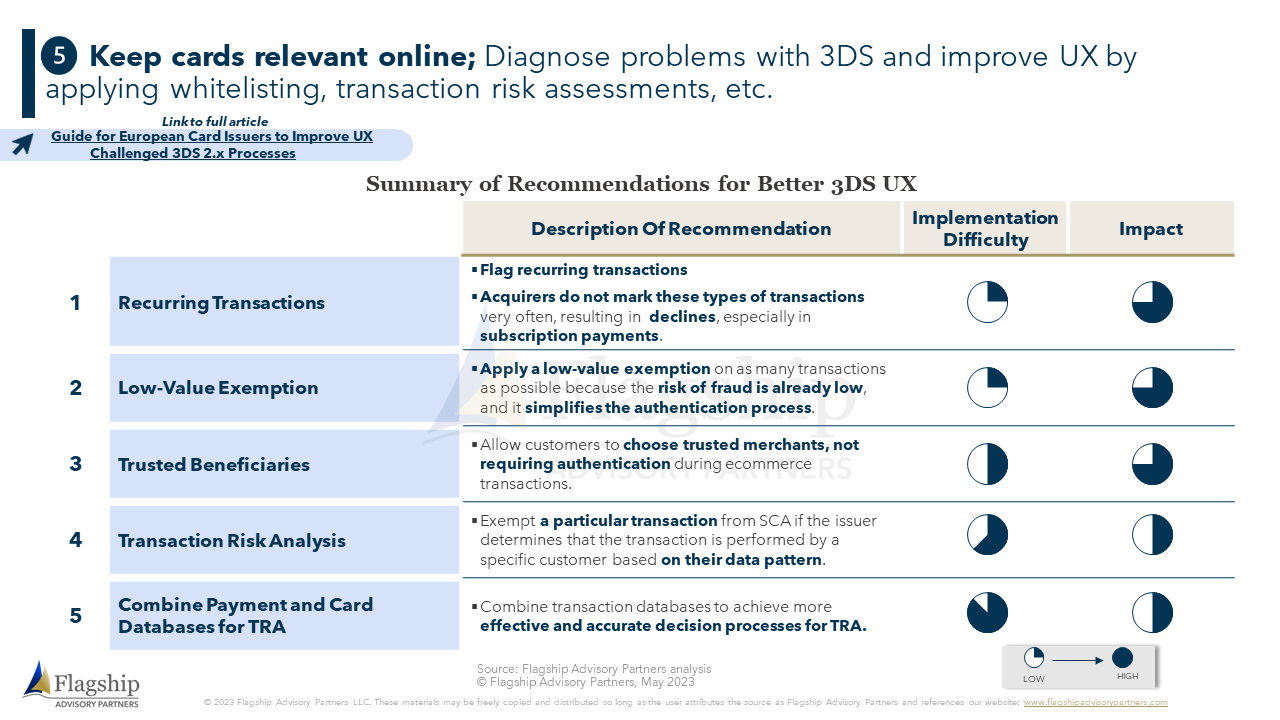

- Keep cards relevant online outside the US

- Diagnose problems with 3DS and improve UX by applying whitelisting, transaction risk assessments, etc.

- Use data enrichment and subscription management vendors to improve the cards’ in-app UX

- Diagnose problems with 3DS and improve UX by applying whitelisting, transaction risk assessments, etc.

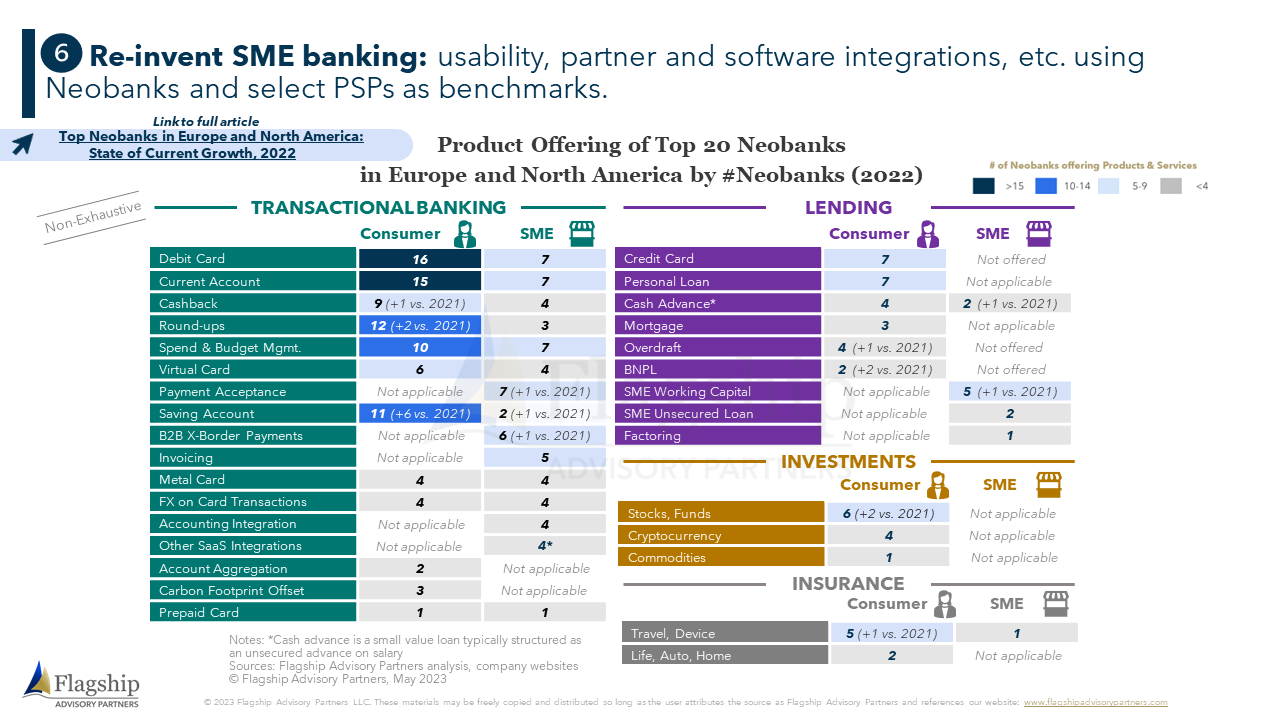

- Re-invent SME banking: usability, partner and software integrations, etc. using neobanks and select PSPs as benchmarks

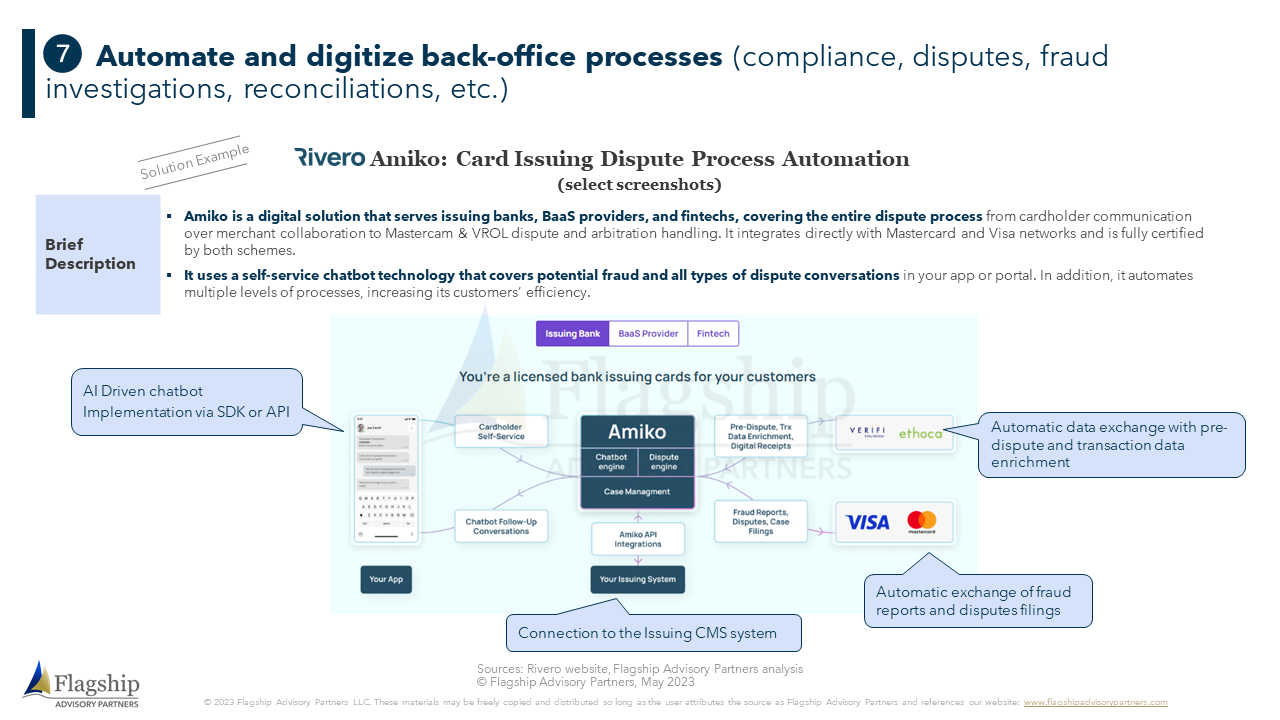

- Automate and digitize back-office processes (compliance, disputes, fraud investigations, reconciliations, etc.)

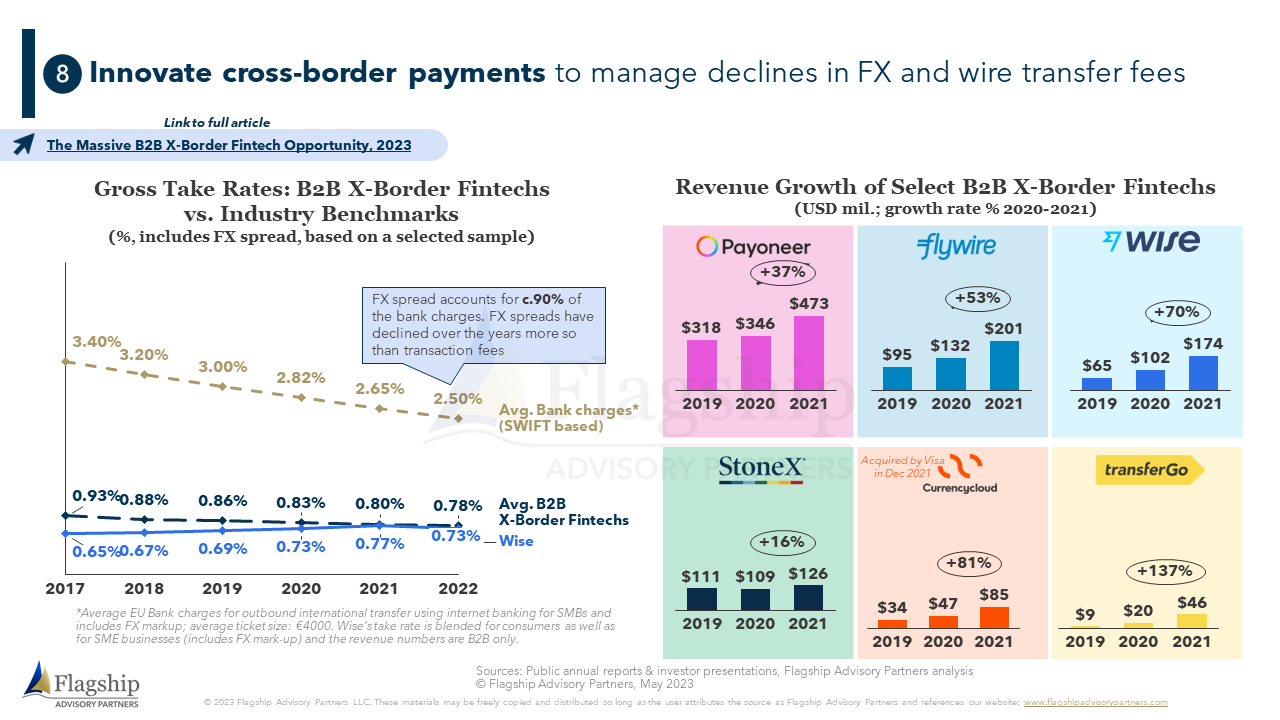

- Innovate cross-border payments to manage declines in FX and wire transfer fees

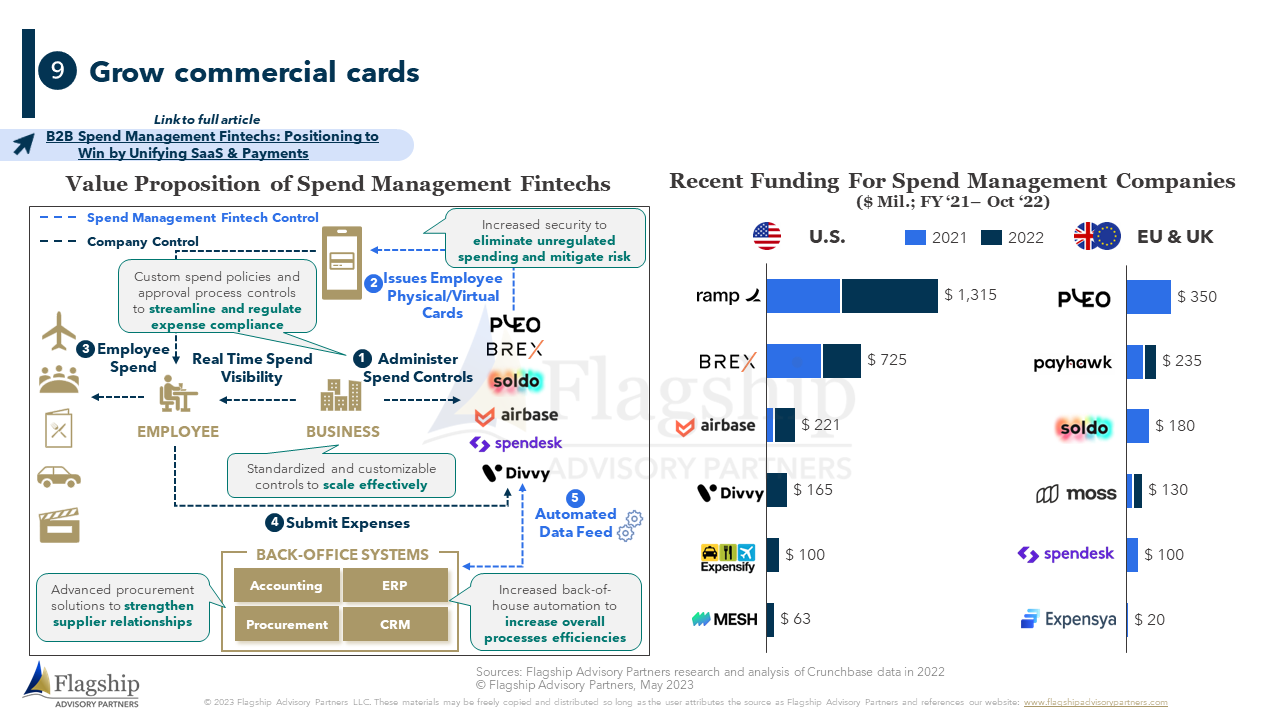

- Grow commercial cards

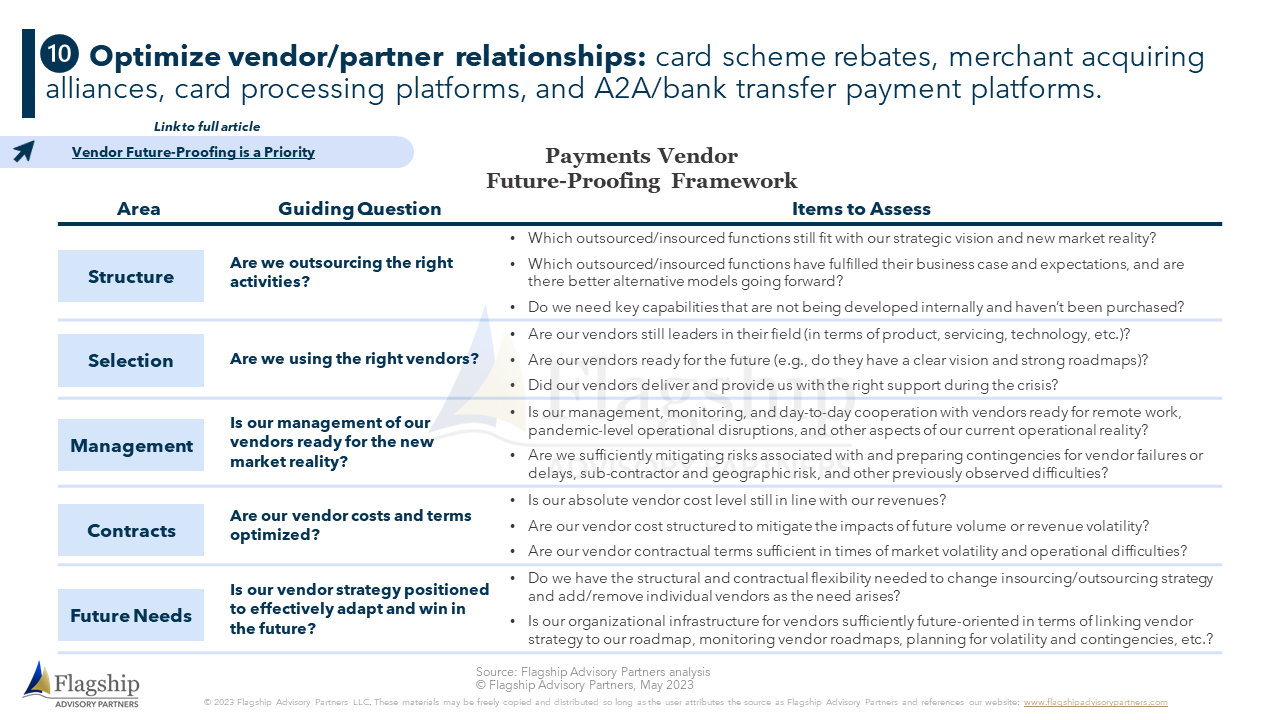

- Optimize vendor/partner relationships

- Card scheme rebates

- Merchant acquiring alliances

- Card processing platforms

- A2A/bank transfer payment platforms

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com with comments or questions.