Neobanks continue to be an important driver of innovation in financial services. In this article, we compare the offerings of the top neobanks in Europe and North America and investigate how they have evolved since our prior research last year.

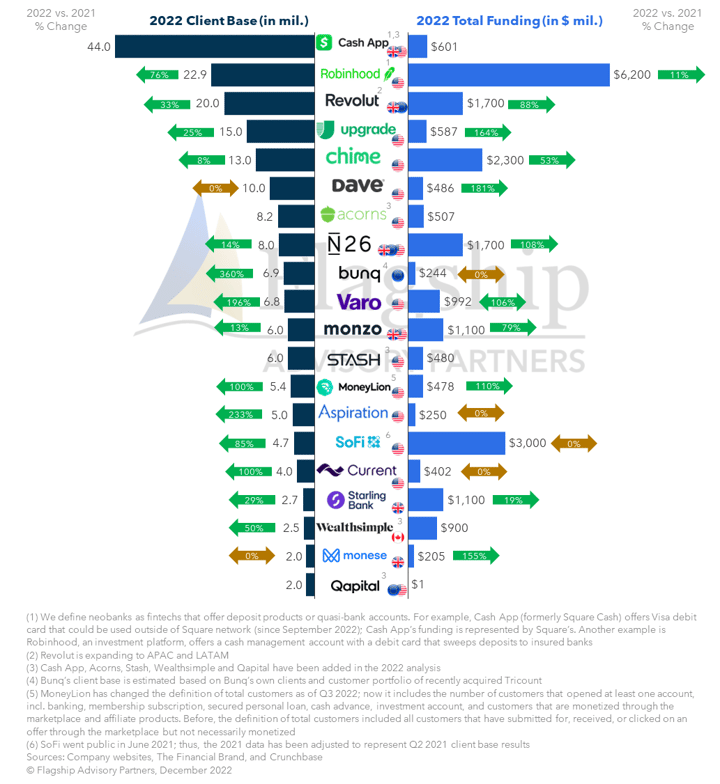

Fintechs and neobanks that receive funding from investors are expected to show positive growth outcomes, such as a growing client base. Having analyzed these two factors (funding and client base) we can summarize three key findings:

- Over half of the top neobanks managed to increase their client base after the influx of new capital.

- Three neobanks (Bunq, Aspiration, and Current) managed to increase their client base without a significant rise in funding. Bunq’s growth is likely driven by the recent acquisition of expense management fintech Tricount, whereas we believe Aspiration’s growth is driven by the popularity of its sustainable banking products.

- Two neobanks (Dave and Monese) did not experience any growth in their client base despite capital injection.

FIGURE 1: Top Neobanks in Europe and North America by Client Base (in mil.) & Total Funding (in $ mil.)

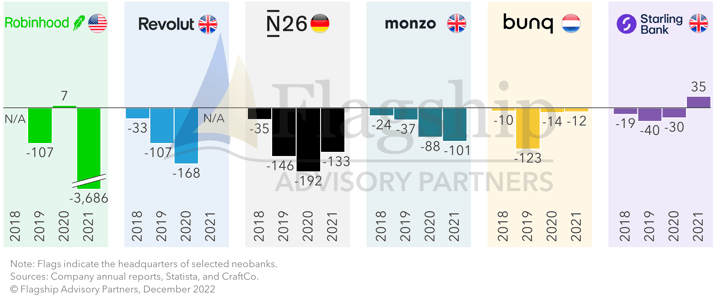

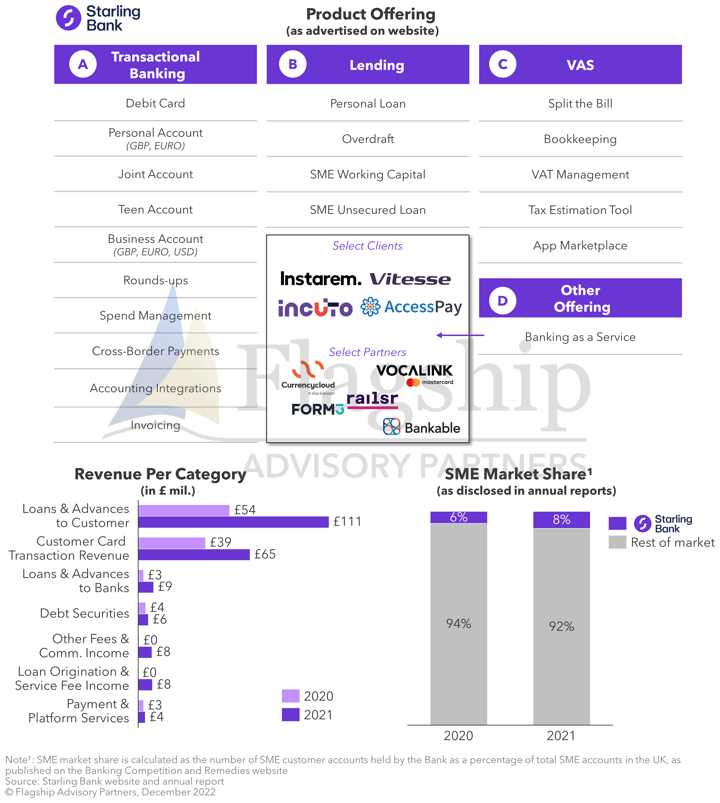

Most neobanks still struggle to achieve profitability (see examples in Figure 2), although there are a few winners such as Starling Bank, who reported profitability for the first time in 2021 (7 years after launch). Starling Bank offers a wide range of products and services (see Figure 3), targeting consumer and small business clients, and claims to represent ~8% of the UK small and medium enterprises market (+2.4% market share increase vs. 2021). Alongside strengthening its positioning within the SME segment, Starling allocates resources to grow its lending portfolio. During the pandemic, the challenger bank gave out £1.4 billion in bounce-back loans to SMEs. Starling illustrates the notion that serving SMEs and offering credit is a path to profitability.

FIGURE 2: Select Neobanks in Europe and North America: Net Income (in $ mil), 2022

FIGURE 3: Starling Bank Products & Metrics

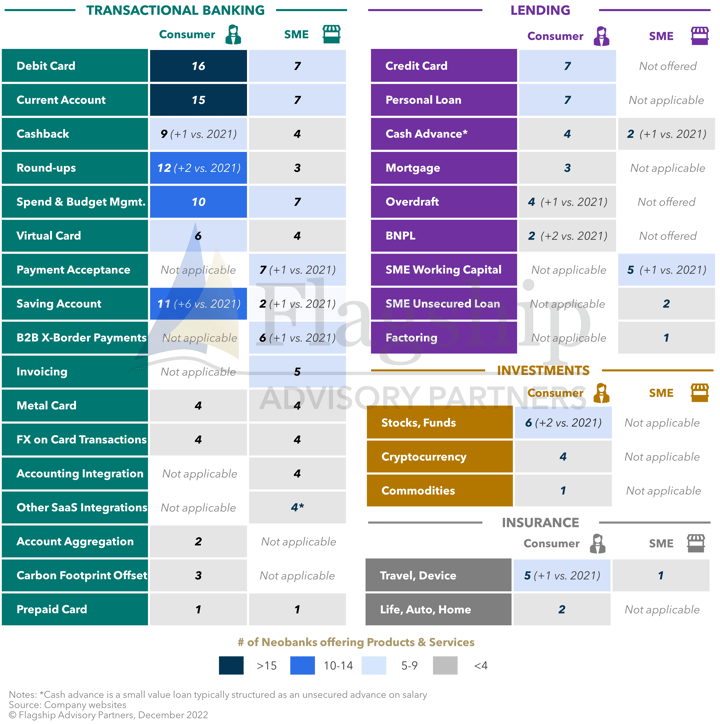

In our previous analysis, we concluded that product expansion was the driving factor for neobank growth - a conclusion that still holds: Having examined the current products offered by the top neobanks (Figure 4 below) we can summarize the following trends:

- Most neobanks are still expanding their range of lending products

- The SME segment continues to be underserved by neobanks, although solutions around payment acceptance, B2B X-border payments, SME cash advance, and SME working capital have grown slightly vs. 2021

- In terms of consumer transactional banking products, neobanks continue to focus on features that are optically attractive to consumers, such as cashback and roundups

- A few more neobanks have added saving accounts to their product suite

- Several neobanks have expanded their investment offer to include stocks and funds

- Despite the product expansions, the overall offer of insurance and investment products remains narrow compared to traditional banks

FIGURE 4: Product Offering of Top Neobanks in Europe and North America (2022, by # of Neobanks)

Although consumer transactional banking services remain the core business of neobanks, we observe a slow shift towards lending and SME products. As a logical next step, neobanks will likely continue to expand their range of lending products (e.g., credit cards, overdrafts, loans, etc.) to earn profits. We also foresee that the SME offering around accounting integrations, factoring, and other financing solutions will likely increase, given that small businesses are underserved by traditional banks. In addition, the expansion of fee-generating products like investments and insurance could be an additional monetization opportunity. Overall, we believe that neobanks will remain influential in shaping the banking space with innovation, although their path to profitability will remain challenging until they broaden their product set and expand their lending capabilities.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com or Aigerim Assembayeva at Aigerim@FlagshipAP.com with comments or questions.