Payments are an increasingly strategic function within merchants of all varieties (retail, travel, digital, etc.). Payments are a key enabler of digital commerce and a mission-critical point of customer interaction and loyalty. Far too often; however, we come across merchants with otherwise large and thriving businesses that lack a strategy to guide payments development and performance improvement. This article highlights some of the best practices for developing a winning payment acceptance strategy.

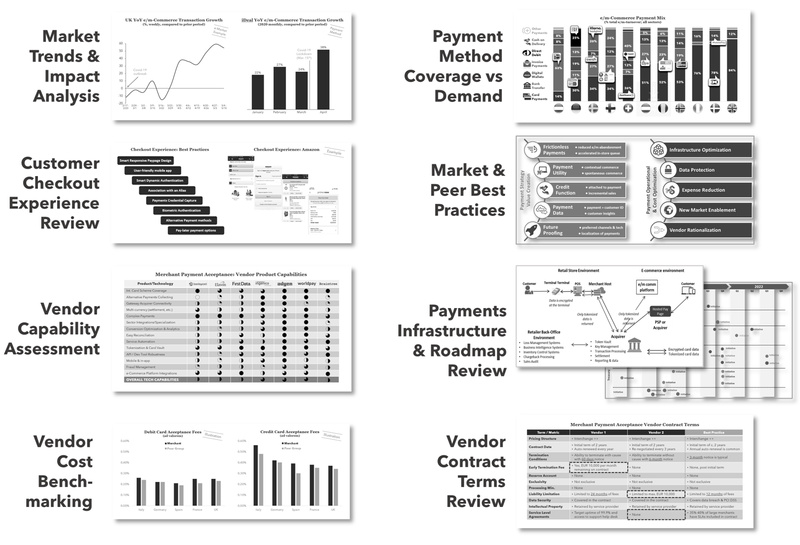

The starting point for any good strategy is a thorough understanding of the current situation. This includes a sound understanding of external market influences as well an internal diagnostic of approach and performance. When conducting a payments acceptance diagnostic, we generally cover each of the areas of shown in Figure 1 including: market trends and influences, payment methods, infrastructure, customer experience, fraud and conversion, peer best practices, and a thorough assessment of the vendors and costs.

FIGURE 1: Components of a Payment Acceptance Merchant Diagnostic

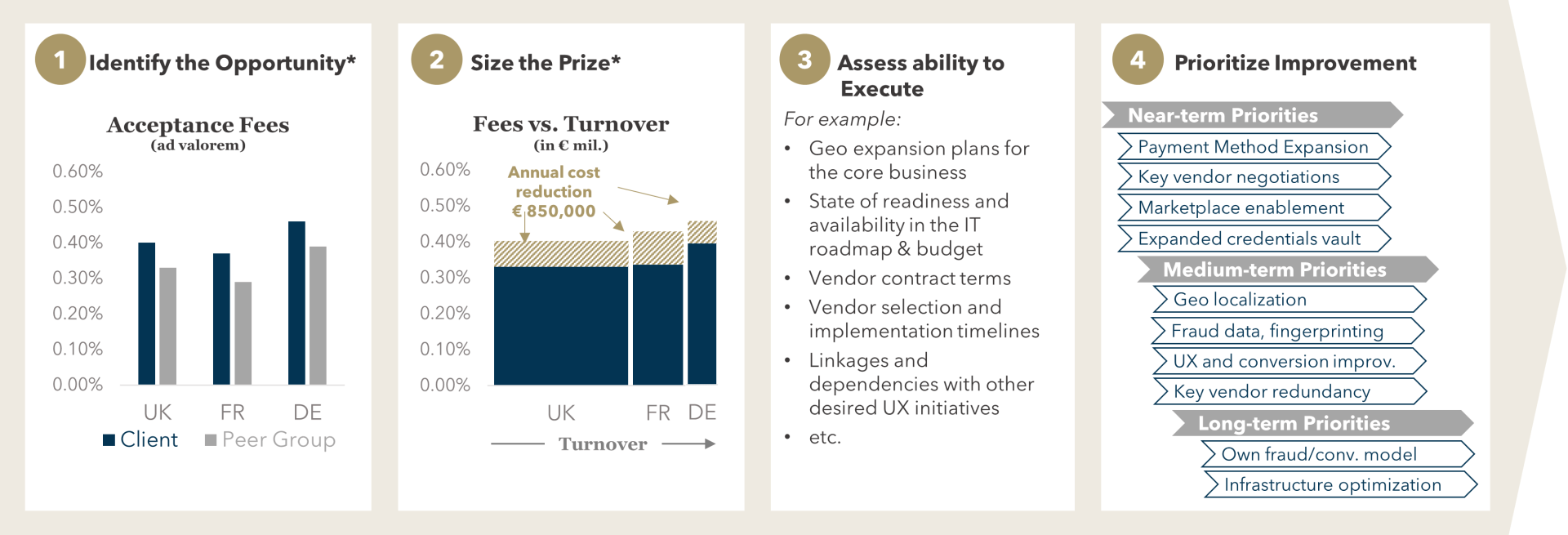

The diagnostic will identify opportunities for improvement in the form of enhanced customer experience (including payment methods), improved conversion/fraud balance, vendor cost reductions, capability gaps, and opportunities to streamline infrastructure. It is critical that this diagnostic not just consider costs and vendors, as much of the improvement opportunity may arise from a merchant’s own decisions related to the checkout experience, fraud tolerance, and internal infrastructure. Once opportunities are identified, we recommend sizing each opportunity and then assessing ability to execute, which will allow for the prioritization of these opportunities as near-term or longer-term. We illustrate (in a simplistic manner) this approach in Figure 2 below.

FIGURE 2: Prioritizing Improvement Opportunities

Source: Flagship Advisory Partners

The prioritization of opportunities flows directly into the formation of a strategic vision for payments. A good strategic vision is a clear and simple set of objectives defining where your organization wants to go and how it will get there. It is important that the vision be shared across an organization as payments is virtually never an autonomous function. Some of our clients manage payments within the CFO office while others within the CTO/CIO office (though the CMO or CPO offices are critical stakeholders for delivering a unified and robust customer experience).

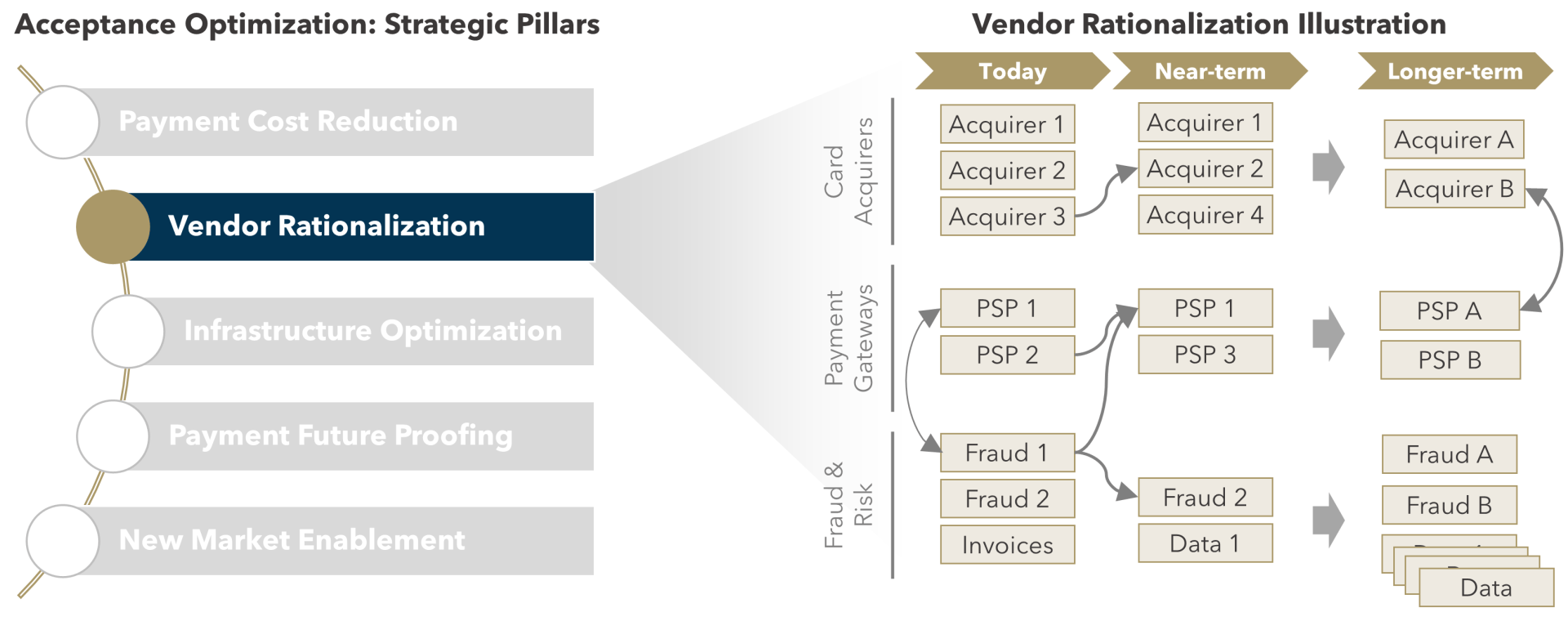

With a clear strategic vision in hand, we then typically define a small number of pillars which drive the execution of the strategy, for example: payment cost reduction, vendor rationalization, infrastructure optimization, payment future-proofing, and new market enablement. These illustrative pillars are not suited for all merchants as the pillars should reflect that merchant’s own priorities. For example, some of our clients are hyper-focused on checkout conversion/approval rate and fraud outcomes while others prioritize geographic expansion above all else.

As shown in Figure 3, under each pillar there should be a clear set of initiatives which define the roadmap for driving the strategy. Within Figure 3, we illustrate a simplified framework for vendor rationalization. The frameworks used to define the strategic initiatives can vary, so long as the objectives and actions to be taken are clear.

FIGURE 3: Strategic Pillars and Vendor Rationalization Illustration

Source: Flagship Advisory Partners

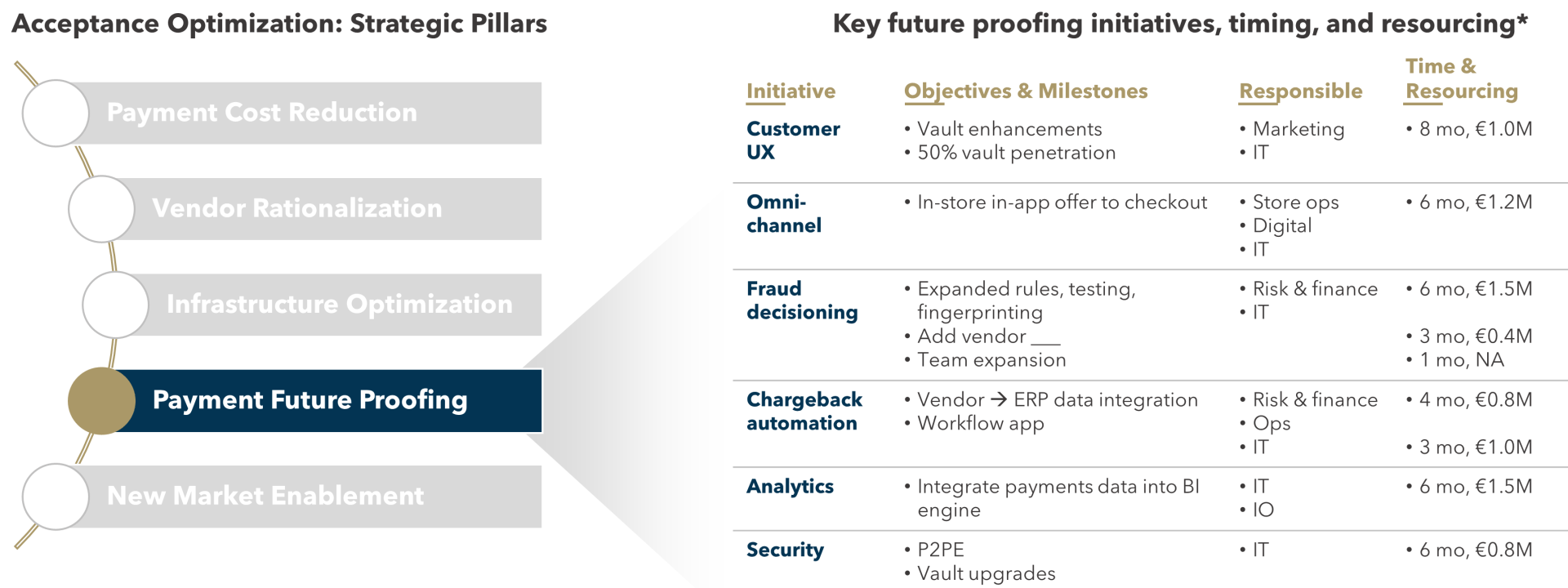

Once the initiatives under each strategic vision are clear, we recommend then elaborating on the roadmap with specific responsibilities, timelines, and resourcing budgets. Figure 4 illustrates such elaboration (though again, in a simplistic manner). The final outputs must be a clear plan of action across the organization, considering critical dependencies and resourcing requirements. Such a plan aligns and motivates the organization.

FIGURE 4: Strategic Pillars and Initiatives Illustration

Source: Flagship Advisory Partners

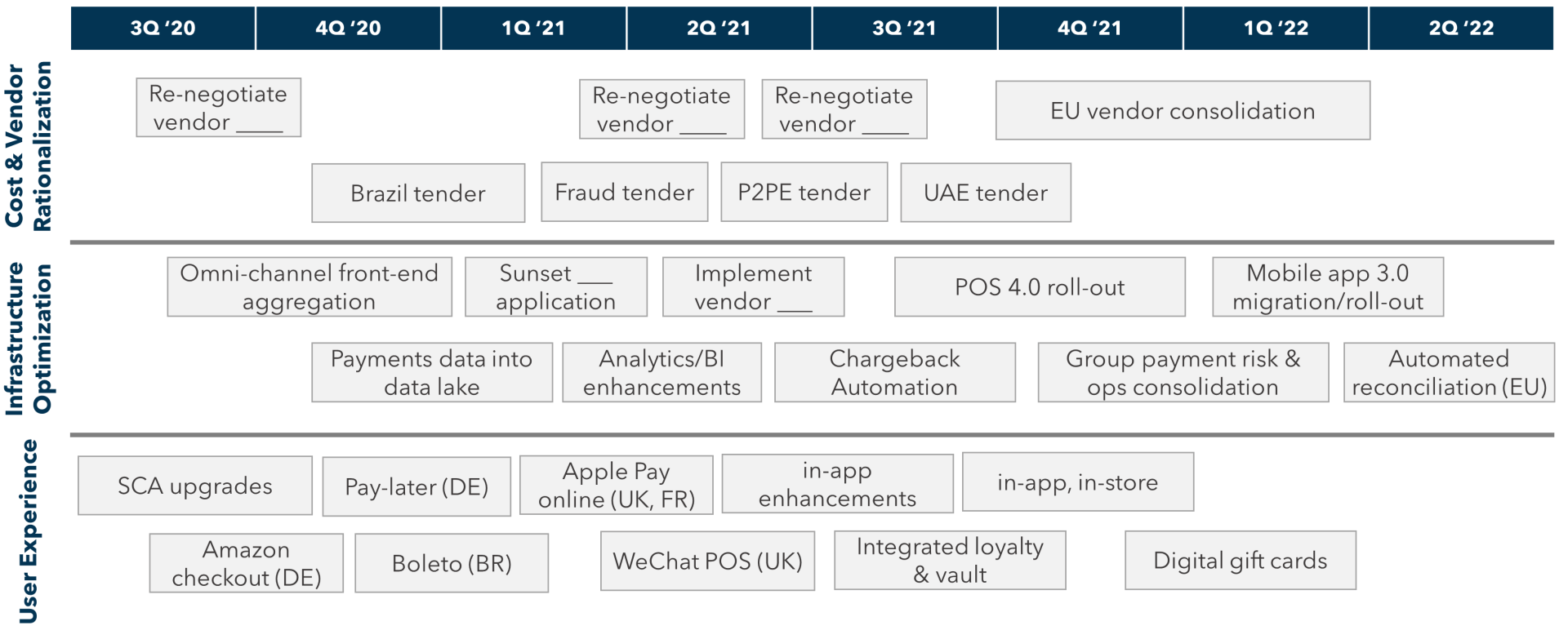

As a final step in the strategy development process, we recommend producing a summary roadmap which highlights each of the key initiatives to drive the company’s payments strategy (an illustrative example is shown in Figure 5 below). Oftentimes we advocate fitting such a summary onto a single page so that it can be easily understood and communicated. A CEO/CTO/CFO should understand and be able to articulate this vision within the company as well as externally to partners and other stakeholders.

FIGURE 5: Summary Roadmap Illustration

Source: Flagship Advisory Partners

As payments become more strategic for merchants, so too must your payments strategy develop and grow. We recommend a thorough process which looks both internally and externally, considers the entire spectrum of payments value creation levers (cost, sales conversion, etc.), and defines a clear vision and actionable plan to drive improvements.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.