Even payments and fintech experts often think of the Nordics as a single market with common consumer behavior, business demographics, and culture. While there are similarities, each Nordic market has a distinct payments infrastructure. The bank systems and networks are fragmented, built on domestic rules which make intra-Nordic cross-border transactions cumbersome. Nonetheless, this is set to change under P27. Named after the 27 million inhabitants in the region, P27 is an inter-bank initiative that will introduce a harmonized inter-bank pan-Nordic cross border account-to-account (A2A) payments infrastructure, making payments more efficient and cost effective for consumers and businesses. In this article, we further explore some of the opportunities for innovation on the back of P27, and why P27 illustrates the global potential for modern A2A rails to drive broad-based fintech innovation.

With A2A instant payments becoming hygiene factor in Europe (and increasingly globally), the true potential of P27 lies in empowering value-added services that banks and fintechs can offer to end users to enhance value propositions riding the P27 rails. The recently announced merger of MobilePay, Vipps and Pivo further illustrates the potential to drive innovation on real-time-payment rails across borders in the Nordics. We expect this combined mobile scheme to rapidly become the preferred means of payment for P2P, e-commerce, and eventually offline commerce.

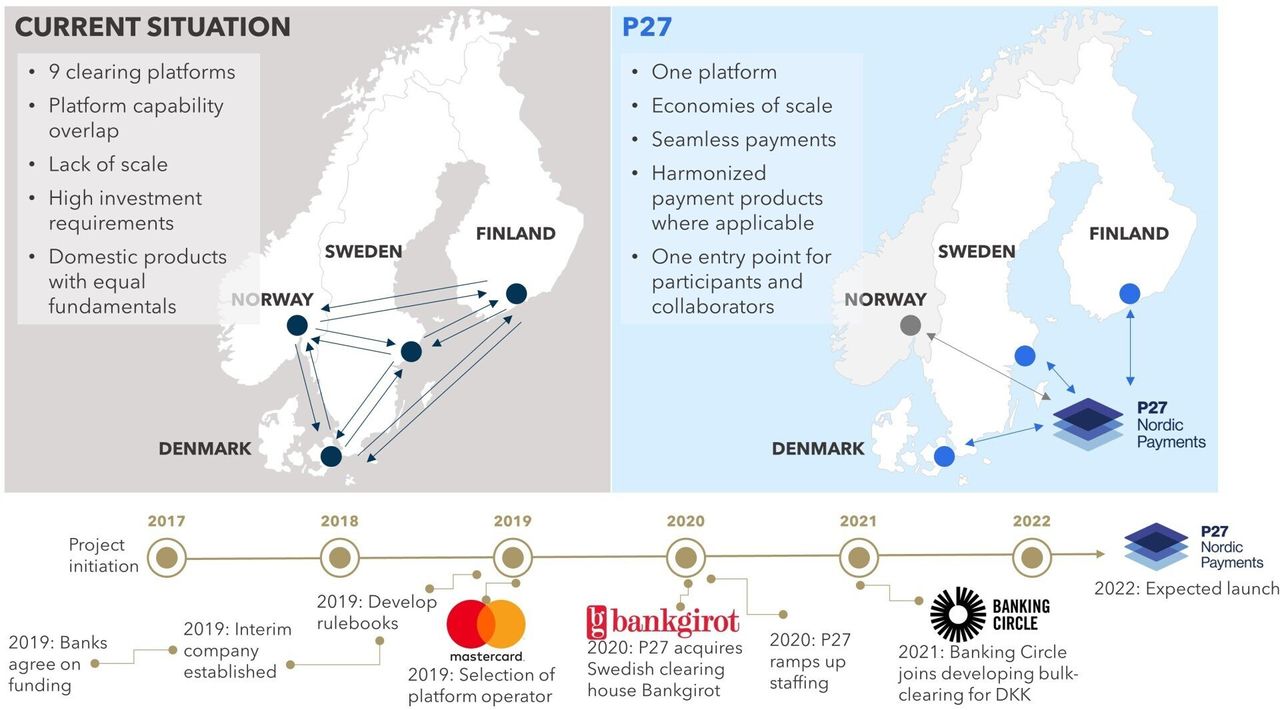

There are nine interbank ACH clearing houses in the Nordics today, most of which have been operating for decades. P27 aims to replace these legacy clearing platforms with a new infrastructure powered by a modern tech stack, driving real-time, domestic, and cross-border payments in various currencies (see Figure 1). This means consumers and businesses will be able to transact with each other in real time across the region, without having to pay expensive cross border bank fees.

FIGURE 1: P27 as One Nordic Clearing Platform

Source: Danske Bank, P27, Flagship market observations

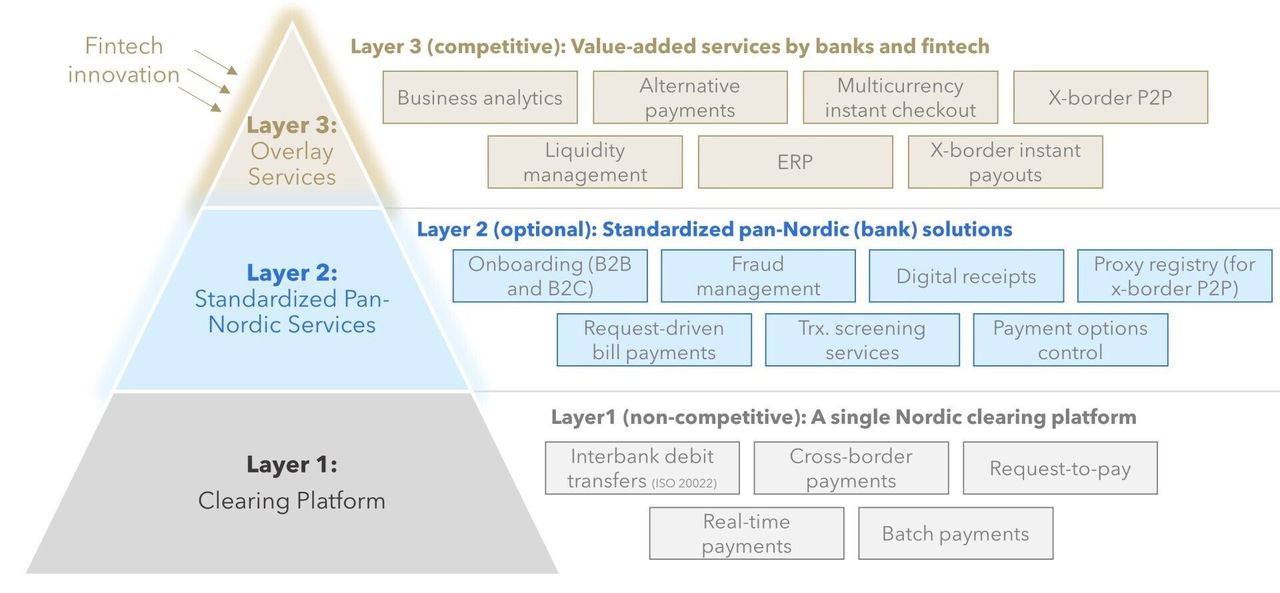

The P27 initiative envisions the development of a new payments infrastructure in three layers (see Figure 2). Today, the focus is on implementing the core back-bone clearing infrastructure (Layer 1). We observe many fintech opportunities in layer 2 and (particularly) layer 3 services and expect fintechs to drive much of the end-user proposition innovation.

FIGURE 2: P27 Layers and Use Case Examples

Source: Nordea, P27, Flagship market observations

P27 illustrates the global potential for modern and well-structured A2A rails to catalyze fintech innovation. Below we discuss a number of these A2A fintech opportunities, which we also expect to arise in the coming years in the Nordics, as well as other cutting-end A2A markets.

1. Modern A2A infrastructure breaks down barriers to use case innovation

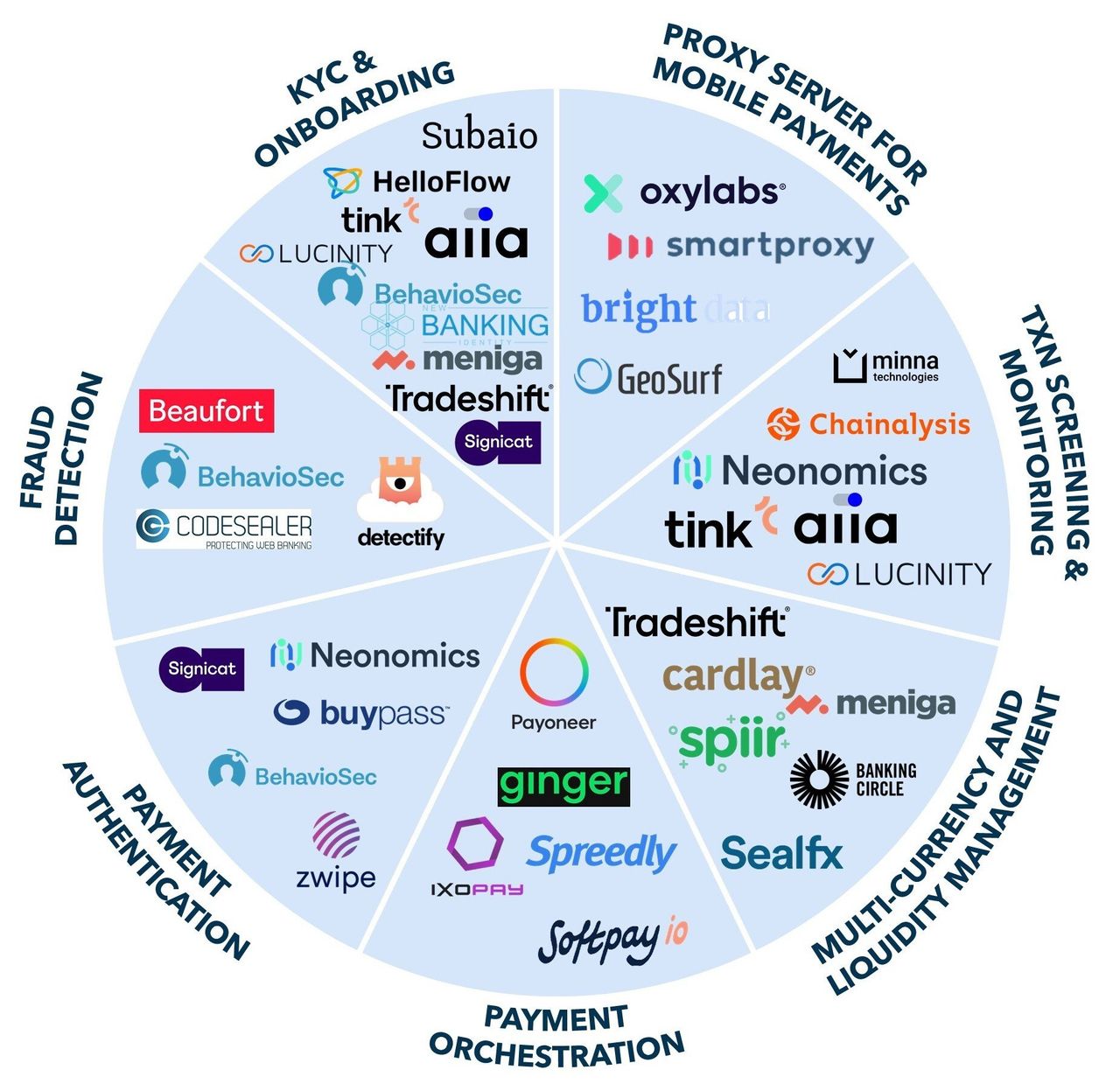

P27 is well positioned to build on deficiencies in existing payment use cases that are underserved by Nordic banks. P27 can enable new use cases for both consumers and businesses (see Figure 3) that widen the proposition in payments, but also adjacent categories such as data aggregation, invoicing, lending, and cash management services. Specialized fintechs should be able to ride the core P27 infrastructure to deliver superior end-user propositions.

FIGURE 3: A2A Innovation Use Cases

Source: Flagship market observations

2. Modern A2A infrastructure allows broader community participation in infrastructure standards and development

P27 Layer 2 services will likely encourage fintechs to shape the key enablers and middleware required to power front-end propositions. In Figure 4, we illustrate a few areas where we foresee collaboration opportunities between banks and fintech. For instance, fraud and KYC providers could leverage pan-Nordic data to screen users and leverage enterprise data to make smarter decisions across borders. Providers of sign-up, signing-in and digital signature services would reach a large new audience.

FIGURE 4: Potential Fintech Participation (select examples)

Source: Flagship market observations

3. Modern A2A infrastructure empowers model payments, including A2A schemes, in e-commerce and POS-commerce

Retail payments in the Nordics are still relatively card-centric today. Nordic consumers abandoned cash at POS long-ago and tend to lean on cards for x-border e-commerce. Mobile schemes such as Swish are rapidly gaining share in domestic e-commerce, but encounter limitations for x-border use cases and POS integrations across the region. P27 could strip down remaining barriers to using Nordic mobile schemes across use cases. This will enhance customer payment options, reduce merchant cost of payment acceptance, and reward innovative merchant providers that embrace the new infrastructure potential.

4. India’s UPI illustrates the potential for modern A2A infrastructure to drive broad-based fintech innovation

While being quite different from the Nordics in many ways, India’s UPI (Unified Payments Infrastructure) illustrates the potential for open-banking innovation on well-crafted and modern A2A rails. As illustrated in Figure 5, since its introduction five years ago, the UPI rails rapidly displaced cards to become the #1 digital payments rails. Ultimately, the Indian government’s infrastructure vision was key to driving this innovation.

FIGURE 5: India – Unified Payments Interface

Source: Flagship market observations, NPCI

We expect P27 to catapult the Nordics to the forefront of open banking in Europe. Three years after the introduction of PSD2 and open banking, the uptake of A2A payment services through open banking rails remains modest. Part of this slowness is due to the fragmented nature of the open banking technical standards, and lack of a unified infrastructure across countries. P27 has the potential to alter these limitations in the Nordics by powering a more standardized infrastructure. This in turn will spur open-banking value proposition development and ultimately usage. We anticipate P27 to drive the Nordics to the front of open-banking innovation and usage in Europe in the coming years.

Please do not hesitate to contact Anupam Majumdar Anupam@FlagshipAP.com or Elisabeth Magnor Elisabeth@FlagshipAP.com with comments or questions.