Introduction

The Nordic P27 initiative is the latest pan-European payments collaboration to fail. Coupled with last year’s struggles of the European Payment initiative (EPI), Europe has seen a slew of failures in pan-European collaborations that have desired to launch new payment schemes and harmonize the European payments landscape. At the time of writing this article, the EPI has just announced to acquire Currence iDEAL (Dutch A2A payment method) and Payconiq International (Belgian and Dutch A2A payment method) and pivot towards creating a pan-European digital wallet and instant payments infrastructure, abandoning its initial plans to create a Visa/Mastercard rival card network.

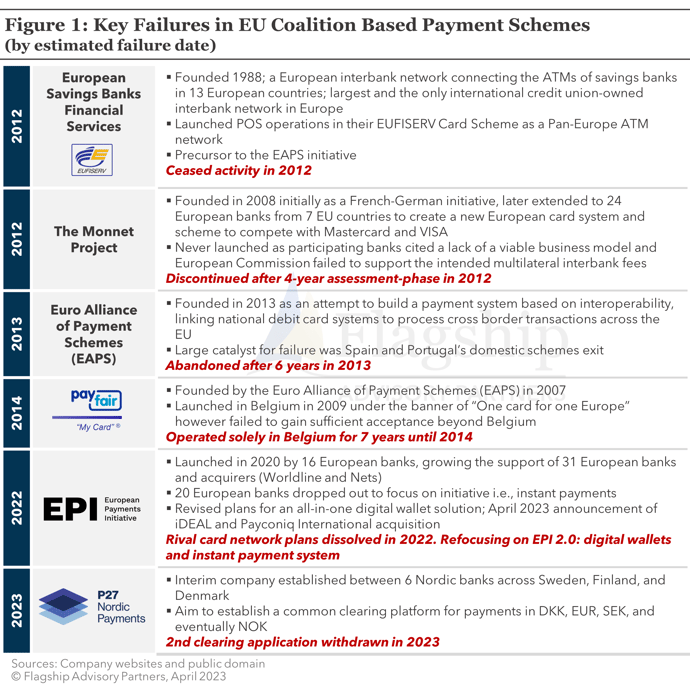

As illustrated below in figure 1, failures in pan-European payment collaborations are not new as there have been several such initiatives in the past. Most of these initiatives failed due to multiple reasons: lack of political alignment and poor commitment across too many stakeholders (e.g., EPI, the Monnet Project); lack of a killer value proposition that fits market needs (e.g., the Euro Alliance of Payment Schemes); or misaligned priorities in context of local market structure (e.g., in the case of PayFair)

The P27 Initiative

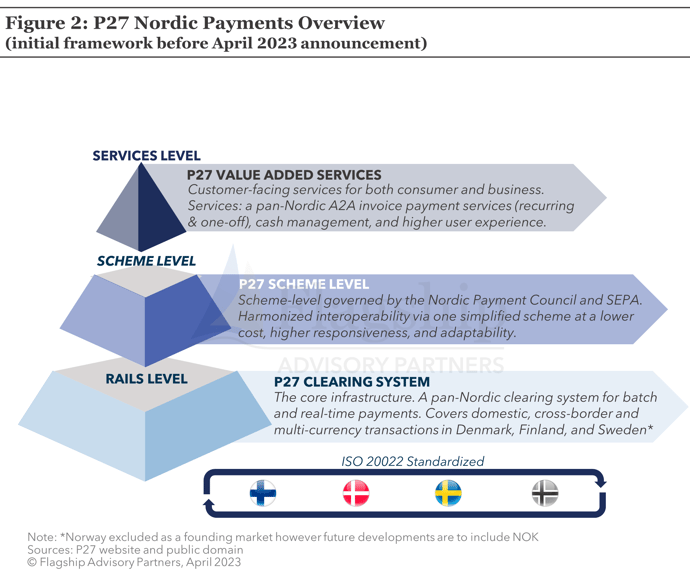

As we wrote previously here, the P27 initiative was launched in 2017 by a consortium of Nordic banks with an aim to introduce a modernized A2A payments infrastructure for 27 million inhabitants in the Nordics, replacing 9 fragmented A2A clearing houses in the Nordics. The end goal was to create a harmonized cross-border payments infrastructure that could achieve cost synergies in back-end payment processing, create opportunities to offer innovation on top of the combined rails, and create new front-end value-added services (e.g., overlay services such as alternative payment methods, bill payments, cross-border payouts, cash management amongst others) (see figure 2).

On paper, P27 had strong underlying rationale, met key market needs: rationalization of the Nordic A2A processing infrastructure, reduction in x-border processing costs, and creation of a platform for fintechs and non-bank participants to build front-end innovations for consumers and businesses. Also being a Nordic initiative, there were no cultural integration challenges.

Reasons Behind Failure

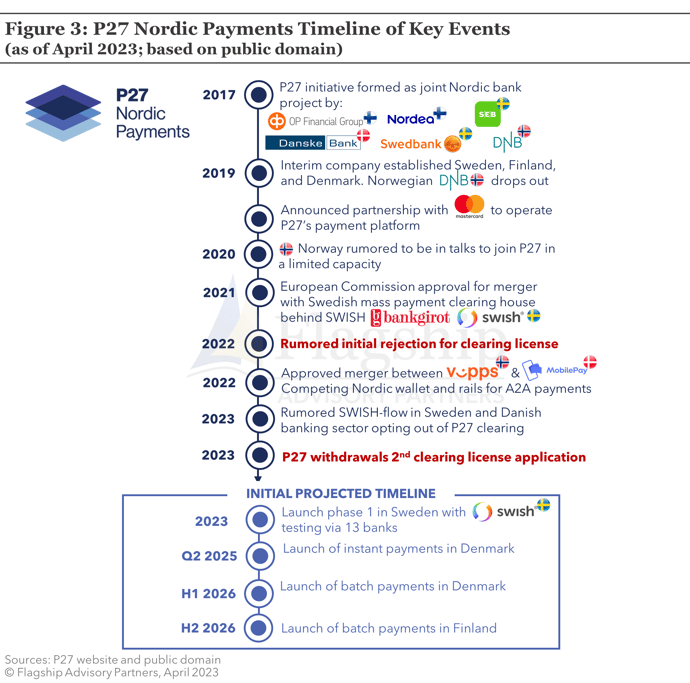

6 years after the launch, as we illustrate in figure 3, a series of events led to the collapse of the initiative. To start with, P27 did not initially see participation from most Norwegian banks. However, in 2020, some Norwegian banks were rumored to join the initiative, but we are unclear as to how many. In 2020, P27 completed the acquisition of Bankgirot, the Swedish A2A clearing house and also the owner of SWISH, the main A2A mobile payment scheme in Sweden used by c.85% Swedish consumers. This was a logical steppingstone as P27 was likely to process all A2A payments in Sweden, including SWISH volumes, in the future.

In 2021 Vipps (the leading Norwegian A2A and cards mobile payment method) merged with MobilePay (the leading Danish A2A and cards mobile payment method) to develop a new entity Vipps MobilePay A/S. Pivo, Finland’s leading mobile payment scheme was initially in the mix, but was later blocked by the European Commission. The merger was a critical milestone as Danske Bank (who used to own a 65% stake in MobilePay, announced to hold c.28% stake in the new entity) as well as other Danish banks which owned MobilePay, along with the consortium of Norwegian banks which owned Vipps, decided to create a competing pan-Nordic infrastructure for A2A payments. The objective was to harmonize cross border A2A mobile payments across 11 million consumers in Norway, Denmark, and Finland. Unsurprisingly, in April 2023, it was announced that the Danish banking sector had decided to relinquish the P27 initiative. At the same time, it was also announced that P27 would not be able to process SWISH A2A volumes (reasons remain unclear).

Lack of political alignment across too many stakeholders, conflicting interests, and a lack of critical mass to start up with (as none of the scalable Nordic mobile payment schemes, e.g., MobilePay and Vipps were to be supported) ultimately led to the failure of P27, with further uncertainly on what this means for the consortium.

Summary of Lessons Learned

As noted above, this is not the first time that pan-European coalitions have failed. The P27 failure reinforces a number of lessons learned for participating banks and fintechs:

- Collaborations at a pan-European level are hard. It requires sharing a common vision, dedicated and sincere focus, as well as very strong stakeholder synergies to launch successful payment schemes. Thus far, we have failed to come across a perfect example that meets all of the above.

- Participating shareholders having conflicting priorities. Danske Bank, a key participant of P27 also had ownership of MobilePay. With the MobilePay and Vipps merger, Flagship's assessment is that Danske Bank (a key influencer in the Danish banking sector) was able to influence the Danish banking sector's approach to P27. Danske Bank disagrees with Flagship's assessment, and stated to Flagship that, "Danske Bank having ownership of MobilePay has nothing to do with the fact that the Danish banking sector unanimously decided to move forward without P27, and Danske Bank has not been swaying the Danish banking sector to abandon P27".

- Lack of meeting unmet needs and poor business case. Most of the pan-European initiatives have been politically motivated projects without a clearly thought-out revenue model or backed by adequate market research to meet a clear market need. Therefore, in most cases stakeholder willingness to fund (often large) required investments has been limited.

- Bank coalitions to create a national payment scheme can be successful; however, extending the vision at a pan-European level is hard. Coalitions at a national level can be successful provided banks are willing to back it up with the required investments and play an active role in developing a successful merchant acceptance ecosystem. This has been observed in several e-commerce payment methods in bank centric markets such as the Netherlands (e.g., iDEAL), Poland (e.g., BLIK), Sweden (e.g., SWISH). However, scaling this vision at a pan-European level requires achieving a commonality across problem areas, finding overlap in solutions and respecting local market conditions and structure. Not many pan-European solutions exist today that share this vision.

- Very often coalitions fail if the vision is too ambitious. For example, the EPI which wanted to establish a pan-European C2B scheme (across cards and A2A) was too ambitious, and from the sidelines appeared requiring a lot of heavy lifting – building the infrastructure, heavy consumer marketing, building the acceptance infrastructure, all of this required heavy leg work and lot of investments. P27, on the other hand, was not overly ambitious. However, as argued previously, it failed due to poor stakeholder alliance and political misalignment across the participants.

- Payments infrastructure rationalization has clear upsides, however it requires strong execution. A case in point is Geldmaat, the recently created entity for managing ATM infrastructure in the Netherlands, that required strong execution from the three largest Dutch banks (ING, ABN AMRO, Rabobank) to rationalize their ATM networks within 3 years.

Conclusion

The failure of P27 adds to the long list of failures in pan-European payment scheme coalitions. As history has told us, coalitions often fail unless there is a proper consensus across stakeholders, zero conflicting priorities, a strong market-product fit backed by strong execution from participants. While P27 is not a case in point, stakeholders embarking on future pan-European payment coalitions may want to resolve conflicting interests and priorities upfront, remain committed to a common vision, and have enough vested interest to remain invested for the long run.

Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Simone Remba at Simone@FlagshipAP.com with comments or questions.

Sources: Finextra, Mobile Pay, Financieel Dagblad