Software-as-a-service (“SaaS”) providers and platforms play an increasingly significant role in the payments ecosystem. Payment facilitation, a term loosely describing how these providers and platforms enable payments for their customers, has several operating models, each with varying levels of control, liability, and revenue opportunity. SaaS providers and platforms should not think of facilitating payments as a single point in time but as an evolutionary journey to offer a more seamless customer experience, greater value-added services, and a jump-off point for future embedded financial services. For these software players, deploying a successful payment strategy depends on selecting the right payment partner(s) that will sit at the core of the service and, ideally, evolve alongside the software player’s broader business strategy.

Introduction

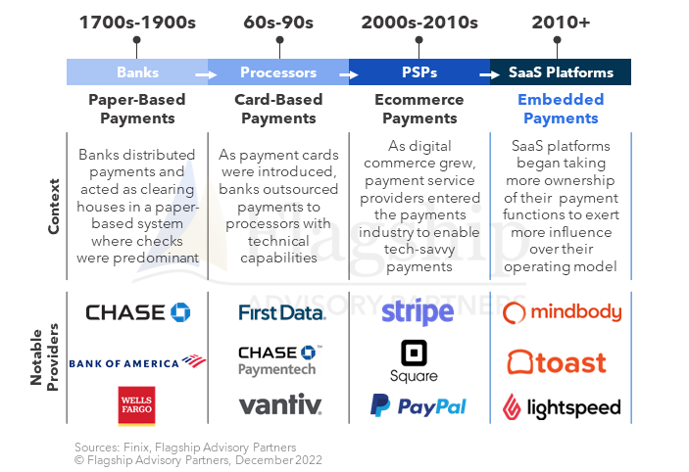

As described in Figure 1, the marketplace for North American payments has undergone a series of evolutionary waves. In the 1990s and early 2000s, businesses procured payment acceptance services as a distinct, standalone solution from other business management systems like accounting and ERP.

Today, businesses prefer payment acceptance services and other financial services interwoven into their business management solutions. As a result, we are witnessing an explosion of SaaS providers integrating and commercializing payments within their broader business management solutions (broadly referred to as “payment facilitators” or “payfacs”).

For SaaS providers and other hosted platforms, successfully integrating and commercializing payments is no small feat. Selecting the suitable operating model and payment service provider (“PSP”) partner is at the core of a payfac strategy. In this article, we explore various forms of payment facilitation, the commercial opportunity for payfacs, the maturation process of select payfac models, and the key features and functionalities to look for in PSPs/payfac enablers.

FIGURE 1: Evolution of Payment Distribution

Payment Facilitation Operating Models

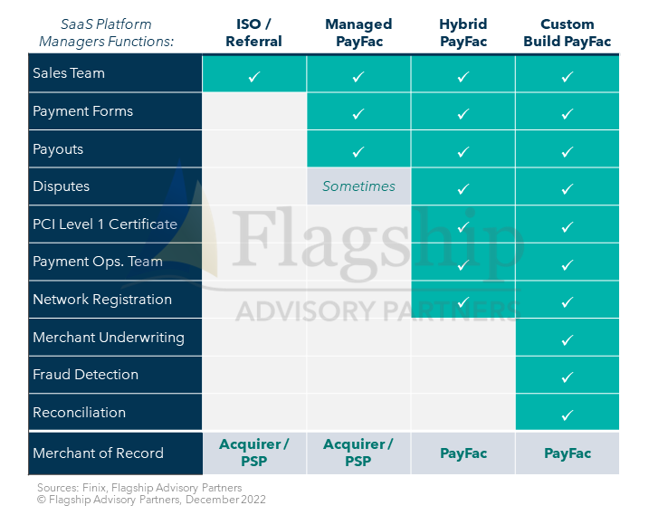

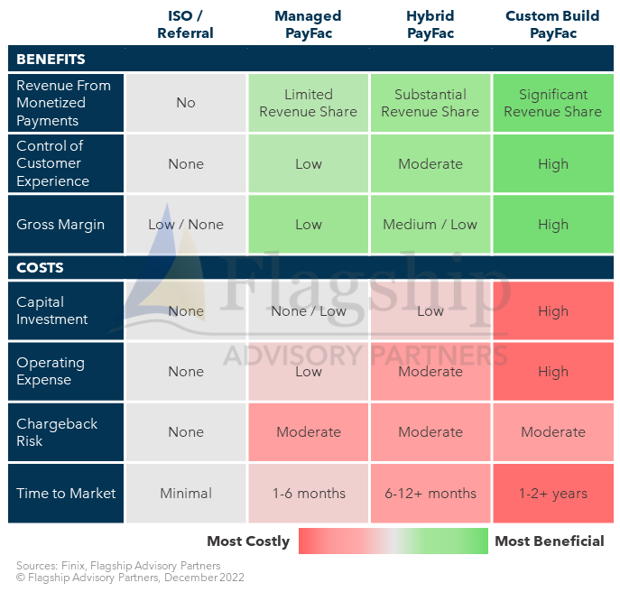

Payment facilitation and payfacs come in many forms. Visa and MasterCard define payment facilitators as “third-party agents that can sign a merchant acceptance agreement on behalf of a sponsoring acquirer and receive the settlement of proceeds on behalf of sub-merchant clients.” In a broader sense, payfacs are essentially any entity non-licensed party that enables and distributes payments, typically through a software solution. This can include independent sales agents (“ISOs”), booking engines, marketplaces, commerce platforms, and integrated software vendors (“ISVs” which are increasingly defined by their SaaS and cloud-based business models). As illustrated in Figure 2, there are various permutations of payment facilitation, each with its own operational and commercial implications.

FIGURE 2: Different Payments Operating Models for SaaS & Platform Providers

Software providers operating as ISOs or ISVs are often said to work under a referral model and are not registered payfacs. As the name implies, the software provider refers merchants to a payment processor partner and, in return, receives economic incentives. While the software provider bears no financial risk for the payment services (i.e., disputes), it has no control over customer onboarding and payment experiences. This can often lead to friction with the software provider’s customers and forces customers to search for alternative solutions where payments are integrated within the software. This gives software providers offering embedded payments a competitive advantage over competitors without it.

Software providers have more control over the user onboarding and payments experience as a payfac. As a managed payfac, the software provider manages the onboarding (payment forms) and payout processes through APIs or pre-designed tools (e.g., Finix Flex, Stripe Connect, etc.). To address these operations, most software providers staff a customer support team responsible for reviewing, approving, and terminating merchants. Meanwhile, the payment service provider acts as the merchant of record and assumes the risk of losses from fraudulent merchants. However, it is important to note that the software provider still bears the chargeback risk and associated costs when initiated by their clients’ customers. Software providers looking to test integrated payments will typically start with this model. However, those looking for greater control over the customer-facing payment solution and visibility over day-to-day payment operations may consider engaging in a hybrid payfac.

In a hybrid payfac, the software provider registers as a payfac with the networks and partners with payfac enablers like Finix, Infinicept, etc., for back-office tools (e.g., onboarding, payouts, disputes management, reporting, etc.). In this model, the software provider is responsible for staffing its own payments operations, such as underwriting and customer support, and uses its payfac enabler’s solutions to manage its sub-merchant (client) portfolio. This model allows the software provider to work with best-fitting PSPs for integrated payment services without the burden of building in-house payfac management tools or a complex integration into legacy processors.

Payment Commercial Opportunity for Software Providers

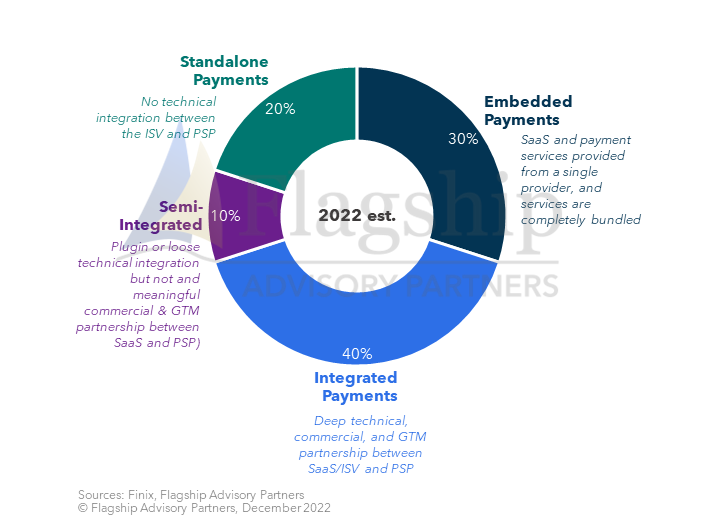

Software providers create significant client value by fully integrating/embedding payments. PSPs recognize that bundling business software and embedded payments is a superior distribution model compared to standalone payments (Figure 3), as the software buying decision is generally the leading decision merchants make (e.g., before selecting a financial institution). SMB merchants prefer software solutions with embedded payments, simplifying their operations and improving customer experiences. Particularly, the integration removes the headache of coordinating between two specialized solutions, and, as a result, the merchants evince lower acquisition costs, higher retention, and less price sensitivity for PSPs.

FIGURE 3: SMB POS Software + Payments Integration Model (estimates for % new SMB merchants signed in 2022)

From a revenue opportunity perspective, software providers (specifically payfacs) benefit from bringing better-bundled products to market and earning larger shares of payment processing revenues by owning more of the payment functions and respective operations/risks. This increase in economics requires both an initial up-front investment and ongoing maintenance costs, in addition to a targeted payments strategy, operational plan, and strong payments partner to optimize these expenditures as well as time to revenue.

FIGURE 4: Payments Distribution Model Deployment Considerations

Beyond commercial benefits (Figure 4), deep integration of software providers and payments/fintech services improves customer outcomes and unlocks a decisive go-to-market advantage (Figure 5). The figure below illustrates some of the benefits of integrated software and payments.

FIGURE 5: Bundled Software + Payments Solution Advantages

The payfac model is a logical starting point for software providers seeking to expand into broader financial services, creating a type of fintech flywheel. The core payfac digital ledger, with its pay-in / pay-out functionality, is foundational for other financial services such as merchant cash advance, lending, BNPL, card issuing, and spend management, to name a few.

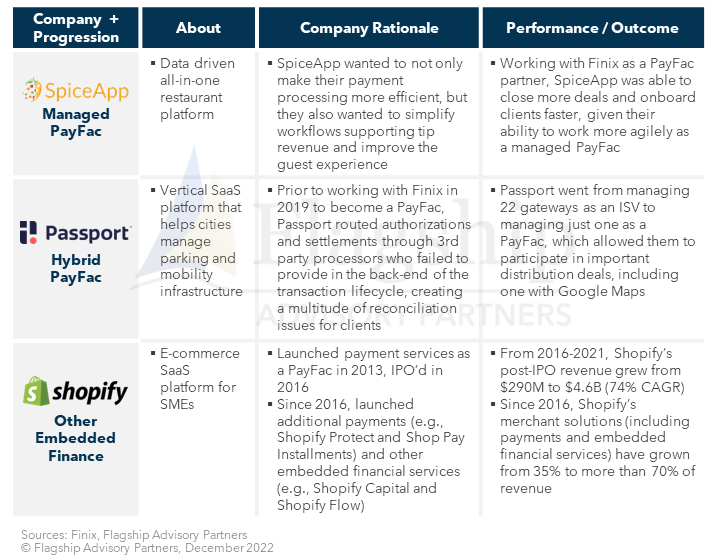

Cases Studies: Maturation of PayFac

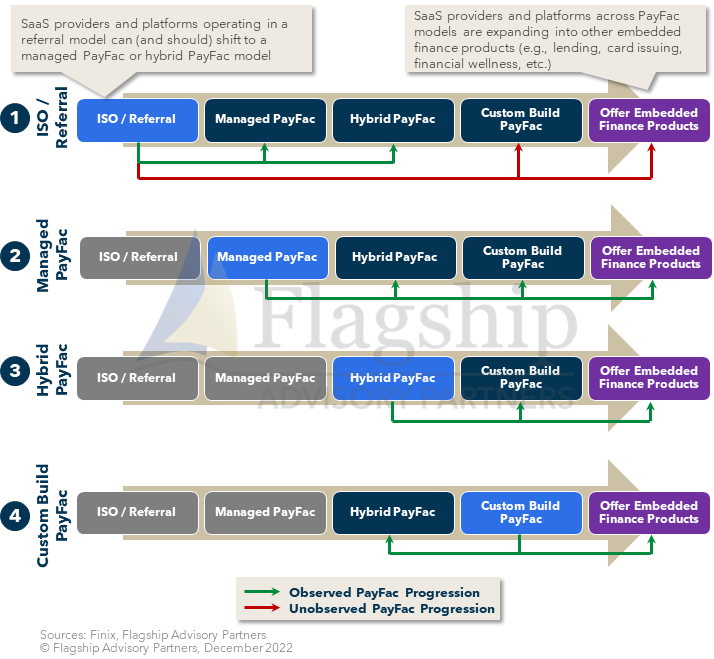

A software provider’s payfac model will adapt based on the development of the company’s go-to-market strategy, the availability of technical and operational resources, and the company’s vision for the user experience. As shown in Figure 6 below, providers can move fluidly across different maturation points with the right payment enablers.

FIGURE 6: SaaS Provider & Platforms – Observed PayFac Model Progression Journeys

While some software providers starting out as an ISO or referral partner may elect a managed payfac solution as the next logical tech enablement progression, other providers may not want to relinquish visibility and control to a third-party provider. As a result, these software providers may opt to develop a hybrid payfac model where they work directly with a PSP or payfac enabler to build their in-house payment capabilities. On the other end of the development spectrum, we observe custom build payfacs that convert their in-house operations to a hybrid payfac model to reduce the burden of technology upkeep/maintenance. Ultimately, we view all three payfac models as viable options for offering future embedded finance products, where payfacs can further monetize fintech services. In the following visual, we highlight several case studies of software providers moving along this maturation journey.

FIGURE 7: SaaS Provider & Platforms Evolution Case Studies

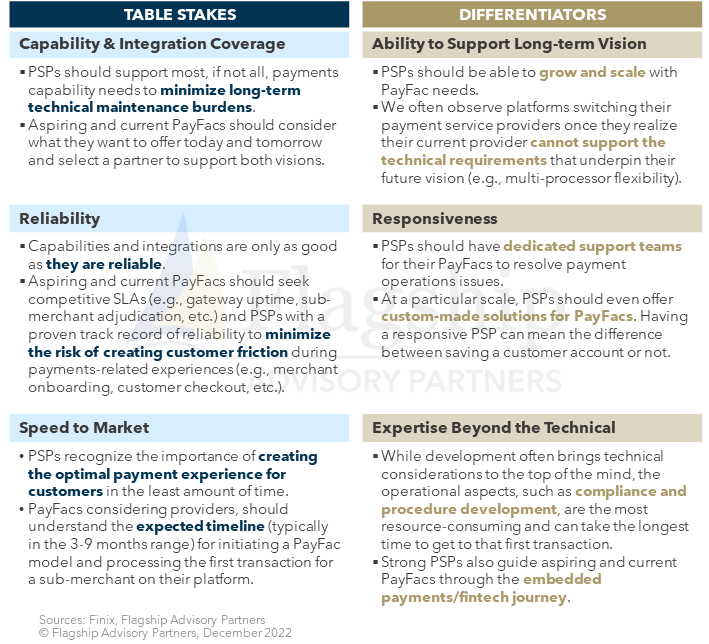

Working with PayFac Enablers

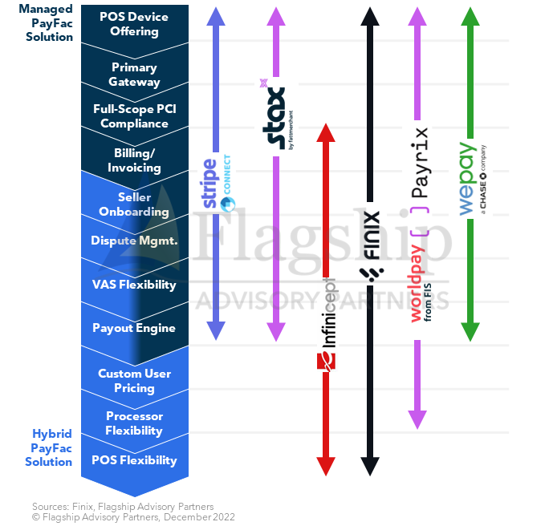

Becoming a payfac is a journey made more manageable through partnerships with PSPs. Platforms looking for a payfac enabler should consider the following criteria when selecting a PSP partner (refer to Figure 8):

FIGURE 8: Table Stakes & Differentiators When Selecting a PSP Partner

FIGURE 9: Range of Services Offered by Select Managed & Hybrid PayFac Solution Providers

Conclusion

When considering which payfac model to pursue, software providers need to understand their customers' payment needs/use cases and envision the optimal internal and external payments experience. With integrated and embedded payments becoming the market standard and merchants continuing to prefer bundled financial services, the market will push SaaS and PSPs to interface not only as business management service providers but also as financial service providers. If not doing so already, software providers should examine how to expand their tech stack and partnerships to offer combined business management and fintech services.

Please do not hesitate to contact Rom Mascetti Rom@FlagshipAP.com or Brittany Logan at Brittany@FlagshipAP.com with comments or questions.